Network Encryption Market Report by Component (Hardware, Solutions and Services), Deployment Mode (Cloud-based, On-premises), Organization Size (Small and Medium-sized Enterprises, Large Enterprises), End Use Industry (Telecom and IT, BFSI, Government, Media and Entertainment, and Others), and Region 2026-2034

Network Encryption Market Overview:

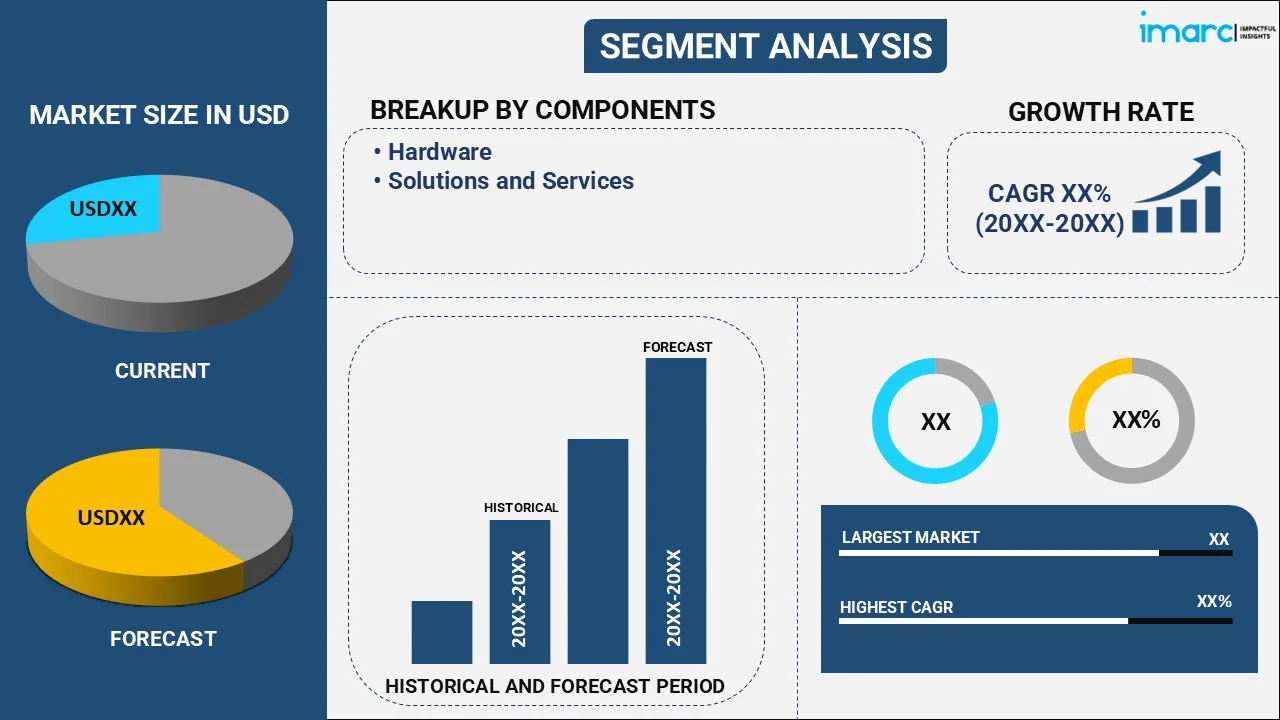

The global network encryption market size reached USD 5.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 10.1 Billion by 2034, exhibiting a growth rate (CAGR) of 7.23% during 2026-2034. The growing demand for 5G networks, need for digitalization, and increasing cybersecurity threats are expanding the growth of the market. In 2023, more than 60% of businesses experienced data breaches linked to unsecured network access.

Key Insights:

- In terms of region, North America held the leading position in revenue in 2025.

- The solutions and services segment accounted for the highest market share by component.

- Large enterprises represent the dominant segment by organization size.

- BFSI emerged as the top end use industry.

Market Size and Forecast:

- Market Size in 2025: USD 5.3 Billion

- Projected Market Size in 2034: USD 10.1 Billion

- CAGR (2026–2034): 7.23%

- Largest Market in 2025: North America

Network Encryption Market Analysis:

- Major Market Drivers: The rising need for the security of sensitive data transmission is strengthening the growth of the market. Moreover, the increasing demand for cloud encryption is propelling the market growth.

- Key Market Trends: The shift towards quantum-safe encryption is facilitating the growth of the market. In addition, ongoing development in technology like multiple software and hardware encryption is bolstering the market growth.

- Geographical Trends: North America holds the largest segment because of rapid expansion of startups and SMEs, along with the robust technology advancements in network encryption devices.

- Competitive Landscape: Some of the major market players in the network encryptor industry include Atos SE, Ciena Corporation, Cisco Systems Inc., Colt Technology Services Group Limited, F5 Networks Inc., International Business Machines Corporation, Juniper Networks Inc., Nokia Corporation, PacketLight Networks Ltd., Raytheon Technologies Corporation, Rohde & Schwarz GmbH & Co KG, Securosys SA, Senetas Corporation Limited, Thales Group, Viasat Inc., and among many others.

- Challenges and Opportunities: While the market faces security challenges, which impact the network encryption system revenue, it also encounters opportunities in the development of user-friendly encryption solutions.

To get more information on this market Request Sample

Network Encryption Market Trends:

Rapid Digital Transformation

Digital transformation is based on the use of new technologies, including cloud computing, the Internet of Things (IoT), and big data analytics, which capitalize on interoperability to enhance capabilities. A significant aspect of this transformation is the substantial volume of data generated, which is transmitted across internal and external networks. Additionally, an increased network perimeter is a trend in digital transformation, with many companies depending more on third-party services, cloud services, mobile devices, and supporting remote work. This expansion of the network perimeter multiplies the potential entry points for cyber threats, underscoring the importance of encryption in network security. Porous network perimeters expose many potential entry points for emerging cybercriminal threats, necessitating the use of data encryption to protect these boundaries.

Emergence of 5G Networks

5G networks are equipped with tremendously faster transmission rates compared to their wireless communications systems. This advantage allows data exchange in the form of bigger volumes and in real-time, such as high definition video, IoT sensor data, and mission-critical communications. The high volume of data inflow means that encryption has gained more relevance so that sensitive information cannot be leaked out by capture and unsupervised use. Additionally, 5G network enables connected devices, not only smartphones and IoT devices but also self-driving vehicles, and smart cities infrastructure, to thrive on the network. The extension of the assault surface offers increasingly more chances for cybercriminals to discover weaknesses and intercept the traffic that travels using 5G networks. High speed network encryptors defend against the threats of data interception, modification, and theft by ensuring secure communication and thwarting unauthorized access.

Increasing Investments in Cybersecurity

According to the National Library of Medicine reports in 2022, 7.8 billion dollars were invested in cybersecurity in the last quarter of 2021. Cyber threats are rapidly evolving in terms of frequency, sophistication, and impact. Enterprises appreciate the vital need for stringent cybersecurity measures to secure their sensitive data and infrastructure. The rise of data breaches, ransomware attacks, and other prominent cybersecurity events is driving the necessity for end-to-end security solutions, including managed encryption service for safeguarding against unauthorized entry and data breaches. Additionally, the increasing acceptance of cloud computing and storage services is causing a move in security paradigms as enterprises entrust the cloud suppliers to sustain their data, thereby supporting the network encryption market growth.

Growing Influence of Remote Work and Device Flexibility

The surge in remote work, combined with Bring Your Own Device (BYOD) policies, has pushed organizations to revisit their encryption strategies. Employees now access corporate networks from personal laptops, mobile phones, and public networks, often outside the reach of traditional security layers. This shift has increased the demand for encryption solutions that protect data in transit and at endpoints, regardless of the device used. Companies are investing in scalable encryption frameworks that can secure hybrid setups and untrusted environments. As a result, computer network encryption system adoption has become a distributed necessity, woven into daily operations and workforce mobility.

AI-Driven Shifts in Encryption Demand and Capability

AI is changing the rules in both offense and defense across cybersecurity, and network encryption is right in the middle of it. On one side, attackers are using AI to find weaknesses in encrypted traffic or to automate evasion tactics. On the other hand, AI-powered analytics are helping organizations detect anomalies in encrypted sessions, automate certificate management, and predict vulnerabilities before they’re exploited. This arms race is pushing vendors to develop database encryption systems that not only protect data but also integrate with AI tools for real-time visibility.

Network Encryption Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on component, deployment mode, organization size, and end use industry.

Breakup by Component:

To get detailed segment analysis of this market Request Sample

- Hardware

- Solutions and Services

Solutions and services accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and solutions and services. According to the report, solutions and services represent the largest segment.

The complexity of implementing network encryption requires specialized expertise and resources, which encourages companies to rely on third-party service providers for assistance. They offer a wide range of services, such as encryption implementation, integration, maintenance, and support, tailoring as per the diverse needs of organizations across multiple industries. Moreover, the solutions of network encryptions assist in protecting network data, traffic, and email. The growing expansion of advanced information technology (IT) networks is driving the demand for solutions to help businesses secure their network infrastructure.

Breakup by Deployment Mode:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

The increased use of cloud-based services across various industries, along with rising remote work and the adoption of mobile devices, is a major driver of cloud-based encryption solutions. Companies are transferring data and applications to the cloud to take advantage of numerous benefits, including scalability, flexibility, and cost reduction. It also provides a convenient and efficient way to address issues like the protection of data in transit and at rest by securing data as it moves between on-premises infrastructure and cloud environments and within the cloud itself.

The highly regulated industries like finance, healthcare, and government prefer to maintain direct control of their data and security infrastructure. As a result, by deploying on-premises encryption solutions, these sectors ensure that sensitive data remains within their physical premises, offering them an excellent sense of security and compliance with industry regulations. It also provides businesses the flexibility to customize their security measures and cater as per the specific requirements and preferences.

Breakup by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium-sized enterprises, and large enterprises. According to the report, large enterprises represent the largest segment.

Large enterprises deal with vast amounts of sensitive data, including financial information, intellectual property, and customer records, and in order to protect them, they are adopting robust encryption solutions. Additionally, these enterprises have complex network infrastructure compassing various locations and cloud environments, which increases the surface area for potential security breaches. Network encryption offers a comprehensive and scalable approach to secure data in transit across these diverse networks.

Breakup by End Use Industry:

- Telecom and IT

- BFSI

- Government

- Media and Entertainment

- Others

BFSI exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes telecom and IT, BFSI, government, media and entertainment, and others. According to the report, BFSI accounts for the largest market share.

The high amount of sensitive and confidential data, such as financial transactions, customer information, and business data, along with the increasing numbers of cybersecurity threats and data breaches is driving the demand for BFSI security. Network encryption offers a strong defense mechanism by encrypting data as it travels across networks, which safeguards it from unauthorized access and interception. Moreover, these industries are investing in network encryption solutions to ensure compliance with data protection regulations. As per the IMARC Group’s report, the global BFSI security market reached US$ 60.5 Billion in 2023.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest network encryption market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for network encryption.

The North American region consists of robust and highly developed IT infrastructure, with a broad network of businesses and governing agencies heavily rely on digital communication and exchange. These businesses are dependent on interconnected networks and are a prime target for cyber threats, which is catalyzing the network encryption demand. In line with this, the growing awareness among the masses about the importance of cybersecurity further boosting the adoption of network encryption. On the other hand, the increasing adoption of 5G connection in North America is heightening the need for strong security measures. According to the National Telecommunications and Information Administration U.S. Department of Commerce report, North America was a leader in the uptake of wireless 5G connections, with a total of 108 million 5G and 506 million LTE connections by the end of Q3 2022.

Key Regional Takeaways:

United States Network Encryption Market Analysis

In the US network encryption industry, there's a growing shift toward securing communications against quantum-era threats. A key development is the move to integrate post-quantum cryptography directly into 5G Open RAN infrastructure. This approach doesn’t just strengthen protection for sensitive data. It also enables real-time encryption across mission-critical operations. Recent field testing on advanced 5G radios shows improved throughput and as much as fivefold energy efficiency, which helps meet both performance demands and federal cybersecurity mandates. The focus is on high-value environments like ports, campuses, and smart cities, areas that can’t afford to be vulnerable as quantum computing matures. As these enhanced security solutions gain traction, they’re redefining what’s expected from encryption technologies in next-generation networks. The shift signals a push beyond legacy methods and toward infrastructure-ready implementations that offer both speed and resilience under real-world conditions. This isn’t speculative anymore; it’s being built and deployed. For example, in July 2025, Eridan and Patero integrated post-quantum cryptography into 5G Open RAN systems, enabling secure, energy-efficient private networks. Tested on Eridan’s new 5G radios, Patero’s CryptoQoR suite protects against quantum threats, aligning with federal cybersecurity mandates. The solution targets critical US infrastructure, such as cities, ports, and campuses, with up to 5X energy efficiency and enhanced data throughput, marking a major step in quantum-secure network encryption.

Europe Network Encryption Market Analysis

Encrypted communication platforms are becoming central to law enforcement strategies across Europe. Recent high-profile investigations targeting organized crime have shown how access to encrypted messaging services can significantly improve surveillance and coordination. Authorities across multiple countries are leveraging these platforms to intercept and decode criminal networks’ activities, leading to large-scale arrests and asset seizures. As criminal groups increasingly depend on secure digital channels, law enforcement agencies are adapting their capabilities to monitor these networks without compromising data integrity. This has pushed demand for advanced encryption analysis tools and lawful interception frameworks. The shift highlights how network encryption is no longer just a data protection tool; it’s now a decisive factor in the balance between privacy and public security in cross-border operations. For instance, in April 2025, Europol-backed raids across Europe and Türkiye led to the arrest of 232 suspects linked to four major drug trafficking networks. Authorities seized €300 million in assets and disrupted operations tied to 21 tonnes of drugs. Investigators credited encrypted platforms like Sky ECC and ANOM for enabling breakthroughs in communication surveillance, reinforcing the growing role of network encryption in high-impact criminal investigations.

Asia Pacific Network Encryption Market Analysis

In Asia Pacific, AI is being used to interpret encrypted network traffic without violating privacy standards. As encryption becomes standard across digital services, service providers are turning to AI to maintain performance visibility. These tools help identify traffic patterns, allowing for better data routing and resource allocation. This shift supports faster, more reliable service delivery in sectors where both privacy and efficiency are essential. The use of AI in managing encrypted traffic is becoming a priority for operators seeking to balance security with consistent user experience. For example, in June 2025, at Huawei Network Summit 2025 in Hong Kong, Huawei launched upgraded Xinghe Intelligent Network solutions for Asia Pacific. A highlight: AI-powered traffic identification achieving 95% accuracy on encrypted data, aiding ISPs in optimizing performance despite growing encryption. This tech reduces latency by over 65% and boosts ISP revenue by 20%, marking a key advance in managing encrypted network traffic in heavily digitized sectors.

Latin America Network Encryption Market Analysis

In Latin America, the move toward encrypted and biometric-based payment systems is gaining momentum. Manual data entry and traditional passwords are being replaced by tokenized information stored securely on personal devices. This approach improves data protection, reduces fraud risk, and simplifies digital transactions. As adoption grows, consumers gain more control over their payment methods while enjoying faster and safer online checkout experiences. The emphasis on encryption and authentication is reshaping how digital payments are secured and processed across the region. For instance, in November 2024, Mastercard announced its aim to phase out manual card entry and passwords by 2030, replacing them with tokenized, encrypted data and biometric authentication. Already in use in some markets, this system secures personal data on devices and streamlines online checkout. The move strengthens payment encryption and privacy, reduces fraud, and enhances consumer control, supporting safer, faster digital shopping as adoption spreads globally.

Middle East and Africa Network Encryption Market Analysis

In the Middle East and Africa, there’s growing interest in using satellite-based encryption to prepare networks for future quantum threats. New trials are exploring Quantum Key Distribution through space and subsea links to protect long-distance optical traffic. This method helps bypass terrestrial limitations and boosts the security of large-scale infrastructure. The approach reflects a regional shift toward quantum-resilient solutions that safeguard critical data across increasingly complex communication environments. For example, in June 2025, Colt, Honeywell, and Nokia partnered to test quantum-safe encryption using satellite communications. The trials aim to secure optical network traffic against future quantum computing threats that could break traditional encryption. By exploring space-based and subsea Quantum Key Distribution (QKD), the project seeks to overcome terrestrial distance limits and deliver globally resilient network encryption for Colt’s vast infrastructure spanning 230 cities worldwide.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major network encryption companies have also been provided. Some of the major market players in the network encryption industry include Atos SE, Ciena Corporation, Cisco Systems Inc., Colt Technology Services Group Limited, F5 Networks Inc., International Business Machines Corporation, Juniper Networks Inc., Nokia Corporation, PacketLight Networks Ltd., Raytheon Technologies Corporation, Rohde & Schwarz GmbH & Co KG, Securosys SA, Senetas Corporation Limited, Thales Group and Viasat Inc.

(Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.)

- Key players are continuously focusing on network encryption market recent developments of algorithms and technologies. In addition, they are integrating encryption capabilities into networking hardware and software. Key manufactures are expanding their product portfolios to address diverse encryption requirements across different industries. They are also investing in research and development (R&D) activities to improve encryption performance and security. Many key players are focusing on collaborations with other industry partners to develop interoperable encryption solutions. They are also developing high-speed encryption solutions to meet the growing demand for evolving networks. For instance, in 2023, Atos, a global leader in managed security services, announced the launch of its new ‘5Guard’ security offering for organizations looking to deploy private 5G networks and for telecom operators looking to enable integrated, automated, and orchestrated security to protect and defend their assets and customers.

Network Encryption Market News:

- June 2025: India achieved a breakthrough in network encryption with IIT Delhi demonstrating free-space quantum secure communication using entanglement over 1 km. Backed by DRDO, the project recorded a secure key rate of 240 bps with a quantum bit error rate below 7%. This marks a step toward real-time quantum cybersecurity applications, including long-distance Quantum Key Distribution (QKD) and secure communication in strategic sectors.

- January 2025: Broadcom launched the Emulex Secure Fibre Channel HBA, the first solution to encrypt all data between servers and storage in real time. With ransomware attacks averaging USD 5.37 Million in 2024, the adapter supports post-quantum encryption mandates like CNSA 2.0 and DORA. It preserves data services, enables live ransomware detection, avoids performance loss, and simplifies key management, marking a shift toward secure, quantum-resilient data center networking.

- August 2024: The US NIST released its first official post-quantum encryption standards, designed to resist cyberattacks from future quantum computers. These new algorithms are now ready for deployment. As quantum technology advances, potentially breaking current encryption within a decade, these standards aim to secure digital infrastructure against emerging threats to national and global cybersecurity.

- October 4, 2023: Nokia Corporation announced that it has been selected with partner DPR by K2 Telecom Brazil to offer solutions that would assist the Internet service provider (ISP) to strengthen its network security and create new revenue streams.

- October 6, 2021: Thales and Google Cloud announced a strategic agreement to co-develop a sovereign hyperscale cloud offering for France. The joint offer of Thales and Google Cloud is based on the most advanced technologies and services of each partner.

Network Encryption Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Network Encryption Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Solutions and Services |

| Deployment Modes Covered | Cloud-based, On-premises |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End Use Industries Covered | Telecom and IT, BFSI, Government, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Atos SE, Ciena Corporation, Cisco Systems Inc., Colt Technology Services Group Limited, F5 Networks Inc., International Business Machines Corporation, Juniper Networks Inc., Nokia Corporation, PacketLight Networks Ltd., Raytheon Technologies Corporation, Rohde & Schwarz GmbH & Co KG, Securosys SA, Senetas Corporation Limited, Thales Group, Viasat Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, network encryption market forecasts, and and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global network encryption market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the network encryption industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The network encryption market was valued at USD 5.3 Billion in 2025.

The network encryption market is projected to exhibit a CAGR of 7.23% during 2026-2034, reaching a value of USD 10.1 Billion by 2034.

The sudden outbreak of the COVID-19 pandemic has led to the increasing demand for network encryption solutions to protect the organization’s private and sensitive data as well as ensure the end-to-end encryption of the data, during the remote working scenario.

Key factors include rising cyber threats, increased adoption of cloud services, regulatory compliance demands, and the shift to remote work. Organizations are investing more in protecting sensitive data across networks, especially with the growing use of IoT, 5G, and enterprise mobility driving the need for secure communication.

Based on the component, the global network encryption market can be bifurcated into hardware and solutions and services, where solutions and services currently account for the majority of the total market share.

Based on the organization size, the global network encryption market has been divided into small and medium-sized enterprises and large enterprises. Currently, large enterprises exhibit a clear dominance in the market.

Based on the end use industry, the global network encryption market can be segmented into telecom and IT, BFSI, government, media and entertainment, and others. Among these, the BFSI sector holds the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

North America dominated the network encryption market in 2025 due to strong cybersecurity regulations, widespread adoption of encryption by enterprises, high investment in IT infrastructure, and the presence of key tech firms.

Some of the major players in the network encryption market include Atos SE, Ciena Corporation, Cisco Systems Inc., Colt Technology Services Group Limited, F5 Networks Inc., International Business Machines Corporation, Juniper Networks Inc., Nokia Corporation, PacketLight Networks Ltd., Raytheon Technologies Corporation, Rohde & Schwarz GmbH & Co KG, Securosys SA, Senetas Corporation Limited, Thales Group, Viasat Inc., etc.

Network encryption is the process of encoding data transmitted across networks to prevent unauthorized access. It protects sensitive information by converting it into unreadable code, ensuring only authorized parties with the correct decryption key can access the original data.

End-to-end encrypted data is information that is encrypted on the sender’s device and only decrypted on the recipient’s device. No intermediaries, including service providers, can access the data during transmission. This ensures maximum privacy and security.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)