Track Acetone Prices in Major Economies – Q2 2025 IMARC Report

05-Sep-2025

Amid subdued downstream demand and steady supply, the global acetone market showed flat-to-soft pricing through Q2 2025, according to IMARC Group’s latest publication, Acetone Prices Outlook Q2 2025, which provides updated insights for Q2 2025. Market dynamics were shaped by weak consumption across coatings, construction, and several manufacturing ends uses, offset by ample feedstock availability and generally stable production. Key geographies defining this picture include the North America, Asia Pacific, and Europe, where buyer caution, modest cost pressures (including freight), and the absence of major supply disruptions collectively tempered price momentum.

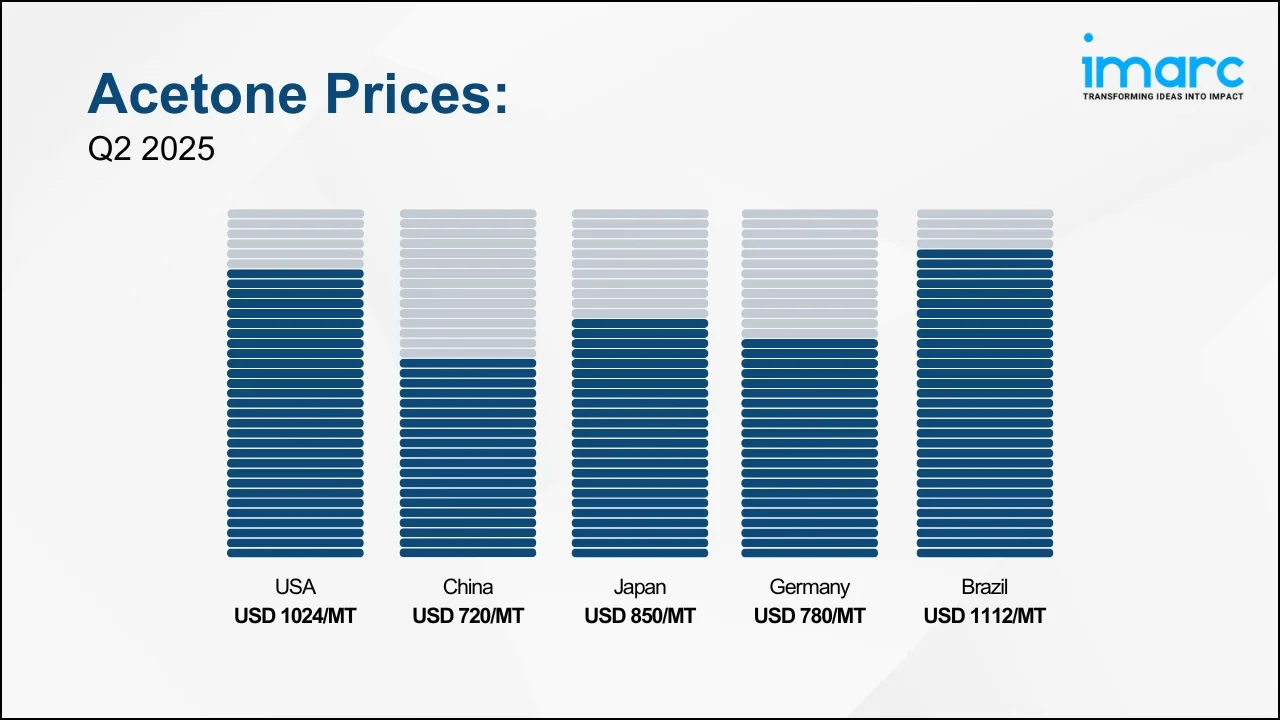

Q2 2025 Acetone Prices:

- USA: USD 1024/MT

- China: USD 720/MT

- Japan: USD 850/MT

- Germany: USD 780/MT

- Brazil: USD 1112/MT

To access real-time prices Request Sample

The current acetone prices underscore the material’s essential role in plastics, coatings, electronics, and pharmaceuticals; however, subdued demand and steady to ample supply in Q2 2025 contributed to a broadly flat-to-soft global price trajectory.

Key Regional Price Trends and Market Drivers:

United States

Acetone prices in the USA reached USD 1024/MT in June 2025. Market levels were capped by weak demand and steady supply, with rising natural gas costs offset by abundant benzene and propylene. With no major refinery disruptions, overall production costs remained relatively flat, limiting any upward push on prices.

China

In China, acetone prices reached USD 720/MT in Q2 2025. Sluggish construction and consumer-linked activity kept buyers hesitant. Although long-haul freight costs rose, regional arbitrage into China remained open enough to restrain domestic offers, preserving a flat-to-soft environment supported by steady inflows from neighboring markets.

Japan

Japan’s acetone prices reached USD 850/MT in June 2025. Downstream consumption was weak construction slowed, coatings producers trimmed procurement, and acrylic sheet demand stayed sluggish. With no notable feedstock disruptions, stable import flows and ample Northeast Asia availability offset higher freight, keeping pricing contained.

Germany

In Germany, acetone prices reached USD 780/MT inQ2 2025. Persistent demand weakness across automotive, coatings, and construction prevented recovery. Buyers focused on short-term, need-based purchases instead of inventory builds, suppressing activity and capping price performance.

Brazil

Acetone prices in Brazil reached USD 1112/MT in June 2025. Lackluster pull from pharmaceuticals, plastics, and coatings—amid broader economic softness—kept the market muted. Highly cautious procurement, limited largely to immediate requirements, curbed momentum and constrained any sustained upside.

Acetone Industry Overview:

The global acetone market reached USD 7.6 Billion in 2024 and is projected to reach USD 12.2 Billion by 2033, expanding at a CAGR of 5.12% during 2025–2033. The market growth is supported by acetone’s role as a key raw material for plastics such as polycarbonates and acrylics, which serve packaging, automotive, and consumer electronics. Expanding consumer electronics, where acetone is used to clean components and produce specialty plastics, adds momentum, while healthcare applications in pharmaceutical manufacturing and medical devices further underpin structural demand.

Some of the key drivers include rising use in composite materials across aerospace and construction, a shift toward bio-based acetone amid environmental regulations, and higher disposable incomes are increasing the consumption of acetone-linked cosmetics and personal care items. The thriving packaging industry and ongoing urbanization with associated construction needs further support demand across global markets.

Recent Market Trends and Industry Analysis:

Acetone’s centrality to plastics production (notably polycarbonates and acrylics) ties market health to packaging, automotive, and consumer electronics. Moreover, the global plastics market is significantly expanding, highlighting a steady downstream base that influences acetone consumption patterns. Increasing adoption of composite materials such as carbon fiber in aerospace and construction also supports solvent demand.

In electronics, acetone is used for component cleaning and in specialty plastics for devices. Healthcare advances bolster usage in pharmaceutical manufacturing and medical devices. Environmental priorities and regulation are catalyzing interest in bio-based acetone pathways, while rising disposable incomes lift demand for cosmetics and personal care products containing acetone-based inputs. Packaging growth and urban construction needs continue to reinforce acetone’s multi-industry relevance.

Strategic Forecasting and Analysis:

IMARC’s report incorporates forecasting models that project near-term price movements based on evolving trade policies, raw material supply, and technological trends. These tools enable businesses to mitigate risk, enhance sourcing strategies, and support long-term planning.

Key Features of the Report:

- Price Charts and Historical Data

- FOB and CIF Spot Pricing

- Regional Demand-Supply Assessments

- Port-Level Price Analysis

- Sector-Specific Demand and Supply Insights

.webp)

.webp)