Netherlands Private Equity Market Size, Share, Trends and Forecast by Fund Type, and Region, 2025-2033

Netherlands Private Equity Market Overview:

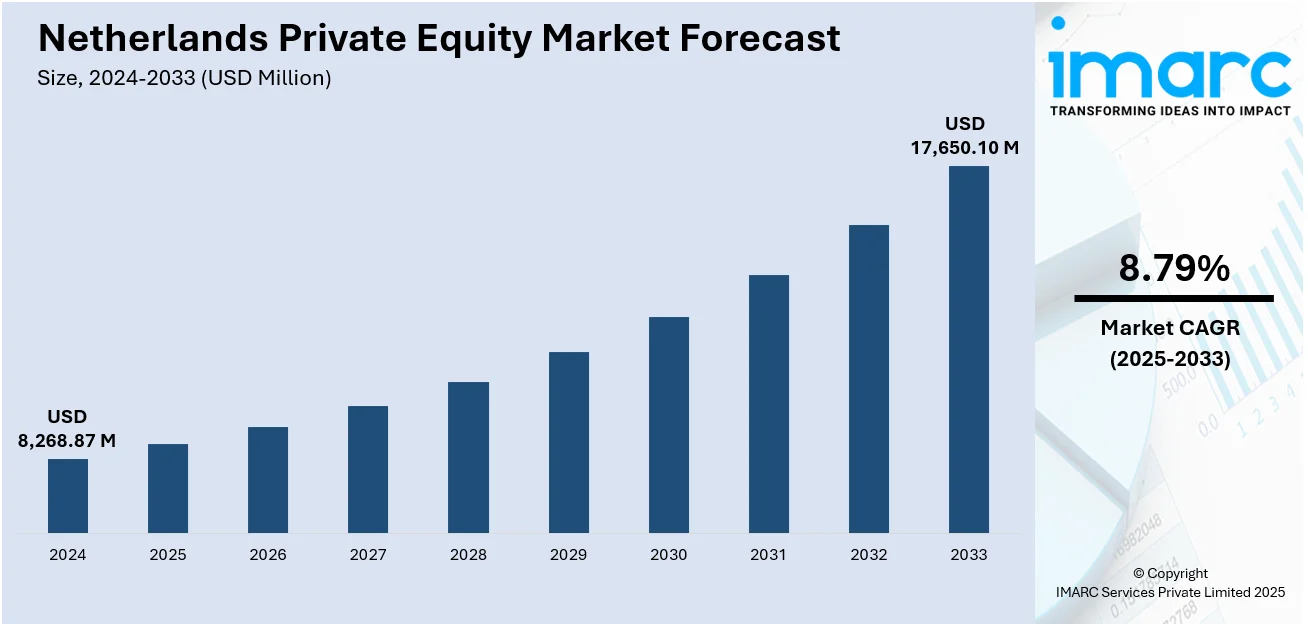

The Netherlands private equity market size reached USD 8,268.87 Million in 2024. The market is projected to reach USD 17,650.10 Million by 2033, exhibiting a growth rate (CAGR) of 8.79% during 2025-2033. The market is adapting to evolving macroeconomic conditions and investor priorities, with growing emphasis on innovation, sustainability, and digital transformation. Fund managers are exploring diverse strategies including mid-market buyouts, continuation funds, and blended credit vehicles to meet shifting demands across regions. Sector focus centers on technology, software, semiconductors, energy transition, and infrastructure. These developments collectively strengthen the Netherlands private equity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8,268.87 Million |

| Market Forecast in 2033 | USD 17,650.10 Million |

| Market Growth Rate 2025-2033 | 8.79% |

Netherlands Private Equity Market Trends:

New Investment Mandates Reshape the Deal Scene

In March 2025, Dutch pension funds revealed plans to increase their investments in higher-risk asset classes, including private equity, as part of ongoing pension reforms. This shift is expected to significantly boost capital availability within the Netherlands private equity market. Pension funds are moving away from traditional fixed-income assets toward equity and alternative investments, aiming to improve returns in a low-yield environment. This increased appetite for private equity is translating into greater deal activity, particularly in mid-sized companies across various sectors such as technology, healthcare, and energy transition. Moreover, the greater flexibility in asset allocation allows institutional investors to support longer holding periods and more strategic value creation. This growing institutional involvement marks a critical development, positioning private equity as a more prominent pillar of the Dutch investment landscape. Consequently, the Netherlands private equity market growth appears well supported by this expanding base of patient capital, fostering deeper liquidity and more robust deal flow.

To get more information on this market, Request Sample

Mid-Market Activity Fuelling Strategic Investments

In 2025, Dutch private equity firms continued to focus heavily on mid-market buyouts, with several new funds raised during the first half of the year reflecting this trend. Despite ongoing macroeconomic uncertainties, investor confidence remains solid, especially in sectors such as IT services, software, and energy transition. Mid-sized companies in these areas are viewed as particularly attractive due to their potential for scalable growth and operational improvements. Fund managers are increasingly favoring hands-on investment approaches, seeking to add value through active management rather than passive holding. This approach aligns well with broader regional shifts toward sector specialization and value creation. The sustained capital flow into buyout funds signals optimism about mid-market deal pipelines and reflects a growing maturity in the Dutch private equity ecosystem. As such, the Netherlands private equity market trends point to a more focused and strategic deployment of capital, emphasizing quality investments with clear growth trajectories. This bodes well for deal volume and overall returns in the coming years.

Sector Consolidation Drives Value Creation

In May 2024, figures revealed a substantial boost in deal activity in the Dutch Industrials & Services sector over the prior year, pointing to robust investor demand for consolidation. Private equity players are targeting this segment to leverage value through strategic growth and operational efficiencies. The trend indicates wider positioning toward focusing on industries with good long-term fundamentals and resilience in the face of market change. In addition to Industrials, digital infrastructure and energy transition are of continued high priority, enabled by supportive government policy and changing customer demand. These industries offer well-defined opportunities for private equity investors interested in establishing competitive strengths through scale and innovation. As strategy becomes more advanced, focus is increasingly given to sustainable development and operational enhancement. This targeted approach should yield more complex transactions and more extensive capital deployment in the future. Generally, this trend is one of the major drivers for the market expansion, with sectoral consolidation defining a more mature and value-based investment environment.

Netherlands Private Equity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on fund type.

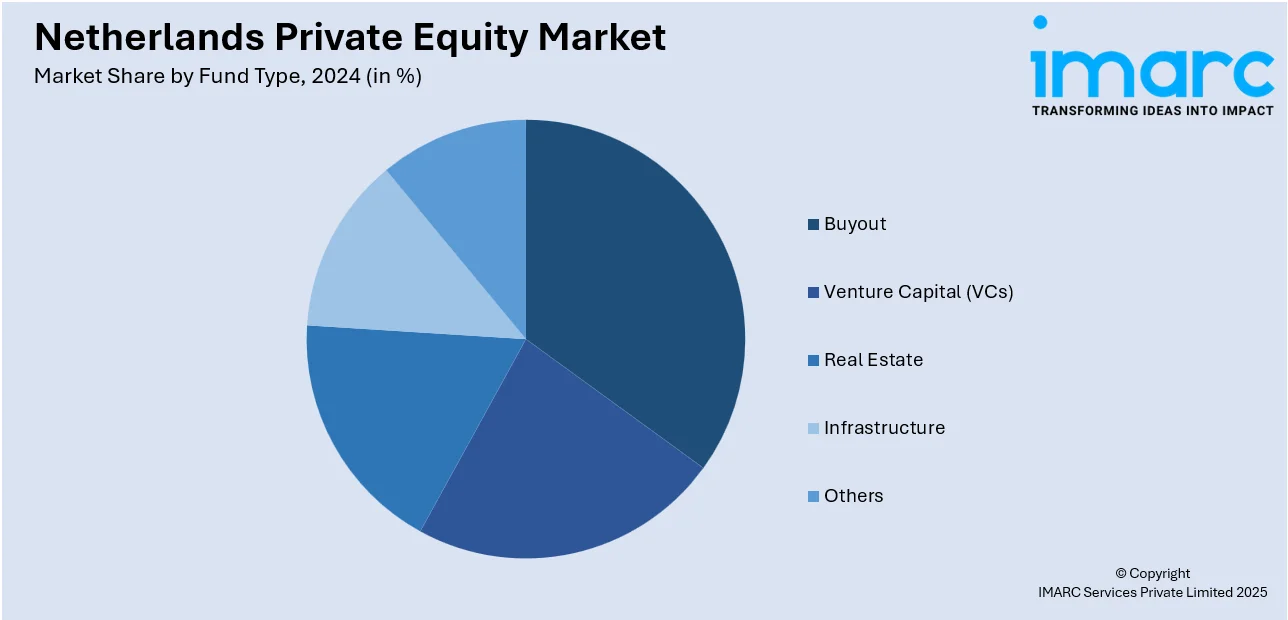

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Private Equity Market News:

- January 2025: Baker Tilly Netherlands joined forces with British private equity company Inflexion in a strategic partnership to drive growth at a faster pace. Inflexion bought a minority stake using its Partnership Capital Fund III, which will allow Baker Tilly to continue organic growth and acquisitions. The partnership is designed to boost service quality, digital innovation, and product development while retaining the company's personality and ownership in its partner group. This action puts Baker Tilly in a position to enhance its position in the fast-paced Dutch accountancy sector.

Netherlands Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands private equity market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands private equity market on the basis of fund type?

- What is the breakup of the Netherlands private equity market on the basis of region?

- What are the various stages in the value chain of the Netherlands private equity market?

- What are the key driving factors and challenges in the Netherlands private equity market?

- What is the structure of the Netherlands private equity market and who are the key players?

- What is the degree of competition in the Netherlands private equity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands private equity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands private equity market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)