Regional Dynamics Drive Corn Syrup Price Fluctuations: Q2 2025 Update

15-Jul-2025

The corn syrup market experienced region-specific pricing shifts in Q2 2025, driven by variations in feedstock supply, logistics costs, and food sector demand. IMARC Group’s latest release, Corn Syrup Price Trend, Index and Forecast Data Report 2025 Edition, presents updated Q2 pricing data and market analysis across key regions including North America, Europe, and Asia Pacific. The report highlights how localized factors and seasonal variables are shaping current corn syrup price movements and production strategies.

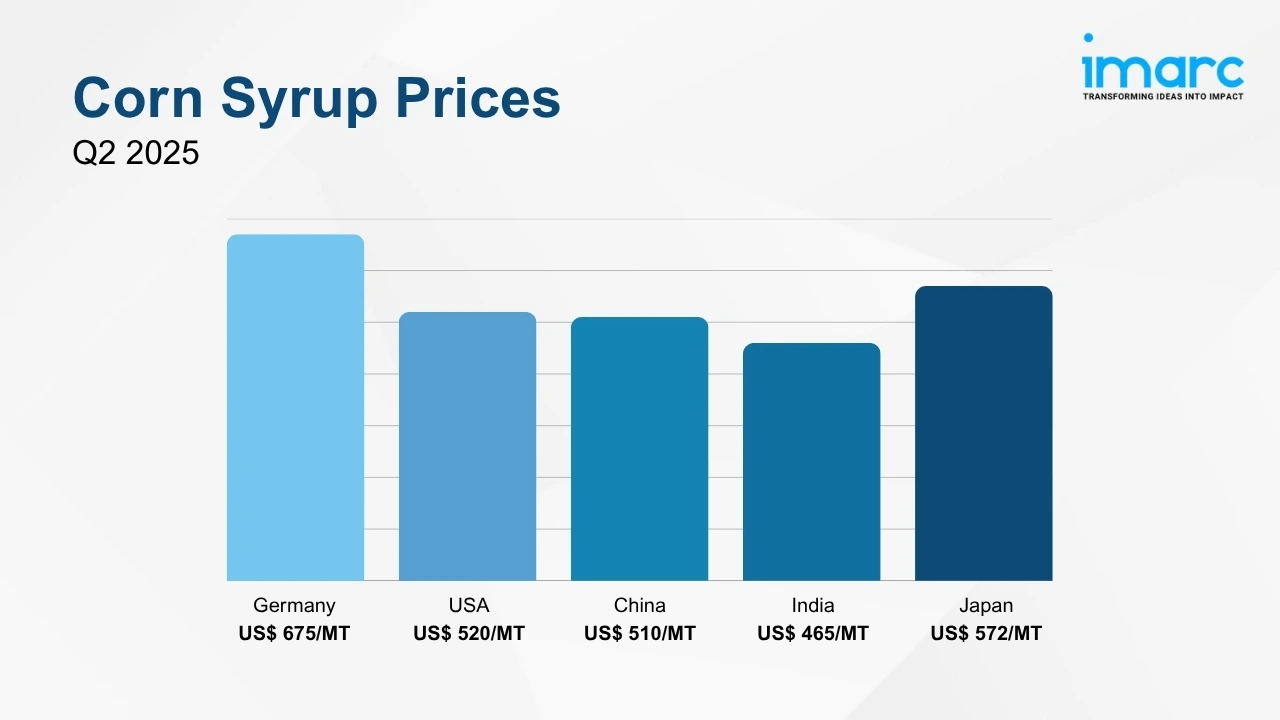

Q2 2025 Corn Syrup Prices:

- Germany: USD 675/MT

- USA: USD 520/MT

- China: USD 510/MT

- India: USD 465/MT

- Japan: USD 572/MT

To access real-time prices Request Sample

These prices reflect steady demand from the food and beverage industry and underscore the role of corn syrup as a core ingredient in processed foods, confectionery, and soft drinks. Regional feedstock trends, energy input costs, and logistical dynamics continue to drive fluctuations.

Key Regional Price Trends and Market Drivers:

Germany

Corn syrup prices in Germany reached USD 675/MT in Q2 2025. Market conditions were influenced by fluctuations in European corn supply and rising energy costs tied to regional utility rates. Imports supplemented domestic production, while demand remained strong in confectionery and bakery applications. Freight availability and input volatility introduced mild pricing pressure during the quarter.

USA

In Q2 2025, the USA reported corn syrup prices at USD 520/MT. Ample corn harvests supported steady production, while processing capacity remained stable across major facilities. Demand from soft drinks, packaged foods, and baking industries remained firm. Regional logistics remained largely intact, helping to contain volatility in transportation-related pricing components.

China

Corn syrup prices in China stood at USD 510/MT in Q2 2025. Pricing remained steady as domestic processors maintained consistent throughput levels. Trade dynamics with neighboring Asian markets provided supply flexibility, and demand from beverage and snack sectors supported stable consumption patterns. Feedstock pricing aligned closely with global grain trends.

India

India reported corn syrup Q2 2025 prices of USD 465/MT. Monsoon patterns and maize procurement cycles influenced input availability, though production volumes remained unaffected. Strong demand from sweets, bakery items, and processed foods drove consumption. Occasional transport disruptions during seasonal transitions created minor volatility.

Japan

In Japan, corn syrup prices reached USD 572/MT in Q2 2025. Market stability was supported by dependable import streams and consistent usage in beverages and packaged food. Though freight costs fluctuated slightly, inventory and supply chain resilience kept pricing relatively firm. Demand from manufacturers remained predictable and aligned with historical consumption levels.

Corn Syrup Industry Overview:

The global corn syrup market reached a value of USD 2.4 Billion in 2024 and is projected to grow to USD 3.1 Billion by 2033, registering a CAGR of 3.0% from 2025 to 2033. The product demand can be attributed to the food processing applications, driven by the continued popularity of packaged and shelf-stable products. The ingredient’s role as a sweetener and texture stabilizer ensures its widespread adoption in processed foods, soft drinks, and baked goods.

The corn syrup industry is witnessing steady growth fueled by consistent demand from the food and beverage sector. Production technologies have improved yield consistency, while product segmentation (light, dark, and HFCS) enables manufacturers to meet different formulation requirements. Manufacturers are also increasingly focusing on ensuring supply chain resilience to meet evolving consumer preferences and regulatory expectations.

Recent Market Trends and Industry Analysis:

Corn syrup continues to be a critical item for the food and beverage sector, valued for its versatility and cost efficiency. It enhances moisture retention, prevents crystallization, and extends product shelf life, making it essential in candy, jams, sauces, baked goods, and beverages. The market is expanding slowly into non-food applications, including fermentation, pharmaceuticals, and personal care.

Global price trends remain linked to corn availability, energy inputs, and logistics reliability. Countries with strong grain reserves and refining capacity maintain competitive pricing advantages. Meanwhile, industry consolidation, facility expansions, and changing regulatory standards are reshaping regional supply chain strategies. Additionally, growing consumer demand for transparent labeling and cleaner formulations is prompting manufacturers to explore modified corn syrup variants with reduced additives and enhanced functional properties.

Strategic Forecasting and Analysis:

IMARC’s report incorporates forecasting models that project near-term price movements based on evolving trade policies, raw material supply, and technological trends. These tools enable businesses to mitigate risk, enhance sourcing strategies, and support long-term planning.

Key Features of the Report:

- Price Charts and Historical Data

- FOB and CIF Spot Pricing

- Regional Demand-Supply Assessments

- Port-Level Price Analysis

- Sector-Specific Demand and Supply Insights

.webp)

.webp)

.webp)

.webp)