North America Legal Cannabis Market Size, Share, Trends and Forecast by Products Derived, Distribution Channel, and Country, 2025-2033

North America Legal Cannabis Market Size and Share:

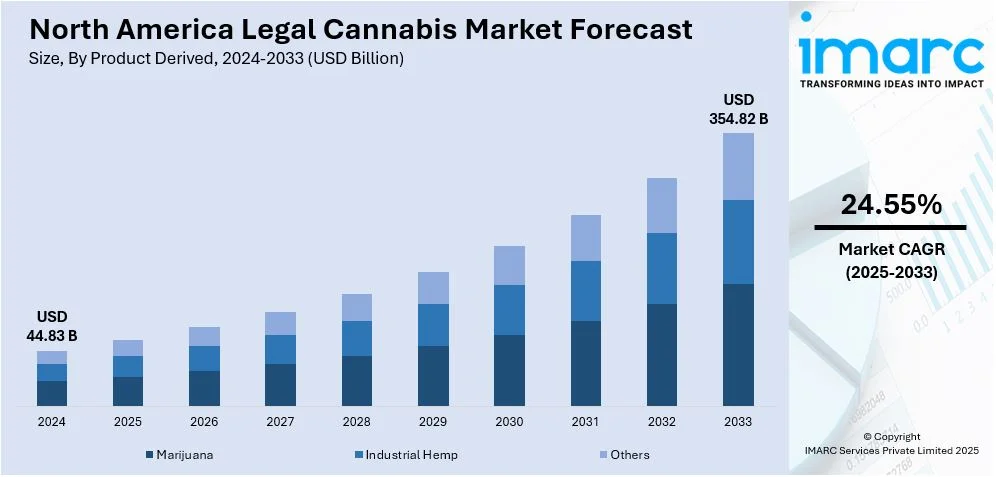

The North America legal cannabis market size was valued at USD 44.83 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 354.82 Billion by 2033, exhibiting a CAGR of 24.55% from 2025-2033. The market is expanding due to increasing legalization, rising medical applications and growing consumer demand for diverse products. Regulatory advancements, investment inflows and technological innovations in cultivation and extraction are driving growth. Product diversification, retail expansion and mainstream industry collaborations further strengthen market dynamics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 44.83 Billion |

| Market Forecast in 2033 | USD 354.82 Billion |

| Market Growth Rate (2025-2033) | 24.55% |

The North America legal cannabis market is expanding due to progressive regulatory reforms and increasing acceptance for both medical and recreational use. The U.S. and Canada are leading with state-level legalizations in the U.S. and full federal legalization in Canada driving market growth. The rising demand for cannabis-based pharmaceuticals driven by clinical research supporting therapeutic benefits for chronic pain, anxiety and epilepsy is accelerating medical adoption. According to a recent clinical trial led by Johns Hopkins and Tufts University, dronabinol, a synthetic cannabis pill, is considered to reduce agitation in Alzheimer’s patients by 30%. As compared to traditional treatments, it shows similar calming effects without severe side effects. The study may enhance care for patients and ease caregiver burdens. Social acceptance and shifting public perception are fueling investments and product innovations.

Economic benefits including job creation and tax revenue are compelling state governments to legalize cannabis. The market is also experiencing product diversification with edibles, beverages and wellness products gaining traction. For instance, in September 2024, Tilray Brands announced its plans to launch a line of Delta-9 THC drinks, including mocktails and seltzers in key U.S. markets. The company aims to cater to diverse consumer preferences as demand for cannabis beverages grows following significant revenue increases in its beverage-alcohol division. Technological advancements in cultivation, extraction and formulation are improving product consistency and quality. Growing consumer preference for organic and sustainably sourced cannabis is pushing companies toward eco-friendly practices. Increasing mergers, acquisitions and investments from mainstream industries including pharmaceuticals and beverages are further driving the North America legal cannabis market growth.

North America Legal Cannabis Market Trends:

Product Diversification

The North American legal cannabis industry is experiencing dramatic product diversification with consumers increasingly moving away from classic flower and vape products. Edibles like gummies, chocolates and baked goods are becoming popular because of accurate dosing and discretion. Cannabis-infused drinks like teas, sodas and non-alcoholic beers are opening up the market. For instance, in December 2024, Seth Rogen's cannabis brand Houseplant announced the launch of THC-infused sparkling waters in four flavors: Pineapple, Citrus, Black Cherry and Blackberry. Each serving contains 3 mg of THC. Available at Total Wine & More and on drinkhouseplant.com the beverages aim to provide a smoke-free low-calorie option for cannabis enthusiasts. Topicals such as creams, balms and transdermal patches are appealing to wellness-oriented consumers. Brands are also innovating with functional formulations combining cannabinoids with adaptogens and vitamins to address stress relief, sleep and relaxation.

Rising Medical Applications

Clinical research is driving medical cannabis adoption in North America with studies confirming its efficacy in managing chronic pain, epilepsy and mental health disorders. Cannabinoids like THC and CBD are increasingly prescribed for neuropathic pain offering an alternative to opioids. Additionally, research on PTSD, anxiety and depression is expanding its role in mental health care. Growing physician acceptance and patient awareness are further fueling demand for medical cannabis. Regulatory advancements are further strengthening the medical cannabis landscape, with states implementing structured programs to ensure product safety and accessibility. For instance, in September 2024, Kentucky awarded its first business license for a medical cannabis program to KCA Labs, a testing facility in Nicholasville. Governer of Kentucky emphasized the importance of safe products for patients as the program prepares to launch in early 2025.

Retail and E-Commerce Growth

The North American legal cannabis market is growing in retail and online sales at a rapid pace with more consumer demand for convenience and ease of access. Licensed web sites and direct-to-consumer business models are increasing, permitting consumers to look at a full range of products, compare potencies, and get lab-tested cannabis delivered right to their doors. For instance, in January 2025, DoorDash launched home delivery for cannabis products containing CBD and THC, responding to the rising consumer demand. The service will include items such as gummies and beverages available in states where hemp-derived cannabis is legal. The company aims to improve access and promote normalization of cannabis use. Regulatory updates are making more states and provinces open up digital sales. In addition, subscription services for cannabis and carefully selected product sets are on the rise, increasing tailored shopping experiences and customer loyalty.

North America Legal Cannabis Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America legal cannabis market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on products derived and distribution channel.

Analysis by Product Derived:

- Marijuana

- Industrial Hemp

- Others

Marijuana leads the North American legal cannabis market, fueled by its pervasiveness in recreational and medicinal use. The category is boosted by growing legalization in U.S. states and Canada's federally legal market. Growing consumer demand for high-THC strains, edibles, and concentrates fuels its growth. Medical marijuana usage is also increasing as it is effective in pain relief, epilepsy, and psychiatric illnesses. Investments in retail expansion, product innovation, and cultivation further reinforce marijuana's market position, as it becomes the largest segment of the industry.

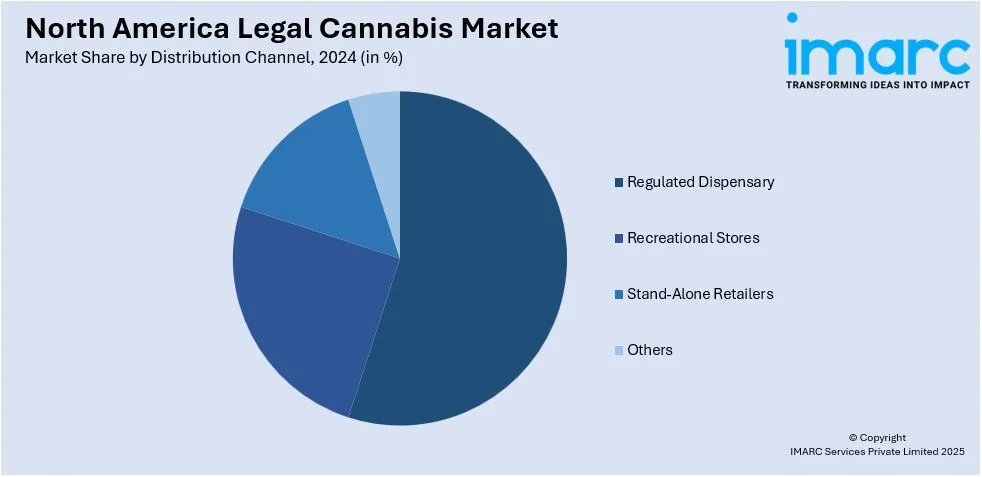

Analysis by Distribution Channel:

- Regulated Dispensary

- Recreational Stores

- Stand-Alone Retailers

- Others

Regulated dispensaries holds the largest North America legal cannabis market share in North America's legal cannabis industry because they strictly adhere to government regulations and consumers' confidence in product quality. Dispensaries provide lab-tested cannabis products, which are safe and consistent. Medical patients and recreational consumers prefer dispensaries for professional advice, variety of products, and secure buying environments. State and provincial laws favor licensed dispensaries, restricting illicit market competition. Expanded legalization, growing retail networks, and greater consumer knowledge continue to entrench the preeminence of licensed dispensaries.

Country Analysis:

- United States

- Canada

The United States is the largest market for legal cannabis in North America, fueled by growing state-level legalization for medical and recreational purposes. Robust consumer demand, an expanding base of licensed dispensaries, and rising investment in cultivation and retail infrastructure drive its leadership. Federal policy debates and economic advantages, including job creation and tax revenues, also fuel market growth. The presence of large cannabis firms, innovation in products, and changing regulatory environments continues to reinforce the U.S. leadership in the sector.

Competitive Landscape:

The North America legal cannabis market is highly competitive with companies focusing on product innovation, strategic partnerships and geographic expansion. Market players are investing in advanced cultivation techniques, extraction technologies and sustainable production methods to enhance quality and efficiency. Regulatory compliance remains a key focus driving investments in testing, labeling and consumer education. Companies are expanding retail footprints through dispensaries and ecommerce platforms catering to both medical and recreational consumers. Mergers, acquisitions and collaborations with mainstream industries including pharmaceuticals and consumer goods are increasing. The growing demand for premium, organic and functional cannabis products is further shaping competitive dynamics.

The report provides a comprehensive analysis of the competitive landscape in the North America legal cannabis market with detailed profiles of all major companies, including:

- 22nd Century Group, Inc.

- Medical Marijuana Inc.

- Hemp, Inc.

- Axim Biotechnologies, Inc.

- Arena Pharmaceuticals, Inc.

- Canopy Growth Corporation

- Aphria Inc.

- Aurora Cannabis Inc.

- Abcann Medicinals Inc.

Latest News and Developments:

- In January 2025, Green Monké and Cookies announced the launch of a line of THC-infused beverages in ten U.S. states. With 500,000 drinks distributed across over 5,000 stores the four flavors cater to consumers seeking alcohol alternatives. This collaboration reflects growing trends in cannabis consumption particularly among younger generations prioritizing wellness.

- In January 2025, the Cannabist Company announced the launch of its Seed & Strain brand in Maryland marking its entry into the twelfth market. Initially offering 0.5-gram vape cartridges at select locations, the brand plans to introduce whole flower and pre-rolls soon, reflecting the state's growing cannabis market.

- In February 2024, Rubicon Organics announced the launch of its Cannabis-Infused Poutine Sauce under the 1964 Supply Co. brand, debuting in Quebec. The sauce combines traditional poutine flavors with 10mg of THC from hash rosin, aiming to enhance culinary experiences.

- In January 2024, Aurora Cannabis Inc. announced the launch of three new cannabis-infused beverages for veteran patients, featuring fruity flavors like Strawberry Pineapple Tropical Soda, Pineapple Coconut Fizz, and Neon Rush. These products aim to provide alternative cannabis options for wellbeing, utilizing SōRSE® emulsion technology for minimal cannabis taste or aroma.

- In August 2023, MediPharm Labs completed its first delivery of cannabis clinical trial materials to the U.S. for an NIH-funded study, following necessary import and export permits. The company also concluded a significant FDA inspection of its Barrie facility, marking key advancements in its pharmaceutical cannabis supply efforts.

North America Legal Cannabis Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Derived Covered | Marijuana, Industrial Hemp, Others |

| Distribution Channels Covered | Regulated Dispensary, Recreational Stores, Stand-Alone Retailers, Others |

| Countries Covered | United States, Canada |

| Companies Covered | 22nd Century Group, Inc, Medical Marijuana Inc, Hemp, Inc., Axim Biotechnologies, Inc, Arena Pharmaceuticals, Inc., Canopy Growth Corporation, Aphria Inc., Aurora Cannabis Inc. and Abcann Medicinals Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America legal cannabis market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America legal cannabis market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America legal cannabis industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The legal cannabis market was valued at USD 44.83 Billion in 2024.

The North America legal cannabis market is growing due to expanding legalization, increasing medical applications, rising consumer acceptance, and strong investment inflows. Product innovation, retail expansion, and advancements in cultivation and extraction technologies further drive growth. Economic benefits, including job creation and tax revenue, also encourage regulatory support and market expansion.

IMARC estimates the legal cannabis market to reach USD 354.82 Billion by 2033, exhibiting a CAGR of 24.55% during 2025-2033.

The regulated dispensary segment held the largest market share in the North America legal cannabis market. These dispensaries ensure compliance with government regulations, offering lab-tested, high-quality cannabis products. Consumers prefer them for safety, product variety, and expert guidance. Expanding legalization and retail networks further strengthen their dominance in the industry.

Some of the major key players include, 22nd Century Group, Inc, Medical Marijuana Inc, Hemp, Inc., Axim Biotechnologies, Inc, Arena Pharmaceuticals, Inc., Canopy Growth Corporation, Aphria Inc., Aurora Cannabis Inc. and Abcann Medicinals Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)