Phosphorus Trichloride Prices Surge in Q2 2025 Amid Rising Industrial Demand and Supply Constraints

16-Oct-2025

Phosphorus trichloride (PCl3) is a colorless, fuming liquid with a pungent odor, serving as a critical intermediate in the production of various phosphorus compounds across global chemical industries. Produced through the reaction of elemental phosphorus with chlorine gas, it is highly reactive and essential in manufacturing organophosphorus pesticides, pharmaceutical intermediates, plasticizers, flame retardants, and phosphite ester stabilizers for plastics and elastomers. Given its fundamental role in agrochemical production, pharmaceutical synthesis, and industrial chemical manufacturing, pricing remains highly sensitive to feedstock availability (yellow phosphorus and chlorine), downstream agricultural and pharmaceutical demand cycles, production capacity constraints, and environmental regulatory frameworks. June 2025 witnessed mixed regional trends as feedstock cost pressures, demand volatility from key end-use sectors, and supply-side dynamics created distinct pricing trajectories across major markets.

Global Market Overview:

Globally, the phosphorus trichloride industry was valued at USD 1.78 Billion in 2024. Projections suggest the market could grow to USD 2.72 Billion by 2033, with a compound annual growth rate (CAGR) of 4.56% from 2025 to 2033. Growth is being driven by increasing demand for agrochemicals (particularly herbicides and insecticides), expanding pharmaceutical production requiring high-purity chemical intermediates, rapid industrialization and urbanization boosting chemical manufacturing capacity, and ongoing technological advancements in production processes. Environmental regulations promoting sustainable pesticide development and market consolidation through strategic mergers and acquisitions further support the long-term market expansion trajectory.

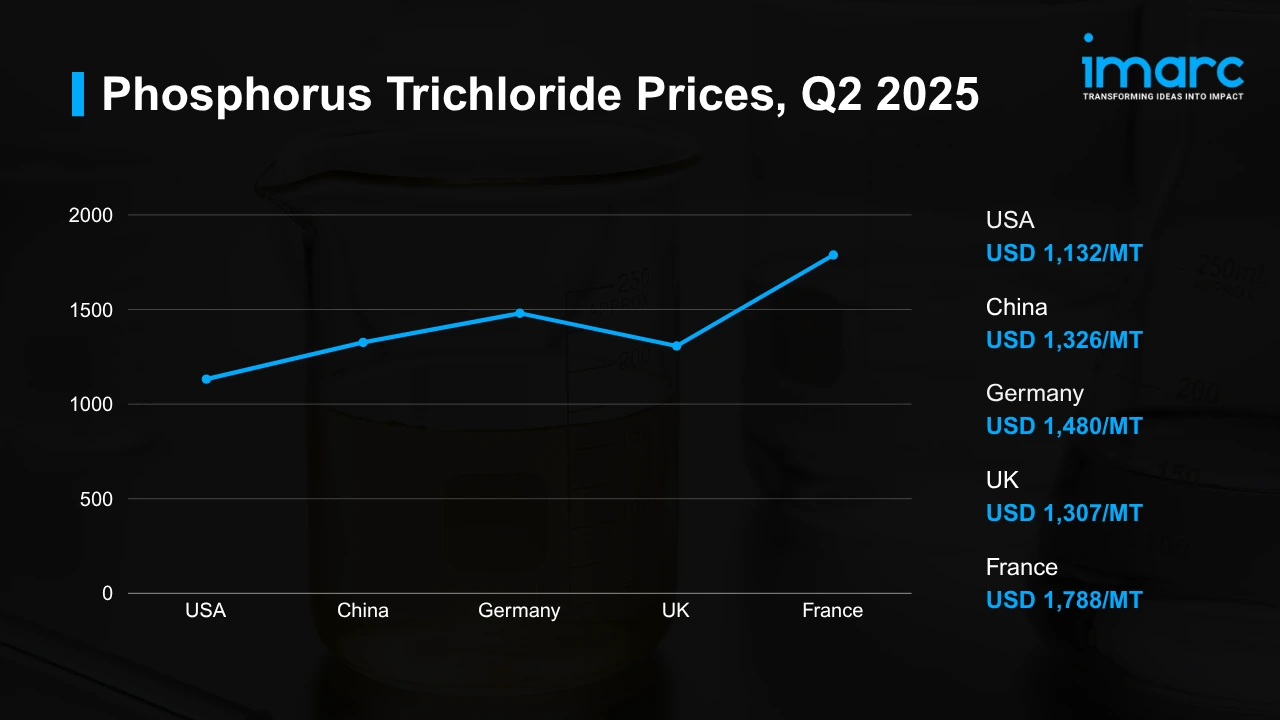

Phosphorus Trichloride Price Trend Q2 2025:

| Region | Price (USD/Kg) |

|---|---|

| USA | 1,132 |

| China | 1,326 |

| Germany | 1,480 |

| UK | 1,307 |

| France | 1,788 |

To access real-time prices Request Sample

What Moved Prices:

- USA: Prices increased moderately as steady domestic fundamentals supported stable market conditions. Production levels remained consistent with reliable operating rates at key manufacturing facilities and stable logistics networks. Balanced inventories covered both contractual and spot market requirements, preventing sharp price fluctuations. Since the majority of the market operated under long-term supply agreements, daily variations in demand or feedstock conditions exerted limited influence on overall pricing direction throughout the quarter.

- China: Prices declined despite firm production cost fundamentals driven by persistently elevated yellow phosphorus prices. Ore scarcity and tight inventory levels constrained producers' ability to reduce cost burdens, while a temporary chlorine price increase in June added upward cost pressure. However, weakening demand signals from downstream agrochemical, dye, and pharmaceutical sectors outweighed input cost support, creating downward pricing momentum as buyers reduced procurement volumes and inventory destocking occurred.

- Germany: Prices rose as feedstock dynamics shifted favorably for producers. Early in the quarter, butadiene prices (a principal feedstock) declined significantly, reflecting improved supply availability and softening demand. This easing in feedstock cost pressure reduced production burdens for phosphorus trichloride manufacturers. However, mixed demand from key industrial sectors including automotive and construction tempered potential price gains, resulting in moderate upward movement rather than sharp increases.

- UK: Pricing reflected tight supply-side dynamics and concentrated market structure. With production capacity limited to a few key players, the market remained sensitive to operational constraints and capacity utilization rates. Expectations of sustained demand growth from downstream sectors, particularly automotive manufacturing and industrial applications, created a tight supply-demand balance. This constrained environment provided support for price stability and modest upward momentum throughout the period.

- France: Prices increased driven by sustained industrial activity across automotive and manufacturing sectors, supporting steady phosphorus trichloride demand. Growing usage in construction applications, adhesives, and industrial rubber products—fueled by infrastructure expansion and manufacturing growth—added incremental demand pressure. Upstream feedstock volatility, particularly in markets experiencing butadiene price fluctuations, translated into higher production costs that producers passed through to buyers, reinforcing the upward pricing trajectory.

Drivers Influencing the Market:

Several factors continue to shape phosphorus trichloride pricing and market behavior:

- Agrochemical Demand for Pesticide Production: Phosphorus trichloride serves as a vital precursor in manufacturing organophosphorus compounds essential for modern herbicides and insecticides. Growing global agricultural demand linked to rising population, food security concerns, and the need for enhanced crop yields drives sustained consumption. Seasonal planting cycles, particularly in major agricultural regions, create periodic demand surges that significantly influence pricing patterns and procurement volumes.

- Pharmaceutical Sector Expansion and High-Purity Requirements: The expanding pharmaceutical industry requires phosphorus trichloride for synthesizing various pharmaceutical intermediates and active pharmaceutical ingredients (APIs). Ongoing medical advancements, new drug development pipelines, and increasing healthcare access in emerging markets drive demand for high-purity phosphorus trichloride. Stringent quality specifications and regulatory compliance requirements in pharmaceutical applications command premium pricing and create market segmentation.

- Yellow Phosphorus Feedstock Cost Dynamics: Production economics are fundamentally tied to yellow phosphorus availability and pricing, which represents the primary raw material input. Ore scarcity, environmental restrictions on phosphorus mining operations, energy-intensive production processes, and geopolitical factors affecting supply chains create significant cost volatility. Fluctuations in yellow phosphorus markets directly translate into phosphorus trichloride production costs and pricing, establishing a firm cost floor for manufacturers.

- Chlorine Market Dynamics and Co-Production Economics: Chlorine gas, the second critical feedstock, is typically produced through chlor-alkali processes. Market conditions in chlorine, caustic soda co-production economics, energy costs for electrolysis, and demand patterns from competing chlorine applications (PVC, water treatment, bleaching) all influence chlorine availability and pricing. Temporary chlorine market tightness or price spikes create immediate upward cost pressure on phosphorus trichloride production.

- Industrialization, Urbanization, and Chemical Manufacturing Investment: Rapid industrialization and urbanization, particularly in emerging economies, drive increased production capacities and investments in chemical manufacturing infrastructure. Expanding industrial bases create sustained demand for phosphorus trichloride across diverse applications including plasticizers, flame retardants, and industrial intermediates. Infrastructure development and manufacturing sector growth provide long-term demand support beyond agricultural cycles.

- Environmental Regulations and Sustainable Production Initiatives: Stricter environmental regulations governing chemical production, workplace safety, emissions control, and hazardous material handling influence operational costs and production practices. Growing emphasis on developing environmentally friendly pesticides and sustainable chemical processes drives research and development investments. Regulatory compliance costs, emission reduction requirements, and waste treatment obligations create upward pressure on production economics and pricing structures.

- Technological Advancements in Production Efficiency: Ongoing innovations in phosphorus trichloride synthesis—including enhanced reaction control systems, process automation, energy optimization, and yield improvements—reduce production costs and improve product quality. Advanced manufacturing technologies enable more efficient feedstock utilization, lower energy consumption, and reduced hazardous emissions. These technological gains improve production economics and market accessibility while potentially moderating long-term price increases through efficiency improvements.

Outlook & Strategic Takeaways:

Looking ahead, the phosphorus trichloride market is expected to maintain steady growth at 4.56% CAGR through 2033, supported by expanding agrochemical demand driven by global food security needs, pharmaceutical industry growth requiring specialized intermediates, continued industrialization in emerging economies, and technological advancements improving production efficiency. Regional price divergence is likely to persist, with markets experiencing premium pricing due to feedstock constraints, concentrated production capacity, or strong end-use demand, while regions with integrated supply chains and established production infrastructure may exhibit more stable pricing patterns. Feedstock availability, particularly yellow phosphorus supply dynamics, environmental regulatory evolution, seasonal agricultural demand cycles, and pharmaceutical industry investment trends will significantly shape medium-term pricing trajectories and supply-demand balances across global markets.

To navigate this complex landscape, stakeholders should:

- Track phosphorus trichloride prices monthly and regionally to identify inflection points or early signals of shifting supply-demand dynamics, particularly monitoring seasonal agricultural procurement patterns, yellow phosphorus market movements, and pharmaceutical industry activity that create demand variability across quarters and influence pricing momentum.

- Benchmark procurement against regional price differentials to optimize sourcing strategies. The USD 656/MT spread between USA and France represents significant opportunity for procurement optimization and strategic sourcing diversification, though quality specifications, logistics costs, regulatory compliance requirements, and supply reliability must be factored into total cost of ownership assessments.

- Monitor upstream feedstock markets closely including yellow phosphorus ore availability, mining output restrictions, chlorine market conditions, and energy costs that directly translate into production economics and pricing fundamentals. Yellow phosphorus supply constraints and chlorine market tightness create immediate upward cost pressures that materially affect phosphorus trichloride availability and pricing across all regions.

- Assess seasonal agricultural demand cycles and planting calendar dynamics across major crop-producing regions, as agrochemical procurement patterns tied to spring and fall planting seasons create predictable demand surges and inventory building that influence pricing trends. Advanced planning around agricultural cycles enables optimized procurement timing and inventory management strategies.

- Evaluate pharmaceutical industry trends and API development pipelines as leading indicators of high-purity phosphorus trichloride demand. New drug approvals, pharmaceutical manufacturing capacity expansions, and regulatory changes affecting pharmaceutical production create incremental demand growth and potential supply tightness for specialty-grade material commanding premium pricing.

- Monitor environmental regulations and compliance requirements affecting production operations, emissions standards, workplace safety mandates, and hazardous material handling procedures that influence operational costs. Regulatory tightening, permitting restrictions, or production shutdowns due to environmental non-compliance can create supply disruptions and pricing volatility across affected regions.

- Diversify supply sources across regions and suppliers to mitigate production disruption risks, feedstock availability constraints, and geopolitical uncertainties. Single-source procurement strategies remain vulnerable to facility outages, feedstock shortages, regulatory actions, and force majeure events that create supply interruptions and pricing spikes during periods of market tightness.

- Establish strategic partnerships with reliable producers offering consistent quality, regulatory compliance, technical support, and supply security. Given the hazardous nature of phosphorus trichloride and strict handling requirements, relationships with established manufacturers providing proper documentation, safety data, and logistics expertise provide competitive advantages in material sourcing and risk management.

- Plan logistics and material handling strategically to navigate the specific challenges of transporting hazardous, corrosive materials requiring specialized containers, safety protocols, regulatory documentation, and trained personnel. Transportation costs, safety compliance, insurance requirements, and emergency response capabilities significantly influence total landed costs and operational risk profiles.

- Explore opportunities in high-value pharmaceutical-grade material where stringent purity specifications, analytical documentation, and regulatory compliance command significant price premiums compared to industrial-grade product. Growing pharmaceutical sector demand and specialized application requirements create market segmentation opportunities for suppliers capable of meeting exacting quality standards.

Subscription Plans & Customization:

IMARC offers flexible subscription models to suit varying needs:

- Monthly Updates — 12 deliverables/year

- Quarterly Updates — 4 deliverables/year

- Biannual Updates — 2 deliverables/year

Each includes detailed datasets (Excel + PDF) and post-report analyst support.

.webp)

.webp)