Nucleic Acid Labelling Market Size, Share, Trends, and Forecast by Product, Labeling Type, Method, Application, Sector, and Region, 2025-2033

Nucleic Acid Labelling Market Size and Share:

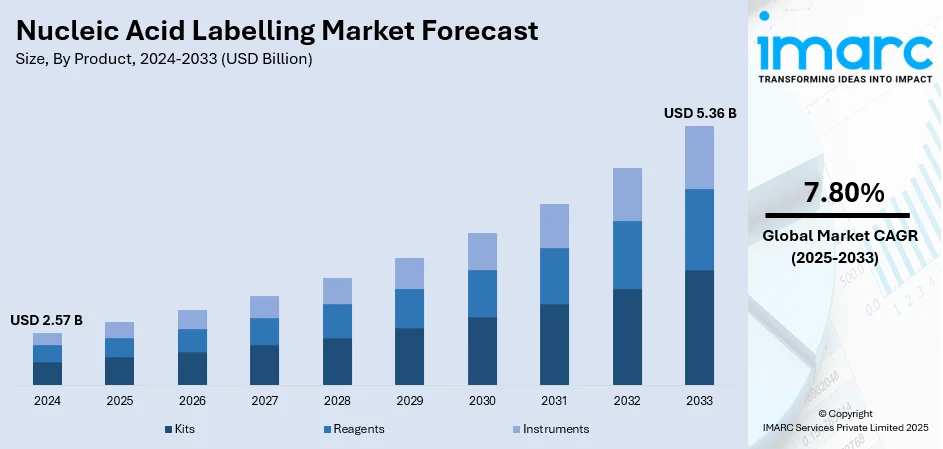

The global nucleic acid labelling market size was valued at USD 2.57 Billion in 2024. Looking forward, the market is expected to reach USD 5.36 Billion by 2033, exhibiting a CAGR of 7.80% during 2025-2033. North America currently dominates the market, holding a significant market share of 43.2% in 2024. The market is expanding steadily, driven by rising demand for advanced molecular diagnostics, genomics research, and drug discovery applications. Increasing adoption of PCR, sequencing, and imaging technologies also enhances the role of labelling techniques in detecting genetic material. Ongoing innovations and academic-industry collaborations further continue to shape the nucleic acid labelling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.57 Billion |

| Market Forecast in 2033 | USD 5.36 Billion |

| Market Growth Rate 2025-2033 | 7.80% |

The market is driven by several key factors, including the rising demand for molecular diagnostics to detect genetic disorders, infectious diseases, and cancer with high precision. The rising number of genetic abnormalities and rare disorders has generated a strong pressure to have an advanced test based on nucleic acids. The increasing use of specialized medicine, whereby treatments are designed depending on the specific genetic makeup, also contributes to the growth of the market. Nucleic acid detection has been enhanced in terms of sensitivity and efficiency by the rapid development of technologies like nanotechnology, next-generation sequencing (NGS), and point-of-care testing. Innovation is also being driven by the growing research and development efforts in the fields of genomics, drug discovery and disease diagnosis. The increasing healthcare spending around the world and government funding of the latest diagnostic equipment largely propels the market.

To get more information on this market, Request Sample

The nucleic acid labelling market growth in the United States is driven by strong demand for advanced molecular diagnostics, fueled by the rising prevalence of cancer, genetic disorders, and infectious diseases. The country’s well-established healthcare infrastructure and robust biotechnology sector support widespread adoption of labelling technologies across research and clinical applications. Significant investments in genomics, next-generation sequencing, and personalized medicine are further propelling market growth. Additionally, government initiatives and funding for precision medicine and biomedical research encourage innovation and commercialization of advanced labelling reagents and kits. The presence of leading pharmaceutical and biotech companies actively engaged in research and development (R&D) also strengthens the market outlook. For instance, in July 2025, New England Biolabs introduced the NEBNext Low-bias Small RNA Library Prep Kit, a next-generation solution aimed at reducing uneven representation of small RNA species during sequencing. This innovative method offers greater speed, improved accuracy, and supports a wider input range compared to existing commercial kits.

Nucleic Acid Labelling Market Trends:

Rising Demand for Nucleic Acid-Based Diagnostics and Personalized Medicine

The market is being strongly propelled by the growing use of nucleic acid-based diagnostics in disease risk management, prenatal testing, and clinical diagnostics. This demand is further amplified by the rising prevalence of genetic disorders worldwide. For instance, in India, approximately 70 million individuals suffer from rare genetic disorders, according to industry reports. Alongside this, the rising preference for personalized medicine is fueling adoption, as it offers tailor-made therapies tailored to individual patients. Supported by an increasing focus on patient-centric healthcare, these advancements are creating opportunities for genetic medicine and emerging biotechnologies. Collectively, these factors are significantly enhancing the role of nucleic acid labelling in modern diagnostics and therapeutic research.

Technological Advancements in Nanotechnology and Point-of-Care Testing

Rapid developments in nanotechnology are another key factor driving the nucleic acid labelling market trends, particularly in enhancing point-of-care (POC) nucleic acid detection. Nanotechnology provides high sensitivity, precision, and rapid analysis, making nucleic acid tests more effective in clinical and research applications. This has accelerated the development of novel diagnostic tools, enabling quicker disease identification and improved treatment outcomes. For instance, the global nanotechnology market reached USD 11.4 billion in 2024 and is estimated to reach USD 102.8 billion by 2033, growing at a CAGR of 27.68% during 2025–2033, according to IMARC Group. Such advancements highlight how nanotechnology integration is revolutionizing nucleic acid labelling, expanding its applications across both healthcare and life sciences.

Growing R&D Investments and Rising Healthcare Expenditure

Increasing research and development (R&D) initiatives in genomics, molecular biology, and disease diagnostics are fueling significant growth in the nucleic acid labelling market. Academic institutions, biotech firms, and pharmaceutical companies are investing heavily to innovate new labelling techniques that enhance genetic analysis and biomarker detection. Simultaneously, expanding healthcare spending is providing financial support for these advancements. According to the World Economic Forum (WEF), global healthcare expenditure reached USD 9.8 trillion in 2021, accounting for 10.3% of global GDP. This rising expenditure not only boosts access to advanced diagnostic tools but also encourages wider adoption of molecular technologies. Together, higher research and development (R&D) activity and robust healthcare funding are strengthening the market outlook for nucleic acid labelling.

Nucleic Acid Labelling Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global nucleic acid labelling market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, labeling type, method, application, and sector.

Analysis by Product:

- Kits

- Reagents

- Instruments

Reagents hold the largest share in the market because they are essential components in nearly every stage of nucleic acid analysis, from labeling and amplification to detection and visualization. Their versatility across applications such as PCR, sequencing, in-situ hybridization, and molecular diagnostics ensures consistent and recurring demand. Reagents also play a critical role in enabling high sensitivity and specificity, which are vital for accurate genetic testing and research outcomes. Additionally, ongoing advancements in molecular biology and genomics are driving the development of specialized reagents tailored for advanced techniques. The frequent need for replenishment, coupled with their central role in diagnostics, research, and drug development, makes reagents the dominant segment in the nucleic acid labelling market.

Analysis by Labeling Type:

- Radioisotope/Radioactive Labels

- Non-Radioactive Labels

Radioisotope/Radioactive labels leads the market with 80.87% of market share in 2024 due to their unmatched sensitivity and accuracy in detecting low-abundance nucleic acids. According to the nucleic acid labelling market forecast, these labels provide highly reliable results in molecular biology applications such as hybridization assays, DNA sequencing, and gene expression studies, where precision is critical. Unlike non-radioactive alternatives, radioisotopes generate stronger signal intensity, making them particularly valuable in research requiring quantitative accuracy. Their established use in academic and clinical research also ensures widespread adoption. Although safety and disposal concerns exist, the ability of radioactive labels to deliver reproducible, sensitive, and clear results keeps them indispensable in advanced genetic studies, thereby securing their dominant position in the market.

Analysis by Method:

- Enzyme-based

- PCR

- 5’ End Labeling

- 3’ End Labeling

- Others

- Chemical-based

- Conjugation

- Photoreaction

Enzyme-based labelling holds the largest share in the nucleic acid labelling market because it offers high efficiency, specificity, and reliability in attaching labels to DNA and RNA molecules. Enzymes such as polymerases, ligases, and terminal transferases enable precise incorporation of labelled nucleotides during amplification, transcription, or repair processes. This method is widely used in applications like PCR, sequencing, microarrays, and cloning, making it indispensable for both research and diagnostics. The popularity of enzyme-based techniques also stems from their ability to work under mild conditions, preserving the integrity of nucleic acids while ensuring strong and stable labelling. With the rising demand for accurate genetic analysis and advanced molecular biology techniques, enzyme-based labelling remains the preferred choice across the industry.

Analysis by Application:

- Oligonucleotide Labeling

- In-Situ Hybridization

- Southern and Northern Blotting

- Cellular Localization

- Others

In-situ hybridization (ISH) holds the largest share in the market because of its unique ability to localize and visualize specific DNA or RNA sequences directly within tissue sections or cells. This technique provides spatial and morphological context, which is crucial for understanding gene expression, chromosomal abnormalities, and disease mechanisms, thus creating a positive impact on the nucleic acid labelling market outlook. Widely applied in cancer diagnostics, neuroscience, and genetic research, ISH enables precise detection of biomarkers while preserving tissue architecture. Its versatility across fluorescence in-situ hybridization (FISH) and chromogenic in-situ hybridization (CISH) formats further broadens its applications. As personalized medicine and molecular pathology gain traction, the demand for ISH continues to grow, reinforcing its dominance in the nucleic acid labelling market.

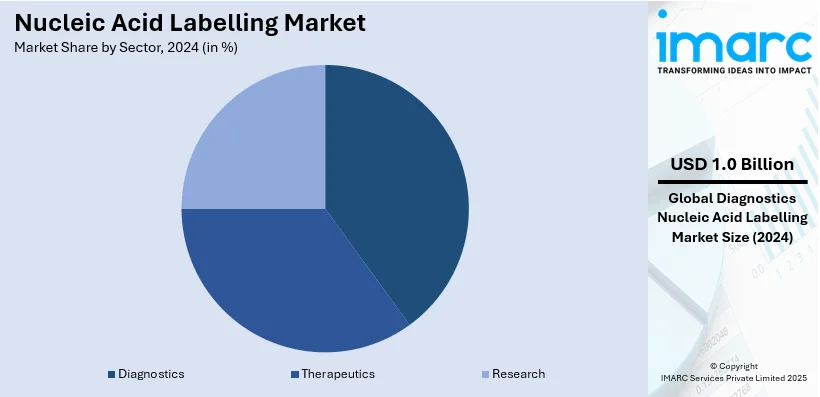

Analysis by Sector:

- Diagnostics

- Therapeutics

- Research

Diagnostics leads the market with 40% of market share in 2024 because labeled nucleic acids are integral to detecting genetic mutations, infectious diseases, and chromosomal abnormalities with high sensitivity and specificity. Techniques like PCR, sequencing, and in-situ hybridization rely heavily on labelling to identify target sequences, making diagnostics a primary application area. With the rising prevalence of cancer, genetic disorders, and viral infections, healthcare providers are increasingly adopting molecular diagnostics to ensure accurate and early detection. Moreover, the growing demand for personalized medicine further strengthens the role of nucleic acid labelling in tailoring treatments to individual genetic profiles. This consistent need for precise, reliable testing ensures diagnostics remain the leading segment in the nucleic acid labelling market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 43.2%. The nucleic acid labelling market demand in North America is driven by strong investment in genomics research, advanced healthcare infrastructure, and widespread adoption of molecular diagnostics. Rising cases of cancer, genetic disorders, and infectious diseases have increased reliance on nucleic acid-based testing for accurate detection and monitoring. Government funding and supportive regulatory frameworks further promote innovation and commercialization of advanced labelling technologies. Additionally, the region benefits from a strong presence of biotechnology and pharmaceutical companies actively engaged in R&D activities, driving demand for high-quality labelling reagents and kits. The growing focus on personalized medicine and point-of-care diagnostics also accelerates adoption, positioning North America as a leading hub for nucleic acid labelling market growth.

Key Regional Takeaways:

United States Nucleic Acid Labelling Market Analysis

In 2024, the United States accounted for 88.9% of the nucleic acid labelling market in North America. The United States nucleic acid labelling market is primarily driven by growing research and development (R&D) activities in genomics, molecular biology, and diagnostics. With the increasing demand for advanced tools in gene expression analysis, sequencing, and personalized medicine, nucleic acid labelling techniques have become essential for accurate detection, tracking, and quantification of DNA and RNA. The expanding focus on early disease detection and the development of targeted therapies has further elevated the need for sensitive and specific labelling methods. Additionally, the rise of the biotechnology and pharmaceutical industries, supported by strong infrastructure and funding, has accelerated the adoption of innovative labelling technologies. Academic institutions and research organizations are also contributing substantially to market growth through ongoing studies involving gene mapping, mutation analysis, and cellular processes. The increasing prevalence of genetic disorders and cancers has further created a pressing need for reliable diagnostic tools, with nucleic acid labelling playing a critical role in improving testing accuracy. According to recent industry reports, the number of new cancer cases in the United States is expected to reach approximately 2,041,910 in 2025, with nearly 618,120 deaths. Other than this, the integration of automation and high-throughput platforms in laboratories is also supporting the demand for scalable and consistent labelling solutions, propelling further growth in the U.S. market.

Asia Pacific Nucleic Acid Labelling Market Analysis

The Asia Pacific nucleic acid labelling market is expanding due to increasing collaborations between academic institutions and biotechnology companies, which are supporting innovation and expanding access to advanced research tools. The growth of contract research organizations (CROs) in the region is further fueling demand for efficient nucleic acid labelling methods used in genomics, proteomics, and pharmaceutical development. Moreover, the rise of digital health and integration of artificial intelligence (AI) in genomic data analysis is creating new opportunities for precise labelling technologies that enhance data accuracy. For instance, the digital health market in India reached a market value of USD 16,114.2 Million in 2024 and is projected to grow at a CAGR of 18.81% during 2025-2033, as per a report by the IMARC Group. Besides this, the increasing focus on agricultural biotechnology, particularly in genetically modified crops and disease resistance research, is also contributing to the expansion of nucleic acid labelling applications beyond healthcare.

Europe Nucleic Acid Labelling Market Analysis

The growth of the Europe nucleic acid labelling market is largely fueled by the region’s strong focus on biomedical research, molecular diagnostics, and advanced genetic studies. A well-established infrastructure of academic institutions, research organizations, and biotechnology companies is supporting continuous innovation in genomic and transcriptomic research. The growing prevalence of genetic disorders, cancer, and infectious diseases is also fueling demand for precise and efficient labelling techniques that enhance nucleic acid detection and analysis. For instance, in the United Kingdom, over 6,000 children are born each year with a genetic disorder so uncommon that it has no known name, according to the Genetic Alliance UK. Additionally, cancer caused 1.1 million deaths in the European Union in 2021, accounting for 21.6% of all deaths in the EU, according to Eurostat. Other than this, substantial funding from both public and private sectors for life sciences research is increasing the adoption of labelling technologies across various applications, including gene expression studies, mutation detection, and molecular imaging. Furthermore, regulatory support and harmonized quality standards across Europe are creating a favorable environment for the commercialization of advanced labelling products. The rising demand for personalized medicine and companion diagnostics is also promoting the use of nucleic acid labelling in clinical research and diagnostic workflows.

Latin America Nucleic Acid Labelling Market Analysis

The Latin America nucleic acid labelling market is experiencing robust growth due to a growing interest in molecular biology, genetic research, and infectious disease diagnostics. As regional healthcare systems modernize, there is an increasing demand for advanced tools that can support accurate gene expression analysis, mutation detection, and pathogen identification. Government and academic institutions are also increasingly investing in life sciences research, particularly in countries such as Brazil, Mexico, and Argentina, where biotechnology sectors are expanding. The growing use of molecular techniques in agricultural biotechnology and environmental research is also supporting market growth. As per the IMARC Group, the Brazil agricultural biotechnology market reached USD 615.3 Million in 2024 and is forecasted to grow at a CAGR of 8.4% during 2025-2033. As the region faces challenges related to food security, crop diseases, and biodiversity conservation, there is an increasing reliance on genetic analysis tools to support sustainable solutions.

Middle East and Africa Nucleic Acid Labelling Market Analysis

The Middle East and Africa nucleic acid labelling market is significantly influenced by increasing investments in healthcare, a rising focus on advanced diagnostics, and growing interest in genomic research. For instance, the Government of Saudi Arabia allocated SR 86,253,063 for the Ministry of Health (MOH) for FY24, equating to 7% of the state budget, according to the Ministry of Health. Governments in the region are prioritizing biotechnology and precision medicine to address public health challenges, including cancer, infectious diseases, and genetic disorders. Nucleic acid labelling is becoming essential for improving the accuracy of molecular diagnostics and research in these areas. The establishment of specialized research centers and laboratories is also supporting the adoption of modern molecular tools.

Competitive Landscape:

The competitive landscape of the nucleic acid labelling market is characterized by the presence of leading biotechnology, pharmaceutical, and life sciences companies focusing on product innovation and strategic collaborations. Key players are investing in advanced labelling technologies, including enzyme-based and non-radioactive methods, to improve efficiency and safety. Partnerships with academic institutions and research organizations are common to accelerate discoveries in genomics, diagnostics, and drug development. Companies are also expanding their global footprint through mergers, acquisitions, and regional expansions, particularly in emerging markets. Moreover, emphasis on personalized medicine and next-generation sequencing (NGS) is driving competition to develop specialized labelling kits and reagents. Overall, continuous innovation and robust research and development (R&D) pipelines define the market’s competitive environment.

The report provides a comprehensive analysis of the competitive landscape in the global nucleic acid labelling market with detailed profiles of all major companies, including:

- Agilent Technologies Inc.

- Cytiva (Danaher Corporation)

- Enzo Biochem Inc.

- F. Hoffmann LA-Roche AG (Roche Holding AG)

- Merck KGaA

- New England Biolabs (UK) Ltd.

- PerkinElmer Inc.

- Promega Corporation

- Thermo Fisher Scientific Inc.

- Vector Laboratories

Latest News and Developments:

- June 2025: Illumina, Inc., a provider of various genotyping, sequencing, and gene expression solutions, including nucleic acid labelling, announced plans for the acquisition of SomaLogic. The transaction is valued at USD 350 Million in cash and up to USD 75 Million in performance-based royalties and short-term performance-based achievements.

- May 2025: Vector Laboratories revealed plans for a merger with Absolute Biotech. The deal marks a significant step in Vector Laboratories' efforts to better serve its life science clients by extending its production and distribution network from several production facilities in the United States to the United Kingdom and Europe.

- May 2025: Qiagen, a provider of various life sciences and molecular diagnostics solutions, including products related to nucleic acid labelling, confirmed plans for the acquisition of Genoox. The acquisition is expected to reinforce Qiagen’s position in genetic interpretation for use in clinical genomics.

- July 2024: Illumina, Inc. successfully completed the acquisition of Fluent BioSciences. This acquisition will allow Illumina to expand its multiomics expansion plans and offer the company’s clients important new capabilities.

Nucleic Acid Labelling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Kits, Reagents, Instruments |

| Labelling Types Covered | Radioisotope/Radioactive Labels, Non-Radioactive Labels |

| Methods Covered |

|

| Applications Covered | Oligonucleotide Labeling, In-Situ Hybridization, Southern and Northern Blotting, Cellular Localization, Others |

| Sectors Covered | Diagnostics, Therapeutics, Research |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., Cytiva (Danaher Corporation), Enzo Biochem Inc., F. Hoffmann LA-Roche AG (Roche Holding AG), Merck KGaA, New England Biolabs (UK) Ltd., PerkinElmer Inc., Promega Corporation, Thermo Fisher Scientific Inc. and Vector Laboratories |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the nucleic acid labelling market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global nucleic acid labelling market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the nucleic acid labelling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The nucleic acid labelling market was valued at USD 2.57 Billion in 2024.

The nucleic acid labelling market is projected to exhibit a CAGR of 7.80% during 2025-2033, reaching a value of USD 5.36 Billion by 2033.

The nucleic acid labelling market is driven by rising demand for molecular diagnostics, growing prevalence of genetic disorders, and increasing adoption of personalized medicine. Advancements in nanotechnology, next-generation sequencing, and point-of-care testing further boost growth. Expanding research and development (R&D) investments and higher healthcare expenditure also contribute to market expansion globally.

North America currently dominates the nucleic acid labelling market due to advanced healthcare infrastructure, rising prevalence of genetic and infectious diseases, and strong adoption of molecular diagnostics. Increased research and development (R&D) funding, government support, and growing demand for personalized medicine further accelerate market growth across the region.

Some of the major players in the nucleic acid labelling market include Agilent Technologies Inc., Cytiva (Danaher Corporation), Enzo Biochem Inc., F. Hoffmann LA-Roche AG (Roche Holding AG), Merck KGaA, New England Biolabs (UK) Ltd., PerkinElmer Inc., Promega Corporation, Thermo Fisher Scientific Inc., Vector Laboratories, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)