Natural Gas Prices Influenced by Global Market Dynamics: Q2 2025 Update

17-Jul-2025

The global natural gas industry witnessed divergent pricing patterns across key regions, influenced by evolving supply-demand dynamics, geopolitical developments, and domestic regulatory frameworks. IMARC's newly released report, Natural Gas Price Trend, Index and Forecast Data Report 2025 Edition, provides updated insights for Q2 2025 and presents an in-depth analysis of price movements. The report further highlights the trends in regional supply chains and demand shaping the market across major economies. Key markets shaping this trend include North America, Asia Pacific, and Europe, where production dynamics, LNG trade flows, and domestic pricing regulations continue to steer pricing behavior.

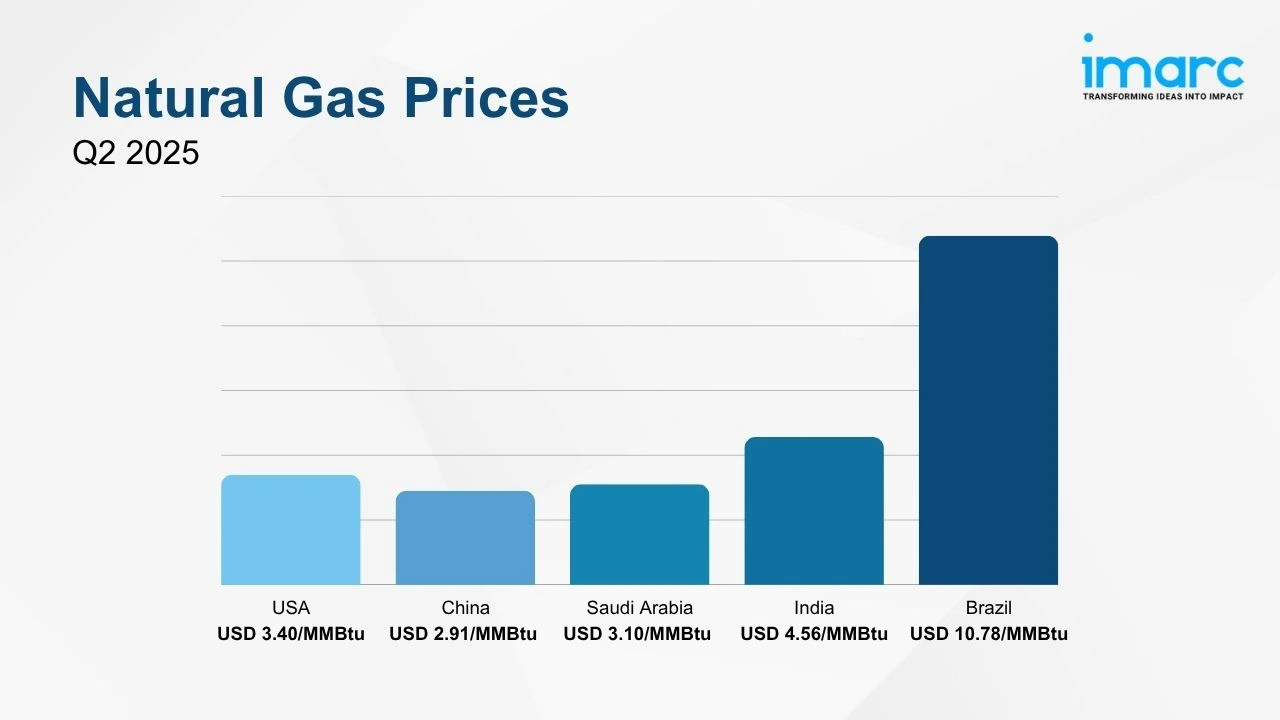

Q2 2025 Natural Gas Prices:

- USA: USD 3.40/MMBtu

- China: USD 2.91/MMBtu

- Saudi Arabia: USD 3.10/MMBtu

- India: USD 4.56/MMBtu

- Brazil: USD 10.78/MMBtu

To access real-time prices Request Sample

The current natural gas prices across key regions underscore the material’s vital role in high-performance industries such as power generation, petrochemicals, and manufacturing, with sustained demand, infrastructure expansion, and policy-driven consumption contributing to a stable or gradually rising global price trend.

Key Regional Price Trends and Market Drivers:

United States:

Natural gas prices stood at USD 3.40/MMBtu as robust shale production outpaced demand. Ample storage and mild seasonal weather further suppressed consumption, maintaining a weak pricing environment despite growing export capacity.

China:

Prices reached USD 2.91/MMBtu due to high LNG inventories and muted industrial demand. Elevated imports from Russia and Central Asia, combined with government oversight and seasonal mildness, reinforced supply-side dominance.

Saudi Arabia:

The natural gas prices averaged USD 3.10/MMBtu, reflecting the impact of fixed domestic pricing and ample supply from non-associated gas fields. Rising industrial demand was offset by government subsidies, ensuring market stability.

India:

Prices held steady at USD 4.56/MMBtu, supported by regulated domestic pricing and steady LNG imports. Firm demand from the fertilizer and power sectors was balanced by abundant contracted supply and infrastructure-based distribution.

Brazil:

Prices rose high to USD 10.78/MMBtu and faced downward pressure amid expanding supply from Petrobras, Rota 3, and Argentine imports. Flexible contracts and enhanced infrastructure contributed to market moderation despite increased power demand.

Natural Gas Industry Overview:

The global natural gas market reached a value of USD 1,126.7 Billion in 2024 and is projected to grow to USD 2,529.11 Billion by 2033, expanding at a CAGR of 8.93% during 2025–2033. The market is witnessing consistent demand from sectors such as automotive, mining, aerospace, and oil and gas, where precision tooling and durability are critical. As manufacturing output expands and infrastructure investments accelerate, tungsten carbide remains a preferred material in high-performance machining and cutting tools.

Key drivers supporting the market include increasing adoption in metal cutting and drilling operations, particularly in developing economies, and growing emphasis on product longevity and process efficiency. Additionally, the rise of electric vehicles (EVs) and renewable energy projects has further strengthened demand for high-performance components, while technological advancements in powder metallurgy and recycling processes continue to enhance material utilization and sustainability across the value chain.

Recent Market Trends and Industry Analysis:

The global natural gas market is experiencing robust growth, driven by rising global energy demand, the shift toward cleaner alternatives to coal and oil, and technological advancements in extraction and distribution. Stable production levels have been maintained despite regional fluctuations, with North America, the Middle East, China, and Australia offsetting declines in Russian output. The U.S. has emerged as a leading producer, supported by increased output and infrastructure development, while natural gas continues to gain preference due to its lower carbon emissions and pivotal role in the global energy transition.

Continuous innovations and geopolitical factors are also shaping the industry landscape. Emerging technologies such as Renewable Natural Gas (RNG), hydrogen blending, and smart methane detection systems are promoting sustainability and operational efficiency. At the same time, energy security concerns are influencing global LNG investments, with countries like Australia becoming dominant exporters. Natural gas remains a critical resource for electricity generation, industrial applications, and residential heating, underscoring its foundational role in the global energy mix.

Strategic Forecasting and Analysis:

IMARC’s report incorporates forecasting models that project near-term price movements based on evolving trade policies, raw material supply, and technological trends. These tools enable businesses to mitigate risk, enhance sourcing strategies, and support long-term planning.

Key Features of the Report:

- Price Charts and Historical Data

- FOB and CIF Spot Pricing

- Regional Demand-Supply Assessments

- Port-Level Price Analysis

- Sector-Specific Demand and Supply Insights

.webp)

.webp)