Netherlands Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Netherlands Steel Tubes Market Overview:

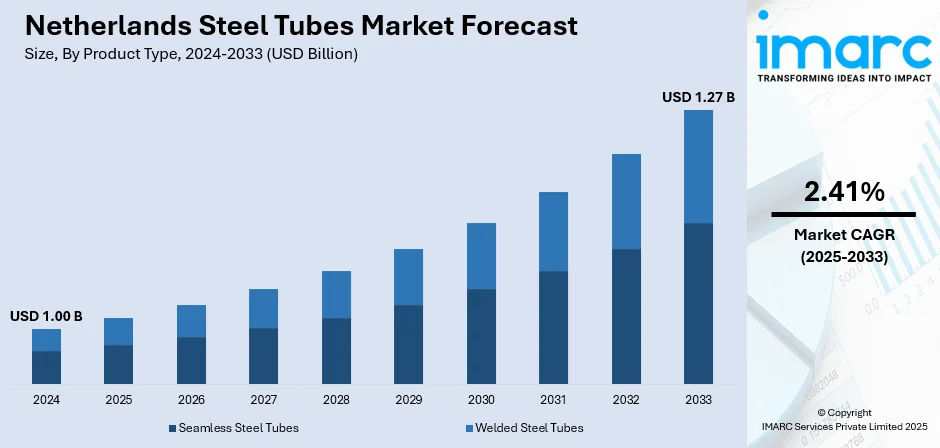

The Netherlands steel tubes market size reached USD 1.00 Billion in 2024. The market is projected to reach USD 1.27 Billion by 2033, exhibiting a growth rate (CAGR) of 2.41% during 2025-2033. The market is witnessing steady growth owing to its widespread demand across construction, automotive, and manufacturing sectors. The push for greener production is evident, as key players transition to hydrogen‑based steel methods in pursuit of sustainability. Technological advancements and recycling initiatives continue to shape the industry’s evolution. Driven by infrastructure investment, innovation in manufacturing, and environmental priorities, this dynamic environment is strengthening the Netherlands steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.00 Billion |

| Market Forecast in 2033 | USD 1.27 Billion |

| Market Growth Rate 2025-2033 | 2.41% |

Netherlands Steel Tubes Market Trends:

Production Revival Fuels Capacity

In January 2024, the Netherlands saw a significant resurgence in crude steel output after months of industrial upgrades and modernization efforts, marking a sharp rebound in annual steel production. This revival has had a meaningful impact on the domestic steel tubes sector, which relies heavily on a stable and accessible supply of raw material. As more steel becomes available within the country, tube manufacturers benefit from reduced sourcing risk and lower input volatility. This improves lead times, supports batch consistency, and enhances planning cycles especially important for infrastructure, industrial fabrication, and municipal projects. The increased availability of base material also encourages investment in product development, as manufacturers can shift attention toward process refinement, rather than material shortages. With local steel production returning to healthy output levels, there’s renewed confidence across the supply chain. This internal alignment enables faster delivery cycles, greater flexibility for customized orders, and overall stronger responsiveness to project timelines. Together, these conditions are forming a dependable base for sustainable Netherlands steel tubes market growth.

To get more information on this market, Request Sample

Renewed Steel Output Strengthens Resilience

In February 2025, official reports verified a robust revival in the steel production of the Netherlands following recent setbacks, marking an improvement for the local manufacturing sector. This return to stability is especially important in the steel tubes industry, in which regular access to raw steel inputs is needed for efficient operations. As supply chains get more stable, manufacturers can synchronize better their production and procurement timetables so that they can capture growing demand in industrial, energy, and infrastructure markets. This shift away from volatility spurs producers to emphasize quality enhancements, customization, and process improvements over rushing to cover shortages. It also assists in enhanced long-term planning and investment confidence, essential for expanding capacity and innovation. By minimizing supply disruptions, the industry can respond more quickly to customer demand and more effectively serve project schedules throughout the region. Ultimately, these conditions come together to form a stronger foundation and enable continuing optimism regarding Netherlands steel tubes market trends.

Green Steel Transition Gains Momentum

In April 2025, the Netherlands accelerated its move toward green steel manufacturing, with the government and business parties working together on programs to decrease carbon emissions and improve sustainability in the steel industry. The move is especially significant for the steel tubes market since demand increases for green materials in infrastructure, energy, and building constructions. The use of green steel technologies, including hydrogen-based production and electric arc furnaces, is predicted not just to decrease the carbon intensity of steel tubes but also to enhance their competitiveness in the market. Besides, the incorporation of renewable energy sources, such as offshore wind power, into steel manufacturing processes also reinforces the goals of sustainability for industry. As these innovations advance, the Netherlands is emerging as the global leader in green steel, welcoming investment and driving innovation. This focus on sustainability is set to fuel long-term growth and stability within the steel tubes industry, cementing the path of Netherlands steel tubes market.

Netherlands Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

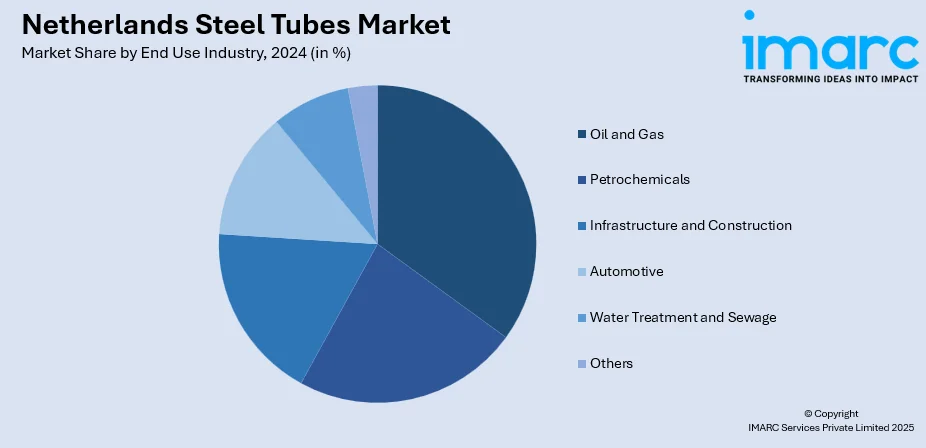

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Steel Tubes Market News:

- March 2024: Tata Steel Nederland revealed a restructuring of its Tubes business segment to improve profitability in the face of weakness in the precision tube market. The proposal is to shut down three welding lines and two sawing machines, resulting in the loss of about 120 positions. This action is intended to curtail overcapacity and increase operational efficiency. The company has filed a Request for Advice with the Works Council and notified trade unions, setting consultations going on the proposed modifications.

Netherlands Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Others |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands steel tubes market on the basis of product type?

- What is the breakup of the Netherlands steel tubes market on the basis of material type?

- What is the breakup of the Netherlands steel tubes market on the basis of end use industry?

- What is the breakup of the Netherlands steel tubes market on the basis of region?

- What are the various stages in the value chain of the Netherlands steel tubes market?

- What are the key driving factors and challenges in the Netherlands steel tubes market?

- What is the structure of the Netherlands steel tubes market and who are the key players?

- What is the degree of competition in the Netherlands steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)