LPG Prices Reflect Global Market Dynamics: Q2 2025 Update

21-Jul-2025

Amid shifting geopolitical dynamics, supply chain disruptions, and fluctuating demand, the global LPG industry is experiencing notable pricing changes, according to IMARC Group’s latest publication, LPG Price Index Trend and Forecast Data Report 2025 Edition. The report provides updated insights for Q2 2025, detailing regional variations and market dynamics that are shaping the LPG pricing landscape. Key regions influencing these trends include North America, China, South Korea, and South Africa, where factors like trade policies, domestic production fluctuations, and international demand continue to drive prices.

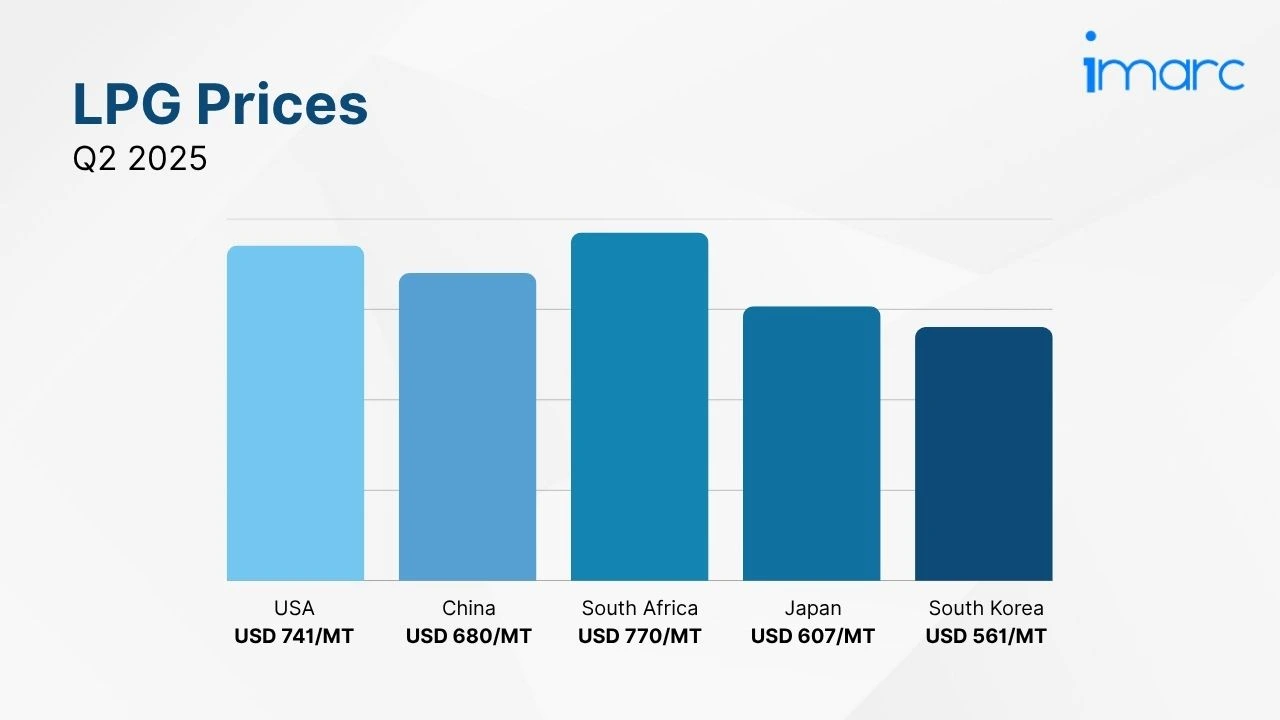

Q2 2025 LPG Prices:

- USA: USD 741/MT

- China: USD 680/MT

- South Africa: USD 770/MT

- Japan: USD 607/MT

- South Korea: USD 561/MT

To access real-time prices Request Sample

The current LPG prices highlight the material's essential role in key high-performance industries, including heating, petrochemical production, and transportation. The ongoing demand for LPG, coupled with supply disruptions and seasonal fluctuations, contributes to a stable to upward global price trajectory.

Key Regional Price Trends and Market Drivers:

United States

Prices rose to USD 741/MT, influenced by trade tensions with China and domestic production constraints. The surge in heating demand amid weather-related challenges, combined with logistical disruptions, further tightened supply.

China

At USD 680/MT, China’s LPG market is shaped by supply-side constraints due to the imposition of high tariffs on US imports and strategic stockpiling efforts. Although tariffs were later waived, panic buying caused prices to rise.

South Africa

The price surged to USD 770/MT, driven by a combination of international price movements and a strong local currency that helped mitigate cost pressures despite regional supply shortages.

Japan

Japan’s LPG prices stood at USD 607/MT, reflecting a decline in global propane prices and improved supply stability following a brief period of elevated import prices.

South Korea

In Q2 2025, South Korea’s LPG prices reached USD 561/MT, showing a modest increase compared to the previous year, influenced by shifts in feedstock utilization within the petrochemical sector and broader regional demand trends.

LPG Industry Overview:

The global LPG market reached a value of USD 144.80 Billion in 2024 and is projected to grow to USD 197.34 Billion by 2033, expanding at a CAGR of 3.33% from 2025 to 2033. Increasing demand from the commercial sector, particularly in heating and cooking applications, alongside LPG’s clean-burning properties, positions the market for steady growth. Its portability, low emissions, and reliable energy supply make it essential across various sectors, including residential, industrial, and off-grid locations.

Key drivers of LPG market growth include rising environmental concerns driving the adoption of cleaner energy solutions, increasing demand from petrochemical industries, and the push for more energy-efficient heating systems. Additionally, LPG’s versatility and low-maintenance requirements continue to make it a preferred energy source in regions with limited access to alternative fuels.

Recent Market Trends and Industry Analysis:

LPG continues to play a crucial role in high-performance sectors, particularly in heating, cooking, and industrial applications, where its cost-effectiveness and energy efficiency are highly valued.

Despite challenges like supply disruptions and geopolitical factors, LPG remains an essential component in the global energy mix. Its growing use in developing regions and off-grid areas further bolsters its market position, making it a key factor in facilitating global energy transitions.

Strategic Forecasting and Analysis:

IMARC’s report incorporates forecasting models that project near-term price movements based on evolving trade policies, raw material supply, and technological trends. These tools enable businesses to mitigate risk, enhance sourcing strategies, and support long-term planning.

Key Features of the Report:

- Price Charts and Historical Data

- FOB and CIF Spot Pricing

- Regional Demand-Supply Assessments

- Port-Level Price Analysis

- Sector-Specific Demand and Supply Insights

.webp)

.webp)