North America Methanol Market Size, Share, Trends and Forecast by Application and Country, 2025-2033

North America Methanol Market Size and Share:

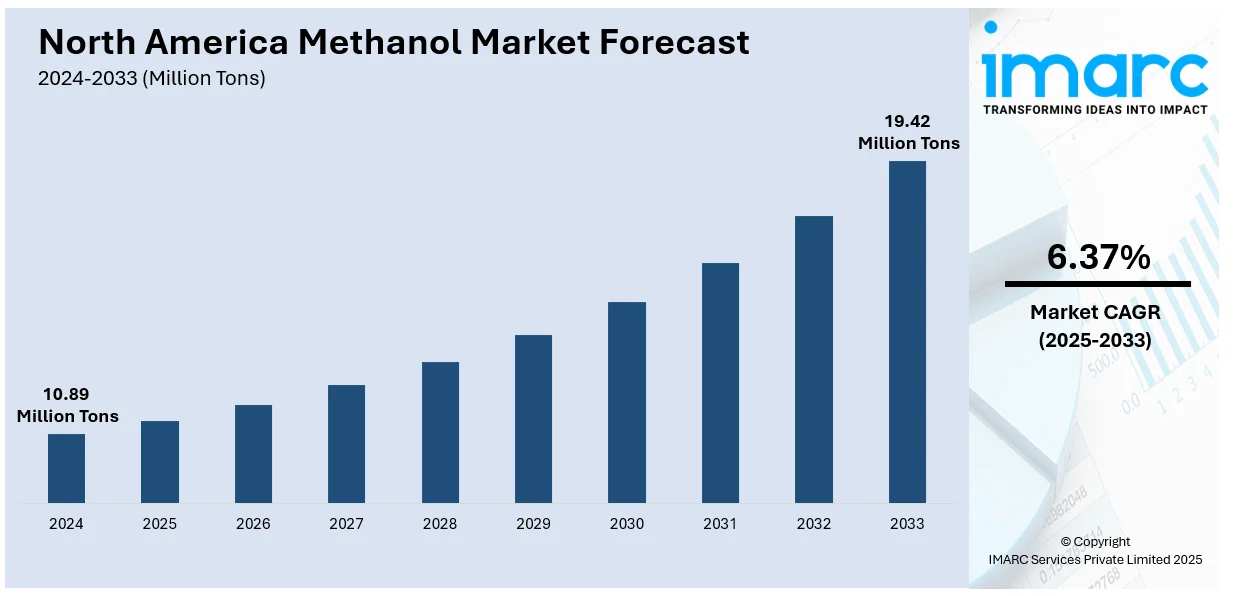

The North America methanol market size was valued at 10.89 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 19.42 Million Tons by 2033, exhibiting a CAGR of 6.37% from 2025-2033. The North America methanol market is driven by increasing demand in automotive fuels, the expansion of methanol-to-olefins (MTO) technologies, and rising demand for formaldehyde production. Additionally, the growth of energy-efficient solutions and the push for cleaner energy alternatives fuel the demand for methanol as a renewable energy source.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

10.89 Million Tons |

|

Market Forecast in 2033

|

19.42 Million Tons |

| Market Growth Rate (2025-2033) | 6.37% |

A significant boost in demand for methanol was witnessed in North America with a shift towards cleaner fuels, especially in the automotive sectors. Methanol is now being promoted as a viable alternative to traditional gasoline as governments introduce stricter emission standards and encourage renewable energy sources. It has a high octane rating and a cleaner burn characteristic that makes it an attractive option for blending with gasoline, thereby improving fuel efficiency and reducing environmental impact. Additionally, with the latest innovations in methanol fuel cell technology, it is opening doors for electric vehicles. This increases the North America's methanol market demand.

The methanol-to-olefins technology has flourished, and its applications have spread to be one of the most significant demand drivers for methanol in North America. Such a process converts methanol to valuable olefins including ethylene and propylene which are indispensable raw materials in plastics, fibers, and other chemicals. This also raises the demand for petrochemicals besides the fact that further environmental-friendly production must be reached in the future; therefore, it is low-cost and cost-effective compared to other pathways of olefins production from MTO. This innovation leads to investments along with growth prospect for the region's methanol market, enhancing its economic relevance.

North America Methanol Market Trends:

Growth of Methanol as a Renewable Fuel Source

Demand for renewable energy solutions in North America has been one of the significant drivers of growth in methanol as an alternative fuel. Methanol is increasingly seen as a cleaner and more sustainable option than fossil fuels. Methanol is increasingly being used in biofuels, such as methyl alcohol blends, to cut carbon emissions and improve energy efficiency. Such growth in methanol use as a source of renewable energy is consistent with government policies meant to reduce oil-based usage and instead increase renewable energy consumption and usage. More importantly, this use in MTG and methanol-to-hydrogen technologies will ensure that it gains more mileage in the renewable energy market and encourages investment and innovative technologies in producing cleaner energy.

MTO technology is expanding fast

Methanol-to-olefins (MTO) technology has been a transformative trend in North America's methanol market, allowing for the direct conversion of methanol into high-value olefins, such as ethylene and propylene. These olefins are crucial for producing a wide range of plastics, chemicals, and fibers used in industries from automotive to consumer goods. The general growing demand for petrochemicals, particularly that concerning the manufacture of plastics, makes MTO technology potentially highly cost-effective and more eco-friendly compared to the traditional olefin production method. North America will be an important location in this global market with new plants and development in the MTO processes that show strong growth for methanol in this industry.

Increase in Industrial Demand for Methanol

The diverse chemical properties of methanol make it a critical input in a wide range of industrial applications, hence its growing demand in North America. Methanol serves as a key raw material in manufacturing formaldehyde, acetic acid, and various other chemicals essential for industries such as construction, automotive, textiles, and electronics. These sectors will continue to expand, with the growing construction and automotive industries in North America, so the consumption of methanol will continue to rise. Also, in a world that seeks sustainable chemical production, the role of methanol in green chemistry and the possibility of its production in biodegradable plastics make it highly in demand. The trend further establishes the significance of methanol as an important industrial feedstock in the region.

North America Methanol Industry Segmentation:

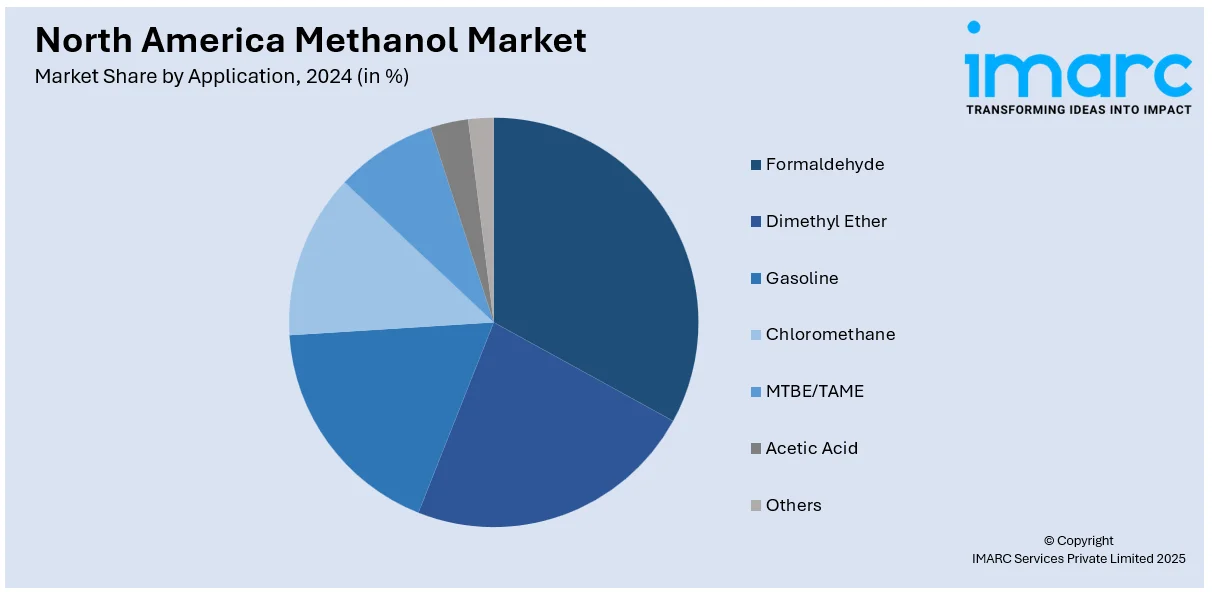

IMARC Group provides an analysis of the key trends in each segment of the North America methanol market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application.

Analysis by Application

- Formaldehyde

- Dimethyl Ether

- Gasoline

- Chloromethane

- MTBE/TAME

- Acetic Acid

- Others

Formaldehyde dominates the North America methanol market share as it is largely consumed in different sectors, such as construction, automotive, and healthcare. It is an important feedstock in the manufacture of resins, adhesives, and coatings applied in wood-based products, furniture, and insulation materials. Increasing demand for light-weight and durable materials in construction and automotive sectors further enhances the consumption of formaldehyde. Additionally, its application in disinfectants, preservatives, and chemical intermediates enhances its market share. The increasing urbanization and infrastructure development worldwide contribute to sustained demand. With advancements in production processes and regulatory compliance for safer use, formaldehyde continues to be the dominant derivative of methanol, maintaining its strong market presence.

Regional Insights:

- United States

- Canada

Based on the North America methanol market forecast, the United States holds the leading position in the market due to abundant natural gas reserves, which serve as a cost-effective feedstock for large-scale methanol production. Advanced production infrastructure, combined with strategic investments in low-carbon and renewable methanol technologies, further strengthens its market dominance. Government policies supporting cleaner energy alternatives and the growing adoption of methanol in marine fuel, automotive, and chemical sectors drive demand. Additionally, the presence of major manufacturers and increasing exports to global markets enhance the country’s competitive edge. Innovations in carbon capture and green methanol production reinforce the U.S. as a leader in sustainable methanol solutions, aligning with global decarbonization efforts and energy transition goals.

Competitive Landscape:

Established as well as new entrants have emphasized technological innovation, production capacity, and strategic partnerships in shaping the competitive dynamics of the methanol market in North America. Established players in this market space have been looking at upgrading their existing production capacity given the spurring demand from renewable fuel applications as well as within the space of methanol-to-olefins technology. Sustainability is also a very important role where companies have cost-efficient sustainable practices so they can compete with each other in the same environment. In addition, market players are partnering and collaborating with petrochemical companies, research institutions, and renewable energy providers to diversify their product offerings and add value to the products. Such an aggressive market position is highly dynamic, thus posing a challenge to market players in terms of continuous innovative and investment activities coupled with attention towards regulatory compliance in order to reap emerging opportunities.

The report provides a comprehensive analysis of the competitive landscape in the North America methanol market with detailed profiles of all major companies.

Latest News and Developments:

- In September 2024, Methanex Corporation announced a definitive agreement to buy international methanol business from OCI Global for $2.05 billion. The acquisition includes the two large-scale methanol facilities, owned by OCI, in Beaumont, Texas; a low-carbon methanol production and marketing business; and an idle methanol facility in the Netherlands. The purchase fits well within Methanex's strategic objectives as it has access to natural gas feedstock in North America and is also expected to augment free cash flow per share.

- In May 2024, SunGas Renewables and C2X joined forces to enhance green methanol production across North America, contributing to global decarbonization efforts. Their partnership focuses on developing and operating multiple facilities, including the Beaver Lake Renewable Energy project in Louisiana, which aims to produce over 400,000 tons per year by 2028. This partnership combines SunGas’ renewable energy expertise with C2X’s large-scale production capabilities, enhancing sustainable fuel supply and advancing low-carbon solutions for hard-to-abate industries.

- In March 2024, Wärtsilä and Elliott Bay Design Group partnered to develop the CHAMP Barge, a floating mobile power platform using Wärtsilä’s methanol engine technology. Designed for U.S. ports, it provides a cost-effective, low-emission power solution where shore power is unavailable. This innovation aligns with zero-emission regulations, helping reduce port emissions while offering adaptable multi-megawatt power solutions for large vessels, supporting sustainability in maritime operations.

- In December 2023, Transition Industries LLC partnered with Macquarie Group to market methanol from its Pacifico Mexinol project in Sinaloa, Mexico. Anticipated to be the world's largest ultra-low carbon chemicals facility, it is designed to produce 300,000 metric tons of green methanol and 1.8 million metric tons of blue methanol each year. Macquarie will handle global sales, financial hedging, and feedstock procurement under a 15-year agreement, supporting sustainable methanol production and global decarbonization efforts.

North America Methanol Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Formaldehyde, Dimethyl Ether, Gasoline, Chloromethane, MTBE/TAME, Acetic Acid, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America Methanol market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America Methanol market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America Methanol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America Methanol market was valued at 10.89 Million Tons in 2024.

The North America Methanol market was valued at 19.42 Million Tons in 2033 exhibiting a CAGR of 6.37% during 2025-2033.

The North America methanol market is driven by abundant natural gas reserves ensuring cost-effective production, rising demand for methanol-based derivatives like formaldehyde and acetic acid, and increasing adoption of methanol as a cleaner fuel alternative in marine and automotive sectors. Advancements in low-carbon methanol production further support market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)