Octyl Alcohol Market by Type (Industrial Grade, Food Grade, and Others), Application (Chemical Intermediates, Cosmetic, Food, and Others), and Region 2025-2033

Market Overview:

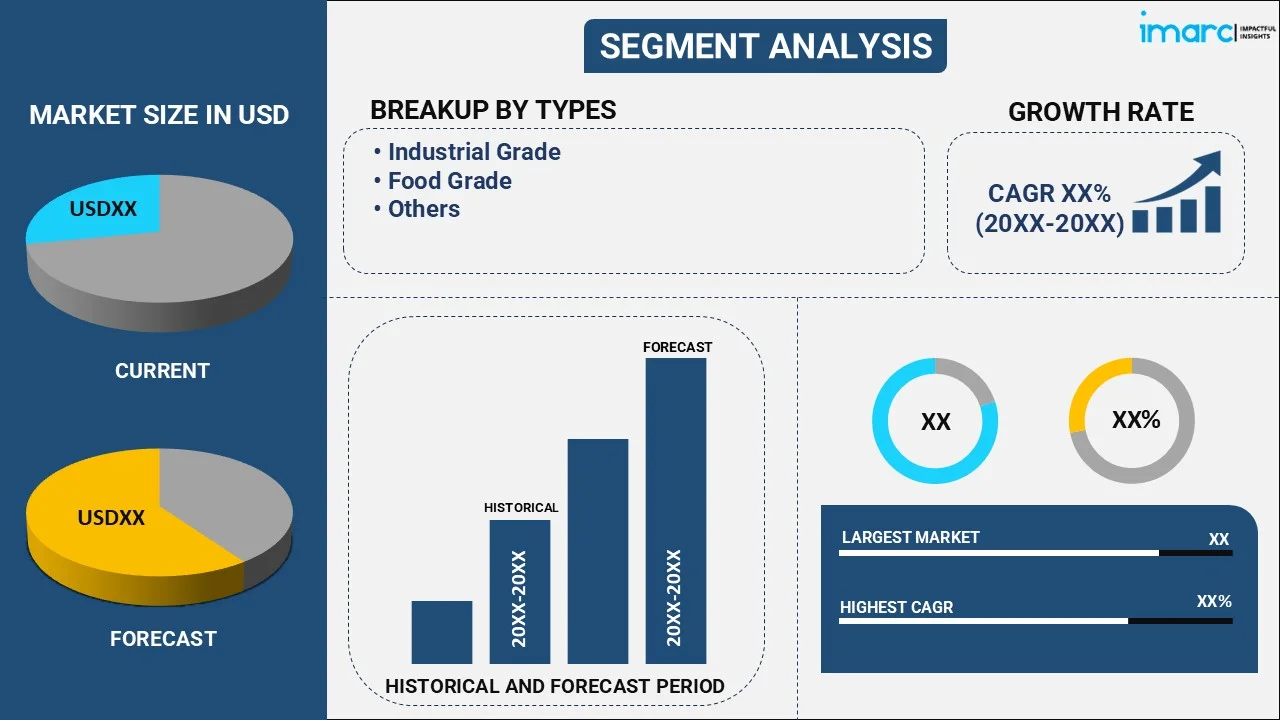

The global octyl alcohol market size reached USD 7.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.4 Billion by 2033, exhibiting a growth rate (CAGR) of 2.76% during 2025-2033. The widespread product utilization across the plasticizers, cosmetic, and construction sectors, the shifting consumer preference for natural and organic products, and ongoing technological advancements in the industry are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.3 Billion |

| Market Forecast in 2033 | USD 9.4 Billion |

| Market Growth Rate 2025-2033 | 2.76% |

Octyl alcohol (C8H18O), or capryl alcohol, is an organic compound belonging to the family of alcohols derived from octane hydrocarbon. It is a colorless liquid that possesses a mild, characteristic odor. Octyl alcohol is commonly used as a solvent in manufacturing flavors, fragrances, and personal care products. Its solubility in water and oil makes it a versatile ingredient in cosmetic formulations, pharmaceuticals, dyes, and other specialty chemicals. Apart from this, octyl alcohol serves as a precursor for the synthesis of esters widely utilized in producing plastics, synthetic lubricants, and industrial solvents.

To get more information on this market, Request Sample

The increasing applications of octyl alcohol in various end-use industries, such as cosmetics, personal care, pharmaceuticals, plastics, and lubricants, are primarily driving the market growth. Besides this, the growing demand for cosmetic and personal care products, such as lotions, creams, hair shampoo, conditioners, and masks, catalyzed by changing lifestyles and the inflating disposable income of consumers, are presenting remunerative growth opportunities for the market. In addition to this, the widespread product adoption across the flourishing pharmaceutical industry as an intermediate in the synthesis of pharmaceutical compounds is aiding in market expansion. Moreover, the significant rise in demand and production of plastic, impelled by the expanding urbanization, industrialization, and infrastructure development, is positively impacting the market growth. Furthermore, the implementation of favorable government regulations promoting the adoption of sustainable and eco-friendly products is contributing to the market growth as octyl alcohol is derived from natural sources.

Octyl Alcohol Market Trends/Drivers:

Rising Product Utilization Across the Cosmetics and Personal Care Industry

Octyl alcohol is widely used to produce various cosmetic and personal care products such as lotions, creams, hair care products, and perfumes. It acts as a solvent, emollient, and viscosity-controlling agent in these formulations. As a result, the surging demand for these products is acting as a significant growth-inducing factor. In addition to this, the extensive focus on physical appearance and personal grooming, driven by the expanding influence of various social media platforms, influencers, and evolving beauty trends, is aiding in market expansion. Besides this, the rising disposable income levels and the increasing popularity of natural and organic cosmetic products are positively impacting the market growth as octyl alcohol is derived from natural sources, thus aligning with the consumer preference for sustainable and eco-friendly ingredients.

The bolstering Growth of the Plastic Industry

The flourishing expansion of the plastic industry is another significant growth-inducing driver of the global octyl alcohol market. Octyl alcohol is utilized in the production of plasticizers, which are additives used to improve the flexibility, durability, and processability of plastics. The increasing use of Plasticizers for manufacturing PVC (polyvinyl chloride) products, adhesives, coatings, and films is creating a favorable outlook for the market. In line with this, the expanding need for various plastic products across the construction, automotive, packaging, and electrical industries is presenting remunerative growth opportunities for the market. Furthermore, the surging demand for plastic-based pipes, cables, insulation, flooring, roofing, and other construction materials due to rapid urbanization, industrialization, and infrastructure development are contributing to the market growth.

Increasing Demand from the Pharmaceutical Sector

The growing use of octyl alcohol as an intermediary in the synthesis of pharmaceutical compounds and the production of various active pharmaceutical ingredients (APIs) and excipients represents one of the key factors driving the market growth. In line with this, the rise in the incidences of numerous chronic ailments, such as obesity, diabetes, cardiovascular disorders (CVDs), and respiratory diseases, are propelling the market forward. Moreover, the expanding geriatric population, the increasing demand for personalized medicines, significant advancements in drug delivery systems, and ongoing research and development (R&D) activities are bolstering the growth of the octyl alcohol market.

Octyl Alcohol Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global octyl alcohol market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on type and application.

Breakup by Type:

- Industrial Grade

- Food Grade

- Others

Industrial grade is dominating the octyl alcohol

The report has provided a detailed breakup and analysis of the octyl alcohol market based on the type. This includes industrial grade, food grade, and others. According to the report, industrial grade represented the largest segment.

The rising use of industrial-grade octyl alcohol as a solvent, emollient, and viscosity-controlling agent in the production of cosmetics and personal care products to improve their texture, stability, and performance is impelling the market growth. Besides this, the increasing healthcare spending and advancements in drug development are propelling the demand for industrial-grade product variants. In addition to this, the growing need for plastics in sectors like construction, automotive, packaging, and electrical are aiding in market expansion. Furthermore, the surging demand for food-grade octyl alcohol that meets strict regulatory standards and quality criteria for its use in edible products in the thriving food and beverage (F&B) industry is positively impacting the market growth. Concurrent with this, the expanding consumption of convenience foods and the significant expansion of the processing industry, wherein octyl alcohol is used to improve the texture, stability, and overall quality of food products, is strengthening the market growth.

Breakup by Application:

- Chemical Intermediates

- Cosmetic

- Food

- Others

Chemical intermediates hold a larger share in octyl alcohol

A detailed breakup and analysis of the octyl alcohol market based on the application has also been provided in the report. This includes chemical intermediates, cosmetic, food, and others. According to the report, chemical intermediates accounted for the largest market share.

The large-scale product adoption as a solvent in the production of various chemicals and chemical intermediates, such as plasticizers, esters, lubricants, and pharmaceutical compounds, is propelling the market growth. In addition to this, the increasing employment of octyl alcohol as an emollient, fragrant agent, solvent, and carrier for other active ingredients in cosmetic formulations of lotions, creams, and hair care products is aiding in market expansion. Apart from this, octyl alcohol is also employed as a food additive to enhance the product texture, stability, and overall quality in various food manufacturing processes, which is further supporting the market growth. Conclusively, as the demand for chemicals, cosmetics, and food products persists to grow, the market for octyl alcohol is expected to expand accordingly.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest octyl alcohol market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

The increasing demand for octyl alcohol from various end-use industries in North America, such as cosmetics and personal care, pharmaceuticals, plastics, and coatings, is contributing to the market growth. The region has a well-established market for these industries, which fuels the demand for octyl alcohol as an essential ingredient in the above mentioned formulations. Apart from this, rapid urbanization, industrialization, the inflating disposable income of consumers, and significant advancements in the healthcare infrastructure in the region are creating a favorable outlook for the market.

Apart from this, many multinational companies are shifting their manufacturing and production bases to the Asia Pacific due to cost advantages and favorable business environments. This, in turn, is generating a surging demand for octyl alcohol in the region. Besides this, the rising consumer spending on cosmetics, personal care items, and household products is further fueling the market growth in emerging economies such as India and China.

Key Regional Takeaways:

Asia Pacific Octyl Alcohol Market Analysis

Asia Pacific's octyl alcohol market is growing strongly due to significant demand from personal care, plasticizer, and solvent applications. The expanding manufacturing base of the region, especially in China, India, and Southeast Asia, continues to drive higher consumption levels. Urbanization, growing disposable incomes, and rising consumer orientation towards cosmetics and homecare products are accelerating the consumption of octyl alcohol in surfactants and fragrances. Regulatory incentives for environmentally friendly industrial operations also promote investment in bio-based production of alcohol. Moreover, the fast growth of the construction and automotive industries is driving demand for plasticizers and coatings, in which octyl alcohol is a key product. Developing economies in Asia Pacific are investing in infrastructure and industrial development, which is expected to boost downstream application opportunities. Overall, the region enjoys low-cost production capacity and increasing domestic demand, making it a major growth center for the global octyl alcohol market.

Europe Octyl Alcohol Market Analysis

The Europe octyl alcohol market demonstrates consistent expansion driven by increasing demand across various end-use industries like cosmetics, pharmaceuticals, and plastic additives. Increased consumer concern about personal hygiene and well-being is promoting increased usage of octyl alcohol in skin care and fragrance products. Further, the strong focus of the region on sustainable manufacturing and regulation compliance is driving interest in environmentally friendly production processes, such as bio-based alcohol replacements. Western Europe, with its matured chemical industry, is the key driver of innovation and leading-edge formulation development with octyl derivatives. Demand from the packaging and construction industries is also noteworthy due to octyl alcohol's involvement in the manufacture of flexible plastics and adhesives. Slow industrial growth in Eastern Europe also contributes to market potential. High-quality infrastructure and research facilities in the region guarantee product consistency as well as regulatory compliance, hence its continued viability in international trade and supply chains with respect to octyl alcohol.

North America Octyl Alcohol Market Analysis

In North America, the market for octyl alcohol is characterized by sustained demand from mature industries like personal care, plastic production, and specialty chemicals. The presence of technologically advanced manufacturing facilities and extensive application of synthetic lubricants, surfactants, and solvents are prime drivers for regional consumption. Growth interest in natural and bio-based substitutes is also driving formulation trends in cosmetics and pharmaceutical markets, where octyl alcohol is a critical intermediate. The transition of the packaging industry to flexibility and toughness is driving demand for octyl plasticizers. Government encouragement of industrial innovation and chemical security is facilitating production of high purity octyl derivatives for niche applications. Infrastructure upgradation and emphasis on industrial productivity are also contributing to octyl alcohol application in coatings and adhesives. With a well-established supply chain network and research on performance-improving formulations, North America remains a strategic player in the global value chain of octyl alcohol.

Latin America Octyl Alcohol Market Analysis

Latin America's octyl alcohol market is developing gradually, driven by industrial growth and growing demand from personal care, packaging, and construction industries. Growing consumer demand for cosmetic products and hygiene is stimulating the adoption of octyl alcohol in surfactants and emulsifiers. Brazil and Mexico, among other nations, are experiencing infrastructural and economic growth, which means greater demand for flexible plastics and coatings—major applications where octyl alcohol is a critical component. The agricultural and industrial processing in the region is also generating interest in chemical intermediates and lubricants based on octyl alcohol. Government programs encouraging manufacturing and foreign investment will be enhancing production and supply capacity. The area has the advantage of good raw material supply and affordable labor, which enhances local competitiveness in production. Increased middle-class population and urbanization in the region are making Latin America a viable potential source of global octyl alcohol market demand.

Middle East and Africa Octyl Alcohol Market Analysis

Middle East and African octyl alcohol market is described as moderate yet increasing demand, bolstered by urbanization, industrialization, and increasing interest in the manufacture of consumer goods. Construction booms in the region, especially in the Gulf Cooperation Council (GCC) nations, are driving demand for flexible plastics and coatings where derivatives of octyl alcohol are extensively used. Growing demand for personal care and hygiene applications is boosting the application of octyl alcohol in surfactant and fragrance manufacture. Middle Eastern economies based on petrochemicals offer a basis for low-cost manufacturing of alcohol and downstream processing. Development of infrastructure, particularly in North Africa and the urban centers of Sub-Saharan Africa, is also boosting demand for adhesives and sealants with the use of octyl compounds. Increased intra-regional trade, along with favorable investment policies, is promoting deeper market integration. Although still in development, the region has long-term potential for expansion of markets through diversification of its industrial base and increasing domestic consumption.

Competitive Landscape:

The global octyl alcohol market is highly fragmented, with the proliferation of multiple regional and international players. The market is expected to stay competitive during the forecasted period owing to the presence of several players and the increasing demand from flavors and fragrances, pharmaceuticals, plasticizers, and food and beverage industries. The major market players are focusing on expanding their product portfolio and improving their production capacity to meet the growing demand for octyl alcohol from different end-use industries. However, the implementation of stringent government regulations, especially in developed markets, such as North America and Europe, is limiting the market growth. Overall, the market will remain competitive in the coming years due to the expanding product application across numerous sectors.

The report has provided a comprehensive analysis of the competitive landscape in the global octyl alcohol market. Detailed profiles of all major companies have also been provided. Some of the key players in the global octyl alcohol market include:

- Arkema S.A.

- Aurochemicals

- Axxence Aromatic GmbH

- BASF SE

- Bharat Petroleum Corporation Limited

- Kao Corporation

- KLK OLEO (Kuala Lumpur Kepong Berhad)

- Sasol Limited

- Saudi Arabia's Basic Industries Corporation (Aramco Chemicals Company)

- Sisco Research Laboratories Pvt. Ltd.

- The Andhra Petrochemicals Limited

Recent Developments:

- In May 2023, Kao Corporation released progress reports on its ESG (Environmental, Social, and Governance) strategy, the Kirei Lifestyle Plan. Details of its progress are released in the Kao Sustainability Report 2023.

- In Feb 2023, Sasol Limited, along with Air Liquide, announced a 260-megawatt wind and solar power purchase agreement with TotalEnergies and the South African renewable energy firm Mulilo to cut its emissions by 30% by 2030. The company expects to reap financial as well as environmental benefits from the drive.

- In January 2023, Arkema S.A. finalized the divestment of Febex, a company specialized in phosphorus-based chemistry, to Belgian group Prayon.

Octyl Alcohol Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Industrial Grade, Food Grade, Others |

| Applications Covered | Chemical Intermediates, Cosmetic, Food, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arkema S.A., Aurochemicals, Axxence Aromatic GmbH, BASF SE, Bharat Petroleum Corporation Limited, Kao Corporation, KLK OLEO (Kuala Lumpur Kepong Berhad), Sasol Limited, Saudi Arabia's Basic Industries Corporation (Aramco Chemicals Company), Sisco Research Laboratories Pvt. Ltd., The Andhra Petrochemicals Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the octyl alcohol market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global octyl alcohol market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the octyl alcohol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The octyl alcohol market was valued at USD 7.3 Billion in 2024.

The octyl alcohol market is projected to exhibit a CAGR of 2.76% during 2025-2033, reaching a value of USD 9.4 Billion by 2033.

The octyl alcohol industry is fueled by rising demand for plasticizers in the polymer sector, growing consumption in personal care and cosmetics formulations, and expanding use in lubricants, solvents, and surfactants. Industrialization, urbanization, and the move toward bio-based chemical substitutes also drive market growth.

Asia Pacific currently dominates the octyl alcohol market, because of high industrial growth, huge demand for flexible plastics and personal care products, and growing construction and automotive industries. Low cost of production, desirable raw material availability, and increasing consumer expenditures further support the leading position of the region.

Some of the major players in the octyl alcohol market include Arkema S.A., Aurochemicals, Axxence Aromatic GmbH, BASF SE, Bharat Petroleum Corporation Limited, Kao Corporation, KLK OLEO (Kuala Lumpur Kepong Berhad), Sasol Limited, Saudi Arabia's Basic Industries Corporation (Aramco Chemicals Company), Sisco Research Laboratories Pvt. Ltd., The Andhra Petrochemicals Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)