Netherlands Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End-Use Industry, and Region, 2025-2033

Netherlands Paper Packaging Market Overview:

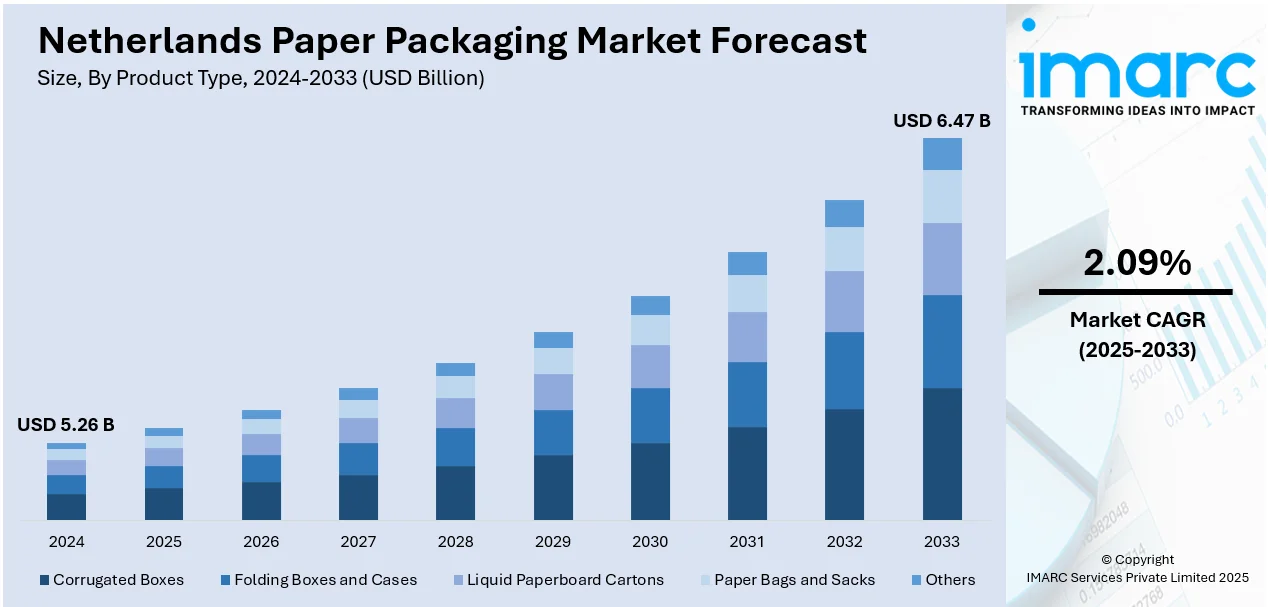

The Netherlands paper packaging market size reached USD 5.26 Billion in 2024. The market is projected to reach USD 6.47 Billion by 2033, exhibiting a growth rate (CAGR) of 2.09% during 2025-2033. The market is driven by the rapid growth of e‑commerce, which boosts demand for durable and customizable shipping solutions along with strong consumer preferences for sustainable, recyclable, and biodegradable materials, reinforced by government policies promoting a circular economy. Moreover, the country’s significant role as a major European trade and logistics hub, creating continuous need for robust, cost‑effective packaging is aiding the Netherlands paper packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.26 Billion |

| Market Forecast in 2033 | USD 6.47 Billion |

| Market Growth Rate 2025-2033 | 2.09% |

Netherlands Paper Packaging Market Trends:

Growth of E‑Commerce and Online Retail

The rapid expansion of e‑commerce is a key Netherlands paper packaging market trend. As more consumers shift toward online shopping for groceries, fashion, electronics, and everyday goods, businesses require packaging that ensures product safety, enhances presentation, and reflects their brand values. Paper‑based solutions, especially corrugated and containerboard formats, meet these needs by offering strength, lightweight handling, and flexibility for customized designs. Moreover, e‑commerce demands packaging that can withstand complex logistics networks, making paper an ideal choice. Dutch fulfillment hubs and delivery networks amplify this demand by prioritizing cost‑effective and eco‑friendly materials that simplify shipping and storage. This combination of consumer behavior and business priorities is driving innovation in paper packaging, including designs tailored for direct‑to‑consumer (D2C) delivery, creating strong momentum for the sector.

To get more information on this market, Request Sample

Consumer Sustainability Preferences & Green Regulations

The Netherlands’ strong environmental culture is reshaping packaging trends, with consumers favoring recyclable, compostable, and biodegradable options over plastic. This has placed pressure on businesses to adopt sustainable materials, a shift reinforced by government policies focused on building a circular economy. In 2023, 88% of all packaging placed on the Dutch market was recycled or reused, far exceeding the national target of 72% and the EU target of 65%. Such results demonstrate the country’s leadership in sustainability and its drive toward minimizing waste and maximizing resource efficiency. Companies in food, retail, and consumer goods sectors are responding by investing in paper packaging that balances functionality with eco‑friendliness. Regulations are further accelerating innovation in lightweight design, material reduction, and recyclability, making paper packaging a strategic choice for brands committed to meeting environmental goals and enhancing Netherlands paper packaging market growth.

Strategic Logistics Hub & Trade‑Driven Demand

The Netherlands’ role as a central hub for European and global trade creates a consistent need for reliable and versatile packaging solutions. With its extensive transport infrastructure, the country handles large volumes of goods moving across borders, requiring packaging that ensures product safety and withstands complex logistics. Paper packaging, particularly corrugated formats, has become an essential tool for exporters and logistics providers due to its durability, cost‑effectiveness, and ease of customization. Businesses favor paper not only for its protective qualities but also for its alignment with sustainability targets, which are increasingly important in international trade. As companies optimize their supply chains, paper packaging offers efficiency benefits by being lightweight, stackable, and adaptable to diverse product types. This trade‑driven demand strengthens the sector, encouraging continuous improvements in design, performance, and sustainability within the paper packaging market.

Netherlands Paper Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, grade, packaging level, and end-use industry.

Product Type Insights:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others.

Grade Insights:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes solid bleached, coated recycled, uncoated recycled, and others.

Packaging Level Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

A detailed breakup and analysis of the market based on the packaging level have also been provided in the report. This includes primary packaging, secondary packaging, and tertiary packaging.

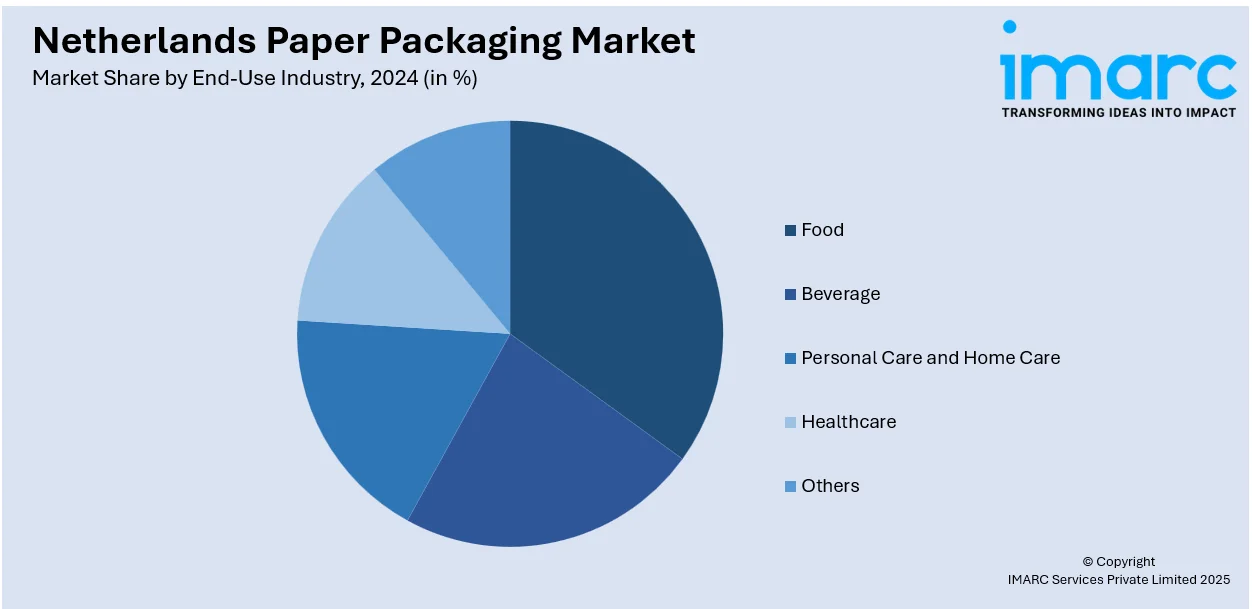

End-Use Industry Insights:

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes food, beverage, personal care and home care, healthcare, and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Paper Packaging Market News:

- In June 2025, PepsiCo launched the SnackBox in the Netherlands and Belgium—a rigid, resealable cardboard box for Doritos, Bugles, and Lay’s Max. Marketed as recyclable and “silent,” it offers a new alternative to plastic chip bags. However, consumer group Foodwatch criticized it for shrinkflation, noting up to 60 g less product at the same price. The backlash led retailers like Delhaize, Aldi, and Colruyt in Belgium to refuse stocking the product.

- In December 2024, Tetra Pak and Yellow Dreams are investing €3 million in a new recycling plant in Ittervoort, Netherlands, to process polyAl from used beverage cartons. Set to open in late 2025, the facility will handle up to 20,000 tons annually, covering Belgium, the Netherlands, and part of Germany. Recycled fibres will support paper products, while recovered polyAl will replace virgin plastics in applications like pallets, crates, and moulded products, enhancing circular packaging efforts.

Netherlands Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End-Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands paper packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands paper packaging market on the basis of product type?

- What is the breakup of the Netherlands paper packaging market on the basis of grade?

- What is the breakup of the Netherlands paper packaging market on the basis of packaging level?

- What is the breakup of the Netherlands paper packaging market on the basis of end-use industry?

- What is the breakup of the Netherlands paper packaging market on the basis of region?

- What are the various stages in the value chain of the Netherlands paper packaging market?

- What are the key driving factors and challenges in the Netherlands paper packaging market?

- What is the structure of the Netherlands paper packaging market and who are the key players?

- What is the degree of competition in the Netherlands paper packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands paper packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands paper packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands paper packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)