Nonwoven Fabrics Market Report by Material Type (Polyester, Polypropylene, Polyethylene, Rayon, and Others), Technology (Spun Bond, Wet Laid, Dry Laid, and Others), Application (Personal Care and Hygiene, Filtration, Healthcare, Automotive, Building and Construction, and Others), and Region 2025-2033

Nonwoven Fabrics Market Size:

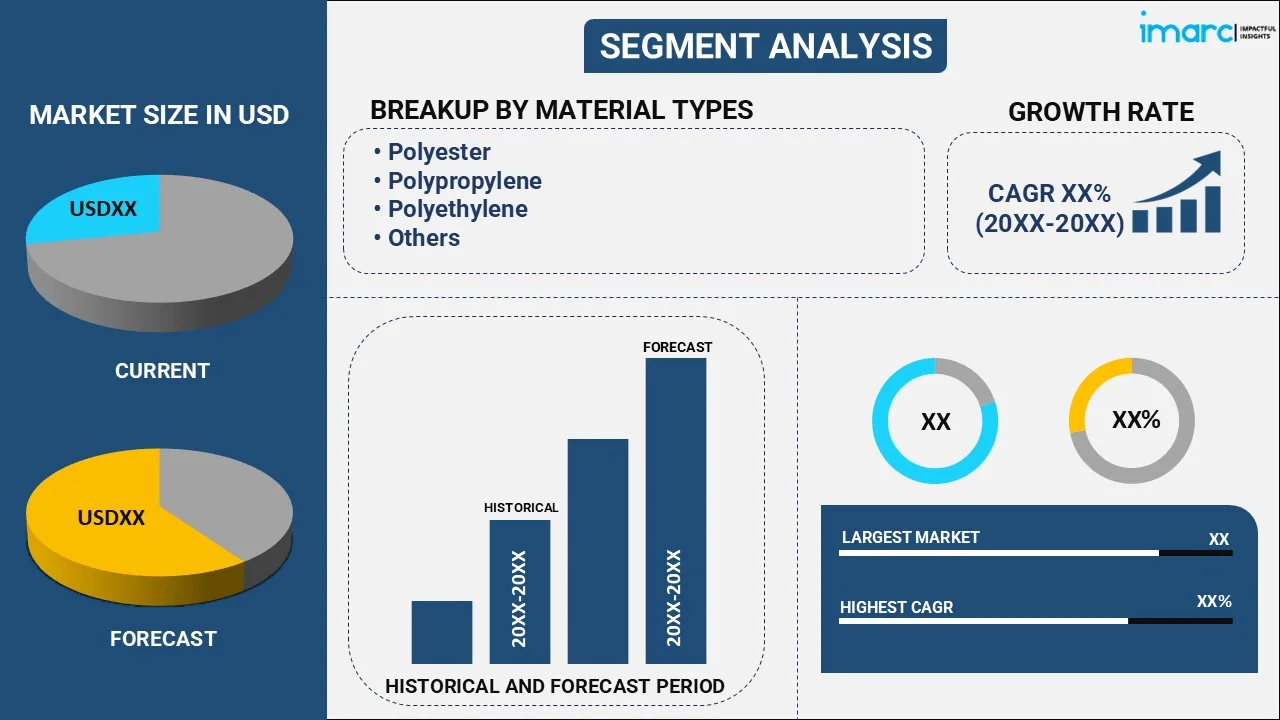

The global nonwoven fabrics market size reached USD 47.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 75.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.2% during 2025-2033. The market is witnessing strong growth because of heightening demand in healthcare and hygienic sectors, where items, such as surgical masks, gowns, and sanitary products are a necessity. Personal care products, including wipes and diapers, are also driving market growth. The automotive sector is using more nonwoven fabrics for insulation, filtration, and interior parts. Innovations in technology and sustainability trends are driving manufacturers towards environmentally friendly and affordable solutions, substantially impacting the nonwoven fabrics market share.

Nonwoven Fabrics Market Insights:

- Medical demand spurs market growth, with increased usage in protective equipment.

- Personal care items grow, fueling demand for gentle, skin-friendly nonwovens.

- Automotive sector adoption increases, employing nonwovens for insulation and interior applications.

- Sustainability themes fuel innovation, encouraging environmental and recyclable nonwoven offerings.

- Asia Pacific leads production, aided by industry growth and population demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 47.7 Billion |

| Market Forecast in 2033 | USD 75.3 Billion |

| Market Growth Rate (2025-2033) | 5.2% |

Nonwoven Fabrics Market Analysis:

- Major Market Drivers: The need for nonwoven textiles is rising owing to the construction, automotive, and healthcare sectors growth. Furthermore, the growing demand for medical items, particularly during and after COVID-19, and improved awareness about cleanliness have greatly increased product demand.

- Key Market Trends: The industry is shaped by technological developments in production processes, such as automation and the use of recycled materials. In line with international environmental initiatives, the increasing need for eco-friendly and sustainable nonwoven textiles are major trends propelling the market growth.

- Geographical Trends: Asia-Pacific nonwoven textiles market is driven by high population density, increasing industrialization, and robust production facilities. Besides, Europe and North America are driven by automotive and healthcare industries significant growth.

- Competitive Landscape: Some of the leading nonwoven fabrics companies include Ahlstrom-Munksjö Oyj, Berry Global Group Inc., DuPont de Nemours Inc., Fitesa S.A. and Affiliates (Petropar SA), Freudenberg Performance Materials SE & Co. KG, Johns Manville Corporation (Berkshire Hathaway), Kimberly-Clark Corporation, PFNonwovens Czech s.r.o. (PFNonwovens Holding s.r.o), Suominen Oyj, Toray Industries Inc., and TWE GmbH & Co. KG., among many others.

- Challenges and Opportunities: The market is faced with challenges from strict environmental rules and growing raw material costs. On the other hand, the growing consumer demand for eco-friendly goods and advancements in production methods represent vast opportunities for companies to increase their market share.

To get more information on this market, Request Sample

Nonwoven Fabrics Market Trends:

Rising Demand from Healthcare and Hygiene Sectors

The market for nonwoven textiles is expanding due to the rise of the hygiene and healthcare industries. In addition, the need for disposable medical supplies including masks, gowns, and surgical drapes surged globally, particularly during the epidemic. The American Medical Association reports that in 2022, US health spending reached $4.5 Trillion, or $13,493 per person, an increase of 4.1%. Additionally, health spending made up 17.3% of the nation's GDP in 2022. Moreover, the demand for medical-grade masks and personal protective equipment has grown due to the recent rapid expansion, which has resulted in a significant increase in the use of nonwoven materials. As healthcare systems across the globe continue to focus on preventing infections and ensuring patient safety, nonwoven fabrics have become essential due to their high filtration efficiency, breathability, and cost-effectiveness. Besides, healthcare facilities are increasingly focusing on infection control and single-use products, and the trend of disposable items in healthcare environments, motivated by hygiene and cross-contamination issues, has further widened the market and will continue to shape healthcare sectors post-pandemic. Furthermore, the increasing awareness regarding personal hygiene in developing economies is increasing the adoption of nonwoven medical products, thus propelling nonwoven fabrics market growth on a global scale.

Growth in Personal Care Products

The growing demand for personal care products is influencing the nonwoven fabrics market. According to the IMARC Group, the global market for beauty and personal care products reached a value of US$ 506.2 Billion in 2023. The market is projected to grow to US$ 759.3 Billion by 2032, with an expected CAGR of 4.5% between 2024 and 2032. Additionally, the increasing awareness about health and hygiene is escalating the nonwoven fabrics demand as nonwovens are soft and gentle on the skin, making them ideal for products like baby diapers, feminine hygiene products, and adult incontinence items. Their texture helps provide comfort during prolonged use. Furthermore, government initiatives promoting hygiene standards and better living conditions are driving the adoption of nonwoven fabrics in various personal care applications.

Significant Expansion in the Automotive Industry

According to the India Brand Equity Foundation (IBEF), Indian market captures the third position in the international market for heavy vehicles. India is the largest tractor manufacturer and second-largest bus manufacturer and third-largest heavy truck maker. For the fiscal year of 2023, India produced 25.9 million vehicles. The economy of the country is supported by healthy internal demand coupled with large export volumes. Passenger vehicles, three-wheelers, two-wheelers, and quadricycles have collectively managed to achieve a production output of 2,358,041 units as of April 2024. Besides, India's total vehicle exports for the fiscal year 2023 were 4,761,487 units. Another important factor that drives the market is the growing usage of nonwoven fabrics by the automotive sector for applications such as insulation, filtration, and upholstery. These materials are lightweight, strong, and possess good thermal and acoustic insulation properties, making them more suitable for the interior of automobiles. Since car manufacturers are always on the lookout for sustainable materials that are offered at minimal costs, nonwoven textiles will be more recurrent in the future of car production, thus creating a positive nonwoven fabrics market outlook.

Nonwoven Fabrics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on material type, technology and application.

Breakup by Material Type:

- Polyester

- Polypropylene

- Polyethylene

- Rayon

- Others

Polypropylene accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the material type. This includes polyester, polypropylene, polyethylene, rayon, and others. According to the report, polypropylene represented the largest segment.

The report for the nonwoven fabrics market reveals that polypropylene is the fastest-growing segment and is gaining the lead owing to the rising demand. It is cost-effective and versatile in use for numerous applications. It is commonly employed in hygiene products such as diapers, sanitary napkins, and medical supplies like masks and gowns, with several industrial applications. Its lightweight and durable properties are essential for producing high-quality, disposable nonwoven fabrics. Moreover, the rising demand due to polypropylene's chemical resistance and eco-friendly recycling options are influencing the market growth. As the requirements for sustainable disposable products increase, polypropylene continues to generate a favorable nonwoven fabrics market revenue.

Breakup by Technology:

- Spun Bond

- Wet Laid

- Dry Laid

- Others

Spun bond holds the largest share of the industry

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes spun bond, wet laid, dry laid, and others. According to the report, spun bond accounted for the largest market share.

Spun bond technology holds the largest market share owing to its versatility, affordability, and various uses. Additionally, spun bond nonwovens are produced by extruding filaments that are laid into a web and then bonded, creating durable, lightweight, and breathable fabrics. Spun bond fabrics are ideal for use in packaging, medical textiles, and hygiene goods owing to their value. Hence, major firms are launching sophisticated product variations to address these demands. As per the nonwoven fabrics market recent opportunities, on 28 August 2024, Welspun Living, a division of the Welspun Group known for its leadership in Environmental, Social, and Governance (ESG) initiatives, entered into a strategic alliance with Avgol Industries. This partnership aims to promote sustainable practices within the nonwoven fabric sector. Avgol, recognized for its expertise in high-performance spun-melt nonwoven fabrics, is part of Indorama Ventures Group, which collaborates exclusively with Polymateria. Polymateria is a UK-based tech firm renowned for pioneering biodegradable alternatives to traditional plastics.

Breakup by Application:

- Personal Care and Hygiene

- Filtration

- Healthcare

- Automotive

- Building and Construction

- Others

Personal care and hygiene represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes personal care and hygiene, filtration, healthcare, automotive, building and construction, and others. According to the report, personal care and hygiene represented the largest segment.

Personal care and hygiene hold the largest market share due to the extensive use of nonwoven materials in products like diapers, feminine hygiene products, and adult incontinence items. Additionally, the growing awareness about personal hygiene, especially in developing regions, along with rising birth rates and an aging population are escalating the demand for these products. Moreover, the nonwoven fabrics market forecast highlights continued growth due to increasing preference for disposable, eco-friendly hygiene products, which increased the need for nonwoven fabrics in this segment. For instance, on 1 November 2023, WPT Nonwovens was thrilled to participate in Hygienix 2023, scheduled for November 13 to 16 in New Orleans, Louisiana. The event is hosted by the Association of the Nonwoven Fabrics Industry (INDA) and Cotton Incorporated. Additionally, hygienix offers unparalleled opportunities for networking and education, as the premier event for the absorbent hygiene and personal care industries.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest nonwoven fabrics market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest regional market for nonwoven fabrics.

According to the nonwoven fabrics market overview, Asia Pacific is primarily driven by the increasing demand from industries such as healthcare, automotive, and textiles in emerging economies like China, India, and Southeast Asia. Additionally, the rising healthcare standards, expanding automotive production, and the ongoing shift toward disposable textiles in consumer and industrial applications are influencing the market growth. For instance, on 19 September 2024, Asahi Kasei Corp., a company based in Tokyo, Japan, announced the introduction of a new variant of LASTAN, a flame-retardant nonwoven fabric designed to boost electric vehicle (EV) battery safety. This innovative material offers enhanced resistance to flames and debris impact, making it an ideal choice for applications such as top covers and busbar protection sleeves in EV battery packs. The fabric’s flexibility and superior protective qualities position it as a prime alternative for thermal runaway protection in the evolving EV market.

Key Regional Takeaways:

North America Nonwoven Fabrics Market Analysis

The market for North American nonwoven fabrics is propelled by increasing demand in the hygiene, medical, automotive, and construction uses. The United States and Canada dominate the regional market owing to advanced manufacturing facilities, an established supply chain, and high consumer visibility about product performance and quality. The hygiene segment like, baby diapers, feminine care, and adult incontinence products continues to be a key driver. Moreover, demand from the automotive industry for light, resilient, and sound-insulating materials keeps increasing. Nonwovens are also finding greater application in filtration, agriculture, and geotextile uses because of their ubiquity and affordability. Environmental factors are encouraging breakthroughs in bio-based and recyclable nonwoven products with leading manufacturers investing in eco-friendly production lines. Compliance with consumer protection norms by regulations also encourages further growth in the market. With emphasis on product innovation and efficiency, North America is an important geography for high-performance nonwoven solutions in various end-use industries.

Asia Pacific Nonwoven Fabrics Market Analysis

The Asia Pacific region is the leading player in the global market for nonwoven fabrics, driven by industrialization, urbanization, and growing middle-class populations. China, India, Japan, and South Korea are contributing countries, inspired by strong demand from personal hygiene, agriculture, packaging, and construction industries. The expansion of retail and e-commerce industries has also boosted the demand for cost-effective packaging materials, where nonwovens provide light-weight and robust options. Improving healthcare infrastructure and heightened awareness of hygiene are fuelling demand for disposable nonwoven products in rural as well as urban regions. The automotive industry and textile industry are also incorporating nonwoven materials for efficiency and expense reduction. Governments within the region are encouraging local manufacturing through supportive policies and environmental regulations, triggering investment in sustainable nonwoven technology. With mass production capacity, competitive prices, and increasing application scope, Asia Pacific remains a key growth driver for the world's nonwoven fabrics market.

Europe Nonwoven Fabrics Market Analysis

Europe's nonwoven fabrics market is influenced by stringent environmental laws, technological advancements, and a developed consumer base that values quality and sustainability. These nations include Germany, France, Italy, and the UK, and they are the leaders of high-performance nonwoven material demand in the region for filtration, automotive, medicine, and hygiene use. The automotive sector specifically employs nonwovens as a means of lightweighting and acoustic insulation to meet fuel-economy objectives. In contrast, disposable gowns, drapes, and surgical masks are demanded by the healthcare industry. The. push by the European Union for the implementation of. circular economy principles and alternatives to plastics has. accelerated the creation and use of bio-based, biodegradable, and recyclable nonwoven materials. Spunbond and meltblown technology innovation. is driving product. performance and increasing end-use. versatility. The producers are also targeting energy-efficient manufacturing processes to meet EU sustainability regulations. With a focus on quality standards, safety, and environmental concern, Europe is a leader in specialty nonwoven products in industrial and consumer markets.

Latin America Nonwoven Fabrics Market Analysis

The nonwoven fabrics market of Latin America is growing steadily, backed by rising demand from hygiene, agriculture, and industrial applications. The primary markets are Brazil and Mexico, with rising investments in baby care, feminine hygiene, and adult incontinence articles fueling the consumption of spunbond and airlaid nonwovens. Agricultural applications of nonwoven products are made for protection of crops, moisture management, and stabilization of soil, especially in the areas where intensive agriculture is practiced. In the building industry, nonwovens are used in insulation and waterproofing, responding to the growing need for energy-saving and long-lasting construction materials. The region is also seeing a slow transition towards locally sourced and eco-friendly nonwoven products, driven by environmental consciousness and reduction of wastes. Economic growth, urbanization of the population, and increasing consumer sensitivity to hygiene promote steady market growth. Although technological potential is still limited in certain regions, expanding foreign investments and local production programs should increase production capacity and broaden uses of nonwoven fabrics.

Middle East and Africa Nonwoven Fabrics Market Analysis

The Middle East and Africa (MEA) nonwoven fabrics market is increasing due to the growth of infrastructure, increased hygiene consciousness, and expansion in the medical and packaging sector. Saudi Arabia, the UAE, and South Africa are becoming key destinations for the consumption of nonwoven products on account of increasing demand in the construction and healthcare sectors. Geotextiles in road construction, erosion control, and water management applications are making use of nonwovens across the region, supporting the infrastructure resilience focus of the area. Spunlace and thermal bonded nonwovens are finding growth in demand driven by a growing supply of hygiene products due to population growth and urbanization. The packaging sector is also embracing nonwoven alternatives for economical, lightweight, and recyclable options. Governments and industry players are seeing the importance of domestic production capacity in order to alleviate import reliance and mitigate environmental issues. With growing consumer demand and industrial use, the MEA region promises long-term growth prospects for the nonwoven fabrics industry.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the nonwoven fabrics industry include Ahlstrom-Munksjö Oyj, Berry Global Group Inc., DuPont de Nemours Inc., Fitesa S.A. and Affiliates (Petropar SA), Freudenberg Performance Materials SE & Co. KG, Johns Manville Corporation (Berkshire Hathaway), Kimberly-Clark Corporation, PFNonwovens Czech s.r.o. (PFNonwovens Holding s.r.o), Suominen Oyj, Toray Industries Inc., and TWE GmbH & Co. KG.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- At present, key players in the nonwoven fabrics market are actively pursuing strategies to enhance market growth through innovation and sustainability. Additionally, various leading players are focusing on developing eco-friendly materials to meet the rising demand for sustainable products, especially in sectors like healthcare and hygiene, which prioritize disposability and environmental impact. Moreover, these companies are expanding their global presence by establishing new production facilities in high-growth regions such as Asia Pacific and Latin America. Besides, nonwoven fabrics market recent developments include collaborations and acquisitions, allowing companies to leverage shared technology and market access to optimize their offerings and streamline production processes, thereby reinforcing their positions in the global market. For instance, on 1 February 2023, WPT Nonwovens Corporation declared an investment of $18.5 Million into a new man-made fiber (MMF) nonwoven manufacturing line. The line will be located in a newly built 75,000-square-foot facility owned by WPT Nonwovens.

Nonwoven Fabrics Market News:

- On 12 September 2024, Governor Glenn Youngkin revealed that Shalag U.S., Inc., a company specializing in the production of nonwoven fabrics for various manufactured products, is set to invest $16.6 Million in establishing a new manufacturing and production facility in Mecklenburg County.

- 2 May 2024, Suominen Corporation has announced an enhancement and upgrade of a production line at its Bethune, South Carolina facility, emphasizing its commitment to sustainability. This initiative aligns with Suominen's strategic goals and reinforces its ambition to lead in nonwovens innovation and environmental responsibility. The investment is valued at around EUR 10 Million and is expected to be finalized in the first half of 2025.

- 29 February 2024, Freudenberg Performance Materials is introducing a new line of 100 percent synthetic wetlaid nonwovens produced in Germany. This line utilizes various polymer-based fibers, including ultra-fine micro-fibers, to create specialized wetlaid materials suitable for filtration and various industrial uses. This addition enhances Freudenberg's extensive portfolio of high-performance wetlaid nonwoven products.

Nonwoven Fabrics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Polyester, Polypropylene, Polyethylene, Rayon, Others |

| Technologies Covered | Spun Bond, Wet Laid, Dry Laid, Others |

| Applications Covered | Personal Care and Hygiene, Filtration, Healthcare, Automotive, Building and Construction, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ahlstrom-Munksjö Oyj, Berry Global Group Inc., DuPont de Nemours Inc., Fitesa S.A. and Affiliates (Petropar SA), Freudenberg Performance Materials SE & Co. KG, Johns Manville Corporation (Berkshire Hathaway), Kimberly-Clark Corporation, PFNonwovens Czech s.r.o. (PFNonwovens Holding s.r.o), Suominen Oyj, Toray Industries Inc., TWE GmbH & Co. KG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the nonwoven fabrics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global nonwoven fabrics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the nonwoven fabrics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global nonwoven fabrics market was valued at USD 47.7 Billion in 2024.

We expect the global nonwoven fabrics market to exhibit a CAGR of 5.2% during 2025-2033.

The growing applications of nonwoven fabrics to manufacture interlinings, insulation and protection clothing, industrial workwear, chemical defense suits, etc., are primarily driving the global nonwoven fabrics market.

The sudden outbreak of the COVID-19 pandemic has led to the rising demand for nonwoven fabrics across the healthcare sector to manufacture healthcare essentials, such as face masks, isolation gowns, drapes, single-use caps, etc., to combat the risk of the coronavirus infection.

Based on the material type, the global nonwoven fabrics market can be segmented into polyester, polypropylene, polyethylene, rayon, and others. Currently, polypropylene holds the majority of the total market share.

Based on the technology, the global nonwoven fabrics market has been divided into spun bond, wet laid, dry laid, and others. Among these, spun bond exhibits a clear dominance in the market.

Based on the application, the global nonwoven fabrics market can be categorized into personal care and hygiene, filtration, healthcare, automotive, building and construction, and others. Currently, the personal care and hygiene sector accounts for the majority of the global market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global nonwoven fabrics market include Ahlstrom-Munksjö Oyj, Berry Global Group Inc., DuPont de Nemours Inc., Fitesa S.A. and Affiliates (Petropar SA), Freudenberg Performance Materials SE & Co. KG, Johns Manville Corporation (Berkshire Hathaway), Kimberly-Clark Corporation, PFNonwovens Czech s.r.o. (PFNonwovens Holding s.r.o), Suominen Oyj, Toray Industries Inc., and TWE GmbH & Co. KG.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)