North America Samarium Cobalt Magnets Market Size, Share, Trends and Forecast by Application, and Country, 2026-2034

North America Samarium Cobalt Magnets Market Summary:

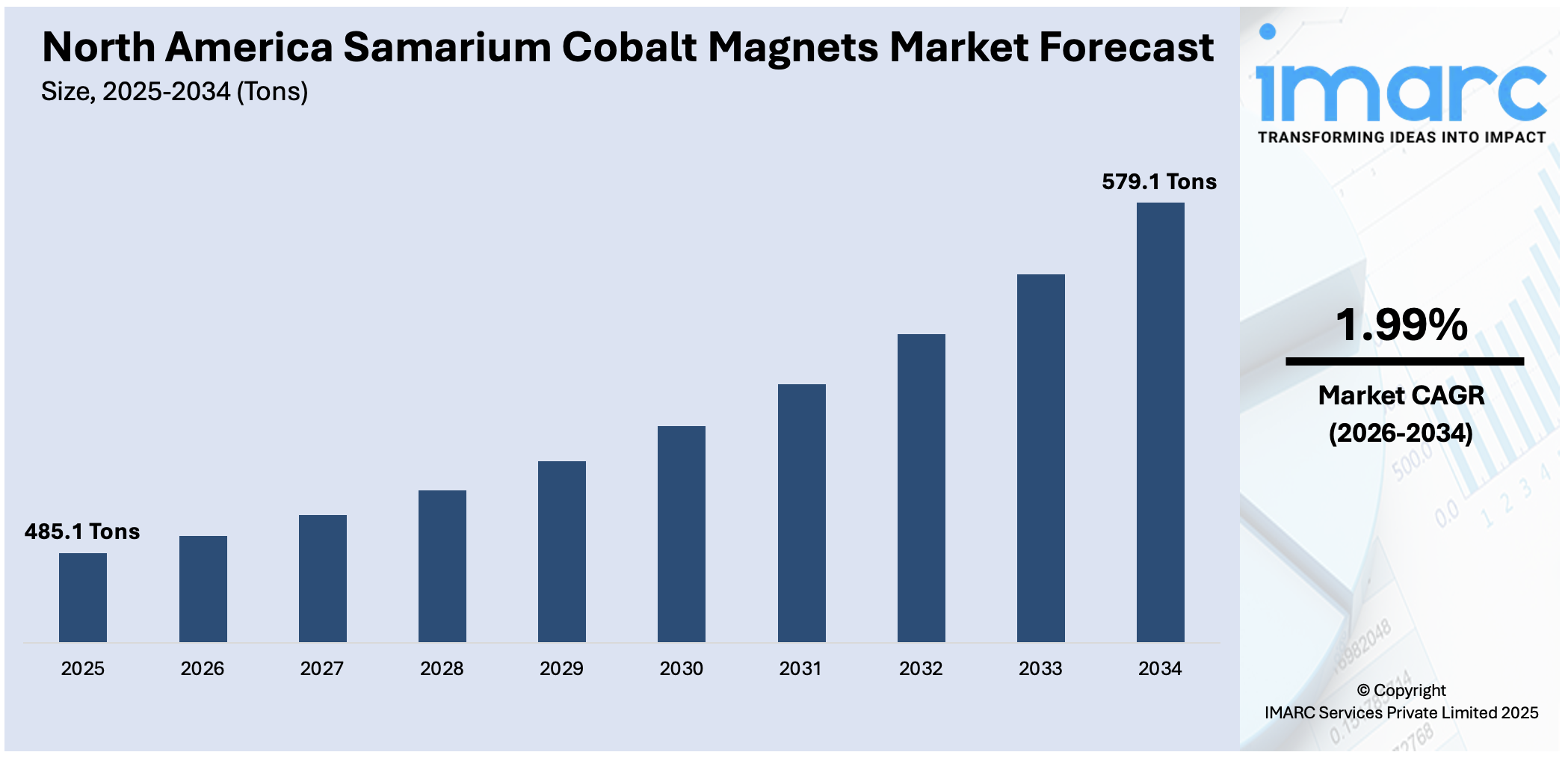

The North America samarium cobalt magnets market size reached 485.10 Tons in 2025 and is projected to reach 579.08 Tons by 2034, growing at a compound annual growth rate of 1.99% from 2026-2034.

The North America samarium cobalt magnets market is witnessing steady expansion, driven by escalating demand from defense modernization programs, aerospace innovations, and advanced electronics manufacturing. Growing emphasis on high-temperature stability, superior corrosion resistance, and demagnetization resilience in mission-critical applications is propelling broader adoption. Strategic government initiatives aimed at strengthening domestic rare earth supply chains and reducing foreign material dependencies are reinforcing long-term market sustainability and competitiveness across the region.

Key Takeaways and Insights:

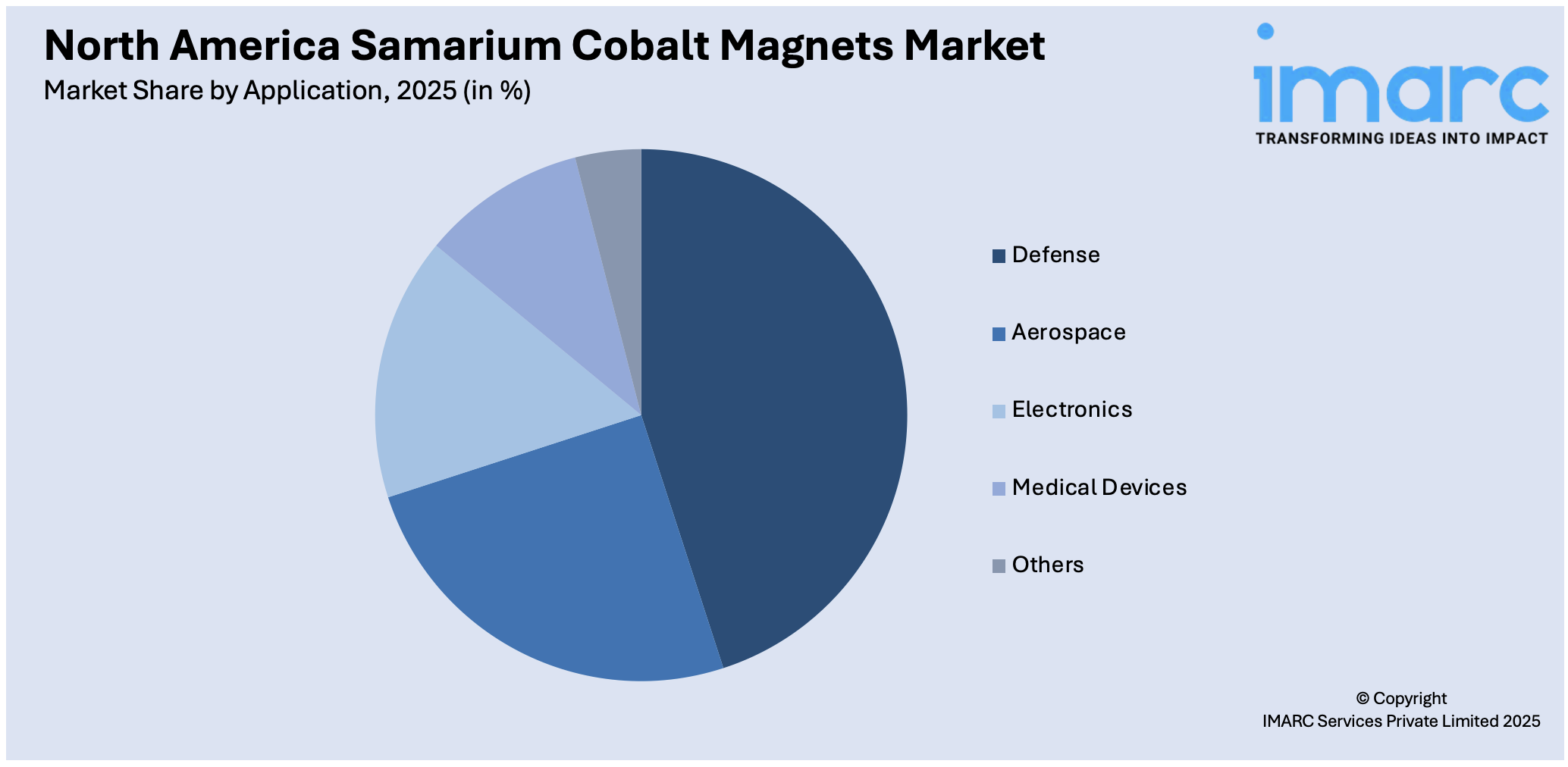

- By Application: Defense dominates the market with a share of 32% in 2025, owing to the critical role of samarium cobalt magnets in high-reliability military systems requiring exceptional thermal stability and resistance to demagnetization across radar, guidance, and communication platforms.

- By Country: United States represents the largest country with 82% share in 2025, driven by substantial federal defense expenditures, a robust aerospace manufacturing base, and accelerating government initiatives to establish domestic rare earth magnet supply chains, ensuring long-term strategic material sovereignty.

- Key Players: Key players drive the North America samarium cobalt magnets market by investing in advanced manufacturing capabilities, expanding production capacity, and forming strategic partnerships to ensure consistent product availability for defense, aerospace, and industrial applications across the region.

To get more information on this market Request Sample

The North America samarium cobalt magnets market is advancing, as defense modernization, aerospace innovation, and high-performance electronics manufacturing converge to drive sustained demand. In February 2026, Congress formally approved the USD 839 Billion defense budget for fiscal 2026 in the United States. The defense funding agreement allocated this amount for essential Air Force modernization initiatives, such as the F-35, F-47, B-21, and the Sentinel intercontinental ballistic missile. Samarium cobalt magnets offer unmatched thermal stability, corrosion resistance, and magnetic retention at very high temperatures, making them indispensable in mission-critical military systems, satellite technologies, and precision medical instruments. Growing emphasis on supply chain sovereignty is further catalyzing market activity, with the United States government prioritizing domestic rare earth processing and magnet manufacturing capabilities to mitigate vulnerabilities associated with concentrated foreign sourcing. Expanding applications in oil and gas directional drilling, electric vehicle (EV) sensors, and industrial automation systems are broadening the consumption base beyond traditional defense channels.

North America Samarium Cobalt Magnets Market Trends:

Accelerating Domestic Rare Earth Magnet Manufacturing Capabilities

The North American rare earth magnet landscape is undergoing a structural transformation as federal agencies prioritize onshoring of critical mineral processing and magnet manufacturing infrastructure. New production facilities are advancing towards commissioning across multiple states, reflecting growing recognition that dependence on single foreign sources for defense-grade materials creates unacceptable national security vulnerabilities. In July 2025, the United States Department of Defense approved a USD 400 Million equity stake in MP Materials Corp., the firm that reactivated an inactive mine in California. In addition to funding of USD 1 Billion from JPMorgan Chase & Co. and Goldman Sachs Group Inc., the commitment would finance a significant new facility producing rare-earth magnets, driving the North America samarium cobalt magnets market growth.

Rising Integration in Next-Generation Defense and Aerospace Platforms

Next-generation defense and aerospace platforms are increasingly incorporating samarium cobalt magnets to achieve superior operational performance in extreme environments. These magnets serve critical functions in precision-guided munitions, electronic warfare systems, satellite attitude control mechanisms, and high-speed turbine components where sustained magnetic integrity at elevated temperatures is essential. Their resistance to demagnetization under intense thermal stress and radiation exposure makes them especially suitable for long-duration missions and harsh operating conditions.

Expanding Adoption in High-Performance Industrial Applications

Samarium cobalt magnets are gaining wider adoption across high-performance industrial applications in North America where reliability under extreme conditions is critical. Thriving industries, such as oil and gas, advanced manufacturing, and energy generation, increasingly rely on these magnets for motors, sensors, and control systems exposed to high temperatures and corrosive environments. Their superior thermal stability and long operational lifespan reduce maintenance needs and downtime, making them cost-effective over extended use cycles. As industrial automation and precision engineering requirements grow, demand for samarium cobalt magnets continues to strengthen across specialized industrial segments.

Market Outlook 2026-2034:

The North America samarium cobalt magnets market is positioned for sustained growth over the forecast period, as defense spending priorities, aerospace innovation, and strategic supply chain development converge to support demand expansion. Continued modernization of military platforms, including precision-guided systems, electronic warfare equipment, and satellite communication arrays, will remain central demand drivers. The market size was estimated at 485.10 Tons in 2025 and is expected to reach 579.08 Tons by 2034, reflecting a compound annual growth rate of 1.99% over the forecast period 2026-2034. Expanding utilization in medical imaging technologies, high-temperature industrial sensors, and aerospace propulsion systems will further broaden the consumption base.

North America Samarium Cobalt Magnets Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Application |

Defense |

32% |

|

Country |

United States |

82% |

Application Insights:

Access the comprehensive market breakdown Request Sample

- Defense

- Aerospace

- Electronics

- Medical Devices

- Others

Defense dominates with a market share of 32% of the total North America samarium cobalt magnets market in 2025.

Defense's commanding position in the North America samarium cobalt magnets market is anchored in the indispensable role these magnets play in high-reliability military systems where extreme thermal stability and resistance to demagnetization are paramount. Samarium cobalt magnets are integral components in precision-guided munitions, radar arrays, sonar systems, and secure communication equipment, functioning reliably at temperatures exceeding 300 degrees Celsius. In the FY2024-25, Canada's defense expenditure was expected to hit 1.37% of its GDP, with 18.6% allocated to major equipment, an increase from 1.31% of GDP and 14.8% for major equipment in fiscal year 2023-24, expanding the procurement of advanced systems requiring high-performance magnetic components.

Defense continues to be the largest application segment, due to the growing complexity of contemporary warfare equipment. These magnets are essential to the functionality of gyroscope assembly, electro-hydrostatic actuators, and inertial navigation systems used in precision strike weapons, fighter aircraft, and submarines. System reliability is improved by their capacity to sustain steady magnetic performance in the face of severe vibration, shock, and electromagnetic interference. Samarium cobalt magnets are becoming more necessary as defense platforms embrace increased automation and technological integration.

Country Insights:

- United States

- Canada

- Mexico

United States exhibits a clear dominance with 82% share of the total North America samarium cobalt magnets market in 2025.

The United States commands the North America samarium cobalt magnets market primarily through its massive defense industrial base and strategic emphasis on domestic rare earth supply chain sovereignty. The country hosts the region's most extensive network of defense contractors, aerospace manufacturers, and electronics firms that collectively drive the overwhelming majority of samarium cobalt magnet consumption. Long-term defense procurement programs and sustained research and development (R&D) spending further reinforce consistent, high-volume demand for these high-performance magnetic materials.

The Rare Earth Magnet Security Act of 2025, introduced as H.R. 1496 in February 2025, proposed tax credits of USD 20 per kilogram for domestically manufactured magnets and USD 30 per kilogram for those using at least 90 percent domestically sourced rare earth materials, demonstrating the federal commitment to developing the capacity to produce magnets on its own. Beyond defense, the United States sees a strong demand from the aerospace industry, which includes the production of satellites, parts for commercial aircraft, and space exploration initiatives, as well as from manufacturers of medical devices that need thermally stable magnets for implantable surgical instruments and diagnostic imaging equipment.

Market Dynamics:

Growth Drivers:

Why is the North America Samarium Cobalt Magnets Market Growing?

Sustained Defense Modernization and Rising Military Expenditure

The market for samarium cobalt magnets in North America is expanding rapidly due to ongoing defense modernization in the United States, Canada, and Mexico, with the United States leading the way in extensive military technology advancements. The ability of samarium cobalt magnets to retain their magnetic integrity at temperatures above 300 degrees Celsius gives them an unmatched operational advantage in electronic warfare equipment, advanced radar platforms, missile guidance systems, satellite communication arrays, and next-generation weapon systems. The need for high-performance permanent magnets that can resist harsh operating conditions is increasing as a result of the heightened focus on creating directed energy platforms, autonomous unmanned systems, and hypersonic weaponry. Additionally, the modernization of naval fleets with advanced sonar and detection systems, along with the upgrading of fighter aircraft avionics and actuation systems, continues to expand the defense sector's consumption of samarium cobalt magnets.

Strategic Government Initiatives for Domestic Rare Earth Supply Chain Sovereignty

The market is benefiting significantly from comprehensive government initiatives designed to establish self-sufficient rare earth processing and magnet manufacturing capabilities within domestic borders. Federal recognition that concentrated foreign sourcing of samarium and cobalt feedstocks creates critical vulnerabilities for national security and industrial competitiveness has prompted a strategic policy response encompassing financial incentives, regulatory mandates, and public-private partnerships (PPPs). Legislative frameworks in the United States requiring defense contractors to eliminate Chinese-origin rare earth materials from weapon systems by January 2027 are compelling the establishment of compliant supply chains spanning mining, separation, metallization, and finished magnet production. These policy measures are creating a favorable investment environment for domestic magnet manufacturers, attracting private capital alongside government funding to scale up production capacity.

Expanding Applications in Aerospace, Medical Technology, and Advanced Electronics

The North America samarium cobalt magnets market is experiencing diversified demand growth from the aerospace, medical technology, and advanced electronics sectors that increasingly require high-performance permanent magnets with exceptional thermal and environmental resilience. In aerospace, samarium cobalt magnets serve essential functions in satellite attitude control systems, aircraft actuators, turbine engine sensors, and reaction wheels for spacecraft navigation, where consistent performance under vibration and temperature extremes is non-negotiable. The medical device sector drives incremental demand through its reliance on samarium cobalt magnets for magnetic resonance imaging equipment, cardiac pacemakers, surgical instruments, and implantable medical pumps requiring stable magnetic fields and biocompatibility. In advanced electronics, the push towards miniaturization of high-performance components for telecommunications infrastructure, precision sensors, and industrial automation systems continues to broaden consumption.

Market Restraints:

What Challenges the North America Samarium Cobalt Magnets Market is Facing?

Heavy Dependence on Chinese Raw Material Supply

The North America samarium cobalt magnets market faces a major constraint due to heavy dependence on China for refined samarium feedstock, as the country dominates global rare earth processing activities. The lack of sufficiently developed alternative processing infrastructure outside China limits the ability of North American manufacturers to secure stable and independent supplies. This structural dependency heightens supply chain risk, increases procurement complexity, and acts as a continuing barrier to large-scale capacity expansion across the region.

Elevated Production Costs Relative to Alternative Magnet Technologies

Samarium cobalt magnets carry substantially higher production costs compared to competing neodymium iron boron magnets, primarily driven by the elevated prices of samarium and cobalt raw materials combined with the energy-intensive sintering and machining processes required during manufacturing. Non-Chinese sourced samarium can cost many times more than Chinese-processed equivalents, further amplifying cost pressures. These pricing dynamics limit the adoption of samarium cobalt magnets in cost-sensitive commercial applications where neodymium alternatives can provide adequate magnetic performance at a fraction of the expense.

Material Brittleness and Complex Manufacturing Requirements

Samarium cobalt magnets are inherently brittle and susceptible to cracking and chipping during machining, handling, and integration into end-use assemblies, creating significant manufacturing challenges. This mechanical fragility demands specialized processing equipment, precise tooling techniques, and careful handling protocols that increase production complexity and costs. The limited tolerance for mechanical stress also restricts design flexibility in certain applications, as engineers must accommodate the material's sensitivity to impact and thermal shock during both manufacturing and operational service life.

Competitive Landscape:

The North America samarium cobalt magnets market features a moderately consolidated competitive landscape, characterized by a mix of established magnet manufacturers, specialized rare earth processors, and emerging domestic producers. Market participants are actively investing in expanding production capacity and advancing manufacturing technologies to meet the growing defense and aerospace demand. Strategic partnerships between magnet producers, rare earth miners, and recycling technology providers are intensifying as companies seek to build vertically integrated supply chains. The competitive environment is further shaped by government procurement mandates that favor domestically produced magnets, creating opportunities for compliant manufacturers while increasing barriers for import-dependent suppliers.

Recent Developments:

- In August 2025, Permag™, the sole United States manufacturer of samarium cobalt magnets, revealed a bold plan to enhance its magnetic production capacity to maintain a steady, strong, and dependable domestic supply chain of essential magnetics.

North America Samarium Cobalt Magnets Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Tons |

| Scope of the report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered |

Defense, Aerospace, Electronics, Medical Devices, Others |

| Countries Covered | United States, Canada, Mexico |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The North America samarium cobalt magnets market reached a volume of 485.10 Tons in 2025.

The North America samarium cobalt magnets market is expected to grow at a compound annual growth rate of 1.99% from 2026-2034 to reach 579.08 Tons by 2034.

Defense dominated the market with a share of 32%, driven by the critical role of samarium cobalt magnets in high-reliability military systems, including radar arrays, missile guidance mechanisms, and secure communication equipment, requiring exceptional thermal stability.

Key factors driving the North America samarium cobalt magnets market include sustained defense modernization, strategic government initiatives for domestic supply chain sovereignty, expanding aerospace applications, growing medical device utilization, and accelerating investments in domestic rare earth magnet manufacturing capabilities.

Major challenges include heavy dependence on Chinese raw material supply, elevated production costs relative to alternative magnet technologies, material brittleness and complex manufacturing requirements, geopolitical supply chain disruptions, and limited domestic samarium processing infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)