Hafnium Metal Prices Reflect Supply Tightness and Sector Demand: Q2 2025 Update

15-Jul-2025

The hafnium metal market saw significant regional price variation in Q2 2025, driven by sector-specific demand, raw material availability, and evolving geopolitical pressures. IMARC Group’s latest release, Hafnium Metal Price Trend, Index and Forecast Data Report 2025 Edition, provides Q2 pricing analysis across key markets, including Asia Pacific, North America, and Europe. The report outlines how aerospace, nuclear, and semiconductor sector activity continues to shape pricing direction and production planning.

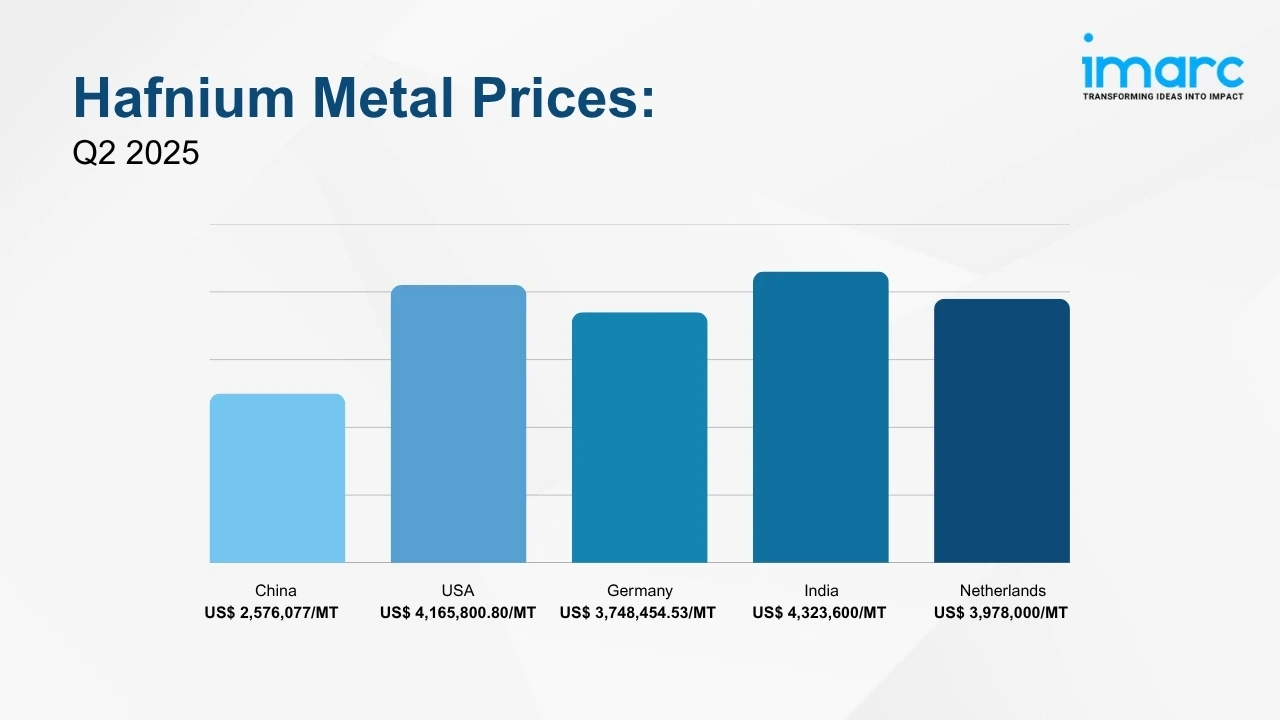

Q2 2025 Hafnium Metal Prices:

- China: USD 2,576,077/MT

- USA: USD 4,165,800.80/MT

- Germany: USD 3,748,454.53/MT

- India: USD 4,323,600/MT

- Netherlands: USD 3,978,000/MT

To access real-time prices Request Sample

These elevated price points reflect hafnium’s strategic value in high-performance applications, from gas turbines and nuclear reactors to advanced microelectronics. Price trends remained sensitive to supply chain constraints, production inputs, and fluctuations in industrial activity across major economies.

Key Regional Price Trends and Market Drivers:

China

In Q2 2025, China reported hafnium metal prices of USD 2,576,077/MT. The market remained stable due to consistent demand from domestic aerospace and electronics producers. With self-sufficient production capacities and limited exposure to imports, pricing was largely insulated from external disruptions. Supply chain equilibrium was maintained through reliable raw material sourcing and steady downstream demand.

USA

Hafnium metal prices in the USA reached USD 4,165,800.80/MT in Q2 2025. Robust industrial demand, particularly from defense and semiconductor manufacturers, supported stable price levels. Domestic production kept pace with consumption, minimizing import dependency. However, ongoing trade measures and tariffs on Asian-origin inputs continued to influence supply planning and pricing strategies.

Germany

Germany recorded Q2 2025 hafnium prices of USD 3,748,454.53/MT. Market conditions were characterized by consistent domestic production and balanced demand, particularly from turbine manufacturers and nuclear component suppliers. With flat import activity and steady processing capacity, prices held firm throughout the quarter.

India

India’s hafnium metal prices reached USD 4,323,600/MT during Q2. Cost structures were affected by scrap rates and energy inputs tied to local processing methods. Demand remained strong across the aerospace and electronics segments, with additional pull from nuclear projects under development. Seasonal logistics inefficiencies had a minor influence on market sentiment.

Netherlands

In Q2 2025, the Netherlands reported prices of USD 3,978,000/MT. Market pricing reflected a combination of aviation-sector demand, modest increases in regional supply, and persistent freight-related costs. Broader EU environmental policies and energy price shifts also contributed to overall pricing dynamics during the quarter.

Hafnium Metal Industry Overview:

The global hafnium metal market reached USD 425.23 Million in 2024 and is projected to grow to USD 931.21 Million by 2033, registering a CAGR of 9.35% from 2025 to 2033. Hafnium’s use in high-temperature alloys, nuclear applications, and microelectronics positions it as a core material across multiple advanced manufacturing sectors.

Ongoing investments in space defense systems, small modular reactors (SMRs), and chip fabrication is expected to drive sustained demand. Supply chain complexity remains a constraint, with the metal’s recovery dependent on zirconium separation, which limits scalability despite growing need.

Recent Market Trends and Industry Analysis:

Hafnium continues to gain strategic value due to its high-temperature stability and neutron absorption properties. It remains indispensable in aerospace turbines, nuclear control rods, and high-k dielectric materials for semiconductors. As governments expand nuclear energy projects and private-sector space programs gain traction, hafnium’s role in long-cycle capital infrastructure is becoming more entrenched.

Semiconductor-grade hafnium oxide is in rising demand due to its efficiency in transistor scaling, supporting devices used in AI, 5G, and high-performance computing. Market sentiment remains bullish, supported by technology adoption trends, although pricing remains sensitive to raw material bottlenecks, export controls, and refining limitations. Industry players are also expanding recycling programs to enhance supply stability, especially in Europe and Asia.

Strategic Forecasting and Analysis:

IMARC’s report incorporates forecasting models that project near-term price movements based on evolving trade policies, raw material supply, and technological trends. These tools enable businesses to mitigate risk, enhance sourcing strategies, and support long-term planning.

Key Features of the Report:

- Price Charts and Historical Data

- FOB and CIF Spot Pricing

- Regional Demand-Supply Assessments

- Port-Level Price Analysis

- Sector-Specific Demand and Supply Insights

.webp)

.webp)