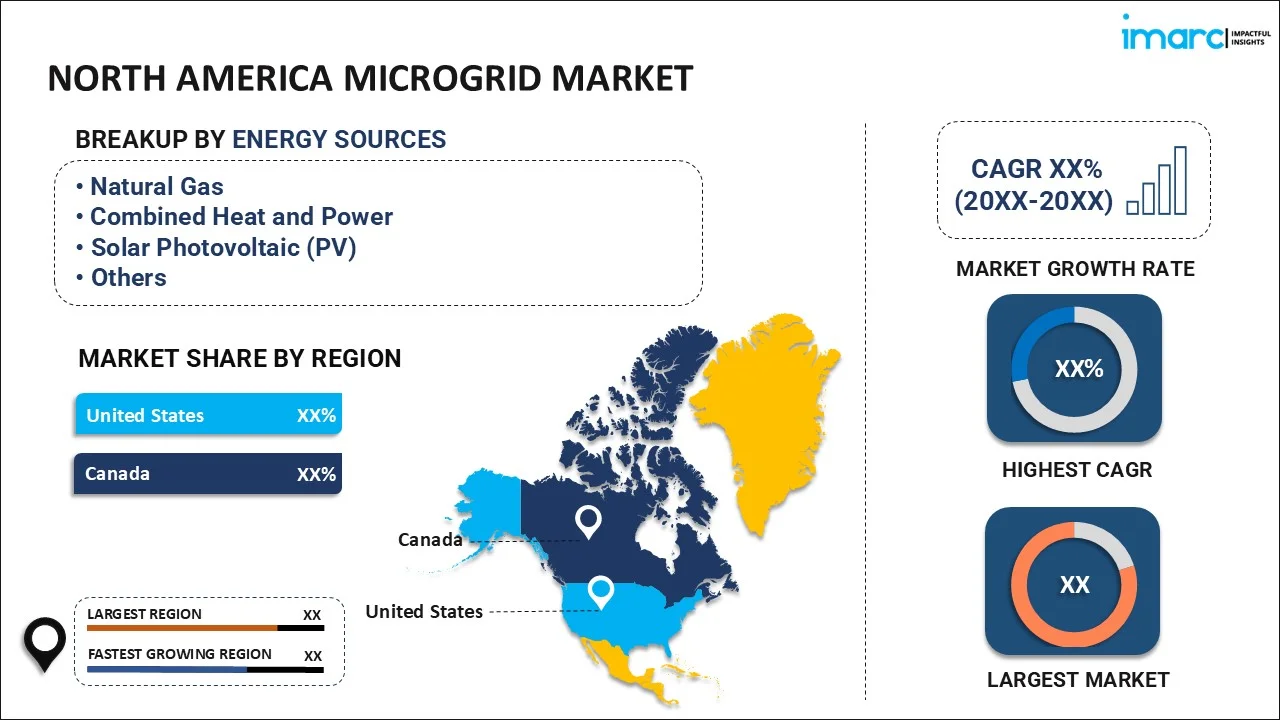

North America Microgrid Market Report by Energy Source (Natural Gas, Combined Heat and Power, Solar Photovoltaic (PV), Diesel, Fuel Cell, and Others), Application (Remote Systems, Institution and Campus, Utility/Community, Defense, and Others), and Country 2025-2033

Market Overview:

The North America microgrid market size reached USD 14.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 36.2 Billion by 2033, exhibiting a growth rate (CAGR) of 9.87% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 14.9 Billion |

|

Market Forecast in 2033

|

USD 36.2 Billion |

| Market Growth Rate 2025-2033 |

9.87%

|

A microgrid refers to a distinct energy system consisting of interconnected loads and distributed energy resources that operate parallelly, or independently from the main power grid. Similar to contemporary electrical grid, a microgrid consists of power generation system, distribution system, and controls, such as voltage regulation and switch gears. It provides power backup for the grid in case of emergencies and is cost-effective. Additionally, it performs dynamic control over energy sources by enabling autonomous and automatic self-healing operations. Some of the other benefits offered by a microgrid include enhancing reliability, reducing greenhouse gas (GHG) emissions, and lowering stress on the transmission and distribution system. As a result, it provides local, reliable, and affordable energy security for urban and rural communities as well as offer solutions for commercial, industrial and federal government consumers.

The North America microgrid market is currently being driven by several factors. The escalating demand for microgrid is based on the availability of reliable, stable and affordable power. Moreover, the usage of microgrid in defense and remote areas to enhance security against cyberattacks and threat of grid outages have also increased its demand in the region. Apart from this, several government initiatives are being implemented to provide energy-efficient power solutions. Additionally, rising environmental concerns and technological innovations will continue to spur the microgrid market growth in the coming years.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the North America microgrid market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on energy source and application.

- Key Regions Analysed

- United States

- Canada

- Analysis for Each Country

- Market by Energy Source

- Natural Gas

- Combined Heat and Power

- Solar Photovoltaic (PV)

- Diesel

- Fuel Cell

- Others

- Market by Application

- Remote Systems

- Institution and Campus

- Utility/Community

- Defense

- Others

- Value Chain Analysis

- Key Drivers and Challenges

- Porters Five Forces Analysis

- Competitive Landscape

- Competitive Structure

- Key Player Profiles

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Energy Source, Application, Country |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the North America microgrid market performed so far and how will it perform in the coming years?

- What are the key regions in the North America microgrid market?

- What has been the impact of COVID-19 on the North America microgrid market?

- What is the breakup of the North America microgrid market on the basis of energy source?

- What is the breakup of the North America microgrid market on the basis of application?

- What are the various stages in the value chain of the North America microgrid industry?

- What are the key driving factors and challenges in the North America microgrid industry?

- What is the structure of the North America microgrid industry and who are the key players?

- What is the degree of competition in the North America microgrid industry?

- What are the profit margins in the North America microgrid industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)