Netherlands Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Netherlands Vegan Cosmetics Market Overview:

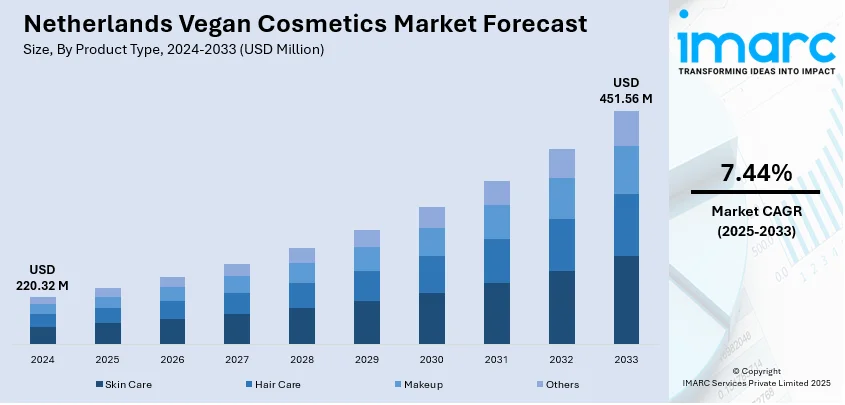

The Netherlands vegan cosmetics market size reached USD 220.32 Million in 2024. Looking forward, the market is expected to reach USD 451.56 Million by 2033, exhibiting a growth rate (CAGR) of 7.44% during 2025-2033. The market is fueled by focus on sustainability, green protection, and ethical shopping. Vegan beauty companies are supported by ubiquitous organic certification standards, open supply chains, and effective recycling systems that facilitate biodegradable packaging. City shoppers in Amsterdam, Rotterdam, and Utrecht appreciating simple, utilitarian formulations stressing ingredient purity and ethical sourcing, along with collaborative culture and high concern about animal welfare, are further contributing to the increasing Netherlands vegan cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 220.32 Million |

| Market Forecast in 2033 | USD 451.56 Million |

| Market Growth Rate 2025-2033 | 7.44% |

Netherlands Vegan Cosmetics Market Trends:

Emphasis on Circular Packaging and Sustainable Supply Chains

A defining trend in the Netherlands vegan cosmetics market is the countrywide cultural and regulatory emphasis on circularity and sustainable packaging. Dutch consumers and regulators strongly prioritize reducing waste, favoring brands that use biodegradable materials, refillable containers, and post-consumer recycled plastic. Plant-based cosmetics brands within the Netherlands regularly test new packaging formats such as aluminum sachets, glass containers with return/refill systems, and renewable bio-plastic plant-based versions. This cycle emphasis mirrors the overall Dutch dedication to sustainability and zero-waste practices, which is especially well-received by the ethical vegan consumer base. Additionally, supply chains will be held to high environmental standards and many of those ingredients will be sourced from certified organic farms or collective EU growers. Dutch producers highlight traceability, with botanical actives like local sea buckthorn, nettle extracts, or hemp seed oil being cultivated sustainably or wild‑harvested. Vegan products are formulated with eco‑friendly environmental impact in mind, aligning with Dutch sentiments for responsible production. With consumers legally calling for eco‑labels and open sourcing, such sustainability‑driven practice is turning into the central trend that characterizes the Netherlands vegan cosmetics market growth.

To get more information on this market, Request Sample

Local Botanical Innovation and Regional Ingredient Heritage

Another trend that is shaping the Netherlands vegan cosmetics industry is the intentional use of locally derived, nature-inspired botanical ingredients that are native to Dutch heritage. Brands are spotlighting more native plants like sea buckthorn that grows by the Wadden Sea, tulip bulb extract that is cold-pressed, dandelion root, and hemp seed oil that is grown in the Dutch countryside. These plant-based ingredients are naturally vegan and give a sensory connection to regional terroir and cultural heritage. Producers frequently collaborate with regional growers and cooperatives for quality and traceability to further regionally grown agriculture. Botanical authenticity is the trend that combines ancient herb wisdom with clean‑beauty technology, developing formulations that engage consumers in ethical sourcing and Dutch botanical heritage. The design packaging usually represents minimalistic Dutch design principles such as clean lines, natural hues, and bilingual labelling to suit global markets. This blending of native plant‑based ingredients, regional culture, and simple style produces a unique vegan beauty trend in the Netherlands that respects heritage and addresses contemporary ethical demands.

Digital Transparency, Ingredient Awareness, and Younger Generation Adoption

The Dutch consumer base which consists of particularly young adults and Gen Z city dwellers, are very active in ingredient‑aware beauty trends driven by digital transparency features and social consciousness. Consumers employ phone applications and websites to scan products and check for vegan certification, cruelty-free declarations, and supply chain values. Brands retaliate by offering full breakdowns of ingredients, histories of the sources of botanical extracts, and environmental impact statements available through QR codes and social media. In Amsterdam and Rotterdam, the major Dutch cities, vegan beauty pop-up boutiques and digital-first brands build community through influencer partnerships, zero-waste activations, and vegan beauty courses. They prioritize "skinimalism," minimalist formulation, and multi-function products that conform to ethical, functional, and minimalist beauty values. Vegan cosmetic science increasingly incorporates clean, clinical textures like gel moisturizers, botanical extract sheet-masks with a serum-like consistency, preservative-free balm, and is often promoted through transparent imagery, ethical influencers, and online community activism. The amalgamation of high digital literacy, green awareness, and ingredient-conscious consumers is fueling the shift towards totally traceable, plant-based formulations in the Netherlands' dynamic vegan beauty market.

Netherlands Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

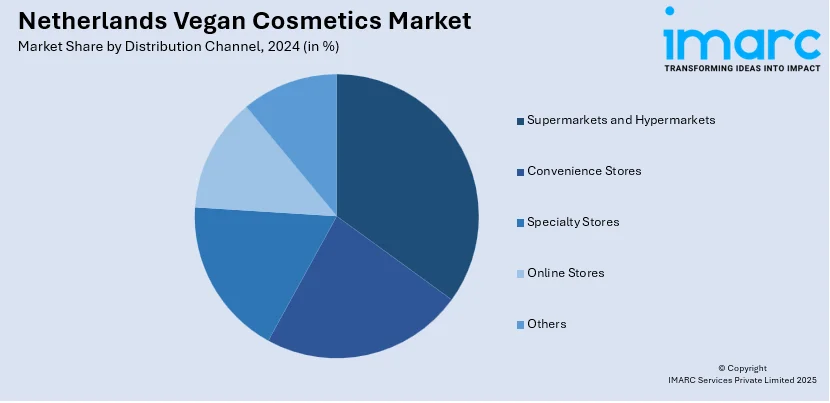

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Vegan Cosmetics Market News:

- In May 2025, e.l.f. Beauty, the bold inventor with a heart of compassion kept expanding e.l.f. Makeup and e.l.f. SKIN throughout Belgium and the Netherlands. An additional step toward the brand's objective of offering the best cosmetic solutions for every eye, lip, and face is the launch of e.l.f. products in KRUIDVAT and TREKPLEISTER.

Netherlands Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands vegan cosmetics market on the basis of product type?

- What is the breakup of the Netherlands vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the Netherlands vegan cosmetics market on the basis of region?

- What are the various stages in the value chain of the Netherlands vegan cosmetics market?

- What are the key driving factors and challenges in the Netherlands vegan cosmetics market?

- What is the structure of the Netherlands vegan cosmetics market and who are the key players?

- What is the degree of competition in the Netherlands vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands vegan cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)