Note Sorter Market Report by Sorter Type (Small Size Note Sorter, Medium Size Note Sorter, Large Size Note Sorter), Enterprise Size (Large Enterprises, Small and Medium Enterprises), End User (BFSI, Retail, and Others), and Region 2025-2033

Note Sorter Market Size:

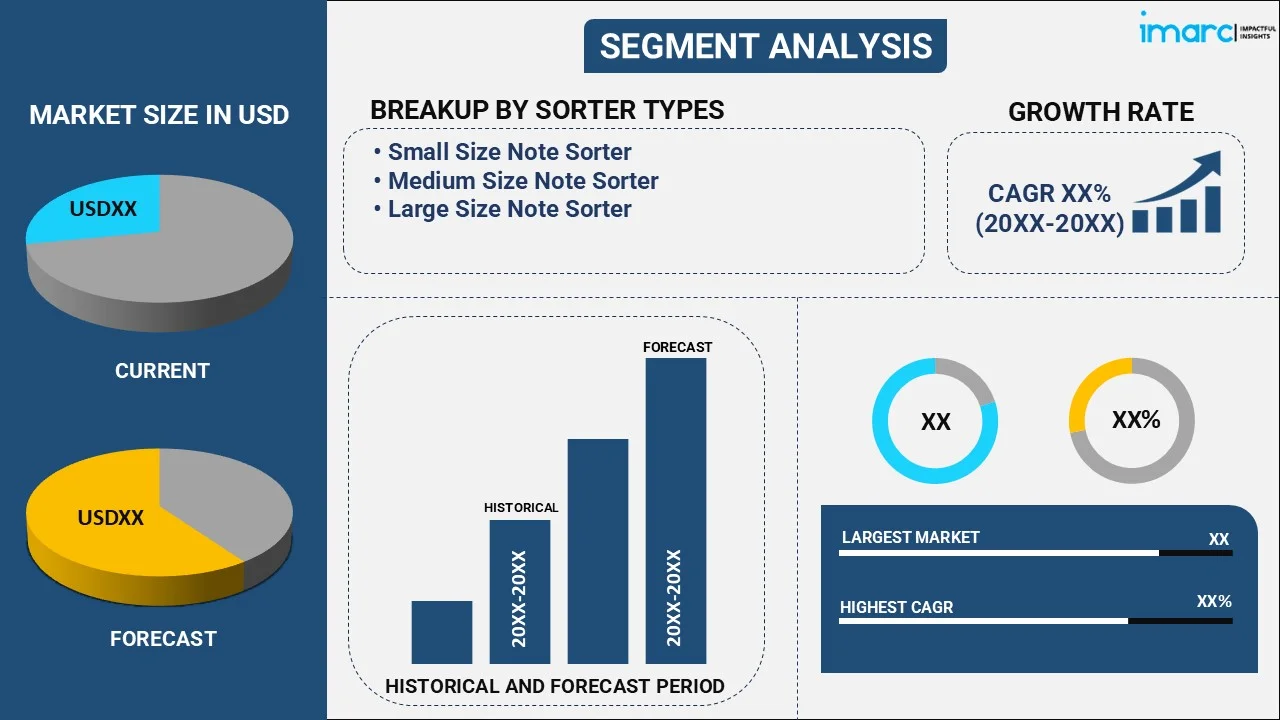

The global note sorter market size reached USD 7.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.0 Billion by 2033, exhibiting a growth rate (CAGR) of 7.5% during 2025-2033. The market is experiencing significant growth mainly driven by the rising demand for efficient cash management solutions in banks and retail sectors. Advancements in automation technology and the widespread product adoption in emerging markets are also contributing positively to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.3 Billion |

|

Market Forecast in 2033

|

USD 14.0 Billion |

| Market Growth Rate 2025-2033 | 7.5% |

Note Sorter Market Analysis:

- Major Market Drivers: Key drivers in the market include the rising need for efficient cash handling solutions in banks, retail, and casinos. The widespread adoption of automated systems to reduce human error and enhance operational efficiency is a significant factor. In line with this, the rising demand for time-saving and cost-effective currency management systems fuels market growth. Emerging economies are also witnessing a significant increase in cash transactions, creating further opportunities for note sorters. Moreover, advancements in technology such as higher accuracy in counterfeit detection and improved sorting speed, are attracting more industries to invest in these solutions. These factors collectively are contributing positively to the note sorter market growth.

- Key Market Trends: Key trends in the market include the increase in automation and integration of AI-driven systems for more accurate and faster currency sorting. Many institutions are adopting compact, multi-currency note sorters that enhance efficiency in handling various denominations. There is also a gradual shift toward advanced counterfeit detection technologies, ensuring better security in cash processing. Contactless and remote-controlled sorting systems are gaining traction, particularly in sectors like retail and casinos, where faster, more reliable cash management is essential. In line with this, the rising demand in emerging markets for cash handling automation, combined with technological advancements, is significantly shaping the future of the market.

- Geographical Trends: Geographical trends in the market shows significant growth in emerging economies like Asia-Pacific and the Middle East, where cash transactions remain prevalent. Increased banking activities and retail expansion in these regions drive the note sorter demand for efficient cash handling solutions. In North America and Europe, the focus is on integrating advanced technologies such as artificial intelligence and machine learning in note sorters for enhanced accuracy and security, mainly in financial institutions. Meanwhile, Latin America is experiencing moderate growth, driven by modernization in cash management systems across retail and banking sectors.

- Competitive Landscape: Some of the major market players in the note sorter industry include BCASH Electronics Co. Limited, Cummins Allison Corp. (Crane Payment Innovations Inc.), De La Rue plc, Giesecke+Devrient GmbH, Glory Ltd., GRG Banking, Julong Co., Ltd., Kisan Electronics, Laurel Bank Machines Co. Ltd., and Toshiba Corporation, among many others.

- Challenges and Opportunities: The market faces various challenges such as the rising shift toward digital and cashless payment systems, which could reduce the demand for cash handling solutions. In line with this, high initial investment and maintenance costs can be a barrier for smaller businesses. However, significant opportunities arise from emerging economies where cash transactions still dominate, thus driving the demand for efficient cash management systems. The ongoing need for improved security features, such as counterfeit detection, also presents significant growth potential. Moreover, advancements in automation and AI integration offer opportunities for developing smarter, more efficient note sorters to meet evolving business needs.

Note Sorter Market Trends:

Rising Demand for Cash Handling Solutions

Despite the increasing adoption of digital payment methods, many sectors in developing economies continue to rely on cash for transactions. According to an article published by the Economic Times in 2024, cash in circulation in India doubled from Rs 13.35 lakh crore in March 2017 to Rs 35.15 lakh crore by the end of March 2024, despite the decision to withdraw Rs 2000 denomination banknotes from circulation. The rise in currency demand during festivals and elections contributed to this increase significantly. This surge in cash usage drives the need for sophisticated note sorting machines that streamline cash handling, enhance accuracy, detect counterfeit currency, and improve overall transaction efficiency. Such machines are becoming indispensable for businesses dealing with high cash volumes, ensuring secure and reliable operations.

Rising Demand from Financial Institutions

Banks and financial institutions are increasingly adopting high-speed note sorters to handle large cash volumes efficiently. According to an article published by the India Brand Equity Foundation in 2024, the Indian banking system includes 13 public sector banks, 21 private sector banks, 44 foreign banks, and 12 small finance banks. In line with this, India now has 15,17,580 micro-ATMs, 1,26,772 on-site ATMs, and cash recycling machines. In order to manage this massive cash flow, banks are utilizing high-speed note sorters to streamline operations, reduce manual errors, enhance cash recycling, and provide quicker, more efficient services. These machines boost operational efficiency while improving security in cash-handling processes.

Growth in Retail Sector

Retailers, particularly in sectors with high cash transactions such as supermarkets, convenience stores, and large retail chains, are increasingly adopting note sorters to streamline cash management. According to an article published by Business Line, cash transactions at semi-urban and rural retail stores surged by 65% in 2023, with average monthly collections reaching ₹1,700 crore. This surge reflects a growing demand for credit and financial solutions, driving the need for efficient cash handling. Handling large cash volumes manually is time-consuming and error prone. By investing in note sorters, retailers can reduce manual counting time, improve accuracy, and enhance security through counterfeit detection, optimizing overall operations. These factors create a positive note sorter market outlook, with significant growth anticipated in the coming years.

Note Sorter Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on sorter type, enterprise size and end user.

Breakup by Sorter Type:

- Small Size Note Sorter

- Medium Size Note Sorter

- Large Size Note Sorter

Small Size Note Sorter accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the sorter type. This includes small size note sorter, medium size note sorter, and large size note sorter. According to the note sorter market report, small size note sorter represented the largest segment.

Small size note sorters are widely preferred due to their compact design and versatility, making them ideal for various retail environments. Retailers often prefer these machines for their ability to handle lower volumes of cash while providing efficient sorting and counting capabilities. Their space-saving nature allows them to fit seamlessly into small retail spaces, such as convenience stores and kiosks, where larger machines may be impractical. Additionally, small size note sorters often come equipped with advanced features like counterfeit detection and high-speed processing, enhancing security and efficiency. This combination of functionality and adaptability drives demand, solidifying their position as the leading segment in the note sorter market. According to note sorter market forecast, the demand for small size note sorters is expected to grow further as retailers continue to prioritize compact and efficient cash management solutions, especially in smaller retail settings and convenience stores. Their ability to offer advanced features in a space-saving design makes them highly appealing, contributing to their projected dominance in the market over the coming years.

Breakup by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Large Enterprises holds the largest share of the industry

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises and small and medium enterprises. According to the report, large enterprises accounted for the largest market share.

Large enterprises hold the largest share of the note sorter industry due to their extensive cash handling needs and high transaction volumes. These organizations, including supermarkets and large retail chains, require efficient cash management solutions to streamline operations and minimize manual labor. By investing in advanced note sorting technology, they enhance accuracy, reduce the risk of counterfeit notes, and improve overall cash flow management. This significant investment in cash handling solutions reflects their reliance on efficient operations to support large-scale transactions. According to the note sorter market overview, the demand for sophisticated cash handling systems continues to grow, driven by the increasing volume of cash transactions and the need for operational efficiency in large-scale retail environments. For instance, in May 2024, Apple installed currency counting machines in its Delhi and Mumbai stores due to high cash transactions in India. Cash payments account for 7-9% of sales in these stores, contrasting with less than 1% in the US and Europe.

Breakup by End User:

- BFSI

- Retail

- Others

BFSI represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end user. This includes BFSI, retail and others. According to the report, BFSI represented the largest segment.

The Banking, Financial Services, and Insurance (BFSI) sector represents the leading segment in the note sorter market due to its heavy reliance on efficient cash handling and processing. Banks and financial institutions deal with vast amounts of cash daily, making note sorters essential for quick, accurate counting, counterfeit detection, and sorting by denomination. These machines help reduce manual errors, streamline operations, and improve security, especially in high-volume environments like bank branches and ATMs. One of the key note sorter market recent opportunities include the expansion of the BFSI sector, particularly in developing regions, where banking infrastructure is rapidly growing. As cash transactions remain a key aspect of the BFSI sector, the demand for note sorters continues to grow, maintaining its dominant market position.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest note sorter market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for note sorter.

North America leads the note sorter market, accounting for the largest market share due to several key factors. The region boasts a highly developed banking and financial services sector that prioritizes efficient cash handling and security measures. Banks, casinos, and large retail chains in the United States and Canada invest heavily in advanced note sorting technologies to streamline operations and reduce manual labor costs. According to industry reports, in the US, there are 1,500-2,200 casinos in 44 states. Notably, Nevada and New Jersey are prominent casino tourism states. Additionally, the presence of major industry players and technological innovators in North America accelerates the adoption of cutting-edge solutions. Strict regulatory standards regarding counterfeit detection and cash handling further drive the demand for sophisticated note sorters, solidifying North America's dominant position in the market. These factors are expected to increase note sorter market revenue in the coming future further solidifying North America's dominance in this sector.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the note sorter industry include.

- BCASH Electronics Co. Limited

- Cummins Allison Corp. (Crane Payment Innovations Inc.)

- De La Rue plc

- Giesecke+Devrient GmbH

- Glory Ltd.

- GRG Banking

- Julong Co., Ltd.

- Kisan Electronics

- Laurel Bank Machines Co. Ltd.

- Toshiba Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

The note sorter market is fiercely competitive, with companies continually advancing technologies to gain an edge. Note sorter companies are focusing on providing comprehensive solutions that reduce manual labor and operational inefficiencies. Automation, counterfeit detection, and high-speed processing remain top priorities, driving innovation across sectors such as banking, retail, and casinos. The market is also witnessing strategic moves like mergers, partnerships, and geographic expansion to enhance their footprint. Additionally, rising demand for improved security measures in cash handling further intensifies the competition, pushing for advancements in software and hardware integration. This dynamic landscape is set for continued growth and innovation. The introduction of AI and machine learning in note sorting is expected to further revolutionize the industry.

Note Sorter Market Recent Developments:

- In October 2023, Kinective and Glory collaborated to certify the GLR-100 Teller Cash Recycler, allowing banks and credit unions to enhance operational efficiency and security. The technology enables significant time savings in manual banknote counting, improved job satisfaction, and reduced human counting errors. Kinective's integration solution connects teller platforms and cash handling hardware, driving security, process improvements, and cost efficiencies across branch operations.

- In June 2024, the Reserve Bank of India (RBI) announced its plans to upgrade Note Sorting Machines (NSM) to detect counterfeit notes better. The enhanced NSM will not only identify fake and real notes but also recognize torn and suspicious ones based on their series. In addition, the machines will be equipped to sort out non-Indian currency, note-size paper, wrong notes, and damaged notes.

Note Sorter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sorter Types Covered | Small Size Note Sorter, Medium Size Note Sorter, Large Size Note Sorter |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Users Covered | BFSI, Retail, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BCASH Electronics Co. Limited, Cummins Allison Corp. (Crane Payment Innovations Inc.), De La Rue plc, Giesecke+Devrient GmbH, Glory Ltd., GRG Banking, Julong Co., Ltd., Kisan Electronics, Laurel Bank Machines Co. Ltd., Toshiba Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the note sorter market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global note sorter market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the note sorter industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global note sorter market was valued at USD 7.3 Billion in 2024.

We expect the global note sorter market to exhibit a CAGR of 7.5% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic had led to the growing adoption of cashless payments across several nations for conducting financial transactions to mitigate the risk of the coronavirus infection, thereby negatively impacting the global market for note sorter machines.

The rising awareness towards numerous benefits offered by note sorter machines, such as controlling operational expenses, minimizing the risk of internal theft, reducing manual error, etc., for hassle-free handling of huge cash deposits, is primarily driving the global note sorter market.

Based on the sorter type, the global note sorter market can be categorized into small size note sorter, medium size note sorter, and large size note sorter. Currently, small size note sorter accounts for the majority of the total market share.

Based on the enterprise size, the global note sorter market has been segregated into large enterprises and small and medium enterprises, where large enterprises hold the largest market share.

Based on the end user, the global note sorter market can be bifurcated into BFSI, retail, and others. Currently, the BFSI sector exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global note sorter market include BCASH Electronics Co. Limited, Cummins Allison Corp. (Crane Payment Innovations Inc.), De La Rue plc, Giesecke+Devrient GmbH, Glory Ltd., GRG Banking, Julong Co., Ltd., Kisan Electronics, Laurel Bank Machines Co. Ltd., and Toshiba Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)