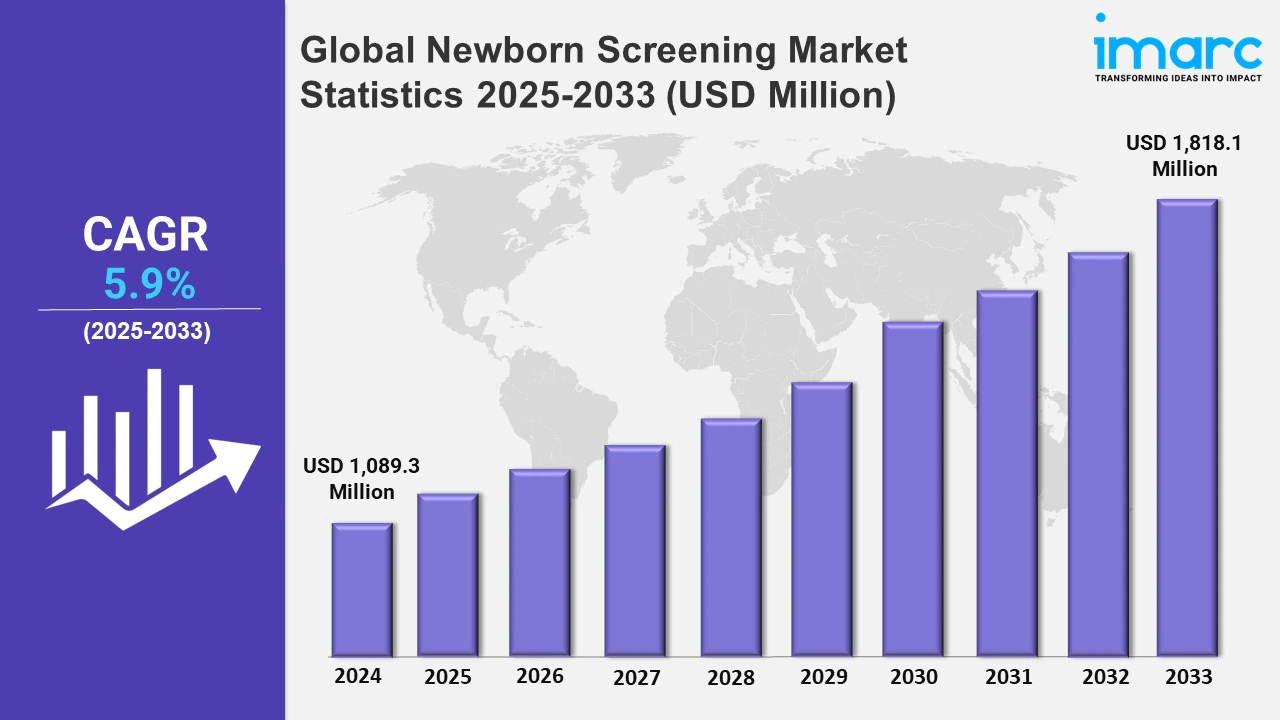

Global Newborn Screening Market Expected to Reach USD 1,818.1 Million by 2033, North America Led with 33.2% Market Share in 2024 - IMARC Group

Global Newborn Screening Market Statistics, Outlook and Regional Analysis 2025-2033

The global newborn screening market size was valued at USD 1,089.3 Million in 2024, and it is expected to reach USD 1,818.1 Million by 2033, exhibiting a growth rate (CAGR) of 5.9% from 2025 to 2033.

To get more information on this market, Request Sample

The newborn screening market is witnessing growth due to continual technological advancements, heightened healthcare awareness, and the drive of regulations. These technologies increase efficiency of the screening process and render the process of high-volume screening more appealing to healthcare providers. Parents and professional caregivers are increasingly becoming aware of the advantages of newborn screening which further explaining higher coverage of these programs. Moreover, the integration of genomic data in newborn screening is driving the market in the health sector. Genomic technologies allow for an accurate diagnosis of genetic disorders at birth, and so early interventions and customized treatment plans are possible. For example, on 8th October 2024, GeneDx provided genomic newborn screenings (gNBS) for over 14,000 infants through research studies exploring the clinical utility of genome sequencing in newborn screening. This work has shown that gNBS can significantly reduce time-to-diagnosis, with over 21% of patients diagnosed earlier. GeneDx's participation in studies like GUARDIAN and Early Check positions it as a leader in advancing genomic screening for early disease detection.

In addition to this, the stringent regulatory measures related to specific conditions all over the world that require newborns to go through screening are augmenting the market demand. Governments are defining minimal conditions that within which screening should be done thereby expanding the reach of the diagnostic services. Furthermore, increasing prevalence of inherited metabolic and genetic disorders necessitates the development of effective screening solutions. This development is stimulating the healthcare systems to implement broader panels to identify more diseases at early stages. Besides this, financial support allows the discovery and application of more complex methods to identify genetic and metabolic disorders in infants. Improved screening capabilities result in higher early detection rates that allow for timely medical intervention and better health outcomes. For instance, On August 19, 2024, Emory University received a grant of USD 2 Million to enhance newborn screening capabilities. The funding will support research and implementation of advanced diagnostic methods, aiming to improve early detection and intervention for genetic and metabolic disorders in infants, ensuring better health outcomes.

Global Newborn Screening Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of advanced healthcare systems, strong regulatory support, and widespread adoption of innovative diagnostic technologies.

North America Newborn Screening Market Trends:

North America is dominating the market due to the advanced health care infrastructure, increased application of advanced diagnostic technologies, governmental support through funding and regulations, and increased awareness of early diagnosis and intervention for genetic and metabolic disorders among health care providers and parents. Emerging innovations in newborn screening technologies are driving market growth, particularly with the development of diagnostic kits for specific disorders such as lysosomal storage diseases. For example, on 29th March 2024, Key Proteo submitted a De Novo application to the FDA for its innovative newborn screening kit. This diagnostic solution aims to enhance early detection of four treatable rare genetic disorders, representing a significant advancement in screening technology and improved healthcare outcomes for infants.

Asia-Pacific Newborn Screening Market Trends:

The Asia Pacific newborn screening market is growing as there is an increase in awareness about healthcare, enhanced government initiatives, and improvement in health infrastructure. Increased investments in diagnostic technologies and the usage of advanced screening methods accelerate growth in the market, mainly across developing economies like China and India. Moreover, rising birth rates in the region lead to a higher demand for newborn screening services.

Europe Newborn Screening Market Trends:

Europe newborn screening market benefits from sound healthcare systems, strict regulations, and wide implementation of advanced diagnostic techniques. All regions have public health programs that support government funding for such extensive screening protocols. The region has seen a rise in genetic and metabolic disorders that the focus on early intervention and prevention has strengthened the market demand in countries like Germany, France, and the United Kingdom.

Latin America Newborn Screening Market Trends:

Increasing availability of healthcare and government policies with regard to early diagnostics enhance newborn screening in Latin America. Early diagnostic facilities offer wide potential benefits, and hence increased adoption is being seen, especially in countries such as Brazil and Mexico. Recent progress in technology and international agreements further improve the accessibility of screening programs in the entire region.

Middle East and Africa Newborn Screening Market Trends:

The Middle East and Africa newborn screening market is moving ahead with increased awareness about genetic disorders and growing government initiatives to establish screening programs. Investments in health infrastructure and collaboration with international organizations are also improving access to advanced diagnostic equipment. Despite the presence of several challenges in the infrastructure, market growth is observed in countries like Saudi Arabia and South Africa.

Top Companies Leading in the Newborn Screening Industry

Some of the leading newborn screening market companies include Agilent Technologies Inc., Baebies Inc., Bio-RAD Laboratories Inc., Chromsystems Instruments & Chemicals GmbH, Danaher Corporation, Masimo Corporation, Medtronic plc, Natus Medical Incorporated, Perkinelmer Inc., RECIPE Chemicals + Instruments GmbH, Thermo Fisher Scientific Inc., Trivitron Healthcare, Waters Corporation, among many others.

- On 31st July 2024, Bio-Rad Laboratories Inc. published a study in nature communications demonstrating the utility of its SpyLock technology for rapid generation and screening of bispecific antibodies. This innovation enhances efficiency in developing diagnostic tools, potentially benefiting applications in areas such as newborn screening and precision medicine.

Global Newborn Screening Market Segmentation Coverage

- On the basis of the product, the market has been categorized into instruments and reagents, wherein instruments represent the leading segment due to their critical role in automating and streamlining diagnostic processes. Advanced devices such as mass spectrometers and hearing screening tools allow for accurate, high-throughput analysis of samples. Increasing demand for early detection technologies and continuous innovations in screening instruments further strengthen their considerable market share.

- Based on the technology, the market is classified into tandem mass spectrometry, pulse oximetry, enzyme-based assay, DNA assay, electrophoresis, and others, amongst which tandem mass spectrometry dominates the market as it enables accurate and efficient analysis of multiple disorders from a single sample. Its ability to detect a broad spectrum of metabolic and genetic conditions with minimal false positives makes it indispensable in newborn screening programs. The technology's precision and scalability drive its widespread adoption globally.

- On the basis of the test type, the market has been divided into dry blood spot test, CCHD, and hearing screen. Among these, dry blood spot test accounts for the majority of the market share as it is easy, cost-effective, and reliable. It requires small volumes of samples, thus ideal for newborns while at the same time giving long-term stability of samples. Its ability to test for several conditions simultaneously gives it a high lead over other methods.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1,089.3 Million |

| Market Forecast in 2033 | USD 1,818.1 Million |

| Market Growth Rate 2025-2033 | 5.9% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Instruments, Reagents |

| Technologies Covered | Tandem Mass Spectrometry, Pulse Oximetry, Enzyme Based Assay, DNA Assay, Electrophoresis, Others |

| Test Types Covered | Dry Blood Spot Test, CCHD, Hearing Screen |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., Baebies Inc., Bio-RAD Laboratories Inc., Chromsystems Instruments & Chemicals GmbH, Danaher Corporation, Masimo Corporation, Medtronic plc, Natus Medical Incorporated, Perkinelmer Inc., RECIPE Chemicals + Instruments GmbH, Thermo Fisher Scientific Inc., Trivitron Healthcare, Waters Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Newborn Screening Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)