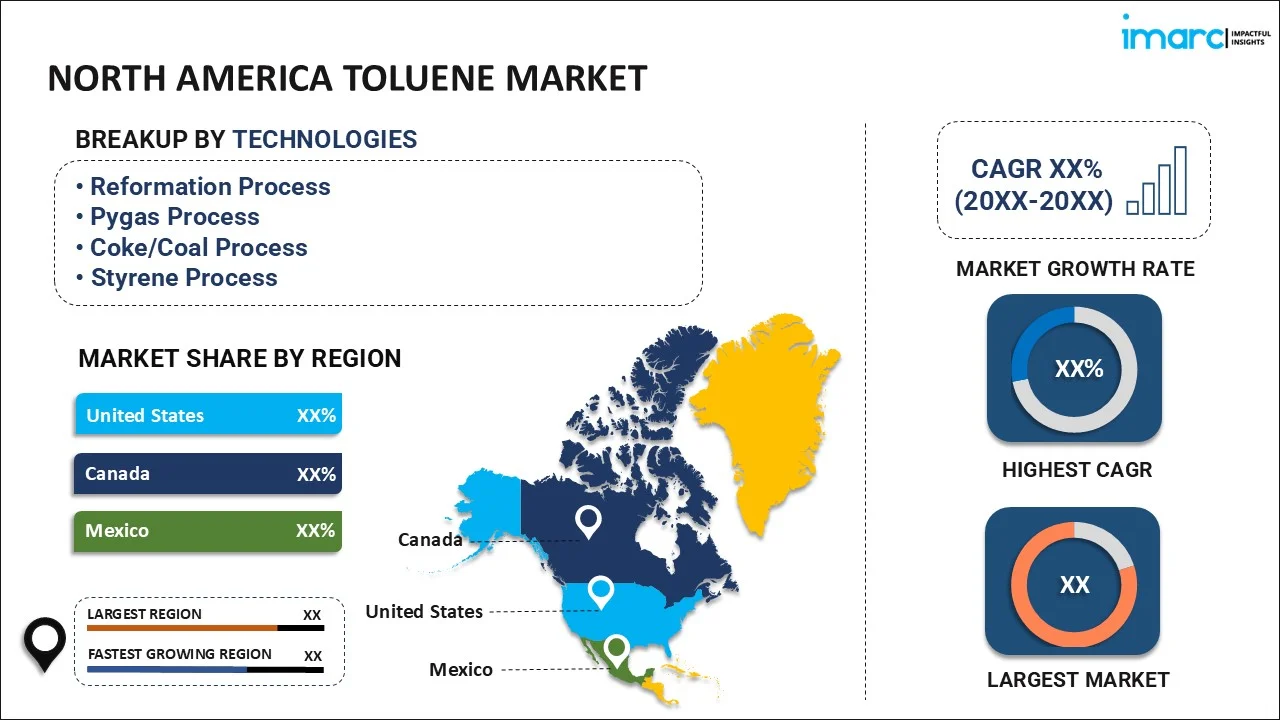

North America Toluene Market Report by Technology (Reformation Process, Pygas Process, Coke/Coal Process, Styrene Process), Application (Gasoline, STDP/TPX, Solvents, Trans Alkylation (TA), Hydrodealkylation, Toluene Diisocyanate (TDI), Toluene Disproportionation (TDP), and Others), and Country 2025-2033

Market Overview:

The North America toluene market size reached 9.9 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 12.7 Million Tons by 2033, exhibiting a growth rate (CAGR) of 2.80% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

9.9 Million Tons |

|

Market Forecast in 2033

|

12.7 Million Tons |

| Market Growth Rate 2025-2033 | 2.80% |

Toluene (C7H8), also known as methylbenzene, is an organic chemical compound which is obtained as a byproduct during the production of crude oil. It is a colorless, water-insoluble liquid with the typical odour of paint thinner. Due to the presence of benzene, toluene is considered an aromatic compound. Additionally, toluene exhibits beta-oxidant, depressant, hepatoprotective, anesthetic, and neurotransmitter properties. Owing to this, it finds wide applications in several downstream industries, such as textiles, food processing and other industrial chemical processes.

The North America toluene market is being currently driven by several factors. The increasing utilization of toluene as a solvent for various commercial products, including paints and glues, has spurred its demand in the chemical-based industries. Furthermore, toluene is utilized in the production of hair dyes and in the explosives industry to manufacture flammable compounds, thereby stimulating the market growth in the region. Apart from this, there is an escalated demand for toluene in the pharmaceutical industry to produce various drugs. These include penicillin G potassium, penicillin G sodium, acetanilide, norfloxacin, ciprofloxacin, acetyl salicylic acid, prednisone and caffeine. Thus, rapid technological advancements in the pharmaceutical industry have positively influenced the growth of toluene market in the region.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America toluene market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on technology and application.

- Key Regions Analysed

- United States

- Canada

- Mexico

- Analysis for Each Country

- Market by Technology

- Reformation Process

- Pygas Process

- Coke/Coal Process

- Styrene Process

- Market by Application

- Gasoline

- STDP/TPX

- Solvents

- Trans Alkylation (TA)

- Hydrodealkylation

- Toluene Diisocyanate (TDI)

- Toluene Disproportionation (TDP)

- Others

- Value Chain Analysis

- Key Drivers and Challenges

- Porters Five Forces Analysis

- PESTEL Analysis

- Government Regulations

- Competitive Landscape

- Competitive Structure

- Key Player Profiles

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Segment Coverage | Technology, Application, Country |

| Countries Covered | United States, Canada, Mexico |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the North America toluene market performed so far and how will it perform in the coming years?

- What are the key regions in the North America toluene market?

- What has been the impact of COVID-19 on the North America toluene market?

- What is the breakup of the North America toluene market on the basis of technology?

- What is the breakup of the North America toluene market on the basis of application?

- What are the various stages in the value chain of the North America toluene industry?

- What are the key driving factors and challenges in the North America toluene industry?

- What is the structure of the North America toluene industry and who are the key players?

- What is the degree of competition in the North America toluene industry?

- What are the profit margins in the North America toluene industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)