Carbon Black Prices Reflect Global Market Shifts: Q2 2025 Update

21-Jul-2025

The global carbon black industry witnessed dynamic price movements, driven by fluctuating feedstock costs, evolving industrial demand, and complex supply chain conditions. IMARC Group’s latest report Carbon Black Price Index, Trend and Forecast Data Report 2025 Edition, provides updated insights for Q2 2025. The report highlights the multifaceted pricing landscape across key regional markets, including North America, Europe, and Asia Pacific. The report underscores the influence of energy costs, currency fluctuations, logistical disruptions, and regulatory frameworks in shaping the pricing trends across regions.

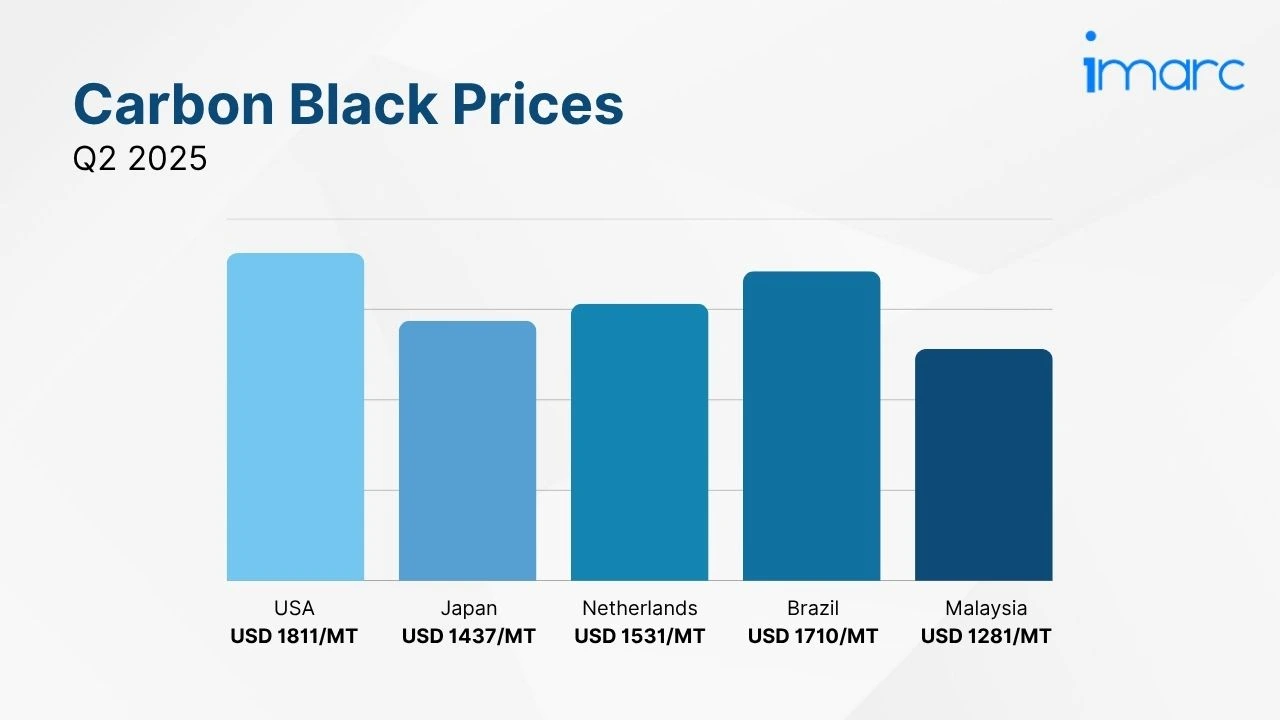

Q2 2025 Carbon Black Prices:

- USA: USD 1811/MT

- Japan: USD 1437/MT

- Netherlands: USD 1531/MT

- Brazil: USD 1710/MT

- Malaysia: USD 1281/MT

To access real-time prices Request Sample

The current carbon black prices across key regions reflect its critical role in high-performance industries such as automotive, tire manufacturing, and industrial rubber, with strong demand, feedstock volatility, and supply chain constraints collectively supporting a stable global price trend.

Key Regional Price Trends and Market Drivers:

United States:

Carbon black prices reached USD 1811/MT in June 2025, supported by firm demand from the automotive and tire sectors. Price pressures were amplified by volatile feedstock costs and rising inland freight expenses, partly due to port bottlenecks in the Gulf Coast region.

Japan:

In Japan, prices stood at USD 1437/MT in Q2 2025, influenced by naphtha and heavy oil price swings amid upstream crude oil volatility. A steady automotive sector and a moderate recovery in industrial rubber demand contributed to pricing support, while yen depreciation and environmental constraints affected import and production dynamics.

Netherlands:

The Dutch market recorded prices at USD 1531/MT during Q2 2025, driven by high energy costs from carbon compliance and natural gas prices. Tightened feedstock availability and import slowdowns from Asia, alongside Rotterdam port congestion, restricted supply and extended lead times.

Brazil

Brazil's prices reached USD 1710/MT in June 2025, driven by reduced domestic output amid maintenance activities at key plants. Fluctuating refinery operations impacted feedstock supply, while higher reliance on imports exposed the market to freight volatility amid stable demand from rubber and plastics industries.

Malaysia

Carbon black was priced at USD 1281/MT in Q2 2025, with consistent demand from the automotive and footwear sectors. Limited regional refinery throughput and intermittent industrial power issues tightened supply. Export commitments to East Asian markets further reduced domestic availability, maintaining upward pressure on prices.

Carbon Black Industry Overview:

The global carbon black market reached a value of USD 17.85 Billion in 2024 and is projected to grow to USD 24.97 Billion by 2033, registering a CAGR of 3.61% during 2025-2033. This growth is strongly supported by rising demand from the automotive and replacement tire industries, which continue to be key end-use sectors. With the global tire market expected to expand significantly, the consumption of carbon black as a reinforcing agent remains fundamental to enhancing product durability and performance.

Key market drivers include the expanding use of carbon black in the rubber, plastics, and construction sectors. Additionally, the material’s growing applications in electronics, coatings, and energy storage, driven by its conductive properties and UV resistance, are further strengthening its demand. The rise in infrastructure development, particularly in emerging economies, and increasing investments in renewable energy and defense manufacturing are also major contributors to the market’s upward trajectory.

Recent Market Trends and Industry Analysis:

The carbon black industry is experiencing robust growth due to its wide-ranging applications in tire manufacturing, mechanical rubber goods, plastics, inks, coatings, and electronics. The market is particularly driven by the expansion of the automotive sector, including electric vehicles, and the growing demand for durable, high-performance materials. In sectors such as construction, packaging, and renewable energy, carbon black plays a vital role in enhancing product longevity, conductivity, and UV resistance, supporting its widespread adoption.

Additionally, the industry is benefiting from increasing infrastructure investments and technological advancements. Rising demand from aerospace, defense, and textile sectors, along with government support for industrial modernization and clean energy initiatives, is contributing to long-term market expansion. With applications spanning from industrial manufacturing to energy storage, carbon black remains a key material in multiple high-growth segments, reinforcing its strategic importance across global supply chains.

Strategic Forecasting and Analysis:

IMARC’s report incorporates forecasting models that project near-term price movements based on evolving trade policies, raw material supply, and technological trends. These tools enable businesses to mitigate risk, enhance sourcing strategies, and support long-term planning.

Key Features of the Report:

- Price Charts and Historical Data

- FOB and CIF Spot Pricing

- Regional Demand-Supply Assessments

- Port-Level Price Analysis

- Sector-Specific Demand and Supply Insights

.webp)

.webp)