OLED Panel Market Size, Share, Trends and Forecast by Type, Technology, Size, End User, and Region, 2025-2033

OLED Panel Market Size and Share:

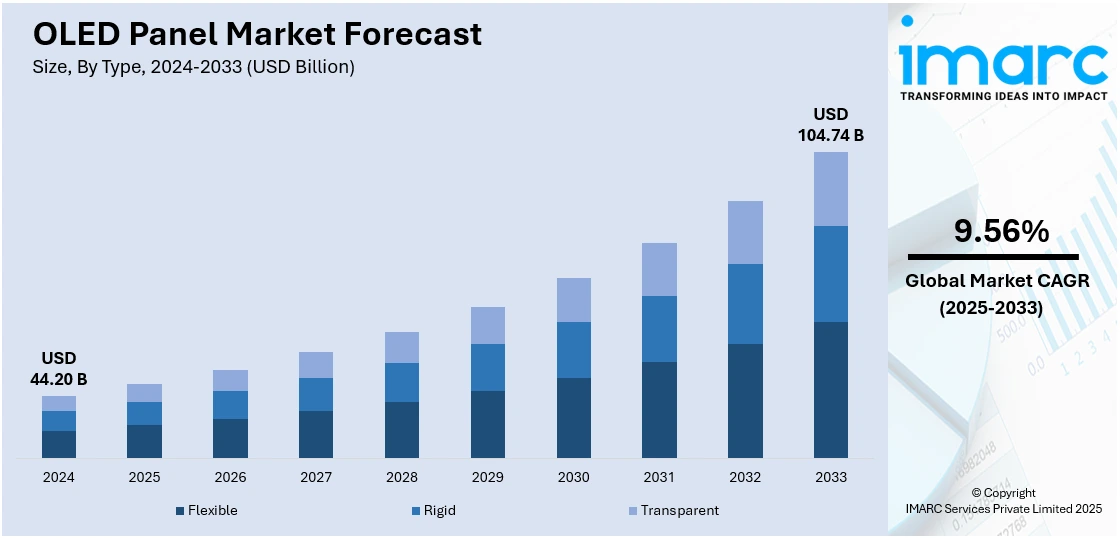

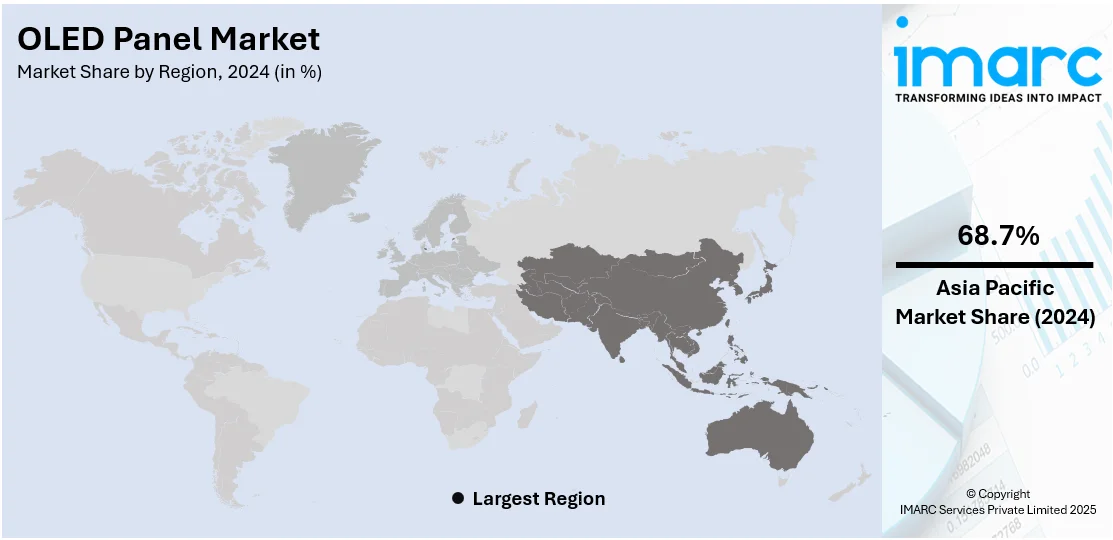

The global OLED panel market size was valued USD 44.20 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 104.74 Billion by 2033, exhibiting a CAGR of 9.56% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 68.7% in 2024. The heightened use of OLED technology in consumer devices like smartphones, TVs, tablets, and wearables is contributing to the market growth. This factor, along with the continuous advancements in display technology, is bolstering the market growth. Apart from this, the growing demand for high-quality, customizable, and energy-efficient display solutions in automotive and industrial applications is expanding the OLED panel market share in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 44.20 Billion |

|

Market Forecast in 2033

|

USD 104.74 Billion |

| Market Growth Rate 2025-2033 | 9.56% |

The market for organic light-emitting diode (OLED) panels is undergoing rapid transformation with ongoing tech developments and a rising need for high-performance screens. Companies are increasingly embracing the use of OLED technology because it offers better visuals, such as deeper blacks, improved contrast levels, and quick refresh rates. This is consequently leading to greater demand for OLED panels in flagship smartphones, TV sets, and wearable devices. At the same time, firms are investing in foldable and flexible OLED technologies, which are broadening the application base across new product categories. Industry players are also upgrading production capacities and optimizing supply chains to address the growing OLED panel market demand.

The United States OLED panel market is experiencing consistent growth, driven by the escalating demand for high-resolution, energy-efficient display technology in consumer electronics and automotive use. The top technology companies are integrating OLED panels into high-end smartphones, laptops, and televisions, leveraging their superior color rendition, thin profile, and improved contrast. With rising preferences for sophisticated visual experiences, companies are keeping pace with constant innovation to provide flexible and foldable OLED solutions to match changing demands. Concurrently, US automakers are incorporating OLED panels into digital displays and infotainment systems, increasing the use of OLED technology in the transportation industry. The market is also driven by increased investment in local production capacities and research and development (R&D) efforts to lower costs and enhance yield rates. Display panel suppliers are entering strategic alliances with device manufacturers to drive product integration and penetration into markets. In 2024, Panasonic made its comeback in the US with its market-leading TVs after it had not been available for ten years. The new product line-up features OLED (Z95A and Z85A) and Mini-LED (W95A) TVs in 55-to-85-inch sizes, all made and engineered in Japan, demonstrating Panasonic's exceptional picture quality.

OLED Panel Market Trends:

Rising Adoption in Consumer Electronics

The heightened use of OLED technology in consumer devices like smartphones, TVs, tablets, and wearables is contributing to the market growth. Companies are taking advantage of OLED's improved characteristics, deeper blacks, improved contrast ratios, and response times to provide a better experience to people. Large consumer electronics companies are continuously releasing new product models with OLED displays, which is driving the overall demand. People are also preferring high-resolution, energy-saving, and visually dense displays, which is encouraging the transition from conventional liquid-crystal displays (LCDs) to OLED-based solutions. Concurrently, OLED panels are facilitating thinner designs and flexibility in devices, thus driving their penetration in premium and foldable devices. For instance, Apple announced its plans to launch the foldable iPhone in late 2024, with Samsung Display providing the OLED panels to the company. Owing to the ongoing technological innovation and affordability, OLED screens are becoming a standard in flagship models, and the trend is impelling the OLED panel market growth.

Technological Advancements and Innovation

Continuous advancements in display technology is bolstering the market growth. Companies are introducing new types of OLED panels such as flexible, foldable, transparent, and rollable displays, which are creating whole new possibilities in product design. These advancements are enabling product manufacturers to explore new form factors, especially in smartphones, laptops, and next-generation consumer electronics. Research institutions and private companies are heavily investing in enhancing panel durability, brightness, resolution, and energy efficiency. At the same time, improvements in manufacturing processes are aiding increased production levels and reduced costs, enabling OLED technology to reach a wider market. Further, innovations in inkjet printing and other advanced fabrication technologies are aiding the production of large-sized OLED panels for TVs and business displays. These continuous innovations are keeping OLED at the leading edge of the display market, allowing it to surpass conventional technologies and address the varied needs of contemporary end users and industries. In 2025, LG Electronics (LG) unveiled its 2025 OLED evo series, featuring a lineup of innovative TV models, including the world's first-ever true wireless OLED evo M5, and OLED evo G5 series. Powered by LG's new α (Alpha) 11 AI processor Gen21, the new OLED evo models deliver unprecedented OLED picture quality with perfect blacks, outstanding brightness and next-generation processing.

Expanding Applications in Automotive and Industrial Sectors

The growing demand for high-quality, customizable, and energy-efficient display solutions in automotive and industrial applications is offering a favorable OLED panel market outlook. Car makers are adopting OLED panels in instrument clusters, central control units, and entertainment systems for user interface and in-car experiences improvement. These panels are providing design flexibility, which is making sleek and curved dashboards possible and in tune with the styling of contemporary vehicles. Moreover, the wide viewing angles and high contrast of OLED screens are finding utility in all types of lighting conditions, particularly in the automotive sector. In industry, OLED panels are being used in medical equipment, control panels, and smart appliances, where responsiveness and image clarity are essential. As the trend shifts toward digitalization and smart systems, industries are leveraging OLED technology due to its performance and reliability advantages. This cross-sector integration is significantly expanding the market's scope beyond consumer electronics, contributing to sustained demand. LG Display exhibited a lineup of ultra-large automotive display solutions, such as the world's largest auto display, to drive advances for future vehicles at CES 2024. LG Display introduced the world's largest automotive display, the '57-inch Pillar-to-Pillar (P2P) LCD,' and the largest slidable panel, the '32-inch Slidable OLED,' for the first time at its specialized booth for automotive displays in the West Hall of LVCC.

OLED Panel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global OLED panel market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, technology, size, and end user.

Analysis by Type:

- Flexible

- Rigid

- Transparent

Rigid stands as the largest component in 2024. This is extensively used in applications where a cost-effective but high-performance display solution is needed. Rigid panels are constructed on a glass substrate, which makes them less flexible but more robust and structurally stable, which is appropriate for devices such as previous-generation smartphones, TVs, and industrial devices. Rigid OLEDs hold a robust market share because of their lower cost of production and easier manufacturing process. Companies are taking advantage of this kind of panel for mid-range consumer devices where display quality and affordability both matter. The reliability, longer lifespan, and simpler integration into thin designs are allowing rigid OLEDs to be a suitable option in markets where flexibility of design is not a concern. Additionally, continued advancements in efficiency and brightness are making rigid OLEDs more competitive in a cost-sensitive market.

Analysis by Technology:

- PMOLED Display

- AMOLED Display

PMOLED display leads the market in 2024. It is finding widespread use in applications that demand simple interface displays with limited size and resolution requirements. It utilizes a passive matrix addressing scheme, which is more cost-effective and easier to manufacture compared to active matrix alternatives. It is particularly well-suited for devices such as fitness trackers, industrial equipment interfaces, digital meters, and small-screen medical instruments. The segment is gaining steady traction due to the growing demand for compact, power-efficient displays that can deliver high contrast and clear visibility in low-light environments. As the market continues to expand for connected, portable, and wearable devices, PMOLED panels are maintaining relevance by offering a practical balance between performance and affordability in constrained display environments.

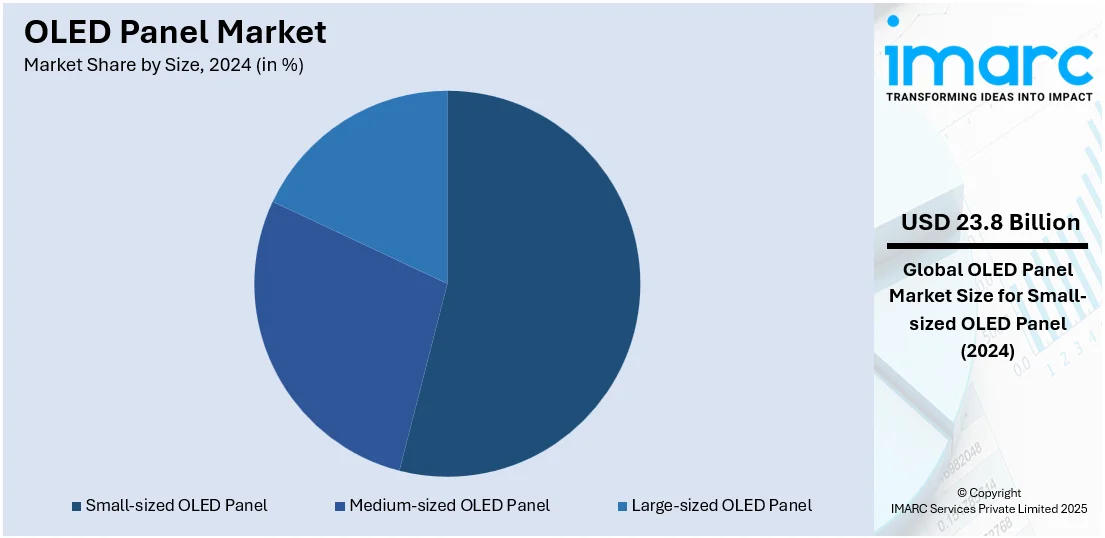

Analysis by Size:

- Small-sized OLED Panel

- Medium-sized OLED Panel

- Large-sized OLED Panel

Small-sized OLED panel leads the market with 53.8% of market share in 2024. They are leading the charge in the display market, with most being stimulated by their prevalence across smartphones, wearables, and small consumer electronics. These panels, typically under 10 inches, are being favored for their ability to deliver high image quality, vibrant colors, and efficient power usage within limited screen space. Demand for small-sized OLEDs is rising alongside the growing popularity of foldable and edge-to-edge phones, which is based on OLED's light, thin, and flexible characteristics. Additionally, wearable tech such as smartwatches and fitness bands continues to benefit from these panels due to their compact form factor and enhanced visibility in various lighting conditions. Since manufacturers are striving to make products differentiate on the basis of better display performance, small-sized OLEDs are becoming the norm in premium and mid-range devices.

Analysis by End User:

- Mobile and Tablet

- Television

- Automotive

- Wearable

- Others

The mobile and tablet segment is representing a dominant share in the OLED panel market, driven by increasing consumer demand for devices with high-resolution displays and advanced visual quality. OLED technology is being widely adopted in smartphones and tablets for its ability to deliver deeper blacks, vibrant colors, and improved energy efficiency. Device manufacturers are focusing on differentiating their premium offerings by incorporating flexible and foldable OLED screens, enabling sleeker designs and enhanced user interaction.

In the television segment, OLED panels are gaining traction for their ability to offer unparalleled picture quality, including higher conflict ratios, wider viewing angles, and faster refresh rates. Leading television brands are transitioning from LED and LCD panels to OLED to meet end user preferences for immersive home entertainment experiences. OLED TVs are becoming the display of choice in the premium category, particularly for users seeking cinematic visuals and minimalistic form factors.

The automotive industry is increasingly utilizing OLED panels to modernize in-vehicle display systems, including digital dashboards, infotainment screens, and head-up displays. Automakers are choosing OLED technology for its design flexibility, high resolution, and ability to perform in diverse lighting conditions. These panels are allowing for curved and edge-to-edge display configurations, supporting the development of advanced human-machine interfaces.

OLED panels are becoming essential in the wearable segment, especially in smartwatches, fitness trackers, and health monitoring devices. The technology’s lightweight, energy-efficient, and compact characteristics make it ideal for devices where form factor and battery life are critical. Wearable device manufacturers are using OLED displays to deliver sharp, readable visuals with vibrant colors, even in outdoor lighting conditions. The increasing focus on health and wellness is driving demand for advanced wearables equipped with real-time tracking and display features, further boosting OLED adoption.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific accounted for the largest market share of 68.7%. The OLED panel market in the Asia Pacific region is growing strongly, driven by innovations in the electronics production industry and rising demand from individuals for sophisticated display technologies. China, South Korea, and Japan are at the forefront of OLED panel manufacturing, with global industry leaders pouring significant investments into local facilities in a bid to ramp up production and lower costs. The area is experiencing a high demand for OLED-integrated smartphones, televisions, and wearable devices due to people prioritizing visual quality, device beauty, and power efficiency. Meanwhile, local players are innovating flexible and foldable OLED technologies, which are creating new opportunities in product design and innovation. According to the OLED panel market analysis, as regional automakers are integrating OLED displays into dashboard and infotainment screens to provide a better user experience, the market is experiencing rapid growth.

Key Regional Takeaways:

United States OLED Panel Market Analysis

The OLED panel market in the United States is witnessing robust growth, holding a share of 84.30%, driven by heightened demand for premium display technologies in consumer electronics and automotive applications. The increasing adoption of OLED displays in high-end smartphones, smart wearables, and infotainment systems has significantly contributed to the market expansion. In North America, the retail revenue from consumer electronics sales reached nearly USD 510 Billion by 2024. The US also benefits from a strong culture of early technology adoption and a high disposable income base, which supports the rapid integration of cutting-edge display innovations. Additionally, the rise of next-generation gaming and augmented reality devices has fueled demand for OLED panels due to their superior visual performance and energy efficiency. The professional and home entertainment sectors are further propelling the market with a shift toward OLED-based televisions and large-format displays. OLED panel technological advancements are transforming commercial and industrial display sectors, with a growing focus on sustainable, low-power consumption solutions, bolstering their market growth due to their energy-efficient properties.

Europe OLED Panel Market Analysis

The OLED panel market in Europe is expanding steadily, driven by the region's focus on sustainability and energy-efficient technologies. A strong regulatory framework promoting eco-friendly products and reduced carbon footprints has accelerated the shift from conventional display technologies to OLED. According to the European Commission, due to Ecodesign and Energy Labelling, EU27 user savings are projected to increase to € 21.4 Billion by 2030, with a 24% reduction in energy consumption. This regulatory push supports the adoption of OLED panels, known for their energy-efficient properties. Europe’s increasing demand for smart lighting systems and high-definition visual interfaces across residential and industrial sectors is further supporting the market. The European luxury goods market, particularly in smart wearables and interior lighting, is promoting the use of OLED panels. Architectural and design communities are also embracing OLED panels for their aesthetic and thinness. Investment in OLED panel market research has led to the development of new OLED applications, including healthcare visualization, smart signage, and public display installations.

Asia Pacific OLED Panel Market Analysis

Asia Pacific is experiencing rapid growth in the OLED panel market, primarily fueled by surging demand for high-resolution and slim-profile displays in consumer electronics. The region benefits from an expansive manufacturing ecosystem that enables cost-effective and large-scale OLED production. Rising urbanization and a tech-savvy population are accelerating the uptake of OLED-integrated smart devices, from televisions to tablets and smartwatches. According to Invest India, electronic goods exports reached USD 29.12 Billion in FY 2023–24, highlighting the region’s growing role as a major player in global technology markets. Increasing investments in industrial automation and digital display systems across the retail and transportation sectors further contribute to the market's expansion. Additionally, regional advancements in micro display and foldable screen technology are enhancing the scope of OLED panel adoption in emerging applications, such as augmented reality and digital signage.

Latin America OLED Panel Market Analysis

The OLED panel market in Latin America is witnessing gradual advancement, supported by rising interest in modern display technologies across the entertainment and advertising sectors. According to Agência Brasil, the Brazilian electronics industry witnessed 29% growth in 2024, which is contributing to the increased demand for vivid, power-efficient OLED screens. Urban consumers are seeking enhanced visual experiences in televisions, signage, and personal electronics. The hospitality and retail sectors are also increasingly deploying OLED-based digital displays to elevate customer engagement and brand presence. Simultaneously, the region is experiencing a push toward adopting energy-efficient technologies, where OLED panels present a compelling option due to their low power consumption and design versatility. This growing interest in advanced display solutions is helping to fuel the overall market expansion across Latin America.

Middle East and Africa OLED Panel Market Analysis

In the Middle East and Africa, the OLED panel market is gaining momentum due to the growing digital transformation initiatives and the rising deployment of advanced display systems in public infrastructure and commercial settings. Saudi Arabia's digital transformation market, for instance, reached USD 10.9 Billion in 2024 and is expected to expand to USD 82.0 Billion by 2033, with a growth rate (CAGR) of 23.1% during 2025-2033, as reported by IMARC Group. This rapid digital evolution is accelerating the adoption of OLED panels, especially in areas like digital signage, control rooms, and high-end home entertainment on account of their superior image quality and sleek design. The rising demand for OLED technology in luxury residential and commercial development is driving the regional market's upward trajectory, aligning with digital and architectural trends.

Competitive Landscape:

Market players in the OLED panel industry are actively expanding production capacities, forming strategic alliances, and investing in advanced technologies to strengthen their market position. Leading manufacturers are building new fabrication facilities and upgrading existing lines to meet the growing demand across consumer electronics and automotive sectors. Companies are also engaging in partnerships with device makers to accelerate the integration of OLED panels into smartphones, televisions, and wearables. Simultaneously, R&D efforts are intensifying, with firms developing flexible, transparent, and energy-efficient OLED solutions to cater to evolving market needs. As per the OLED panel market forecasts, by enhancing product portfolios and streamlining supply chains, these players are expected to maintain competitiveness and responding swiftly to shifts in preferences and technological trends across global markets.

The report provides a comprehensive analysis of the competitive landscape in the OLED panel market with detailed profiles of all major companies, including:

- BOE Technology Group Co. Ltd.

- Innolux Corporation

- Koninklijke Philips N.V.

- LG Display (LG Electronics Inc.)

- OSRAM OLED GmbH (OSRAM GmbH)

- Raystar Optronics Inc.

- RITEK Corporation

- Samsung Display Co. Ltd. (Samsung Electronics Co., Ltd.)

- Sony Group Corporation

- Universal Display Corporation

- Visionox Co. Ltd

- Winstar Display Co. Ltd.

- WiseChip Semiconductor Inc.

Latest News and Developments:

- May 2025: Haier launched two OLED Google TV lineups in India: the C90 and C95. The C90 series, available in 55", 65", and 77" sizes, offers a 120Hz refresh rate and powerful audio, while the C95, with a 144Hz variable refresh rate, targets gamers.

- April 2025: Samsung Display launched a new brand identity for its QD-OLED technology, highlighting its wide color gamut and blue emission. Introduced in 2021, QD-OLED panels are used in over 170 products by brands like Samsung, Sony, and Dell. Samsung plans to increase QD-OLED monitor shipments by 50% in 2025.

- April 2025: Nubia's RedMagic gaming sub-brand revealed plans to launch a gaming tablet with a 9-inch OLED display featuring a 3K resolution and 165Hz refresh rate. The tablet, powered by Qualcomm’s Snapdragon 8 Elite, is expected to debut by June 2025.

- April 2025: Alienware launched the AW3425DW, a 34.2-inch QD-OLED curved gaming monitor in the US, featuring a 240Hz refresh rate, 3440x1440 resolution, and an 1800R curvature. It offers improved thermal efficiency with a graphene-based heatsink, 1000 nits' peak brightness, and full DCI-P3 color coverage.

- April 2025: The OnePlus 13T launched with a 6.32-inch OLED display, offering a 120Hz adaptive refresh rate, 1,600 nits' peak brightness, and 94.1% screen-to-body ratio. Powered by Snapdragon 8 Elite, it features up to 16GB RAM, a 6,260mAh battery, and 80W fast charging, available in multiple configurations.

OLED Panel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flexible, Rigid, Transparent |

| Technologies Covered | PMOLED Display, AMOLED Display |

| Sizes Covered | Small-sized OLED Panel, Medium-sized OLED Panel, Large-sized OLED Panel |

| End Users Covered | Mobile and Tablet, Television, Automotive, Wearable, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BOE Technology Group Co. Ltd., Innolux Corporation, Koninklijke Philips N.V., LG Display (LG Electronics Inc.), OSRAM OLED GmbH (OSRAM GmbH), Raystar Optronics Inc., RITEK Corporation, Samsung Display Co. Ltd. (Samsung Electronics Co., Ltd.), Sony Group Corporation, Universal Display Corporation, Visionox Co. Ltd, Winstar Display Co. Ltd. and WiseChip Semiconductor Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the OLED panel market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global OLED panel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the OLED panel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The OLED panel market was valued at USD 44.20 Billion in 2024.

The OLED panel market is projected to exhibit a CAGR of 9.56% during 2025-2033, reaching a value of USD 104.74 Billion by 2033.

Rising demand for high-performance, energy-efficient displays in smartphones, televisions, wearables, and automotive systems is driving the OLED panel market. Technological innovations, including foldable and flexible OLEDs, and expanding industrial applications are further accelerating market growth.

Asia Pacific currently dominates the OLED panel market, accounting for a share of 68.7%. The region is leading due to its strong manufacturing base, increasing adoption of OLED displays in consumer electronics, and continuous investments in advanced display technologies.

Some of the major players in the OLED panel market include BOE Technology Group Co. Ltd., Innolux Corporation, Koninklijke Philips N.V., LG Display (LG Electronics Inc.), OSRAM OLED GmbH (OSRAM GmbH), Raystar Optronics Inc., RITEK Corporation, Samsung Display Co. Ltd. (Samsung Electronics Co., Ltd.), Sony Group Corporation, Universal Display Corporation, Visionox Co. Ltd, Winstar Display Co. Ltd., WiseChip Semiconductor Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)