North America Secondary Wood Products Market Size, Share, Trends and Forecast by Type and Country, 2026-2034

North America Secondary Wood Products Market Summary:

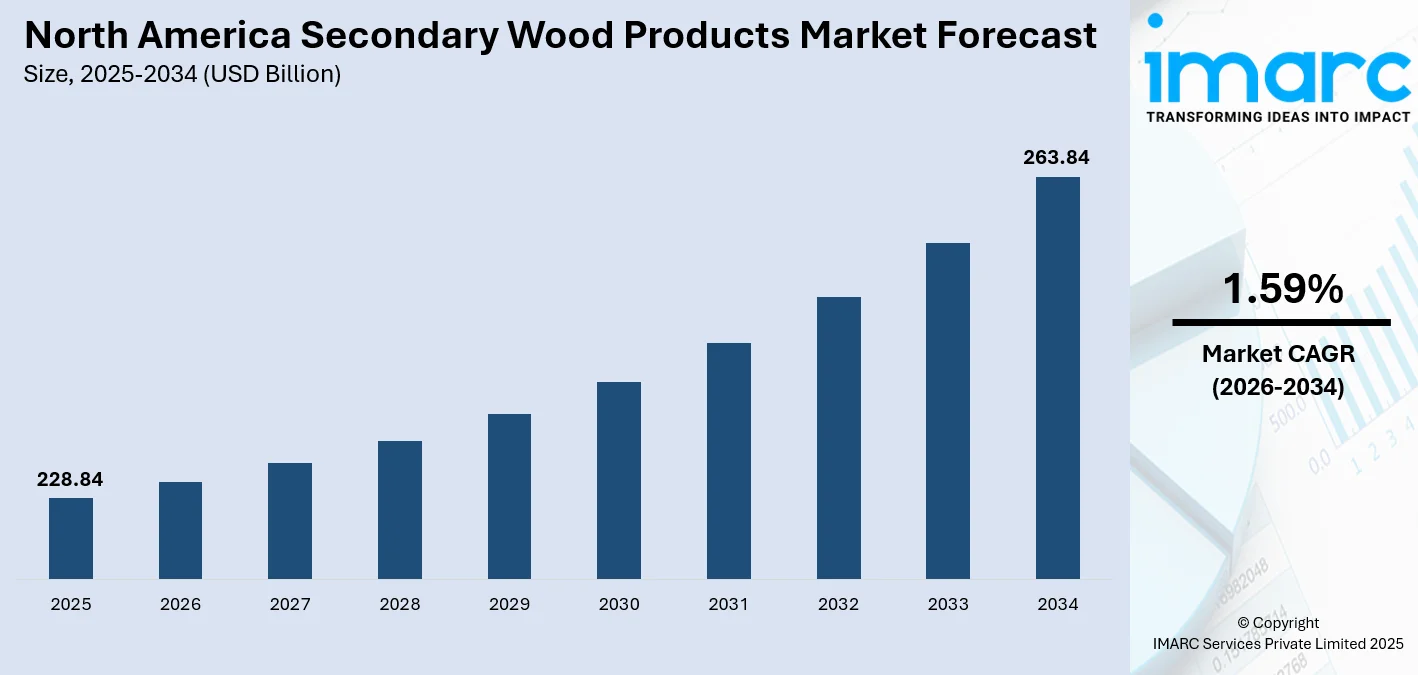

The North America secondary wood products market size was valued at USD 228.84 Billion in 2025 and is projected to reach USD 263.84 Billion by 2034, growing at a compound annual growth rate of 1.59% from 2026-2034.

The North America secondary wood products market demonstrates steady expansion driven by residential construction activities, growing demand for sustainable building materials, and evolving consumer preferences for eco-friendly furniture. The region benefits from abundant timber resources, advanced manufacturing infrastructure, and increasing adoption of engineered wood products across construction and interior design applications, supporting consistent market development throughout the forecast period.

Key Takeaways and Insights:

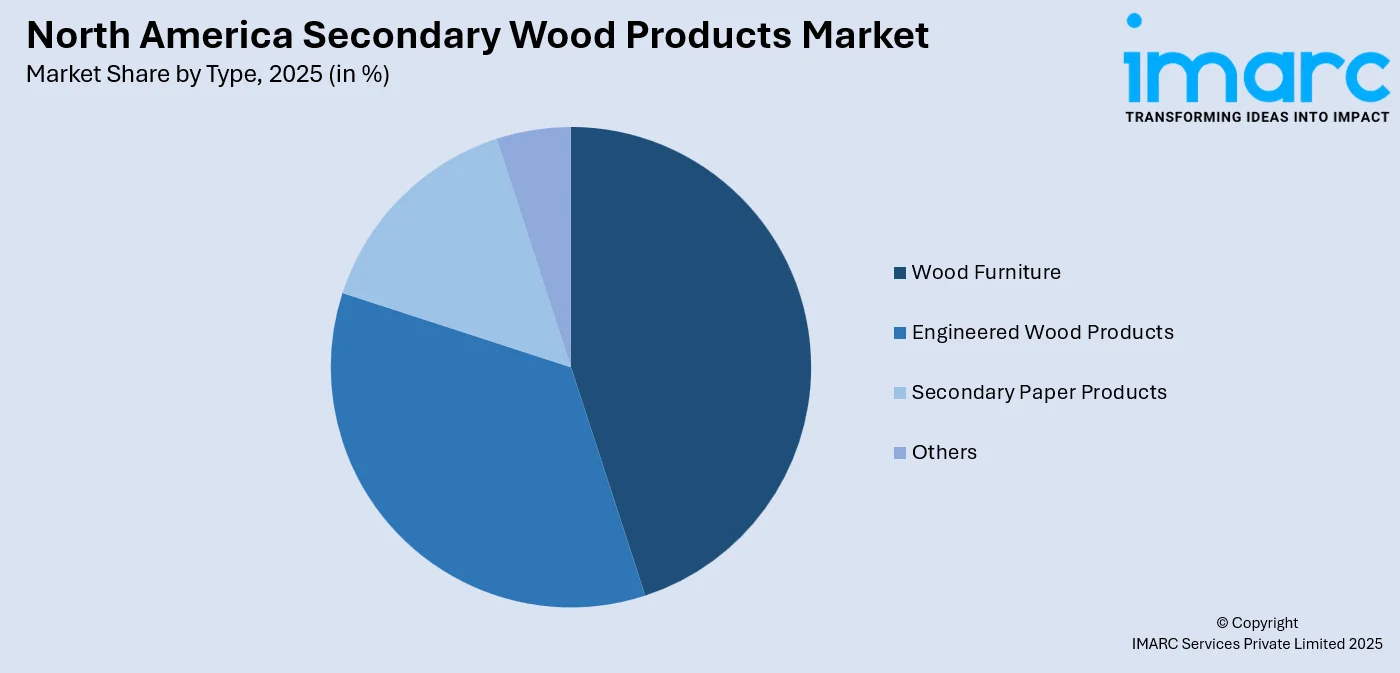

- By Type: Wood furniture dominates the market with a share of 44% in 2025, driven by robust residential construction activities, rising consumer demand for natural and sustainable home furnishings, and the increasing preference for premium customized wooden furniture solutions across households and commercial establishments throughout the region.

- By Country: United States leads the market with a share of 81% in 2025, attributed to the nation's extensive housing construction base, high renovation spending patterns, mature manufacturing infrastructure, and strong consumer demand for premium wood products across residential and commercial applications nationwide.

- Key Players: Key players drive the North America secondary wood products market by expanding manufacturing capabilities, investing in sustainable forestry practices, and strengthening distribution networks. Their focus on product innovation, automation technologies, and strategic acquisitions enhances operational efficiency while meeting evolving consumer preferences for eco-friendly and high-quality wood products across diverse applications. Some of the key players operating in the industry are Ashley Furniture Industries, Steelcase, HNI Corporation, Herman Miller and Weyerhaeuser Company.

To get more information on this market Request Sample

The North America secondary wood products market is experiencing sustained growth propelled by multiple favorable factors across the construction and furniture sectors. The ongoing demand for residential housing construction, coupled with active home renovation and remodeling activities, continues to generate substantial requirements for wood furniture, engineered panels, and cabinetry products. Consumer preferences are increasingly shifting toward sustainable and eco-friendly materials, with wooden products gaining traction due to their natural appeal, durability, and environmental credentials compared to synthetic alternatives. The region's abundant forest resources and established timber supply chains provide manufacturers with reliable access to quality raw materials while supporting sustainable harvesting practices. Technological advancements in wood processing and manufacturing have enabled producers to develop innovative engineered wood products with enhanced performance characteristics suitable for modern construction applications. The growing emphasis on green building standards and certifications further accelerates adoption of wood-based materials in both residential and commercial projects. Additionally, the expansion of e-commerce platforms has improved market accessibility, enabling consumers to explore diverse wood furniture options conveniently while supporting overall market expansion.

North America Secondary Wood Products Market Trends:

Growing Preference for Sustainable and Eco-Friendly Wood Products

Consumer awareness regarding environmental sustainability has significantly influenced purchasing decisions across the North American wood products market. Buyers increasingly prioritize furniture and construction materials derived from responsibly managed forests with recognized certifications. This shift reflects broader lifestyle changes emphasizing reduced environmental footprints and healthier living spaces. Manufacturers are responding by adopting sustainable sourcing practices, utilizing reclaimed wood, and developing products with lower volatile organic compound emissions. The preference for natural materials over synthetic alternatives continues strengthening as consumers recognize the aesthetic appeal and longevity benefits associated with authentic wood products. According to the Sustainable Furnishings Council and National Wildlife Federation's 2024 Wood Furniture Scorecard, furniture retailers are increasingly prioritizing sustainable wood sourcing, with top-scoring retailers expanding their use of Forest Stewardship Council (FSC) certifications to ensure wood is harvested responsibly and in accordance with rigorous environmental standards.

Rising Adoption of Engineered Wood Products in Construction

The construction industry increasingly embraces engineered wood products as cost-effective and sustainable alternatives to traditional building materials. Cross-laminated timber, laminated veneer lumber, and oriented strand board are gaining prominence in residential and commercial projects due to their structural reliability, dimensional stability, and favorable environmental profiles. These materials offer architects and builders greater design flexibility while meeting stringent building codes and green certification requirements. The evolution of mass timber construction techniques enables taller wood-framed structures, expanding the addressable market for engineered wood applications in urban development projects throughout the region. According to the Environmental and Energy Study Institute (EESI), the number of US mass timber construction projects is rapidly increasing, with 1,860 completed or planned as of June 2023, demonstrating the growing acceptance of engineered wood in modern construction.

Expansion of E-Commerce Channels for Wood Furniture Distribution

Digital retail platforms have transformed how consumers discover and purchase wood furniture, creating new distribution opportunities for manufacturers and retailers. Online channels provide extensive product selections, price comparisons, and convenient home delivery options that appeal to modern shoppers. Virtual visualization tools enable customers to preview furniture arrangements within their living spaces before committing to purchases. The direct-to-consumer model allows emerging brands to reach wider audiences while established manufacturers leverage omnichannel strategies combining digital presence with traditional showroom experiences to maximize market reach and enhance customer engagement effectively. According to the U.S. Census Bureau's Quarterly Retail E-Commerce Sales report, e-commerce sales in Q3 2025 accounted for 16.4% of total retail sales, reflecting the continued shift toward digital purchasing channels across retail categories including furniture.

Market Outlook 2026-2034:

The North America secondary wood products market exhibits promising growth prospects driven by favorable construction activities, evolving consumer preferences, and sustainable building initiatives throughout the forecast period. The market expansion is supported by residential housing demand, home renovation trends, and increasing adoption of wood-based materials in commercial construction. Manufacturers continue investing in advanced processing technologies and sustainable practices to meet environmental standards while addressing consumer requirements for premium quality products. The region's established forestry infrastructure and skilled workforce position North America favorably for continued market development. The market generated a revenue of USD 228.84 Billion in 2025 and is projected to reach a revenue of USD 263.84 Billion by 2034, growing at a compound annual growth rate of 1.59% from 2026-2034.

North America Secondary Wood Products Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Wood Furniture |

44% |

|

Country |

United States |

81% |

Type Insights:

Access the comprehensive market breakdown Request Sample

- Wood Furniture

- Office Furniture

- Household & Institution

- Wooden Kitchen, Cabinets and Countertops

- Others

- Engineered Wood Products

- Plywood

- OSB

- Particle Board

- Others

- Secondary Paper Products

- Paper Products

- Paperboard Containers

- Others

Wood furniture dominates with a market share of 44% of the total North America secondary wood products market in 2025.

The wood furniture segment maintains its dominant position owing to sustained residential demand and consumer preferences for natural, durable furnishings that complement diverse interior design styles. Homeowners increasingly value the timeless aesthetic appeal and longevity that solid wood pieces provide, driving consistent purchasing activity across income demographics. The segment encompasses diverse product categories including household furniture, office installations, and kitchen cabinetry, serving both residential and commercial applications. Manufacturers continue innovating with sustainable sourcing practices and contemporary designs to meet evolving consumer expectations while preserving traditional craftsmanship standards.

Consumer demand for customized and premium wood furniture continues strengthening as households invest in quality furnishings that offer longevity and timeless aesthetic appeal. The segment benefits from robust renovation and remodeling activities, with homeowners upgrading existing furniture to enhance living spaces. The Sustainable Furnishings Council reported that sales of Forest Stewardship Council certified wood furniture in the United States increased substantially between recent years, reflecting stronger eco-conscious purchasing behavior among consumers seeking responsibly sourced products that align with environmental values.

Country Insights:

- United States

- Canada

United States leads with a share of 81% of the total North America secondary wood products market in 2025.

The United States sustains its leading position due to its mature and diversified manufacturing sector, extensive construction work, and full integration of wood products into the country’s building infrastructure. The United States has abundant domestic timber resources, advanced processing technology, and favorable regulatory policies that promote sustainable forestry practices. The country’s large consumer base, diverse demographic trends, and comprehensive distribution channels ensure stable demand for all secondary wood products. Ongoing investments in manufacturing technology and human resource development further enhance the competitive strengths of wood product manufacturers in the United States to meet both regional and export demands.

The United States housing market is a major driver of demand, with residential construction and renovation activities creating significant demand for wood furniture, engineered panels, and millwork products. The development of mass timber construction methods has opened new opportunities for the integration of secondary wood products in contemporary building projects for both commercial and residential purposes. Increasing interest in sustainable building methods and green certification further propels market growth as the construction industry and consumers increasingly turn to environmentally responsible materials. Government programs to promote domestic manufacturing and human resource development continue to improve the wood products supply chain in the United States.

Market Dynamics:

Growth Drivers:

Why is the North America Secondary Wood Products Market Growing?

Robust Residential Construction and Home Renovation Activities

The North America secondary wood products market is greatly aided by the continuous residential construction activities and home renovation projects being undertaken in the region. Residential construction is a basic demand-creating factor, as every new residential unit constructed demands large volumes of wood products for structural framing, interior finishes, cabinetry, and furniture installation. The continuous housing shortage in the region continues to create demands for new residential construction, while existing residential unit owners increasingly undertake renovation and remodeling projects to upgrade their living environments. This trend in home renovations continues to create a steady demand for replacement furniture, upgraded kitchen cabinets, and renovated interior wood finishes. The enhancement in household formation rates among younger generations entering their prime home-buying ages continues to fuel construction demand. Furthermore, the trend towards single-family residential construction with outdoor living areas has increased demands for both indoor and outdoor wood furniture. The wood-framed construction method being adopted by the construction sector for multifamily residential construction creates new market demand beyond the traditional single-family residential market.

Expansion of Remote and Hybrid Work Models Driving Home Office Furniture Demand

The widespread adoption of remote and hybrid work arrangements has created sustained demand for home office furniture throughout North America. Workers establishing dedicated workspaces within their residences require functional desks, ergonomic seating, and storage solutions that replicate professional office environments. This shift in employment patterns has transformed residential spaces into productive work environments, generating consistent purchasing activity for wood-based office furniture. Employers increasingly support home office investments to maintain workforce productivity and employee satisfaction, while workers prioritize comfortable and aesthetically pleasing furniture that integrates with existing home décor. The home office furniture segment continues expanding as flexible work arrangements become permanent fixtures in corporate employment policies. According to the U.S. Bureau of Labor Statistics, in the first quarter of 2024, 35.5 million people teleworked or worked at home for pay, accounting for 22.9 percent of people at work, up from 19.6% recorded a year earlier, demonstrating the sustained shift toward remote work arrangements that drives ongoing demand for home office furnishings.

Technological Advancements in Wood Processing and Manufacturing

Continuous innovations in wood processing and manufacturing technology have increased the functionality of wood products and improved the efficiency of operations in the secondary wood products industry. Modern manufacturing technologies have made it possible for manufacturers to create engineered wood products with improved strength, moisture resistance, and stability for high-performance applications. Computer-aided design and manufacturing capabilities have enabled manufacturers to provide more customized product options while retaining the economies of scale for cost-effective production. The creation of new and improved adhesive materials and surface finishes has increased the longevity of wood products and minimized emissions of volatile organic compounds. Mass timber technology, such as cross-laminated timber, has made it possible to build high-rise wood-frame structures, thereby providing access to new markets that were previously served by steel and concrete alternatives. Digitalization in the retail sector has improved consumer access to a wide range of product options through improved visualization tools and simplified purchasing processes. These technological developments, taken together, have improved the competitiveness of wood products relative to other materials.

Market Restraints:

What Challenges is the North America Secondary Wood Products Market Facing?

Volatile Raw Material Prices and Supply Chain Disruptions

The secondary wood products market faces challenges from fluctuating raw material costs and supply chain vulnerabilities that impact manufacturing operations and pricing stability. Lumber price volatility creates uncertainty for manufacturers attempting to maintain competitive pricing while protecting profit margins. Supply chain disruptions affecting transportation logistics and material availability can delay production schedules and increase operational costs throughout the value chain. These challenges require manufacturers to implement robust inventory management strategies and maintain diversified supplier relationships.

Trade Policy Uncertainties and Import Tariff Implications

The North American secondary wood products market contends with ongoing trade policy uncertainties that affect import costs and competitive dynamics. Tariffs on imported wood products and furniture impact pricing throughout the supply chain while creating compliance complexities for importers and distributors. These trade measures affect material sourcing decisions and may necessitate adjustments to established supply chain configurations. Market participants must navigate evolving regulatory requirements while managing cost implications associated with changing tariff structures and trade agreement provisions.

Competition from Alternative Materials and Imported Products

Secondary wood products face competitive pressures from alternative materials including engineered plastics, metal composites, and laminated surfaces that offer different cost-performance characteristics. Imported furniture and wood products from lower-cost manufacturing regions create pricing pressures for domestic producers. Changing consumer preferences toward modern minimalist designs may favor non-wood materials in certain applications. Manufacturers must continuously innovate and emphasize the distinctive qualities of wood products to maintain competitive positioning against diverse material alternatives in the marketplace.

Competitive Landscape:

The North America secondary wood products market has a moderately fragmented competitive environment, with the presence of MNCs, regional players, and niche players catering to different market segments. The market is highly competitive, with players competing on the basis of product quality, design, price, and sustainability. The major players are concentrating on increasing production capacity, adopting automation technology, and improving distribution networks to improve market positioning. Acquisitions and collaborations help players expand their product offerings and reach new market segments. The competitive environment is shifting towards sustainability and environmentally responsible sourcing as a differentiating factor. Players are investing in R&D to develop innovative products that can meet changing construction regulations and consumer demands. Digital transformation projects are improving customer engagement through enhanced online platforms and visualization tools that aid in purchase decisions.

Some of the key players include:

- Ashley Furniture Industries

- Steelcase

- HNI Corporation

- Herman Miller

- Weyerhaeuser Company

Recent Developments:

- In August 2025, HNI Corporation agreed to acquire Steelcase for USD 2.2 Billion in cash and stock, creating a combined company with significant market presence in office furniture and workplace solutions across North America. The merger aims to leverage complementary geographic footprints and dealer networks while enhancing capabilities to serve diverse customer segments including healthcare, education, and hospitality sectors.

- In November 2024, Weyerhaeuser Company announced plans to invest approximately USD 500 Million to build a new TimberStrand facility near Monticello and Warren, Arkansas, expanding engineered wood products capacity in the U.S. South. The facility will have an annual production capacity of approximately ten million cubic feet, with construction expected to begin in 2025 and operations commencing in 2027, creating nearly two hundred jobs.

North America Secondary Wood Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Countries Covered | United States, Canada |

| Companies Covered | Ashley Furniture Industries, Steelcase, HNI Corporation, Herman Miller and Weyerhaeuser Company |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The North America secondary wood products market size was valued at USD 228.84 Billion in 2025.

The North America secondary wood products market is expected to grow at a compound annual growth rate of 1.59% from 2026-2034 to reach USD 263.84 Billion by 2034.

Wood furniture dominated the market with a share of 44%, driven by sustained residential construction activities, consumer preferences for natural and sustainable furnishings, and strong renovation demand across households.

Key factors driving the North America secondary wood products market include robust residential construction activities, growing consumer preference for sustainable materials, technological advancements in wood processing, and expanding e-commerce distribution channels.

Major challenges include volatile raw material prices, supply chain disruptions, trade policy uncertainties, tariff implications on imported products, competition from alternative materials, and pricing pressures from lower-cost imported furniture and wood products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)