Offshore Patrol Vessel Market by Vessel Type (Advanced Vessels, Basic Vessels), Size (<50 Meters, 50 to 90 Meters, >90 Meters), Application (Coast Guard, Navy, Police Force), and Region 2025-2033

Market Overview:

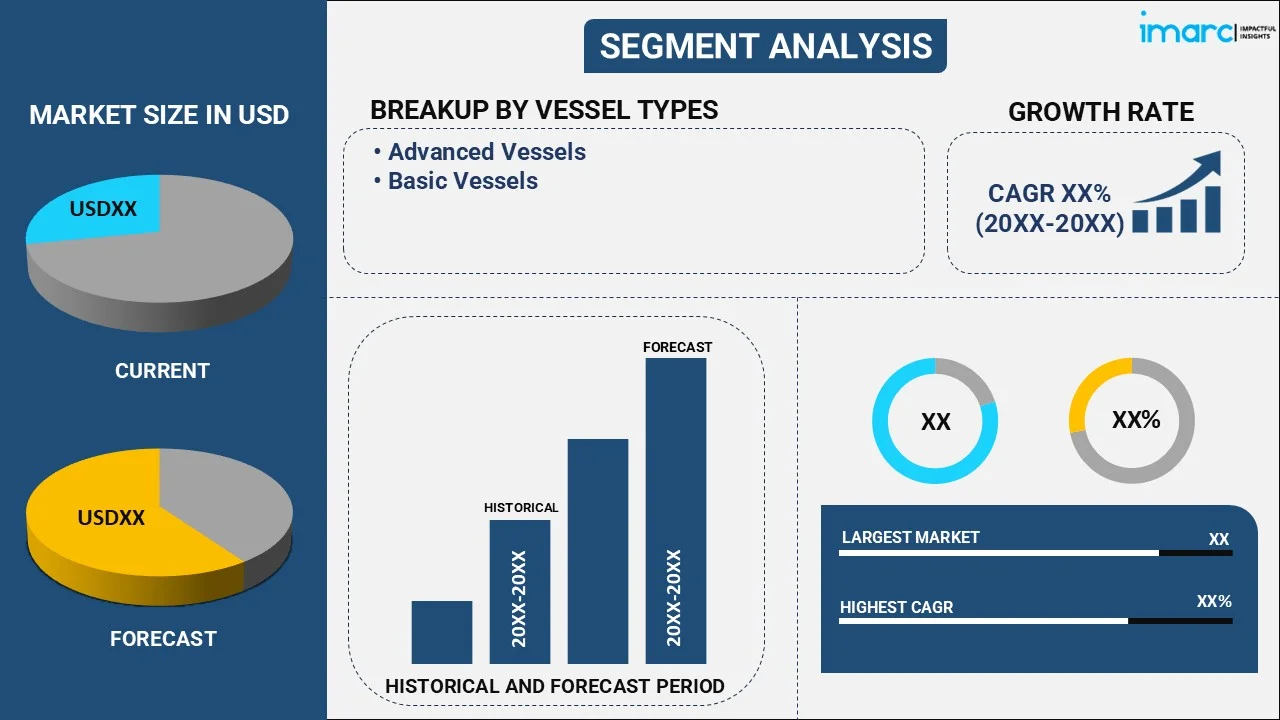

The global offshore patrol vessel market size reached USD 38.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 73.3 Billion by 2033, exhibiting a growth rate (CAGR) of 7.15% during 2025-2033. The growing maritime trade activities, increasing integration of unmanned systems, and rising threat of terrorism, human and drug trafficking activities, and geopolitical tensions among neighboring countries are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 38.1 Billion |

| Market Forecast in 2033 | USD 73.3 Billion |

| Market Growth Rate 2025-2033 | 7.15% |

Offshore patrol vessel (OPV) refers to a small surface, highly versatile ship specially designed for executing various exclusive economic zone (EEZ) management operations, protecting shipping lanes, and ensuring coastal security. It can be remotely operated by the navy, marine police, coast guard, and customs for defense at coastal regions. It is further utilized by several law enforcement agencies for ensuring optimal maritime security and border control. OPV is high-performance, reliable, durable, and persistent and offers customizability, excellent stability, and exceptional seakeeping attributes to facilitate varying tasks in different seagoing environments. Apart from this, OPV is employed for offshore patrolling, policing maritime zones, control and surveillance, and protecting against maritime criminality, piracy, marine pollution, and human or narcotics trafficking activities. As a result, OPV finds extensive applications in external firefighting, search, and rescue, anti-mine and humanitarian operations.

An offshore patrol vessel (OPV) is a naval vessel designed for conducting patrol and surveillance operations in offshore waters, coastal regions, and exclusive economic zones (EEZs) of a country. It is smaller and more cost-effective than larger warships and is equipped with essential systems and capabilities to conduct a variety of missions, such as maritime security, law enforcement, anti-piracy operations, search and rescue, environmental protection, and border control. It also provides an economical solution for maritime security and patrol missions compared to larger warships.

At present, the increasing demand for OPVs due to the rising threat of terrorism and geopolitical tensions among neighboring countries is impelling the growth of the market. Besides this, increasing incidents of human and drug trafficking operations is propelling the growth of the market. In addition, the growing initiatives taken by the governing agencies of various countries to strengthen the security measures around the coastal borders are offering a favorable market outlook. Apart from this, the increasing popularity of naval offshore patrol vessels (NOPVs) integrated with superior rapid gun mount systems along with short-range defensive features in warfare-like situations is supporting the growth of the market. Additionally, rising investments in upgrading the functionalities of OPV fleets to meet the evolving security challenges is bolstering the growth of the market.

Offshore Patrol Vessel Market Trends/Drivers:

Rising maritime trade activities

At present, there is a significant rise in maritime trade activities, driven by a confluence of factors that are reshaping the global economic landscape and accelerating the demand for OPVs. Besides this, the liberalization of trade policies, expanding global markets, the rise of emerging economies, and the growing need for sustainable transportation solutions are positively influencing maritime trade market. Moreover, advancements in technology are revolutionizing the maritime trade industry, making it more efficient and cost-effective. Innovations in containerization, OPV design, and port operations are also streamlining logistics, enabling goods to be transported more swiftly and securely across vast distances. Automated systems for cargo handling and tracking are also improving accuracy and reducing human errors, thereby enhancing the reliability of maritime trade.

Increasing integration of unmanned systems

The integration of unmanned systems, such as unmanned aerial vehicles (UAVs) and unmanned surface vessels (USVs), is gaining momentum in the OPV market. These systems complement the capabilities of conventional OPVs by providing extended surveillance, reconnaissance, and intelligence gathering. Unmanned systems allow OPVs to cover larger areas and operate in riskier environments without endangering crew members. The growing adoption of unmanned systems is enhancing the efficiency and effectiveness of OPV operations. Furthermore, unmanned systems offer a cost-effective alternative to manned operations as they can reduce labor, training, and maintenance costs associated with human-operated systems. Additionally, unmanned systems can be deployed in hazardous or challenging environments without risking human lives.

Growing focus on sustainable practices

At present, there is an increase in the adoption of greener and more fuel-efficient vessels due to the rising focus on environmental sustainability. As a result, navies and coast guards are opting for hybrid or electric-powered OPVs to reduce emissions and operational costs while maintaining operational capabilities. Moreover, governing bodies, naval forces, and maritime agencies are becoming conscious of minimizing their ecological footprint and reducing the pollution caused by vessels. The development and commercialization of greener technologies are making sustainable practices more feasible and cost-effective for the OPV market. These technologies include advanced propulsion systems, fuel-efficient engines, hybrid or electric propulsion, and alternative fuels to reduce emissions.

Offshore Patrol Vessel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global offshore patrol vessel market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on vessel type, size and application.

Breakup by Vessel Type:

- Advanced Vessels

- Basic Vessels

Basic vessels dominate the market

The report has provided a detailed breakup and analysis of the market based on the vessel type. This includes advanced vessels and basic vessels. According to the report, basic vessels represented the largest segment.

Basic OPVs are a specific class of naval vessels designed for patrolling and surveillance tasks in offshore waters. These vessels are designed to operate in relatively open waters, away from the coastline, and are typically employed by navies, coast guards, and other maritime agencies for various missions and roles. They are used for enforcing maritime laws and regulations. They can intercept and apprehend vessels involved in illegal activities, conduct inspections, and enforce maritime borders. They are also equipped with surveillance and sensor systems, such as radar, sonar, and electro-optical sensors, enabling them to conduct extensive surveillance and reconnaissance missions. They are often involved in search and rescue operations, assisting distressed vessels or individuals in distress at sea.

Breakup by Size:

- <50 Meters

- 50 to 90 Meters

- >90 Meters

>90 meters hold the largest share in the market

A detailed breakup and analysis of the market based on the size have also been provided in the report. This includes <50 meters, 50 to 90 meters, and >90 meters. According to the report, >90 meters accounted for the largest market share.

A more than 90 meters-sized offshore patrol vessel (OPV) is a larger and more capable vessel designed for extended offshore operations. These larger OPVs often have enhanced capabilities compared to their smaller counterparts, allowing them to undertake more diverse and complex missions. They are designed to have a greater fuel capacity and endurance, allowing them to remain at sea for extended periods without needing frequent refueling. They are also equipped with advanced long-range radar, electro-optical sensors, and communication intelligence (COMINT) systems for effective surveillance of larger maritime areas. They are designed with improved living quarters and facilities for the crew, allowing them to operate more effectively during extended patrols.

Breakup by Application:

- Coast Guard

- Navy

- Police Force

Navy holds the biggest share of the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes coast guard, navy, and police force. According to the report, navy accounted for the largest market share.

Offshore patrol vessels (OPVs) are used by navies for a variety of important reasons, making them indispensable assets in modern maritime security and naval operations. These vessels serve as versatile and capable platforms that play a crucial role in safeguarding national interests, protecting territorial waters, and promoting maritime security. OPVs are designed and optimized for patrolling and surveillance tasks in offshore waters. Their ability to operate efficiently in open seas away from the coastline allows navies to extend their presence and maintain a continuous watch over critical maritime areas. With advanced surveillance and sensor systems, including radar, electro-optical sensors, and communication intelligence capabilities, OPVs enable navies to monitor and detect a wide range of maritime activities, such as piracy, illegal fishing, smuggling, and other illicit activities.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest offshore patrol vessel market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represented the largest market.

Asia Pacific held the biggest market due to rising investments by governing agencies in the region for strengthening border security and preventing terrorist attacks. Besides this, the rising maritime trade activities are propelling the growth of the market.

Apart from this, the increasing promotion of domestic shipbuilding industries, along with the rising availability of customization options to meet specific operational requirements, is supporting the growth of the market.

North America is estimated to expand further in this domain due to the increasing focus on maintaining border security. Furthermore, the rising focus on naval modernization and the replacement of obsolete vessels is bolstering the growth of the market.

Competitive Landscape

Key market players are upgrading communication systems, sensor suites, navigation equipment, and surveillance capabilities. They are also focusing on offering OPVs that can be modelled depending on the needs of clients. Top companies are designing OPVs with multi-mission capabilities which can perform various tasks, such as patrol and surveillance, search and rescue, environmental protection, and disaster response. They are also working to improve the endurance and range of their vessels and increase their operational effectiveness and reduce the need for frequent refueling or resupply. Leading companies are using advanced composite materials and lightweight design techniques that help in reducing the overall weight of the vessel, leading to improved fuel efficiency and performance.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Austal Ltd.

- BAE Systems plc

- Damen Shipyards Group N.V.

- Dearsan

- Fincantieri S.p.A.

- Fr. Fassmer GmbH & Co. KG

- Fr. Lürssen Werft GmbH & Co.KG

- Garden Reach Shipbuilders & Engineers Limited

- Israel Shipyards Ltd.

- Naval Group

Recent Developments:

- In 2023, Austal Ltd. announced the launch of the Littoral Combat Ship, USS Canberra (LCS-30), into Sydney Harbor for its official commissioning.

- In June 2023, Dearsan Shipyard announced that it signed a contract with the Nigerian Navy to refit and remodel the NNS ARANDU Frigate (F89), the flagship of the Nigerian Navy, to renew it to modern-day standards.

Offshore Patrol Vessel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Vessel Types Covered | Advanced Vessels, Basic Vessels |

| Sizes Covered | <50 Meters, 50 to 90 Meters, >90 Meters |

| Applications Covered | Coast Guard, Navy, Police Force |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Austal Ltd., BAE Systems plc, Damen Shipyards Group N.V., Dearsan, Fincantieri S.p.A., Fr. Fassmer GmbH & Co. KG, Fr. Lürssen Werft GmbH & Co.KG, Garden Reach Shipbuilders & Engineers Limited, Israel Shipyards Ltd., Naval Group etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the offshore patrol vessel market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global offshore patrol vessel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the offshore patrol vessel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The offshore patrol vessel market was valued at USD 38.1 Billion in 2024.

The offshore patrol vessel market is projected to exhibit a CAGR of 7.15% during 2025-2033, reaching a value of USD 73.3 Billion by 2033.

Key factors driving the offshore patrol vessel market include rising maritime security threats, naval modernization efforts, increased offshore oil and gas exploration, demand for border surveillance, and advancements in modular shipbuilding. Governments are prioritizing cost-effective, multi-mission vessels for patrolling exclusive economic zones and supporting humanitarian or anti-piracy operations.

Asia Pacific dominated the offshore patrol vessel market in 2024 due to growing territorial disputes, increased defense spending, and expanded maritime patrol needs by countries like China, India, Japan, and Southeast Asian nations.

Some of the major players in the offshore patrol vessel market include Austal Ltd., BAE Systems plc, Damen Shipyards Group N.V., Dearsan, Fincantieri S.p.A., Fr. Fassmer GmbH & Co. KG, Fr. Lürssen Werft GmbH & Co.KG, Garden Reach Shipbuilders & Engineers Limited, Israel Shipyards Ltd., Naval Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)