North America Vehicle Rental Market Size, Share, Trends and Forecast by Application Type, Booking Type, Vehicle Type, End User, and Country, 2025-2033

North America Vehicle Rental Market Overview:

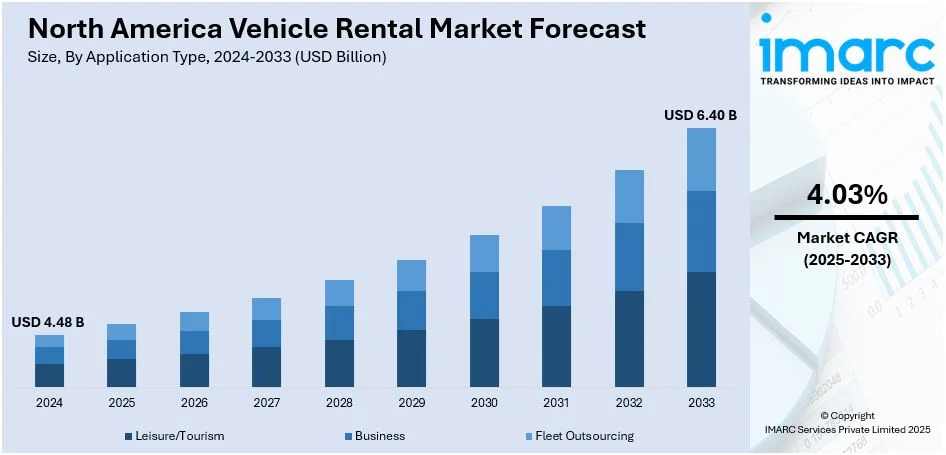

The North America vehicle rental market size reached USD 4.48 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.40 Billion by 2033, exhibiting a growth rate (CAGR) of 4.03% during 2025-2033. The market is driven by increasing travel and tourism, post-pandemic recovery, and rising demand for flexible mobility solutions. Growth is further fueled by technological advancements including contactless rentals, mobile apps, and AI-driven fleet management. Additionally, the shift toward eco-friendly vehicles and partnerships with ride-sharing platforms are favoring North America vehicle rental market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.48 Billion |

| Market Forecast in 2033 | USD 6.40 Billion |

| Market Growth Rate (2025-2033) | 4.03% |

North America Vehicle Rental Market Trends:

Significant Growth in the Travel and Tourism Sector

The industry is witnessing continuous growth, boosted by rising mobility and tourism activities both domestically and overseas. Business travel, together with the desire for flexible mobility arrangements, has strengthened demand for car rentals quite profoundly. The size of the United States business travel market was USD 241.0 Billion in 2024, according to a report by IMARC Group. The market is anticipated to grow to USD 500.0 Billion by 2033, at a growth rate (CAGR) of 8.50% between 2025-2033. Furthermore, post-pandemic recovery has also reinstated a spur in leisure travel, adding fuel to the growth of the market. Customers are preferring rentals over owning cars because of its cost-saving benefits and ease, especially in major cities. Also, the seamless integration of technological advancements like smartphones and contactless rentals has positively impacted customer satisfaction, fueling North America vehicle rental market expansion.

Shift Toward Sustainability and Innovation

One of the key trends in the industry is the movement towards green and sustainable alternatives. Most rental businesses are adding electric and hybrid cars to their fleet to cater to the increasing demand for eco-friendly transport. Electric and hybrid vehicle sales made up a record 21.2% of light-duty vehicle sales in the United States in the third quarter of 2024. The rise was driven mainly by battery electric vehicles (BEVs), which made up 8.9% of sales, and hybrid vehicles, which accounted for 10.6%. This aligns with stricter emission regulations and consumer preferences for greener alternatives. Furthermore, the adoption of AI-driven analytics and IoT-enabled vehicles is transforming fleet management, optimizing operations, and improving efficiency. The market is also witnessing a rise in partnerships between rental companies and ride-sharing platforms, offering customers seamless mobility solutions. These innovations are reshaping the North America vehicle rental market outlook, making it more competitive and customer-centric.

North America Vehicle Rental Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on application type, booking type, vehicle type, and end user.

Application Type Insights:

- Leisure/Tourism

- Business

- Fleet Outsourcing

The report has provided a detailed breakup and analysis of the market based on the application type. This includes leisure/tourism, business, and fleet outsourcing.

Booking Type Insights:

- Online Booking

- Offline Booking

A detailed breakup and analysis of the market based on the booking type have also been provided in the report. This includes online booking and offline booking.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars and commercial vehicles.

End User Insights:

.webp)

- Tour Operator

- Fleet Operator

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes tour operator and fleet operator.

Country Insights:

- United States

- Canada

The report has also provided a comprehensive analysis of all the major regional markets, which include the United States and Canada.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

North America Vehicle Rental Market News:

- January 15, 2025: FlightHub partnered with Turo to offer travelers in the United States and Canada access to flexible, affordable rental cars, including over1,600 makes and models of vehicles to choose from. This partnership helps to simplify the booking process by offering FlightHub bookings through Turo's car-sharing platform.

- October 17, 2024: Mapless AI and Aero Corporation announced a pilot program led by Mapless AI to enable the teleoperation of Aero's fleet of more than 4,000 rental vehicles across 35 locations in five US states. Focuses on control of electric vehicles and customer pick-up and drop-off processes This partnership is expected to enhance efficiency, and safety, and enable the car rental industry scalability.

- April 22, 2024: SIXT USA opened a new rental location at Kansas City International Airport (MCI), increasing its premium fleet offerings. SIXT is aggressively growing in North America and has over 100 branches in 24 states in the U.S. and services in 46 of the top airports. The company currently employs more than 1,900 individuals and plans to expand more in the U.S. and Canada.

North America Vehicle Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Application Types Covered | Leisure/Tourism, Business, Fleet Outsourcing |

| Booking Types Covered | Online Booking, Offline Booking |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| End Users Covered | Tour Operator, Fleet Operator |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the North America vehicle rental market performed so far and how will it perform in the coming years?

- What is the breakup of the North America vehicle rental market on the basis of application type?

- What is the breakup of the North America vehicle rental market on the basis of booking type?

- What is the breakup of the North America vehicle rental market on the basis of vehicle type?

- What is the breakup of the North America vehicle rental market on the basis of end user?

- What are the various stages in the value chain of the North America vehicle rental market?

- What are the key driving factors and challenges in the North America vehicle rental market?

- What is the structure of the North America vehicle rental market and who are the key players?

- What is the degree of competition in the North America vehicle rental market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America vehicle rental market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the North America vehicle rental market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America vehicle rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)