North America Hand Sanitizer Market Size, Share, Trends and Forecast by Type, Ingredient, Product Form, Pack Size, Distribution Channel and End-Use, and Country, 2025-2033

North America Hand Sanitizer Market Size and Share:

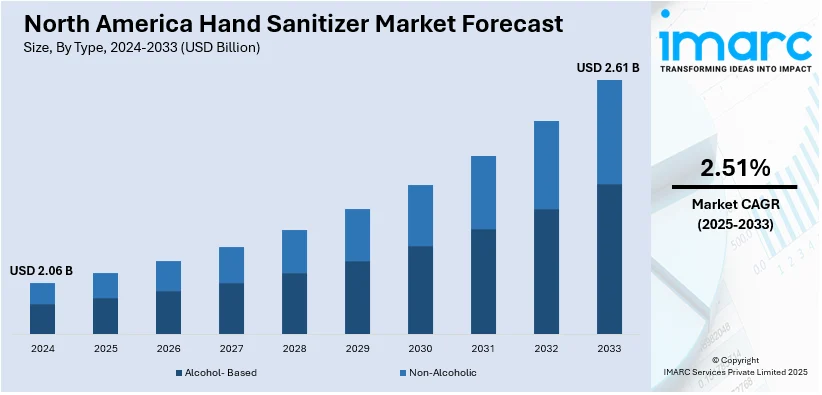

The North America hand sanitizer market size was valued at USD 2.06 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.61 Billion by 2033, exhibiting a CAGR of 2.51% from 2025-2033. The North American hand sanitizer market is experiencing steady growth, driven by increasing demand for alcohol-based and natural sanitizers, a focus on eco-friendly packaging, and the expansion of online retail channels, as consumers prioritize hygiene, convenience, and sustainability in their daily routines.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.06 Billion |

|

Market Forecast in 2033

|

USD 2.61 Billion |

| Market Growth Rate (2025-2033) | 2.51% |

Various factors are contributing to the robust growth of North America's hand sanitizer market. The boosting interest in personal hygiene and sanitation in consumers due to heightened awareness of the need for regular washing of hands to ensure good health and to prevent the transfer of bacteria and viruses escalates demand. As people include sanitizing in their daily routine, hand sanitizers have become a household item in homes, offices, schools, and public places. The demand for alcohol-based hand sanitizers, which provide effective germ protection, and natural ingredient-based sanitizers also reflects consumer preferences for products that combine efficacy with skin care. For example, in April 2022, Just Human launched the world's first 24-hour Shimmer Hand Sanitizer, combining skincare and hygiene by leaving a natural glow and providing effective protection against pathogens for the entire day. Moreover, with increased public awareness of the negative implications of some chemicals, natural and organic hand sanitizers are highly in demand and driving the market forward.

The demand for easy and convenient portable sanitizing solutions has impelled the market. Increasingly hectic lifestyles urges more convenience in personal and hygiene items that can easily be carried, and on-the-go use demands a rise in the sale of travel-sized bottles, sprays, and wipes. Innovation in product formulations has also been beneficial to the market, with manufacturers introducing sanitizers enriched with moisturizing agents and essential oils to provide a more soothing and skin-friendly experience. Additionally, the growing popularity of eco-friendly packaging is motivating brands to adopt recyclable and sustainable materials, appealing to environmentally conscious consumers. For instance, In April 2024, GOJO Industries launched the ES10 Touch-Free Dispenser, reducing plastic consumption by 30% and greenhouse gas emissions by 38%, aligning with its sustainability goals through eco-friendly design and smart technology. Additionally, the hike in e-commerce has amplified access for consumers to the wide variety of hand sanitizer available, which means they can conveniently buy them from home, leading to an expansion in the market.

North America Hand Sanitizer Market Trends:

Rise in Demand for Alcohol-Based and Natural Ingredient Sanitizers

Consumer demand for alcohol-based and natural ingredient sanitizers in North America has accelerated significantly to stimulate the North American hand sanitizer market. People are looking at products that would kill germs but also safely and healthily care for the skin. There is still huge demand for alcohol-based sanitizers, as alcohol has been well proven to effectively eliminate bacteria and viruses. This, however, has been complemented by a desire for natural and organic alternatives because of the dangers of synthetic chemicals and skin irritation. The general trend toward more natural formulations, such as aloe vera-infused sanitizers or those with essential oils is thus reflecting broader consumer trends toward wellness and clean living. As consumers become highly health-conscious, brands are focusing on creating sanitizers that balance both efficiency and skin care.

Growing Focus on Eco-Friendly and Sustainable Packaging

Sustainability is an emerging trend in the North American hand sanitizer market, as the consumer seeks environmentally friendly products. With boosted plastic waste reduction initiatives, demand for eco-friendly packaging solutions has significantly increased. The response of the brands has been to opt for recyclable and biodegradable materials, with some even creating reusable packaging designs. Another encouraging trend is in the direction of innovation on the size of packaging, where many brands have opted for refilling options, is reducing the usage of plastic. Some companies are also replacing plastics with plant-based alternatives while others are infusing recycled materials into their products. As more people take environmental considerations to heart in shaping their choices, companies which embrace sustainability have an edge as they attract customers who are seeking environmentally friendly purchases.

Expansion of Online Retail and E-Commerce Channels

The accelerating growth of e-commerce and the online retail marketplace is transforming the North American hand sanitizer market. With the surging preference for shopping online, along with the growth induced by digital transformation, consumers have easy access to a wider range of hand sanitizers from home. Availability through online retailers, such as Amazon, as well as to consumer-direct platforms has intensified sales and efficiency in terms of decision-making through consumers. There is also transparency with online brands showing product formulation, ingredients, and sustainability effort. The new trends in bulk purchasing and subscription services helped to promote greater convenience along with saving through bulk buying which propels further market growth. This trend has made hand sanitizers highly accessible to consumers across regions, especially those in remote or underserved areas.

North America Hand Sanitizer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America hand sanitizer market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, ingredient, product form, pack size, distribution channel, and end-use.

Analysis by Type:

- Alcohol- Based

- Non-Alcoholic

The major product type of alcohol-based hand sanitizers leads the North American market in consumer demand because it has been proven effective against harmful germs and viruses. These usually contain ethanol or isopropyl alcohol as an active ingredient and provide quick drying and a high level of germ protection, which is ideal for places where hygiene is critical. They are now popular because of hygiene practice awareness and easy, quick use on the go. Individual consumers and businesses focus on alcohol-based hand sanitizers since these products provide a quick, portable, and effective means of reducing the transmission of bacteria. As concerns related to health and safety increase, alcohol-based formulations will continue to hold the lead position in the market, where innovative efforts in formulating skincare ingredients and using ecofriendly pack formats are currently taking place.

Analysis by Ingredient:

- Natural

- Organic

- Synthetic

Synthetic ingredients used in hand sanitisers include the ability to improve product performance, stability, and cost-effectiveness. Some common synthetic chemicals are benzalkonium chloride, propylene glycol, and synthetic fragrance compounds, which often are added in formulations to give the sanitizer good texture, effectivity, and shelf life. These ingredients have allowed manufacturers to produce hand sanitizers at a more affordable price while killing bacteria and viruses consistently. The market for synthetic ingredient-based hand sanitizers is strong, especially in mass-market products, where cost efficiency is the priority. Despite the amplifying popularity of natural and organic products, synthetic formulations continue to dominate due to their reliability, long shelf life, and low production costs. These sanitizers can also be developed in various flavors and textures, so that their usage can be easily adopted by the customers in the entire market.

Analysis by Product Form:

- Gel

- Liquid

- Foam

- Spray

- Others

Gel-based hand sanitizers are the most popular product form because of its ease of application, portability, and effectiveness in hand disinfection without the use of water. It gives the gel form of a controlled and smooth application of the product for accurate application and minimal spillage. It is highly favored in the use of high-traffic public places, households, offices, and health institutions. It ensures that the alcohol content remains in contact with the skin for enough time required to kill germs and viruses. Moisturizers and essential oils have also been incorporated into gel hand sanitizers to accelerate user comfort and acceptance. The gel product form has maintained a significant market share due to its convenience, ease of use, and effectiveness, offering a practical solution for consumers seeking both cleanliness and skin care benefits in one product.

Analysis by Pack Size:

- Small

- Medium

- Large

Medium pack size hand sanitisers have really picked the right spot in the North American market. There's great personal and commercial usage in such sanitisers. They are popularly applied in homes, offices, schools, and restaurants for enough that last till the end of daily usage without becoming too cumbersome to be carried. Bottles with a medium capacity are ideal for highly accessed public places where several people use the same container at different times. They are also used in households and commercial organizations to provide affordable supplies which save one from making several frequent purchases. The increasing popularity of refillable packaging has added to the medium-sized sanitizers' popularity as consumers opt for sustainable options. As hygiene awareness continues to boost, the medium pack size segment is expected to continue growing steadily in the coming years.

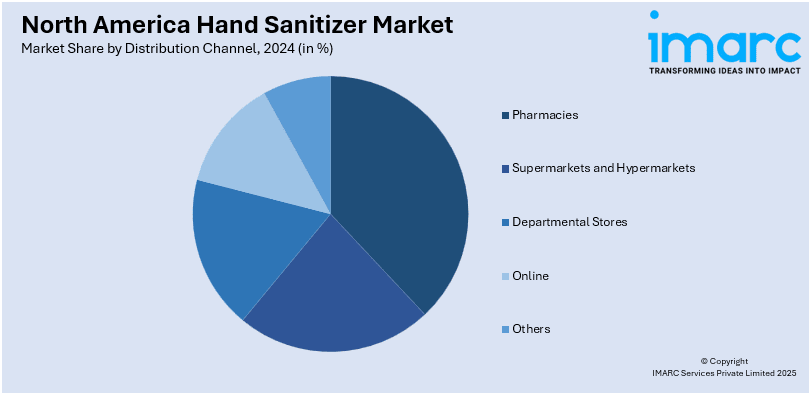

Analysis by Distribution Channel:

- Pharmacies

- Supermarkets and Hypermarkets

- Departmental Stores

- Online

- Others

Hand sanitizer distribution can significantly be undertaken in supermarkets and hypermarkets because it is also purchased by the customer during the shopping trip as it is considered an accessory to groceries, and such product lines offer ample varieties in the form of various sizes, formulation, and brand. Supermarkets and hypermarkets are ideal places for the purchase of hand sanitizers since they have a high footfall. Consumers are likely to pick up hand sanitizers while purchasing groceries and other household products from these stores. Apart from the alcohol-based and gel formats, the retailers are stocking eco-friendly, natural, and organic alternatives as well to attract a wider audience. The high product lines, easy availability, and aggressive pricing by supermarkets and hypermarkets will continue to drive the growth of the hand sanitizer market going ahead. Additionally, with hygiene still being a primary concern for consumers, retail channels like supermarkets and hypermarkets will remain a prime mode of distribution over the near term.

Analysis by End-Use:

- Hospitals

- Households

- Restaurants and Hotels

- Others

Hospitals are a crucial end-use sector of hand sanitizers because maintaining hygiene standards is a must for the safety of their patients and to prevent infection. In health care, hand sanitizers are a convenient and effective solution to decontaminate hands between medical procedures or patient interactions on the part of health professionals, patients, and visitors. Alcohol-based hand sanitizers are much used in hospitals as they ensure the killing of a variety of pathogens such as bacteria, viruses, and fungi. Such an environment in hospitals demands frequent hand sanitization against healthcare-associated infections, and hand sanitizers are placed at strategic points in medical facilities for easy access. In addition, there is growing recognition in hospitals to place more emphasis on skin-friendly formulations so that frequent hand sanitization does not irritate or damage the skin of the healthcare worker's hands. Demand within the healthcare sector will continue to remain strong as hospitals continue to emphasize infection prevention and require good quality, efficient, and accessible hand sanitizers.

Regional Analysis:

- United States

- Canada

The United States leads with the largest share in North America, driven by several factors like heightened awareness of personal hygiene issues, an established consumer base, and advanced healthcare infrastructure. In the U.S. market, hand sanitizers are available in all shades, from simple alcohol-based formulas to rich natural ingredients or additional skincare properties. Incorporating their health and wellbeing emphasis into preventing the spread of infectious diseases and more, it is not an understatement when one says the country's products have taken house, work offices, hospitals and public spaces; hand sanitizers have been fronted as very important. Its U.S equivalent also has gigantic, established brick and mortar with e-commerce also, that means the access can be done quickly to many other variations of hand sanitisers. Intensifying demand for sustainable packaging solutions and growth of online shopping platforms support market growth. Hygiene practices continue to evolve, making the U.S. a driver of innovation and product diversification in the hand sanitizer market.

Competitive Landscape:

The North American hand sanitizer market is highly competitive, with several players driving innovation and technological advancements to match the surging demand for hygiene products. Companies operating in the region are emphasizing alcohol-based and alcohol-free sanitizers and are coming up with various innovative formulations containing moisturizing agents, essential oils, and antibacterial properties. To individualize their products, firms are increasingly packaging sanitizers in different formats, ranging from sprays and gels to wipes as these meet both commercial and consumer requirements. Eco-friendly packaging is yet another thrust area, on account of the accelerating preference of consumers for green environment-friendly products. Moreover, market players have grasped trends, such as introducing sanitizer products with features of advanced skin care, which resonate well with health-conscious consumers. The awareness about hygiene practices, has been driving market growth, while ongoing innovations that aim to enhance user experience and product efficacy have continued to spur the market.

The report provides a comprehensive analysis of the competitive landscape in the North America hand sanitizer market with detailed profiles of all major companies, including:

- Ecolab

- Gojo Industries, Inc.

- Henkel AG & Co. KGaA

- Reckitt Benckiser Group plc

- Procter & Gamble Company

- S.C. Johnson & Son, Inc.

- Edgewell Personal Care LLC

- Unilever US, Inc.

- Vi-Jon Group

Latest News and Developments:

- In January 2025, Touchland launched its innovative hand sanitizers in Canada, available in Sephora. The Power Mist, with scents like Wild Watermelon and Berry Bliss, combines skincare and hygiene, offering hydration while killing germs. This launch marks a milestone in Touchland’s global expansion, blending functionality and luxury.

- In March 2022, PURELL® expanded its consumer portfolio with the launch of two new foam hand sanitizers: PURELL® Advanced Hand Sanitizer Naturals Foam and PURELL® Advanced Hand Sanitizer 2in1 Moisturizing Foam. These products kill 99.99% of germs while being gentle on skin, featuring eco-friendly and moisturizing formulas. Available at major retailers.

North America Hand Sanitizer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Alcohol-Based, Non-Alcoholic |

| Ingredients Covered | Natural, Organic, Synthetic |

| Product Forms Covered | Gel, Liquid, Foam, Spray, Others |

| Pack sizes Covered | Small, Medium, Large |

| Distribution Channels Covered | Pharmacies, Supermarkets and Hypermarkets, Departmental Stores, Online, Others |

| End Uses Covered | Hospitals, Households, Restaurants and Hotels, Others |

| Countries Covered | United States, Canada |

| Companies Covered | Ecolab, Gojo Industries, Inc, Henkel AG & Co. KGaA, Reckitt Benckiser Group plc, Procter & Gamble Company, S.C. Johnson & Son, Inc, Edgewell Personal Care LLC, Unilever US, Inc and Vi-Jon Group |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America hand sanitizer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America hand sanitizer market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America hand sanitizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America hand sanitizer market was valued at USD 2.06 Billion in 2024.

The growth of the North American hand sanitizer market is driven by heightened hygiene awareness due to the pandemic, increasing demand for convenient and portable sanitation solutions, rising consumer preference for alcohol-based and natural ingredients, and innovations in product formulations. Additionally, the growing focus on personal health, safety, and sustainability in packaging further fuels market expansion.

IMARC Group estimates the market to reach USD 2.61 Billion by 2033, exhibiting a CAGR of 2.51% from 2025-2033.

Supermarkets and hypermarkets accounted for the largest distributional channel segment in the North America hand sanitizer market share.

Ecolab, Gojo Industries, Inc, Henkel AG & Co. KGaA, Reckitt Benckiser Group plc, Procter & Gamble Company, S.C. Johnson & Son, Inc, Edgewell Personal Care LLC, Unilever US, Inc and Vi-Jon Group

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)