Graphite Prices in the USA Hold at USD 856/MT Amid Stable Industrial Demand

04-Feb-2026

Graphite is a naturally occurring crystalline form of carbon, characterized by its layered hexagonal structure, which imparts exceptional thermal conductivity, electrical conductivity, and chemical inertness. These distinctive properties render it indispensable across a broad spectrum of industrial applications, including steelmaking through electric arc furnaces, metallurgical crucibles, high-performance lubricants, refractory linings, and battery anodes for lithium-ion energy storage systems. Graphite also finds critical usage in aerospace components, automotive brake systems, and gasket manufacturing, owing to its lightweight strength and thermal resilience. Consequently, graphite pricing remains acutely sensitive to fluctuations in battery sector demand, steel production volumes, energy costs, export policy changes from key producing nations, and logistics expenditures.

Global Market Overview:

Globally, the graphite industry was valued at USD 28.8 Billion in 2025. Market projections indicate steady growth, with the industry expected to reach USD 50.2 Billion by 2034, with a compound annual growth rate (CAGR) of 6.32% during 2026-2034. This growth is primarily driven by the increasing use of lithium-ion batteries in the consumer electronics and electric car industries, as well as strong demand from makers of refractories, industrial lubricants, and renewable energy applications. The need for graphite for battery anode manufacture is growing, as the world moves more quickly towards sustainable energy infrastructure, but the steel and construction sectors continue to use the same amount of the material. Additionally, the long-term growth trajectory of this crucial mineral industry is being reinforced by growing investments in sophisticated graphite processing technology and synthetic graphite production capacity.

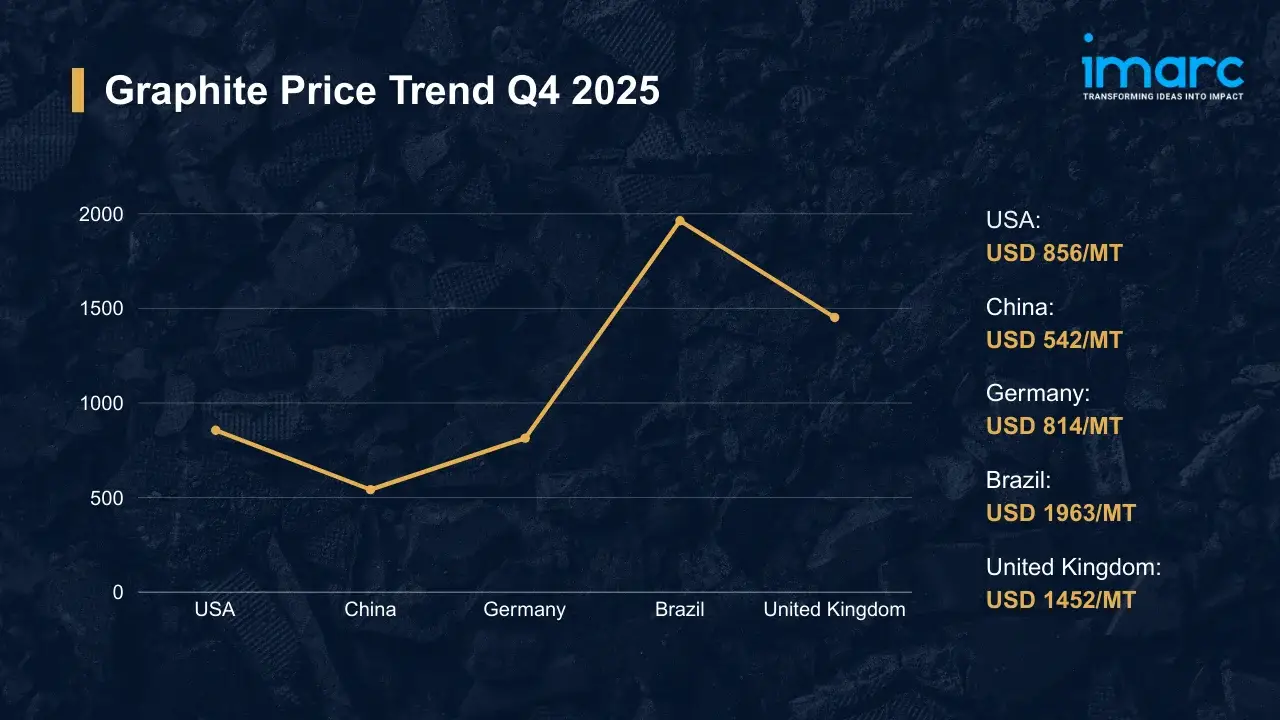

Graphite Price Trend Q4 2025:

Regional prices (USD per MT) and QoQ changes vs Q3 2025:

| Region | Price (USD/MT) | QoQ Change | Direction |

|---|---|---|---|

| USA | 856 | -2.28% | ↓ |

| China | 542 | -5.41% | ↓ |

| Germany | 814 | +0.99% | ↑ |

| Brazil | 1963 | +1.08% | ↑ |

| United Kingdom | 1452 | +1.89% | ↑ |

To access real-time prices Request Sample

What Moved Prices:

- USA: Graphite prices in the USA fell to USD 856/MT in Q4 2025, since domestic consumption in several important end-use industries continued to decrease. As production schedules shrank and inventory levels at key distribution centers remained high, demand from producers of energy storage systems and users of battery-grade graphite declined even more. Because of steady imports from Asian producers and growing domestic extraction capabilities, the supply environment remained well-balanced, preventing any upward price correction. Throughout the quarter, freight and inland transportation costs remained quite stable and had no impact on the total price structure. Producers and processors faced slight extra costs due to expenses for complying with regulations concerning environmental and occupational safety.

- China: In China, graphite prices plummeted to USD 542/MT in Q4 2025, a notable quarterly decrease fueled by ongoing deterioration in the automotive and battery manufacturing sectors. Due to market overstock and dwindling order volumes, some manufacturers of lithium-ion batteries reduced their operations, which further reduced downstream use. Domestic utilization levels were limited by government-directed modifications to industrial output targets and changing export control regulations. On the supply side, market valuations were continuously under pressure to decline due to plentiful availability from nearby mining activities and lower raw material procurement costs. Throughout the period, changes in the Renminbi to US dollar exchange rate had little impact on pricing dynamics.

- Germany: In Germany, graphite prices increased slightly to USD 814/MT in the fourth quarter of 2025, driven by consistent purchases from the heavy industrial and manufacturing sectors. Market pricing was consistently supported by the demand for high-purity graphite used in specialized industrial processes, such as refractory manufacture and advanced material fabrication. Limited processing capacity at domestic facilities impacted supply-side conditions, further driving up appraisals. International freight rates and customs-related fees for imported shipments stayed mostly constant, although they had an impact on the overall cost architecture. Moderate cost burdens were further ingrained across the supply chain by adherence to strict European Union environmental and safety regulatory regulations.

- Brazil: During Q4 2025, graphite prices in Brazil advanced to USD 1963/MT, supported by resilient demand from the steel, refractory, and battery application segments. Industrial consumption remained firm as domestic manufacturers sustained steady procurement volumes, particularly for high-temperature processing materials. The supply environment benefited from reliable local production output, although logistical expenses encompassing port handling charges, rail transportation fees, and inland freight added incremental cost layers to the pricing structure. Currency movements between the Brazilian Real and the US dollar exerted a marginal influence on the cost of imported raw materials and processed graphite products. Compliance with local environmental standards and quality certification requirements maintained consistent cost pressures across the value chain.

- United Kingdom: In Q4 2025, graphite prices in the United Kingdom climbed to USD 1452/MT, reflecting sustained procurement activity from the industrial manufacturing and energy storage sectors. Consumption of high-purity graphite for advanced applications, including battery-grade materials and specialized engineering components, provided firm demand-side support throughout the quarter. Supply conditions remained moderately constrained, with domestic production fulfilling a portion of overall requirements while imports accounted for the balance. Transportation and logistics expenditures, particularly port handling operations and domestic distribution networks, contributed to gradual price appreciation. The stability of the British Pound against the US dollar provided a measured influence on import cost calculations during this period.

Drivers Influencing the Market:

Several factors continue to shape graphite pricing and market behavior:

- Lithium-Ion Battery Demand: The rapid proliferation of electric vehicles (EVs) and portable electronic devices has intensified global consumption of battery-grade graphite for anode manufacturing. This persistent demand expansion from energy storage applications continues to serve as a primary determinant of market pricing dynamics across all major producing and consuming regions.

- Export Policy Adjustments in China: Beijing's evolving regulatory stance on graphite export controls has introduced substantial supply-side uncertainty into international markets. Periodic tightening of outbound shipment quotas and licensing requirements directly constrains global availability, creating pronounced price volatility for importing nations reliant on Chinese production capacity.

- Steel and Refractory Industry Consumption: Graphite remains essential for electrode production in electric arc furnaces and high-temperature refractory linings utilized by the global steel sector. Fluctuations in crude steel output volumes and infrastructure construction activity across major economies directly influence procurement patterns and consequently shape regional pricing trajectories.

- Energy and Processing Costs: The energy-intensive nature of graphite purification and synthetic graphite production renders market pricing vulnerable to shifts in electricity and fuel costs. Rising energy tariffs in major processing centers elevate operational expenditures, which producers subsequently transmit through the supply chain via higher product valuations.

- Environmental and Regulatory Compliance: Increasingly stringent environmental regulations across Europe, North America, and Asia mandate comprehensive emissions controls and waste management protocols for graphite extraction and processing operations. These compliance obligations impose additional capital and operational expenditures on producers, which are progressively reflected in market pricing structures.

- Logistics and Transportation Expenditures: Port handling charges, international shipping rates, inland freight costs, and customs processing fees collectively influence the landed cost of graphite across consuming regions. Disruptions or efficiency improvements within global logistics networks can amplify or attenuate regional price differentials significantly.

- Currency Exchange Rate Fluctuations: Movements in key currency pairs, particularly the Chinese Renminbi, Brazilian Real, Euro, and British Pound against the US dollar, affect the competitiveness of graphite exports and the import costs borne by consuming nations. Sustained currency depreciation in producing countries can temporarily reduce export prices and reshape global trade flows.

Recent Highlights & Strategic Developments:

Recent strategic moves within the industry further illustrate evolving dynamics:

- In January 2025, the United States Department of Defense, through its Defense Logistics Agency, highlighted a collaborative venture between Graphite One and Vorbeck Materials focused on developing an eco-friendly firefighting foam. This Congressionally supported program sought to replace conventional foam formulations employed by US military and civilian firefighting agencies, leveraging graphite sourced from Graphite One's deposit in Alaska.

Outlook & Strategic Takeaways:

Looking ahead, the graphite market is expected to sustain its upward trajectory, propelled by escalating battery sector requirements, expanding renewable energy infrastructure, and persistent industrial demand from steelmaking and refractory applications. In addition, evolving trade policies will continue to shape regional pricing disparities.

To navigate this complex landscape, stakeholders should:

- Track Regional Price Movements Consistently: Establish systematic monitoring frameworks for monthly and quarterly graphite price fluctuations across all key consuming and producing regions. Leverage real-time market intelligence to identify procurement windows and anticipate cost escalations before they materialize.

- Diversify Supplier Base Geographically: Reduce dependency on single-source procurement by cultivating relationships with graphite producers across multiple jurisdictions. Engage suppliers from emerging African and South American mining regions to mitigate exposure to Chinese export policy disruptions.

- Benchmark Procurement Against Cross-Regional Differentials: Conduct periodic cost analyses comparing landed graphite prices across regions to identify favorable sourcing opportunities. Align purchasing strategies with prevailing currency dynamics and logistics cost advantages to optimize total acquisition expenditures.

- Monitor Upstream Feedstock and Energy Costs: Assess fluctuations in electricity tariffs and raw material pricing at key processing centers on a regular basis. Factor energy cost trajectories into forward procurement planning to safeguard operational margins against unexpected input cost surges.

- Assess Regulatory and Trade Policy Developments: Maintain vigilance over evolving export controls, tariff structures, and environmental compliance mandates across primary producing nations. Integrate policy risk assessments into supply chain contingency plans to ensure operational continuity amid shifting regulatory landscapes.

- Explore Synthetic Graphite Investment Opportunities: Investigate emerging synthetic graphite production technologies that offer supply chain independence from natural graphite sources. Consider strategic partnerships with synthetic producers to secure high-purity material access for premium applications.

Subscription Plans & Customization:

IMARC offers flexible subscription models to suit varying needs:

- Monthly Updates — 12 deliverables/year

- Quarterly Updates — 4 deliverables/year

- Biannual Updates — 2 deliverables/year

Each includes detailed datasets (Excel + PDF) and post-report analyst support.

.webp)

.webp)