Online Gambling Market Report by Game Type, Device, and Region, 2025-2033

Online Gambling Market 2024, Size and Share:

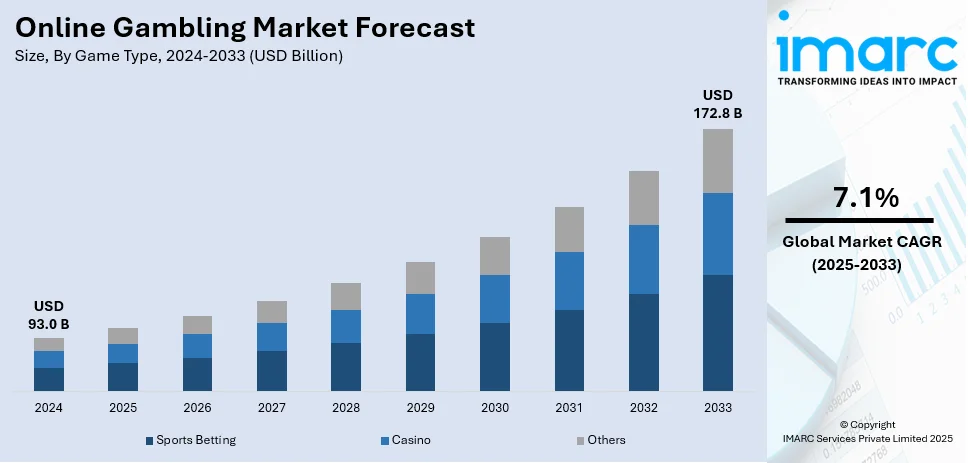

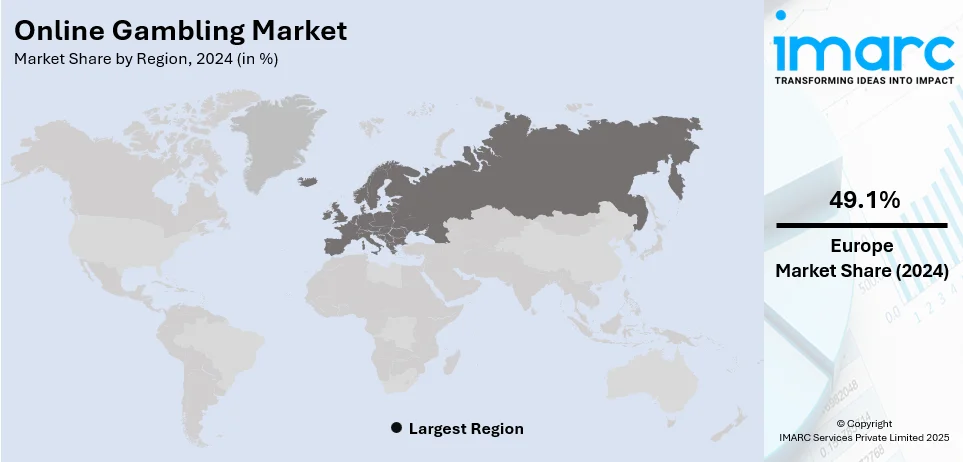

The global online gambling market size was valued at USD 93.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 172.8 Billion by 2033, exhibiting a CAGR of 7.1% during 2025-2033. Europe currently dominates the online gambling market share, holding a significant market share of over 49.1% in 2024. Technological developments, regulatory changes, a wide variety of games, successful marketing techniques, and changes in global demographic and economic trends are all contributing to the market's strong growth and appeal to a larger, more varied audience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 93.0 Billion |

|

Market Forecast in 2033

|

USD 172.8 Billion |

| Market Growth Rate (2025-2033) | 7.1% |

The online gambling market share is largely driven by the penetration of smartphones and the internet in a wider population, giving users easier access to online betting sites. Advances in technology like live streaming, virtual reality, and AI enhance user experiences and attract more people to gamble online. Favorable changes in the regulatory environment in various regions have legalized and popularized online gambling. Simpler transactions have also been facilitated through digital payment solutions, leading to increased trust among users. The increasing popularity of e-sports and online gaming increases betting opportunities. Marketing strategies such as bonuses, promotions, and partnerships with sports teams further drive customer engagement. Finally, the demand for convenient, entertainment-driven experiences amid busy lifestyles continues to propel the growth of the online gambling industry worldwide.

Several factors drive the online gambling market outlook in the United States. The legalization of online gambling in various states has created a favorable regulatory environment. Increased smartphone usage and high-speed internet availability make online platforms more accessible. Advancements in technology, such as secure payment gateways and immersive gaming experiences, boost user trust and engagement. The increasing popularity of sports betting by integrating gambling operators with some major sports leagues further amplified the market growth. Aggressive marketing campaigns, promotional offers, and the convenience of platforms to play online have answered the demand of consumers for flexible entertaining options in gaming. As recently as December 2024, PENN Entertainment, Inc., in Pennsylvania, announced the launch of its standalone Hollywood Casino app has been launched. Hollywood Casino, built on PENN's proprietary technological platform, has over 700 iCasino games, daily promos, and thrilling jackpots. Customers in the Keystone State are able access Hollywood Casino from their desktop, iOS, or Android devices using ESPN BET app or the new Hollywood Casino app, ensuring a seamless user experience across all of PENN's online casino and betting platforms. Subject to regulatory clearances, PENN plans to open Hollywood Casino in other territories in 2025.

Online Gambling Market Trends:

Technological advancements

Some of the prime reasons driving the online gaming market are technological advancements. This is because, through developments such as mobile gaming platforms, advance gaming software and greater security measures, more excellent experiences have been accorded to users. This has allowed larger crowds to be pulled into this arena due to the exciting and engaging game productions between virtual reality (VR) and augmented reality (AR). AR and VR brought in revenues of around USD 12 Billion back in the year 2020, and the market shall rise to USD 72.8 Billion by 2024; this is a test to the fact that they are in high demand, owing to their increasing use. People can trust online gaming platforms and, therefore, play at higher stakes due to novel levels of security and transactions with the help of block chain technology and cryptocurrencies. This technological advancement has made it not only accessible but more engaging, hence increasing the scope of the industry.

Accessibility and Convenience

The best thing about online gambling sites is that they are accessible anywhere in the world and at any time. According to the International Telecommunication Union, internet users worldwide totaled 5,300 million in 2022. Mobile application-based lottery games also became more popular because of increased penetration of smartphones and provided end-users with the convenience and comfort of gambling from within their own space. This accessibility, through the general availability of internet services and the proliferation of smart gadgets, has been important in attracting a broad variety of clients. It has attracted people who otherwise may not have gambled. People are easily attracted to playing at home or even while out and about without necessarily going to a real casino. This has been instrumental in driving the growth of the online gambling market forecast since it caters to a modern, convenience-seeking consumer base.

Regulatory Changes and Legalization

Progressive legalization and regulation have greatly enhanced the expansion of the market in various parts of the world. The economic benefits of a regulated online gambling sector, such as job creation and tax revenue, are now being recognized by governments. As a result, many jurisdictions are amending their regulations to allow lawful internet gambling, thus encouraging market development. The Supreme Court ruled in May 2018 that the Professional and Amateur Sports Protection Act was unconstitutional; that decision marked a landmark that opened the door for states to allow sports betting all over the United States. Before the judgment, PASPA effectively had limited sports gambling to Nevada alone for 25 years. The clear legal frameworks allow more players and operators to enter the market as they create a safe and equitable environment. In addition to giving the sector legitimacy, improvements in regulations are also assisting in the reduction of illicit gambling, which is driving market expansion.

Online Gambling Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on game type, and device.

Analysis by Game Type:

- Sports Betting

- Football

- Horse Racing

- E-Sports

- Others

- Casino

- Live Casino

- Baccarat

- Blackjack

- Poker

- Slots

- Others

- Others

Sports betting leads the market with around 51.5% of market share in 2024. The sports betting segment constitutes a notable section of the online gambling market demand, driven by a global enthusiasm for sports. It encompasses betting on the outcomes of different sports events, including football, basketball, baseball, and horse racing, among others. The growth of the segment is further enhanced by major events like the FIFA World Cup, Olympic Games, and national leagues. Platforms for online sports betting provide an option for live betting, extensive event coverage, and competitive odds. Live streaming combined with real-time data analytics provides a better user experience in betting. Changes in regulations in several countries opening legal avenues in sports betting are also greatly affecting the expansion of this market segment.

Analysis by Device:

- Desktop

- Mobile

- Others

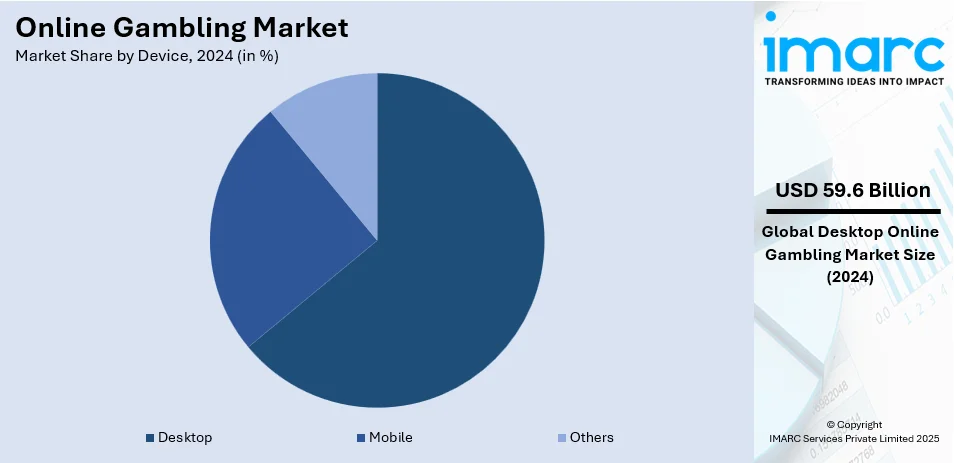

Desktop leads the market with around 64.0% of market share in 2024. The desktop segment of the market caters to users who prefer gambling on personal computers and laptops. This segment conventionally dominated the market due to the rise of online gambling websites easily accessible through desktop browsers. Desktop platforms offer the advantage of larger screens and more stable internet connections, providing an immersive experience, especially for complex games like poker and virtual casinos. Businesses in this sector focus on advanced graphics, robust software, and complete game offerings to attract users. However, with the shift towards mobile usage, the desktop segment continue to evolve to remain competitive, by offering seamless integration with mobile platforms.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 49.1%. Europe's online gambling market growth is fast-growing, with both increased consumer demand and support from regulatory policies driving its growth. Sports betting was responsible for the largest share of online gambling in 2022, according to research conducted by the European Gaming & Betting Association. The UK Gambling Commission, through the implementation of the Gambling Act 2005, has enabled gambling websites to be promoted further, thereby making it more accessible and regulated for consumers, further driving the growth of the market. The legal framework of the Act ensures that gambling activities are safe and fair, and therefore attracts more participants to the online platforms. In 2022, the gross win of the online gambling sector in Europe reached EUR 29.3 Billion (USD 30.4 Billion), according to the European Gaming & Betting Association, indicating a powerful and growing market in this region. The growth of this sector is likely to continue as consumers become increasingly accepting, favorable regulations grow, and online sports betting increases in popularity.

Key Regional Takeaways:

North America Online Gambling Market Analysis

Major factors shaping the online gambling industry in North America are the combination of developing regulatory, technological, and consumer factors. Improved legalization and increased acceptance of online gambling in major jurisdictions, especially in the US and Canada, have opened much room for growth. With the rising internet and the growing use of smartphones, people find it easy to access gambling platforms, thereby driving the adoption of online gambling. The intelligent payment gateways, live-dealer option, and mobile apps are some of the improvements that will help improve the quality of the client’s experience. AI and data analytics are used to allow platforms to offer personalized recommendations to enhance customer loyalty. The rise of sports betting, especially with partnerships between gambling operators and professional sports leagues, has also fueled growth. Aggressive marketing campaigns, bonuses, and loyalty programs further drive customer engagement. Additionally, the growing popularity of eSports betting and virtual gaming reflects evolving consumer preferences. The convenience of online platforms, coupled with changing lifestyles, supports the steady growth of the online gambling market across the region.

United States Online Gambling Market Analysis

In 2024, the United States accounted for the market share of over 76.90%. The growth of the online gambling market in the United States is mostly driven by a few key factors, including high internet penetration, which reached 92% of the population in 2022, as per an industry report. It has led to the facilitation of more access to internet-gambling activities. Secondly, cultural acceptance and further legalization of online gambling in most states have driven this market forward. The legal frameworks are continually updated to provide more divergent options for gambling with a tendency to attract either new users or investors, while celebrity endorsements and the support of large corporations take up the major role on increasing the popularity of Internet-based online gambling platforms within mainstream culture. The sector has its financial implication, as stated by the American Gaming Association. The association pointed out that U.S. commercial gaming revenues amounted to approximately USD 52.99 Billion in 2021, with nearly a 77% rise from that of 2020. Such growth would demonstrate that gambling is rather deep into American culture and continues growing, with the support of a further boost of technological advance.

Asia Pacific Online Gambling Market Analysis

The Asia-Pacific region has become a leading force in the online gambling market, accounting for 50% of global mobile gaming revenue. This growth is driven by the increasing number of mobile gamers, now surpassing 1.5 billion across the region, according to Industry Reports. The rapid expansion of mobile gaming is supported by high smartphone penetration, improved internet connectivity, and the growing acceptance of mobile gambling platforms. Countries like China, Japan, and India have witnessed massive adoption of mobile gambling, including sports betting, casino games, and esports betting. In addition, the progress in mobile technology, including better user experiences and improved security, has contributed to the success of this sector. With these positive trends, the Asia-Pacific region will continue to lead growth in the global online gambling market, further establishing it as a key player in the industry.

Latin America Online Gambling Market Analysis

The Latin America online gambling market is booming, driven by the progressive legalization of online gambling throughout the region. In 2016, Colombia legalized online gambling, which includes sports betting and casinos, as a benchmark for its neighbours. Licensing regimes for online gambling will reportedly come into effect in Brazil, Peru, and Chile by 2024, after the lead of Colombia, Mexico, Panama, and parts of Argentina. Brazil, in particular, has played a significant role as a country that has enacted new legislation to legalize and regulate sports betting with the opening of operations to start January 1, 2025. Over 200 million people inhabit this nation, and their fast-rising economy has already seen the entry of more than 130 companies. The online gambling sector in Brazil experienced an astonishing 135% growth in 2022, as reported by industry reports, which indicates the immense potential for expansion in the region. These developments are likely to continue fueling the growth of the Latin American online gambling market.

Middle East and Africa Online Gambling Market Analysis

The Middle East and Africa online gambling market will have strong growth fueled by increased technology and growing gaming culture. According to an industrial report, by 2030, the number of smartphones in total connections in the Middle East and North Africa (MENA) is projected to stand at 90% from the 81% recorded in 2023, thereby increasing easy access to online gambling sites. The region is experiencing enormous government investments and the esports sector, with the Kingdom of Saudi Arabia, for example, transforming its gaming and esports sectors. The government's support is expected to create 39,000 jobs by 2030, which will further power the industry. Moreover, the region's strong gaming communities and the World Cup planned are expected to boost online gambling, especially in sports betting. These factors are creating a positive environment for the growth of the online gambling market in the MEA region. Mobile gaming and esports-driven initiatives are likely to drive future expansion.

Competitive Landscape:

Companies are heavily investing in advanced technologies like artificial intelligence (AI), blockchain, and virtual reality (VR) to enhance user experience. AI is used for personalized gaming experiences and predictive analytics, while blockchain ensures transparency and security in transactions. To build immersive game environments, researchers are investigating VR and AR technology. These companies are expanding the range of products they offer to draw in a larger clientele. To simulate the experience of real casinos, this entails introducing new game types, incorporating sports betting choices, and providing live dealer games. To enhance their gaming platforms, major players are now partnering with content producers, software developers, and other IT companies. These companies are also concentrating on adhering to legal standards in various countries to guarantee sustained growth.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Bet 365 Group Ltd.

- Betsson AB

- Caesars Entertainment

- Entain plc

- Evoke plc

- Flutter Entertainment Plc

- Playtech plc

- Rush Street Interactive

- Scientific Games

- Sportech PLC

- William Hill

Recent Developments:

- July 2024: The government has outlined a comprehensive approach to regulating online casinos, aimed at minimizing harm, supporting tax revenue generation, and ensuring consumer protection for players in New Zealand.

- September 2023: Betsson AB has obtained a license for the regulated Serbian market, allowing the launch of its renowned online casino, Rizk, thereby marking a key step in its strategic expansion. This move enhances Betsson's presence in the Central and Eastern Europe and Central Asia (CEECA) region, which contributed to 43% of the Group's revenue in Q2 2023.

- August 2023: 888AFRICA, a joint venture of 888 Holdings operating the 888bet brand, has acquired BetLion, a licensed operator in Kenya and Zambia since 2019, expanding its presence in Africa and bringing in new talent and a localized product platform. This acquisition, including a new license in the Democratic Republic of Congo, positions 888AFRICA for further growth and customer expansion, with BetLion's Nairobi headquarters complementing the existing hub in Dar es Salaam, Tanzania.

- June 2023: Inspired Entertainment, Inc. announced today that it has signed a long-term contract extension as the provider of Virtual Sports to leading online gambling operator and Inspired's long-time partner bet365. Under the agreement, Inspired will continue to provide bet365 with their latest products including licensed games giving bet365 the advantage of leading content for their Virtual Sports offerings.

Online Gambling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Game types Covered |

|

| Devices Covered | Desktop, Mobile, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bet 365 Group Ltd., Betsson AB, Caesars Entertainment, Entain plc, Evoke plc, Flutter Entertainment Plc, Playtech plc, Rush Street Interactive, Scientific Games, Sportech PLC, William Hill, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the online gambling market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global online gambling market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the online gambling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The online gambling market was valued at USD 93.0 Billion in 2024.

The global online gambling market is driven by increasing smartphone adoption, improved internet access, and advancements in technology like AI and VR. Favorable regulatory changes, the rise of eSports and sports betting, secure digital payment systems, and engaging marketing strategies, such as bonuses and promotions, further boost market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global online gambling market include Bet 365 Group Ltd., Betsson AB, Caesars Entertainment, Entain plc, Evoke plc, Flutter Entertainment Plc, Playtech plc, Rush Street Interactive, Scientific Games, Sportech PLC, William Hill, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)