North America Flavors and Fragrances Market Size, Share, Trends and Forecast by Product Type, Form, Application, Ingredients, and Country, 2025-2033

North America Flavors and Fragrances Market Size and Share:

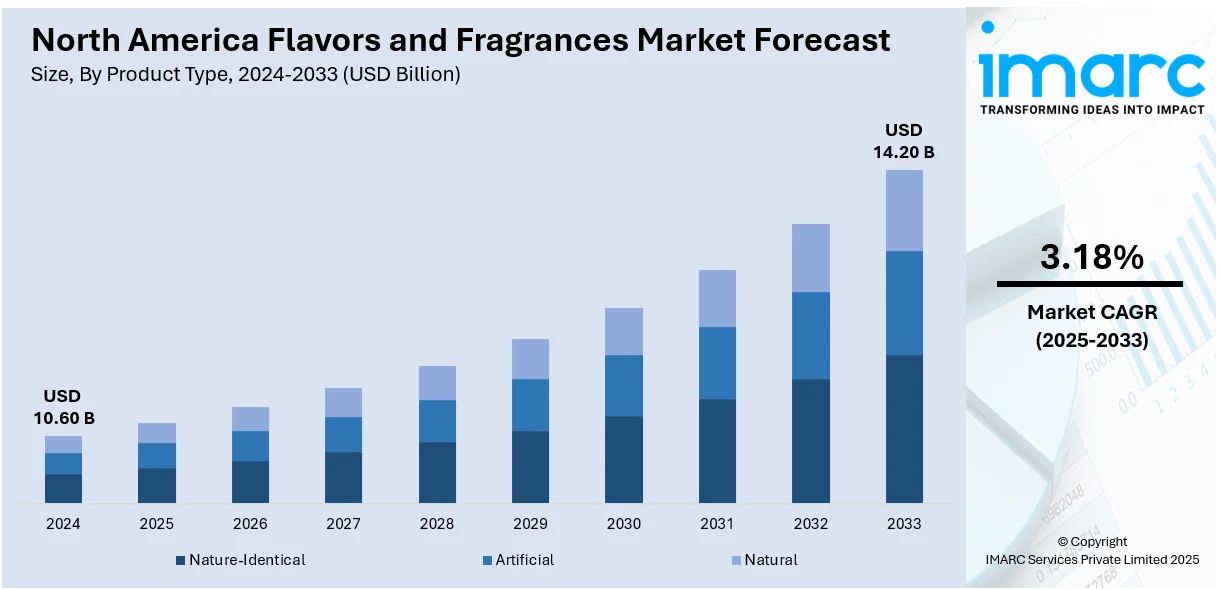

The North America flavors and fragrances market size was valued at USD 10.60 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.20 Billion by 2033, exhibiting a CAGR of 3.18% from 2025-2033. The market is expanding due to rising demand for natural, clean-label and sustainable ingredients. Innovations in biotechnology, encapsulation and AI-driven formulations are shaping product development. Sustainability and premiumization trends further influence market dynamics across food, beverages, personal care and homecare sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.60 Billion |

|

Market Forecast in 2033

|

USD 14.20 Billion |

| Market Growth Rate (2025-2033) | 3.18% |

Rising consumer preference for natural and clean-label ingredients is driving the North America flavors and fragrances market growth. The demand for plant-based, organic, and non-GMO flavors in food, beverages and personal care is increasing driven by health-conscious consumers and regulatory scrutiny over synthetic additives. For instance, in October 2023, Debut a synthetic biology company raised over $40 million in Series B funding led by L'Oréal's BOLD. The investment will enhance the development of bio-identical and novel fragrance molecules promoting sustainability in the fragrance industry. Debut aims to address challenges posed by climate change and resource scarcity in ingredient sourcing. Advancements in biotechnology and precision fermentation enable the production of sustainable, nature-identical flavors reducing reliance on traditional extraction methods. Bio-based solutions are attracting major players to invest in the market because of its increasing trend towards sustainability and new consumer expectations.

The expansion of the personal care, cosmetics and homecare sectors is fueling fragrance innovation. Premiumization trends influenced by wellness-oriented lifestyles are increasing demand for functional fragrances with aromatherapy benefits. For instance, in September 2024, AllSaints announced the launch of a luxury collection of unisex Eau de Parfum fragrances in partnership with Scent Beauty and perfumer Gabriela Chelariu. The trio including Sunset Riot Intense, Shoreditch Leather and Ravaged Rose reflects the brand's rebellious spirit and features a distinctive bottle design inspired by its heritage. Smart scent technology including encapsulated fragrances for long-lasting effects is gaining traction. Additionally, regulatory frameworks such as IFRA standards shape formulation strategies prompting R&D investments in safe and compliant fragrance compounds. Strategic collaborations with biotech firms further accelerate the shift toward sustainable and biodegradable fragrance solutions. These factors are collectively creating a positive North America flavors and fragrances market outlook.

North America Flavors and Fragrances Market Trends:

Rising Natural and Clean-Label Demand

North American consumers are increasingly prioritizing natural and clean-label flavors and fragrances demanding products free from artificial additives, preservatives and synthetic chemicals. For instance, in October 2024, Lifeway Foods announced the launch of 10 new organic kefir flavors expanding its single-serve lineup. The lactose-free offerings include innovative combinations like Pink Dragon Fruit and Hot Honey appealing to consumers' growing interest in exotic flavors. These products are now available nationwide aiming to enhance convenience and cater to evolving tastes. This shift is further driven by health concerns, transparency demands and regulatory pressures that promote natural alternatives. Food and beverage manufacturers incorporate plant-based extracts, essential oils and fermentation-derived ingredients to enhance taste while maintaining a clean-label appeal. Personal care and homecare brands are formulating with botanical and non-toxic fragrance compounds. Companies are investing in sustainable sourcing, bio-based production and minimal processing techniques to align with consumer expectations for authenticity, safety and environmental responsibility in flavor and fragrance formulations.

Growing Focus on Sustainability and Green Chemistry

North American flavors and fragrances market embrace sustainability and green chemistry by prioritizing bio-based, biodegradable and eco-friendly ingredients. Consumers and regulatory bodies push to reduce the dependency on petrochemical-derived compounds so companies are now designing plant-based, fermentation-derived and upcycled ingredients. For instance, in May 2024, ScentAir® announced the launch of Eco Allure and Eco Serenity its first line of Sustainable Fragrances infused with essential oils and upcycled ingredients. The cartridges are fully recyclable reinforcing ScentAir's commitment to environmental sustainability. The fragrances aim to enhance experiences while reducing ecological impact. Fragrances become biodegradable and extraction processes occur without solvents to reduce their environmental footprint. Innovations in enzymatic processes and CO₂ extraction are enhancing ecofriendly production. Brands are also emphasizing transparency and ethical sourcing, reinforcing consumer trust in sustainable nature-inspired flavors and fragrances without compromising performance or quality.

Exploration of Exotic and Regional Flavors

North American consumers increasingly demand exotic and regional flavors driven by global influences in the culinary world and increased interest in the variety of tastes. Brands now offer tropical fruits like dragon fruit, yuzu and guava alongside bold spices like Szechuan pepper, turmeric and harissa. For instance, in June 2023, Sensegen announced the launch of its Exotic Flavors collection featuring six unique natural flavors: lychee, guava, papaya, yuzu, dragon fruit and violet. This new line aims to enhance food and beverage experiences reflecting consumer preferences for adventurous tastes. Floral notes are popular in beverages, confectionery and personal care such as hibiscus, elderflower and rose. Fusion flavors blending cultural elements such as spicy-sweet combinations or floral-citrus infusions are reshaping product innovation. This trend is fueled by adventurous palates, travel influences and the rise of international cuisines in mainstream food, beverages and fragrances. The growing popularity of regional and exotic flavors is increasing the overall North America flavors and fragrances market share significantly.

North America Flavors and Fragrances Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America flavors and fragrances market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, form, application, and ingredients.

Analysis by Product Type:

- Natural-Identical

- Artificial

- Natural

Natural-identical flavors are chemically synthesized but structurally identical to their natural counterparts. They are cost-effective alternatives to purely natural flavors while retaining authenticity. These flavors are used in most processed foods, beverages and confectionery providing stability and consistency. The regulatory approvals ensure safety and hence manufacturers prefer them to balance the appeal of natural flavors with affordability.

Artificial flavors are entirely synthetic created through chemical processes to replicate specific taste profiles. They enhance flavor intensity, improve shelf life and provide cost efficiency. Common in carbonated drinks snacks and candies artificial flavors allow precise customization. Despite consumer preference for natural alternatives they remain relevant due to regulatory safety assurances, affordability and stability in processed food applications.

Natural flavors are derived from plant, animal or microbial sources using physical, enzymatic or fermentation processes. Increasing demand for clean-label, organic and plant-based products is driving growth in this segment. Used in beverages, dairy and functional foods they offer authenticity and health appeal. Sustainability concerns encourage the adoption of bio-based and fermentation-derived natural flavor solutions.

Analysis by Form:

- Liquid

- Dry

Liquid flavors are the most prominent in the North America flavors market as they are easy to blend, have improved solubility and maintain uniform dispersion in food, beverages and pharmaceuticals. They are used in carbonated drinks, dairy products and confectionery. Advances in encapsulation technology improve stability and shelf life further driving their adoption in flavor formulation.

Dry flavors in the form of powders and granules provide extended shelf life and stability. They are ideal for bakery, snacks and instant food applications where moisture sensitivity is critical. Spray-drying and freeze-drying techniques ensure the retention of natural taste compounds making dry flavors an ideal choice for manufacturers that value long-term product consistency and cost efficiency.

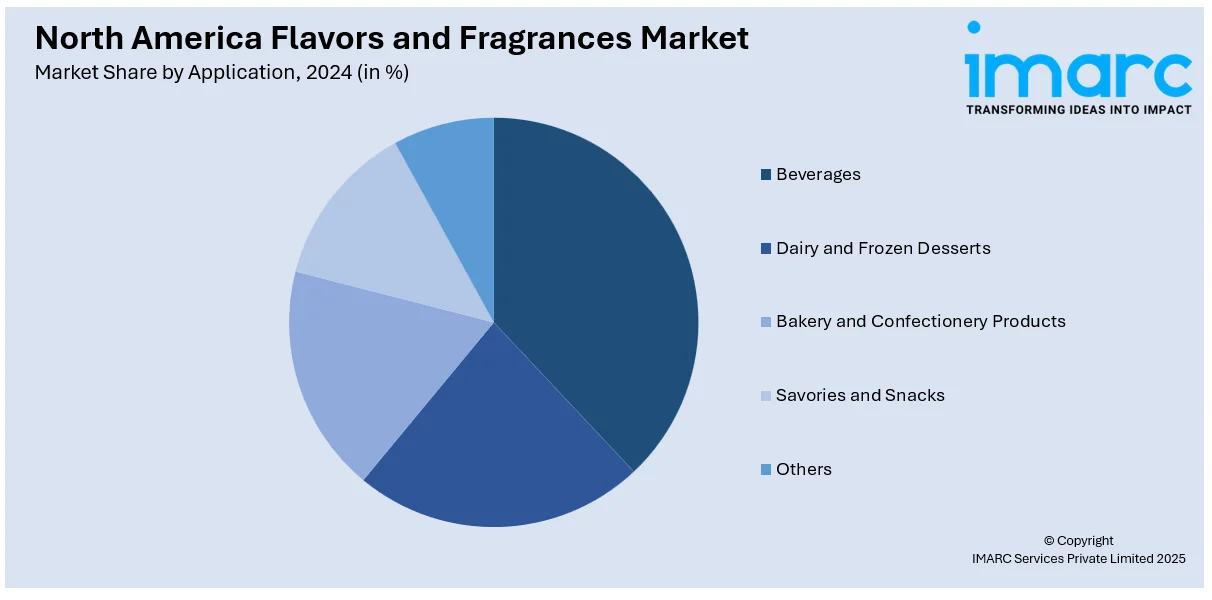

Analysis by Application:

- Beverages

- Dairy and Frozen Desserts

- Bakery and Confectionery Products

- Savories and Snacks

- Others

The beverages segment holds the significant North America flavors market share driven by demand for innovative, functional and natural ingredients. Brands are focusing on botanical extracts, exotic fruits and reduced-sugar formulations. Functional beverages infused with adaptogens, nootropics and immune-boosting flavors are gaining traction. The rise of plant-based dairy alternatives further fuels the need for enhanced flavor masking solutions.

Dairy and frozen dessert flavors are currently moving in clean-label, indulgent and plant-based trends. Consumers desire authentic dairy flavors, innovative fruit and nut relationships and nostalgic profiles such as caramel and toast. Trends for dairy-free alternatives such as almond, oat and coconut-based products drive demand for higher flavoured vanilla, chocolate and tropical fruit flavors.

Flavor innovation in bakery and confectionery focuses on indulgence, health-conscious formulations and premiumization. Traditional profiles like vanilla, chocolate and cinnamon remain strong while demand for floral, nutty and globally inspired flavors is rising. Sugar reduction strategies require sophisticated flavor-masking techniques. Clean-label formulations with natural extracts and functional ingredients like probiotics are gaining traction in premium baked goods.

For savory and snack flavors bold ethnic and plant-based innovations are adding to the category. Profiles trending include spice, umami and smokiness-from chipotle, miso and truffle. Better-for-you snacking demands minimal processing and natural seasonings in the form of seaweed and fermented flavors, nutritional yeast and other gut-friendly ingredients with potentially adaptogenic properties.

Country Analysis:

- United States

- Canada

The U.S. holds the significant North America flavors market share with strong demand for natural, organic and functional ingredients. Innovations in plant-based, clean-label and biotech-derived flavors are changing the game. Food and beverage companies are expanding exotic and regional flavor offerings while regulatory compliance and sustainability concerns influence ingredient sourcing and product development strategies.

Increasing consumer demand for authentic, natural and health-focused ingredients is driving the flavors market in Canada. Functional flavors with immunity-boosting and wellness benefits are in high demand. Ethnic and fusion flavors are also gaining popularity as the country's multicultural food landscape continues to evolve. Regulatory frameworks that promote clean-label transparency shape product formulations and ingredient choices.

Analysis by Application:

- Cosmetics and Toiletries

- Fine Fragrances

- Household Cleaners and Air Fresheners

- Soap and Detergents

- Others

The cosmetics and toiletries segment in North America's fragrance market is growing with consumers looking for more natural, long-lasting and skin-friendly fragrances. Consumers opt for botanical and allergen-free formulations which increases the innovation of bio-based and sustainable fragrances. Functional fragrances that offer aromatherapy benefits, stress relief and mood enhancement are also increasingly being used in skincare, haircare and body care products.

Fine fragrances continue to evolve with premiumization and personalization trends. Consumers seek niche, luxury and bespoke scents leading to increased demand for rare, natural and ecofriendly ingredients. Sustainable alcohol bases, biodegradable fixatives and AI-driven scent creation are shaping the industry. Gender-neutral and hybrid fragrances blending floral, woody and gourmand notes are becoming more popular in the region.

Fragrance innovation in household cleaners and air fresheners is driven by the shift toward ecofriendly, non-toxic and long-lasting scent solutions. Essential oils, plant-derived ingredients and odor-neutralizing technologies are replacing synthetic additives. Smart scent diffusion, encapsulated fragrance delivery and wellness-inspired aromas such as lavender for relaxation and citrus for freshness are influencing product formulations and consumer preferences.

The soap and detergents market is embracing biodegradable and hypoallergenic fragrances aligning with clean-label and sustainability demands. Mild and skin-safe scents with antibacterial and deodorizing properties are increasingly preferred. Laundry detergents incorporate long-lasting fragrance-release technology while artisanal and natural soaps feature essential oil-based scents. Regulatory compliance and consumer preference for chemical-free formulations shape the segment’s fragrance innovations.

Analysis by Ingredients:

- Natural

- Synthetic

The demand for natural fragrances in North America is increasing as consumers choose plant-based, sustainable and clean-label products. Natural alternatives are replacing synthetic aromas by essential oils, botanical extracts and fermentation-derived aroma compounds. Brands are now investing in ecofriendly sourcing, biodegradable formulations and ingredient transparency which are compliant with regulatory guidelines and commitments towards sustainability.

Synthetic fragrances remain crucial in North America due to their stability, cost-effectiveness and consistent performance. Advanced molecular synthesis and green chemistry innovations are improving safety and sustainability. Regulatory compliance with IFRA guidelines ensures consumer safety while encapsulation technologies enhance fragrance longevity. Brands are blending synthetic and natural ingredients to balance authenticity, affordability and environmental impact.

Country Analysis:

- United States

- Canada

The U.S. fragrance market is expanding with strong demand for clean-label, sustainable and functional scents. Consumers seek biodegradable, plant-based and wellness-oriented fragrances in personal care, homecare and luxury segments. Encapsulation technologies for long-lasting scents are gaining traction while regulatory standards drive innovation in safe and IFRA-compliant formulations. Premiumization and customization further fuel market growth.

Canada’s fragrance market is witnessing a shift towards natural, hypoallergenic and ecofriendly formulations. Consumer preference for botanical extracts and essential oils is growing especially in personal care and home fragrances. Regulatory scrutiny on synthetic ingredients is influencing product innovation. Aromatherapy and functional fragrances promoting relaxation and mood enhancement are key trends shaping market expansion.

Competitive Landscape:

The North America flavors and fragrances market is highly competitive, with established players focusing on innovation, sustainability, and strategic acquisitions. Companies are investing in biotechnology and precision fermentation to develop nature-identical, clean-label ingredients that meet evolving consumer preferences. Sustainability initiatives, such as biodegradable formulations and eco-friendly sourcing, are key differentiators. Firms are also expanding their portfolios with exotic, functional, and regional flavors and fragrances to cater to diverse tastes. Advanced encapsulation technologies for long-lasting fragrance retention and AI-driven formulation tools are enhancing product development. Regulatory compliance remains a critical factor, influencing ingredient selection and production methods. Market participants are leveraging collaborations, R&D investments, and digital advancements to strengthen their presence and drive growth.

The report provides a comprehensive analysis of the competitive landscape in the North America flavors and fragrances market with detailed profiles of all major companies.

Latest News and Developments:

- In February 2025, Keurig Dr Pepper announced the launch of exciting new flavors including Dr Pepper Blackberry, 7UP Tropical and Snapple Peach Tea & Lemonade. Other additions include Bai Simbu Strawberry and A&W Ice Cream Sundae.

- In December 2024, FlavorSum released its 2025 Seasonal Flavor Guide, the third edition aimed at food and beverage developers. The guide highlights seasonal flavor trends across various categories and reveals the top 10 flavors launched in North America. It emphasizes the demand for limited-time offerings and provides insights for successful seasonal innovations.

- In October 2024, Sheralven was appointed the exclusive North American distributor for Messi Eau de Parfum, which will launch through JCPenney. The fragrance boasts unique notes such as cardamom and cedarwood, capturing Messi’s global appeal.

- In March 2024, Sephora Canada announced the launch of Henry Rose, an exclusive line of genderless fine fragrances created by Michelle Pfeiffer. Available both in-store and online, the brand prioritizes ingredient transparency by disclosing 100% of its components. Henry Rose is certified EWG Verified® and Cradle to Cradle Certified™ promoting clean beauty for Canadian consumers.

North America Flavors and Fragrances Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment: North America Flavors Market:

North America Fragrance Market:

|

| Product Types Covered | Natural-Identical, Artificial, Natural |

| Forms Covered | Liquid, Dry |

| Application Covered |

North America Flavors Market: Beverages, Dairy and Frozen Desserts, Bakery and Confectionery Product, Savories and Snacks, Others North America Fragrance Market: Cosmetics and Toiletries, Fine Fragrances, Household Cleaners and Air Fresheners, Soap and Detergents, Others |

| Ingredient Covered | Natural, Synthetic |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America flavors and fragrances market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America flavors and fragrances market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America flavors and fragrances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The flavors and fragrances market was valued at USD 10.60 Billion in 2024.

The North America flavors and fragrances market is growing due to rising demand for natural, clean-label, and sustainable ingredients. Innovations in biotechnology, functional wellness-focused products, and AI-driven formulation tools are accelerating growth. Expanding applications in food, beverages, personal care, and homecare, along with regulatory compliance and premiumization, are also key drivers.

IMARC estimates the flavors and fragrances market to reach USD 14.20 Billion by 2033, exhibiting a CAGR of 3.18% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)