Nitinol Medical Devices Market Size, Share, Trends and Forecast by Product Type, Application, End User, and Region, 2025-2033

Nitinol Medical Devices Market Size and Share:

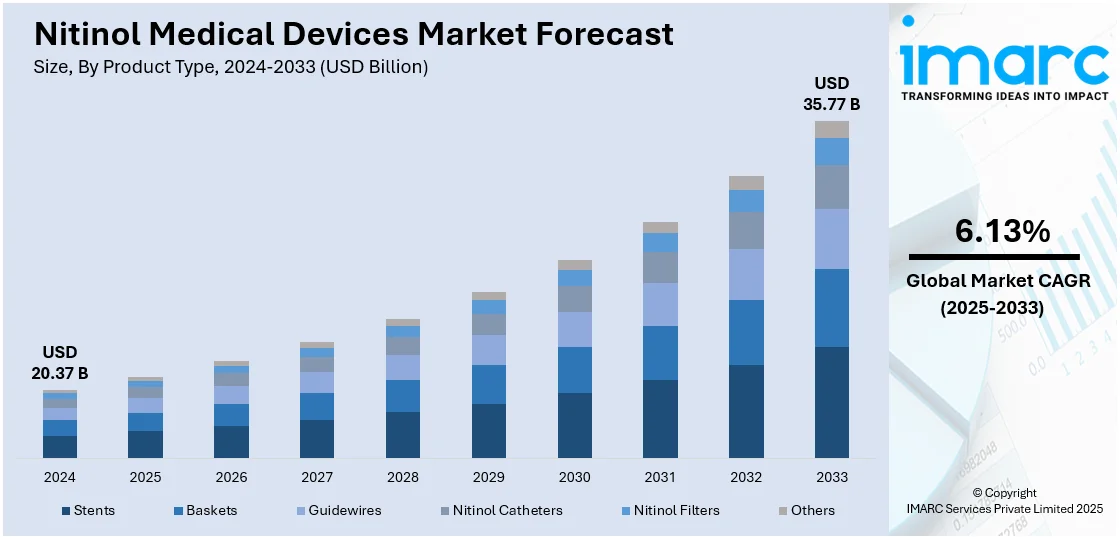

The global nitinol medical devices market size was valued at USD 20.37 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 35.77 Billion by 2033, exhibiting a CAGR of 6.13% from 2025-2033. North America currently dominates the market, holding a market share of 40.2% in 2024. The increasing need for minimally invasive (MI) surgical methods is impelling the growth of the market. This trend, along with technological improvements in nitinol processing and medical device technology, is offering a favorable market outlook. Apart from this, the heightened occurrence of chronic ailments and the growing aging population are expanding the nitinol medical devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 20.37 Billion |

|

Market Forecast in 2033

|

USD 35.77 Billion |

| Market Growth Rate 2025-2033 | 6.13% |

The market is witnessing strong growth, led by a combination of technological innovation and high clinical demand. Shape memory and superelastic alloys are continuously innovated by manufacturers, allowing devices to function well in minimally invasive (MI) procedures. These materials are increasing device flexibility and durability, which is particularly valuable in applications like stents, guidewires, and orthopedic implants. Since medical professionals are using more MI methods, nitinol-based devices are becoming more widely accepted in interventional cardiology, neurology, and urology. At the same time, the healthcare industry is witnessing a rise in the aging population and an increment in chronic disease prevalence. This trend is driving the demand for long-term implantable solutions, where nitinol's biocompatibility and mechanical properties are offering significant advantages.

The United States nitinol medical devices market is experiencing steady growth, driven by technological advances and rising clinical adoption of cutting-edge materials. The makers of medical devices are continuously incorporating nitinol's distinctive features, like shape memory and superelasticity, into diverse products ranging from stents and catheters to orthopedic implants. These devices are making procedures less invasive and enhancing recovery times for patients, which is maintaining the shift toward value-based healthcare and outpatient delivery models. As per the nitinol medical devices market report, hospitals and surgical centers across the US are increasingly adopting nitinol-based technologies, which offer the ability to conform to anatomical shapes and provide consistent long-term performance. In parallel, healthcare professionals are experiencing a high demand for solutions that provide treatments for cardiovascular and neurological diseases, which is further driving the adoption of nitinol in key interventional procedures. Approximately 61% of American adults will have cardiovascular disease in 2050, according to new projections by the American Heart Association. The largest contributor to this trend will be the huge number of individuals who have or will develop high blood pressure, which puts them many times at risk for developing lethal issues, such as a heart attack.

Nitinol Medical Devices Market Trends:

Rising Demand for Minimally Invasive (MI) Surgical Procedures

The industry is driven by the heightened demand for MI surgical procedures. Nitinol-based devices are increasingly being used by surgeons due to their better flexibility, shape memory, and biocompatibility. These characteristics are facilitating devices like stents, guidewires, and retrieval devices to travel through complex anatomical pathways with minimal trauma. Hospitals and outpatient facilities are embracing MI surgical methods on a constant basis because of decreased recovery time, lower risk of infection, and fewer days spent in the hospital. As patients are growing more familiar with the advantages of MI procedures, medical professionals are focusing on equipment that ensures accuracy and safety. Nitinol's capability to recover its pre-established shape following deformation is improving procedural accuracy and dependability. Also, companies are investing in the production of new nitinol-based devices to address changing surgical needs. The IMARC Group predicts that the global minimally invasive surgery market is projected to attain USD 94.9 Billion by 2033.

Technological Advancements in Nitinol Processing and Device Design

Technological improvements in nitinol processing and medical device technology are propelling the nitinol medical devices market growth. Scientists and manufacturers are innovating new alloy compositions and manufacturing processes that are enhancing nitinol's mechanical properties and fatigue resistance. Technologies like laser cutting, electropolishing, and sophisticated surface coatings are enhancing device lifespan and biocompatibility. These advances are enabling nitinol-based devices to function consistently under dynamic physiological conditions, particularly in cardiovascular and orthopedic applications. Concurrently, engineers are creating more advanced nitinol devices that can dynamically respond to changes in body temperature and pressure, optimizing function within the human body. Medical firms are heavily investing in research and development (R&D) to maximize device precision and customization, especially for patient-specific solutions. As these technological advancements are making devices more efficient and secure, they are promoting increased uptake among healthcare professionals. In 2024, the FDA permitted Abbott’s TriClip system, which employs nitinol for transcatheter edge-to-edge repair (TEER) of tricuspid valves within the heart.

Increasing Occurrence of Chronic Illnesses and Aging Population

The rising occurrence of chronic ailments and the growing aging population are offering a favorable nitinol medical devices market outlook. Healthcare systems are finding it imperative to address conditions like cardiovascular disease, peripheral artery disease, and osteoporosis that need long-term and long-lasting solutions. Nitinol's special feature of providing superelasticity and shape memory is rendering it suitable for uses like stents and orthopedic implants in geriatric patients. With the aging population worldwide, the need for less invasive medical interventions with quicker recovery is increasing. Physicians are also on the lookout for devices that minimize the physical stress of surgery on elderly patients, and hence, nitinol-based products are a choice of preference. At the same time, both public and private healthcare systems are rising investments in managing chronic diseases, promoting the adoption of sophisticated nitinol technologies. Worldwide, life expectancy at birth increased to 73.3 years in 2024, up from 8.4 years during the last quarter of a century since 1995. The population aged 60 and above globally is expected to grow from 1.1 billion in 2023 to 1.4 billion by 2030. This will further increase the need for effective medical devices to cure various devices.

Nitinol Medical Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global nitinol medical devices market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, application, and end user.

Analysis by Product Type:

- Stents

- Baskets

- Guidewires

- Nitinol Catheters

- Nitinol Filters

- Others

Stents stand as the largest component in 2024, holding around 68.9% of the market. They are becoming a dominant product type, stimulated by increasing clinical uses and technology advancements. Nitinol stents are becoming widely applied in vascular and non-vascular interventions because of their superior flexibility, superelasticity, and capacity to expand and conform to complex anatomical structures. Medical professionals are gradually embracing these stents in treating diseases like coronary artery disease, peripheral artery disease, and carotid artery stenosis. Companies are presently developing self-expanding nitinol stents to achieve radial force uniformity and maximize positioning, especially in tortuosity or dynamic vasculatures. These stents are eliminating risks of restenosis and providing long-term improvement, which is improving their appeal with interventional cardiologists and vascular surgeons.

Analysis by Application:

- Cardiovascular

- Urology

- Dentistry

- Gastroenterology

- Others

Cardiovascular leads the market with 58.8% of market share in 2024. Nitinol-based products are increasingly used in cardiovascular interventions because of their special characteristics like super elasticity and shape memory, which are facilitating improved navigation and deployment in the vascular system. Medical practitioners are increasingly working with nitinol in products such as stents, guidewires, and vena cava filters to treat conditions like coronary artery disease and venous insufficiency. Hospitals and dedicated cardiac institutes are continuously investing in nitinol-advanced technologies to enhance procedural success and accelerate patient recovery. Its strength retention under conditions of dynamic physiology is making nitinol an optimum choice for devices that are to be implanted within pulsatile blood vessels. At the same time, a rise in catheter-based therapies and a shift toward outpatient cardiovascular procedures are driving the demand for nitinol devices. Companies are also focusing on innovation in products using drug-eluting and bioabsorbable nitinol technology to increase the range of therapeutic effects.

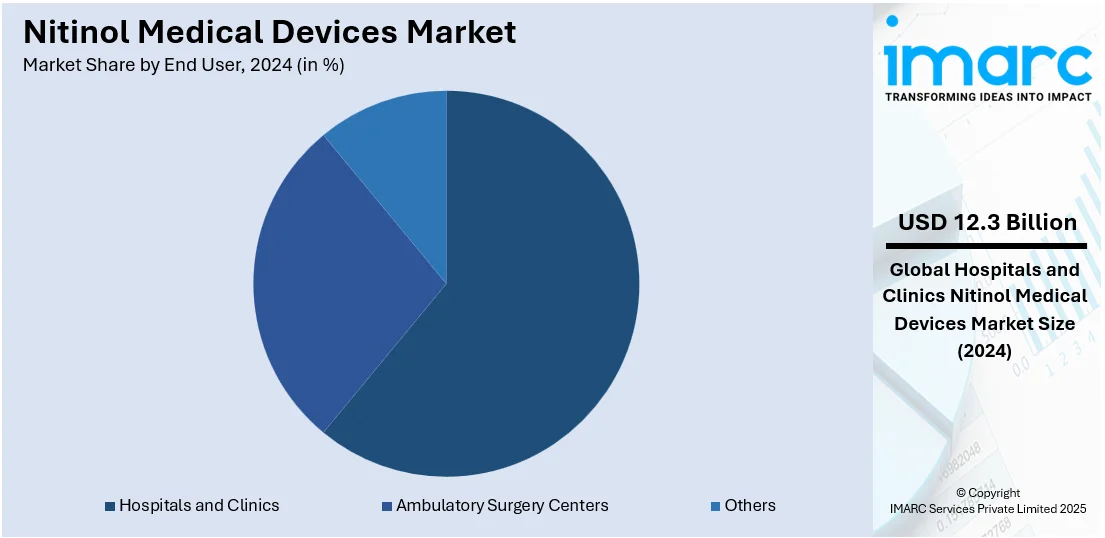

Analysis by End User:

- Hospitals and Clinics

- Ambulatory Surgery Centers

- Others

Hospitals lead the market with 60.6% of the market share in 2024. Hospitals are acting as the key end-users of nitinol medical devices, motivated by their increasing demand for sophisticated, secure, and MI therapeutic solutions. They are shifting to nitinol-based technologies to increase procedural productivity, enhance outcomes, and decrease hospital stays. Surgeons and interventional professionals in hospitals are employing nitinol devices like stents, catheters, and orthopedic implants for extensive procedures, especially cardiovascular and neurological treatment. Hospitals are also pushing the boundaries of surgery with MI technology, and nitinol's shape memory and superelastic characteristics are providing dramatic clinical benefits. These instruments are reshaping patient anatomies more precisely, allowing for more accurate interventions. Besides this, hospital procurement teams are emphasizing long-lasting and economical solutions, and nitinol devices are satisfying such requirements with their high performance and long-term durability.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds 40.2% share driven by continuous technology advancements in the healthcare sector and the increasing requirement for MI treatments. Healthcare facilities in the United States and Canada are steadily embracing nitinol-based products because of their excellent biomechanical characteristics, such as shape memory and superelasticity, which are becoming paramount in cardiovascular, orthopedic, and neurologic procedures. Device makers are constantly coming up with newer, more accurate, and robust products, driving clinical uptake by specialty. In parallel, the region is seeing a gradual increase in the incidence of chronic conditions like coronary artery ailment and peripheral artery complications, mostly among the elderly. This is catalyzing the demand for advanced implantable high-performance devices, and nitinol is turning into a desirable material for use in stents, filters, and guidewires. Regulation authorities in North America are streamlining approval channels, promoting the swift commercialization of cutting-edge nitinol technology. According to the nitinol medical devices market forecast, enhanced R&D funding and targeted collaborations between producers and healthcare providers are expected to improve the market's innovation infrastructure.

Key Regional Takeaways:

United States Nitinol Medical Devices Market Analysis

The United States holds 87.60% share in North America. The market is primarily driven by the high frequency of chronic diseases, such as cardiovascular disorders. According to the Centers for Disease Control and Prevention, approximately 129 Million individuals in the United States suffer from at least one major chronic disease. Moreover, 42% of individuals suffer from two or more chronic diseases, while 12% suffer from at least five. The market is also driven by growing applications beyond cardiology, notably in orthopedics, neurology, and urology. In orthopedic surgery, nitinol-based bone anchors and fixation devices offer flexibility and durability, reducing complications and enhancing post-operative recovery. Similarly, in urology, nitinol stents are increasingly used for treating ureteral obstructions, benefiting from their kink resistance and long-term patency. The expanding use of robotic-assisted and image-guided surgeries has further heightened the demand for precision instruments made from nitinol due to their excellent maneuverability and fatigue resistance. Additionally, increasing awareness among clinicians about the advantages of nitinol, such as its biocompatibility and low risk of allergic reactions, has led to a shift in preference from traditional materials. The industry also benefits from a favorable regulatory environment and the strong presence of leading medical device manufacturers, facilitating quicker approval and commercialization of new nitinol devices.

Asia Pacific Nitinol Medical Devices Market Analysis

The Asia Pacific market is expanding owing to the adoption of Western medical practices and surgical standards, particularly in emerging economies. The rise in medical tourism, particularly in countries such as India, Thailand, and Singapore, is creating a strong demand for high-performance, minimally invasive solutions, where nitinol devices play a vital role due to their precision and flexibility. As such, the medical tourism market in India reached USD 21.0 Billion in 2024 and is expected to grow at a CAGR of 13.78% during 2025-2033. Moreover, the growing number of private hospitals and specialty clinics is increasing the uptake of technologically advanced devices, including nitinol-based stents, filters, and orthopedic implants. For instance, in 2020, there were 43,486 private hospitals in India. Moreover, private infrastructure makes up almost 62% of the total healthcare infrastructure in the country. Besides this, collaborative ventures between global medical device manufacturers and local firms are also facilitating the localization of nitinol device production, reducing costs and improving accessibility across the region.

Europe Nitinol Medical Devices Market Analysis

The Europe market is facing robust growth, driven by numerous key factors. The increasing geriatric population in the region is contributing substantially to a higher prevalence of chronic conditions such as cardiovascular diseases, orthopedic disorders, and urological issues, necessitating advanced medical interventions. According to Eurostat, individuals aged 65 years and over accounted for 21.6% of the population of the European Union in January 2024. Moreover, nitinol-based devices, known for their superelasticity and shape memory properties, are being increasingly utilized in minimally invasive procedures, offering benefits such as reduced recovery times and improved patient outcomes. Countries such as Germany, France, and the United Kingdom are leading in the adoption of these devices, supported by well-established healthcare systems and a strong focus on medical innovation. Technological advancements in nitinol processing have also enhanced device performance, expanding their applications in neurovascular treatments and other complex procedures. In addition to this, favorable reimbursement policies and regulatory support are facilitating industry expansion by encouraging the adoption of innovative medical tools. The market is also benefiting from increased investments in research and development (R&D), preceding the introduction of new nitinol-based products tailored to specific medical needs.

Latin America Nitinol Medical Devices Market Analysis

The Latin America market is significantly propelled by the expansion of local manufacturing capabilities, which has enhanced regional supply chains, reduced costs, and improved access to advanced medical devices. Moreover, numerous governments are expanding healthcare expenditure across Latin America, boosting access to advanced treatments and thereby increasing demand for high-performance nitinol medical devices. For instance, in 2023, healthcare expenditure in Brazil accounted for 9.47% of the country’s GDP, equating to USD 161 Billion, as per the International Trade Administration (ITA). The increasing availability of skilled medical professionals trained in advanced device usage is also boosting confidence in the adoption of nitinol technologies, further supporting industry expansion in the region.

Middle East and Africa Nitinol Medical Devices Market Analysis

The Middle East and Africa market is being greatly influenced by the incidence of cardiovascular illnesses and the high requirement for minimally invasive procedures, which have led to a higher adoption of nitinol-based devices, such as stents and guidewires, known for their superelasticity and shape memory properties. Countries such as Saudi Arabia and the UAE are also increasingly investing in healthcare infrastructure, enhancing access to advanced medical technologies. According to the International Trade Administration, Saudi Arabia accounted for 60% of healthcare expenditure among the Gulf Cooperation Council (GCC) countries in 2024. Additionally, the expansion of private healthcare facilities and the growth of medical tourism in the region are also contributing to industry expansion.

Competitive Landscape:

Major market participants in the are undertaking various strategic measures to enhance their market positions and business performance. Major players are continuously investing in R&D to enhance the functionality, biocompatibility, and durability of products. By developing advanced nitinol processing technologies and incorporating innovative design features, these players are creating next-generation devices that are meeting intricate clinical demands in cardiovascular, orthopedic, and neurological treatments. Firms are also entering into strategic alliances and collaborations with hospitals, research organizations, and academic centers to speed up product innovation and clinical validation. These collaborations are enabling them to increase their product offerings while aligning with changing medical standards. At the same time, market leaders are rising their global distribution networks and strengthening their presence in emerging economies by setting up local manufacturing plants and sales operations.

The report provides a comprehensive analysis of the competitive landscape in the nitinol medical devices market with detailed profiles of all major companies, including:

- Arthrex Inc.

- B. Braun Melsungen AG

- Becton Dickinson and Company

- Boston Scientific Corporation

- Cook Group Incorporated

- Endosmart GmbH

- Medtronic plc

- Shanghai MicroPort Medical (Group) Co. Ltd.

- Stryker Corporation

- Terumo Corporation

- W. L. Gore & Associates Inc.

- Zimmer Biomet.

Latest News and Developments:

- April 2025: Medline UNITE secured FDA 510(K) clearance for its most recent implant device, the REFLEX HYBRID Nitinol Implant System. The nitinol implant offers advanced dynamic compression post-implantation.

- February 2025: Stryker completed its USD 4.9 billion acquisition of Inari Medical, whose portfolio included innovative nitinol-based devices like the FlowTriever and ClotTriever systems, designed for mechanical thrombectomy without thrombolytic drugs. These devices utilize nitinol's unique properties to effectively remove clots in venous thromboembolism cases.

- November 2024: Medical Device Components (MDC), a supplier of parts for minimally invasive medical devices, acquired Lighteum, a manufacturer of nitinol medical device components. Through this acquisition, MDC aimed to more effectively address the changing demands of the medical equipment sector and broaden its range of medical devices.

- May 2024: Medical Component Specialists (MCS) acquired an 18,000-square-foot nitinol devices production facility in New Hampshire. The acquisition allowed MCS to significantly expand its operations and increase its production of nitinol devices.

- May 2024: MedRes International, Inc. launched a novel technology development facility in Carlsbad, USA. The Carlsbad research team consisted of professionals who specialized in designing, developing, testing, and characterizing medical devices, particularly nitinol-based devices, and those who needed specialized delivery methods with exceptional performance.

Nitinol Medical Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Stents, Baskets, Guidewires, Nitinol Catheters, Nitinol Filters, Others |

| Applications Covered | Cardiovascular, Urology, Dentistry, Gastroenterology, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgery Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arthrex Inc., B. Braun Melsungen AG, Becton Dickinson and Company, Boston Scientific Corporation, Cook Group Incorporated, Endosmart GmbH, Medtronic plc, Shanghai MicroPort Medical (Group) Co. Ltd., Stryker Corporation, Terumo Corporation, W. L. Gore & Associates Inc., Zimmer Biomet, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the nitinol medical devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global nitinol medical devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the nitinol medical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The nitinol medical devices market was valued at USD 20.37 Billion in 2024.

The nitinol medical devices market is projected to exhibit a CAGR of 6.13% during 2025-2033, reaching a value of USD 35.77 Billion by 2033.

The market is being driven by the increasing need for minimally invasive surgical methods, ongoing technological innovations in nitinol processing and device design, the rising prevalence of chronic diseases, and the growing global aging population.

North America currently dominates the nitinol medical devices market, accounting for a share of 40.2%. This is attributed to strong healthcare infrastructure, high adoption of minimally invasive technologies, and continuous product innovation.

Some of the major players in the nitinol medical devices market include Arthrex Inc., B. Braun Melsungen AG, Becton Dickinson and Company, Boston Scientific Corporation, Cook Group Incorporated, Endosmart GmbH, Medtronic plc, Shanghai MicroPort Medical (Group) Co. Ltd., Stryker Corporation, Terumo Corporation, W. L. Gore & Associates Inc., Zimmer Biomet, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)