Soybean Oil Prices in the U.S. Ease During Sep 2025 Amid Rising Stocks

03-Sep-2025

Amid evolving trade dynamics and shifting biofuel incentives, the global soybean oil market is undergoing notable pricing adjustments, according to IMARC Group’s latest publication, Soybean Oil Price Trend, Index and Forecast Data Report 2025 Edition, which provides updated insights for Q2 2025. The report highlights how policy changes, weather-related disruptions, and logistics costs are shaping quarterly outcomes. Key markets steering these movements include North America, Asia Pacific, and Europe, where demand patterns, crushing margins, currency effects, and export timing continue to influence price momentum.

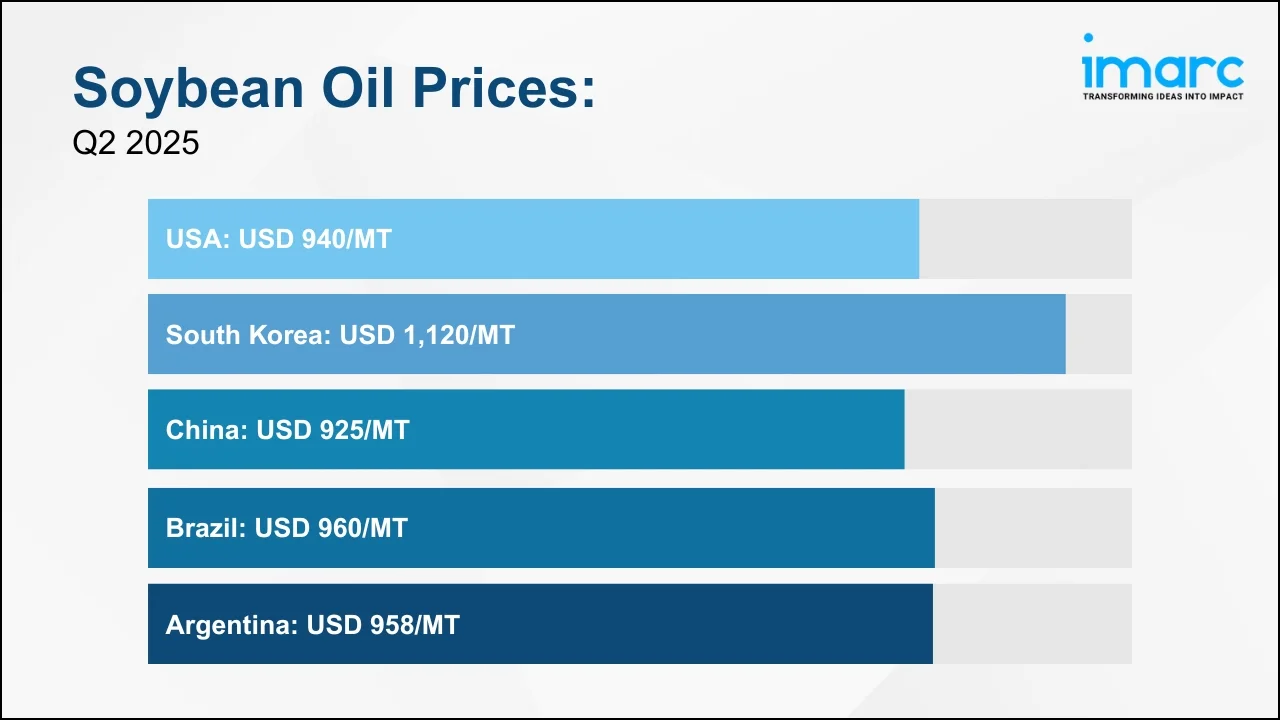

Q2 2025 Soybean Oil Prices:

- USA: USD 940/MT

- South Korea: USD 1,120/MT

- China: USD 925/MT

- Brazil: USD 960/MT

- Argentina: USD 958/MT

To access real-time prices Request Sample

The current soybean oil prices underscore the commodity’s essential role in edible oil and food processing and its linkage to the biodiesel value chain, with sustained demand and supply constraints contributing to a stable to upward global price trajectory.

Key Regional Price Trends and Market Drivers:

United States

Soybean oil prices in the USA reached USD 940/MT in Q2 2025, with an upward intra-quarter push supported by policy shifts, firm global demand, and persistent supply constraints. Higher freight expenses and squeezed crushing margins lifted costs, while weather-related planting delays in the Midwest tightened oilseed availability and constrained the raw material pipeline.

South Korea

In South Korea, soybean oil prices stood at USD 1,120/MT in June 2025, demand remained cautious. Food processors limited buying to immediate needs amid economic uncertainty. Industrial uptake tied to biofuel blending was restrained by lower crude prices, reducing incentives for soybean oil usage. Importers also shifted toward cheaper substitutes (e.g., palm oil), pressuring soybean oil’s domestic position.

China

In China, Soybean oil prices settled at USD 925/MT in June 2025, drifting consistently lower on oversupply and subdued demand at home and abroad. Record-high crushing volumes flooded the market, while muted export appetite left sellers competing aggressively and kept prices under pressure.

Brazil

Soybean oil prices in Brazil reached USD 960/MT in June 2025. Currency fluctuations and weather variability complicated cost bases early in the quarter, but logistics efficiencies in June enabled exporters to meet strong external demand, firming late-quarter pricing and offsetting mid-quarter bearishness.

Argentina

At USD 958/MT in June 2025, soybean oil prices in Argentina traced a turbulent path amid shifting policy signals, weather-related production factors, and variable international demand. Early-quarter tight harvest availability kept crushing cautious and prices firm; a June acceleration in exports ahead of anticipated duty increases marked the pivotal turn in quarterly dynamics.

Q2 vs. Q1:

| Country | Q2 2025 | Q1 2025 | Q2 vs. Q1 Trends |

|---|---|---|---|

| USA | USD 940/MT | USD 1015/MT | Prices decreased in Q2. The decline is due to higher freight, compressed crushing margins, and weather-delayed planting—mixed pressures despite intra-quarter upward moves |

| China | USD 925/MT | USD 947/MT | Prices dropped slightly from Q1. This was influenced by record crushing, oversupply, muted exports, and subdued end-use demand |

| Brazil | USD 960/MT | USD 937/MT | Prices increased in Q2. Q1 prices tied to strong exports and currency depreciation; Q2 firmed further as June logistics efficiencies improved reliability and met strong external demand despite earlier weather/currency uncertainty |

| Argentina | USD 958/MT | USD 976/MT | Prices decreased Q2. Q1 had high export demand, inflationary pressures, and cost increases amid weaker yields; Q2 volatility culminated in accelerated June shipments ahead of possible export duty hikes |

Soybean Oil Industry Overview:

The global soybean oil market reached a volume of 62.3 Million Tons in 2024 and is projected to reach a volume of 72.3 Million Tons by 2033, expanding at a CAGR of 1.70% during 2025-2033. Rising health awareness, amid elevated global obesity incidence, continues to shift consumer preferences toward healthier cooking oils, supporting soybean oil’s role in everyday diets. Concurrently, rapid urbanization and population growth are lifting edible oil consumption across regions.

Additional growth drivers include the expanding plant-based foods movement and soybean oil’s broadening industrial footprint in biodiesel, lubricants, paints, and coatings. Supportive government programs and mandates that encourage biofuel feedstocks, alongside technological advances in agriculture, are enhancing yields, stabilizing quality, and creating favorable conditions for long-term market expansion.

Recent Market Trends and Industry Analysis:

The global soybean oil market is expanding due to rising health awareness, urbanization, and shifting consumer preferences toward plant-based diets. Growing concerns about obesity and heart disease are driving demand for healthier cooking oils, while increasing disposable incomes enable consumers to opt for premium, health-focused choices. Additionally, the growing popularity of plant-based foods in the U.S. and globally is fueling demand, as soybean oil is considered a sustainable alternative to animal-derived fats.

Beyond food applications, soybean oil is gaining traction in industrial uses such as biodiesel, lubricants, and coatings. Supportive government initiatives and subsidies, particularly in biofuels, are strengthening demand. Furthermore, advancements in agricultural practices, including genetically modified seeds and precision farming, are enhancing yields and quality, creating new growth opportunities. Together, these factors position soybean oil as a key player in both food and industrial markets.

Strategic Forecasting and Analysis:

IMARC’s report incorporates forecasting models that project near-term price movements based on evolving trade policies, raw material supply, and technological trends. These tools enable businesses to mitigate risk, enhance sourcing strategies, and support long-term planning.

Key Features of the Report:

- Price Charts and Historical Data

- FOB and CIF Spot Pricing

- Regional Demand-Supply Assessments

- Port-Level Price Analysis

- Sector-Specific Demand and Supply Insights

.webp)

.webp)

.webp)

.webp)