Organic Food and Beverages Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Organic Food and Beverages Market Size and Share:

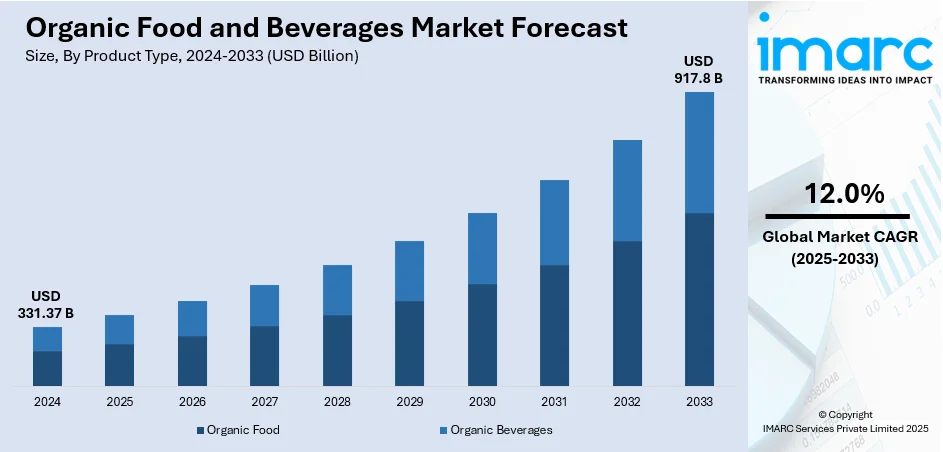

The global organic food and beverages market size was valued at USD 331.37 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 917.8 Billion by 2033, exhibiting a CAGR of 12.0% from 2025-2033. North America currently dominates the market, holding a market share of 45.8% in 2024. The market is driven by the growing health consciousness among consumers, increased demand for natural and sustainable products, and a rising awareness about the environmental impact of conventional farming. Additionally, advancements in organic farming practices, government support, and the expansion of organic product availability are influencing the organic food and beverages market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 331.37 Billion |

| Market Forecast in 2033 | USD 917.8 Billion |

| Market Growth Rate 2025-2033 | 12.0% |

People are becoming more conscious about the health advantages of organic items, like enhanced nutritional content and reduced chemical usage. With a growing emphasis on healthier living, there is an increase in the demand for organic foods and beverages, as consumers look for substitutes of traditional items to minimize their contact with pesticides and additives. Furthermore, governments around the globe are providing incentives and subsidies to encourage organic agriculture. Strict organic certification criteria also contribute to product safety and quality, fostering consumer confidence. These guidelines not only assist farmers but also motivate consumers to select certified organic goods. Besides this, continuous introduction of novel product formulations, packaging, and flavors, are appealing to a wider range of consumers. The launch of organic snacks, drinks, and ready-to-eat (RTE) meals is broadening the market's attractiveness, addressing diverse tastes and dietary needs.

To get more information on this market, Request Sample

The United States plays a vital role in the market, influenced by moral issues, such as animal rights and equitable trade. Organic food producers commonly adhere to these principles by prioritizing the ethical treatment of animals and eco-friendly agricultural methods. This ethical appeal connects with consumers ready to spend more on responsibly sourced items. Additionally, the presence of organic food in regular supermarkets, health shops, and online sites is strengthening the market growth. With more options available across various price points, consumers are finding it easier to incorporate organic products into their diets. In 2025, Hewitt Foods USA introduced "The Organic Meat Co.," a new USDA-certified organic brand of grass-fed beef to meet increasing consumer demand. The brand provides items like organic ground beef, steaks, and additional options, free from antibiotics and added hormones. The beef line can be found in 193 GIANT Co. locations throughout various US states.

Organic Food and Beverages Market Trends:

Growing Consumer Health Awareness

Consumers are becoming more aware about the components in their food, especially concerning the possible dangers of pesticides, synthetic additives, and genetically modified organisms (GMOs). This increased awareness is resulting in a movement toward organic products, which are viewed as a healthier option. Additionally, the increasing incidence of chronic illnesses like obesity, diabetes, and heart conditions are encouraging people to adopt healthier dietary choices. The movement towards comprehensive well-being, including not only physical health but also mental and environmental wellness, is catalyzing the demand for organic products. With consumers placing greater emphasis on health-oriented options in their everyday routines, organic foods and drinks manufacturers are diversifying their offering. In 2024, GURU Organic Energy launched its zero-sugar energy drink line, starting with GURU Zero Wild Berry, targeting health-conscious consumers. The drink was free from sucralose, aspartame, and artificial ingredients, promoting metabolism-boosting and physical performance benefits.

Increasing Availability and Accessibility

In recent times, organic items have become more readily available through different retail avenues, such as grocery stores, wellness shops, and online marketplaces. Major grocery retailers are expanding their organic offerings to meet the growing consumer demand, ensuring organic products are more accessible and affordable. The expansion of online shopping boosts the accessibility of organic products, allowing them to reach isolated regions and attract a broader, more varied audience. This enhanced accessibility lowers obstacles for consumers, making organic options more budget-friendly and simpler to integrate into daily routines. In line with this trend, in 2024, Mother Dairy partnered with Bharat Organics to distribute premium organic staples like Atta and Jaggery in Delhi NCR. The collaboration leveraged Mother Dairy's distribution network to make certified organic products more accessible. The partnership aimed to promote sustainability, health, and farmer welfare, with products available at over 300 Safal stores and online platforms.

Rising Demand for Plant-Based and Alternative Diets

With an increasing number of consumers embracing vegetarian, vegan, or flexitarian diets, the demand for organic plant-based products that match their food preferences is growing. Organic plant-based foods like plant milks, meat alternatives, and vegan snacks are viewed as healthier options compared to traditional non-organic items, often appealing to eco-conscious buyers. Moreover, organic items devoid of synthetic additives and preservatives are becoming a staple in these alternative diets, as they are viewed as more wholesome and natural. The convergence of the plant-based food movement with organic product demand is creating a synergistic effect, contributing to the adoption of organic food and beverages across various dietary categories. In 2025, Rude Health launched a dairy-free iced coffee range in the UK, offering two flavors, including Oat Latte and Mocha. These organic beverages are free from artificial additives, sweeteners, and added sugar, catering to the growing demand for plant-based drinks.

Organic Food and Beverages Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global organic food and beverages market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Organic Food

- Organic Fruit and Vegetables

- Organic Meat, Fish and Poultry

- Organic Dairy Products

- Organic Frozen and Processed Foods

- Others

- Organic Beverages

- Fruit and Vegetable Juices

- Dairy

- Coffee

- Tea

- Others

Organic food (organic fruit and vegetables, organic meat, fish and poultry, organic dairy products, organic frozen and processed foods, and others) holds the biggest market share owing to the growing consumer awareness regarding the health advantages and sustainability of organic choices. Items like organic fruits and vegetables, dairy, meat, and poultry are in great demand as they match increasing preferences for healthier, natural, and chemical-free food options. The increasing worry about the possible dangers linked to traditional farming techniques, like pesticide application and genetic alteration, drives the need for organic options. Consumers are progressively viewing organic foods as enhanced in quality, providing improved taste, nutrition, and ecological advantages. This trend is supported by increasing research highlighting the beneficial effects of organic farming on health and the environment. Additionally, the widespread availability of organic products across various retail channels boosts consumer confidence and access, making organic foods a favored option for individuals aiming to make more mindful choices

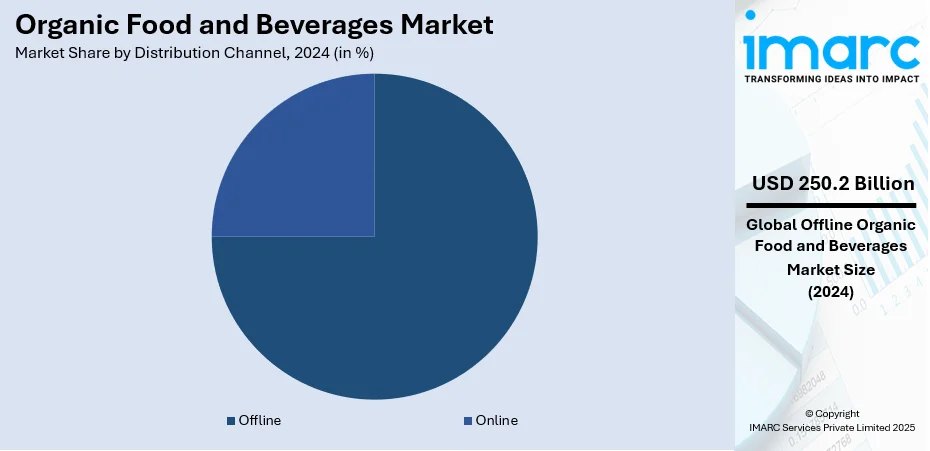

Analysis by Distribution Channel:

- Offline

- Online

Offline represents the largest segment, accounting for 75.6% market share, attributed to its developed infrastructure and robust consumer confidence. Offline retail stores, such as supermarkets, health food shops, and specialty organic retailers, offer direct access to diverse organic foods and drinks, enabling consumers to examine items in person prior to buying. This platform is especially beneficial for connecting with a wider audience, including individuals who are not as acquainted with online shopping. Furthermore, offline segment provides instant access to products, which is a significant aspect for individuals who value the ease of instant satisfaction. The in-store experience allows brands to connect directly with buyers, foster brand loyalty, and provide tailored recommendations. Moreover, the sensory attraction of organic goods, including freshness and quality, is typically best communicated through in-person experiences. As a result, the offline distribution channel remains vital for the broad acceptance of organic products among a varied user group.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market with 45.8%, because of increased consumer awareness and a preference for healthier, sustainable, and eco-friendly products. The area benefits from robust retail and distribution systems, ensuring that organic products are easily reachable for a vast population. Additionally, the increasing focus on organic farming methods and environmental sustainability appeals to consumers who are increasingly aware of the lasting health and ecological effects of their decisions. The region's progressive stance on wellness, combined with a well-educated consumer base, is impelling the market growth. In 2025, Nature's Path, North America's largest independent organic breakfast and snack food brand, launched two new protein-packed granolas made with organic pea protein and coconut oil, offering 10g of plant-based protein per serving. Available in Blueberry Cinnamon and Maple Almond Butter flavors, the products are vegan-friendly and certified organic. These granolas provide a clean, nutritious snack or breakfast option.

Key Regional Takeaways:

United States Organic Food and Beverages Market Analysis

In North America, the market portion held by the United States was 90.00%, influenced by the rise of online e-commerce platforms, which offer consumers greater accessibility and convenience for buying organic products. As reported by the Census Bureau of the Department of Commerce, US retail e-commerce sales represented 16.2% of total sales in the first quarter of 2025. Digital marketplaces enable producers to directly reach health-conscious consumers, and subscription models along with delivery services improve product accessibility. In addition, people are placing more importance on transparency and sustainability, and online platforms provide comprehensive product details and certifications that foster trust. The movement towards healthier living is encouraging more families to purchase organic food and beverages online, backed by advancements in digital retail. This growing consumer demand for authenticity, driven by increased awareness about health benefits and a rising focus on transparent sourcing and certification practices are offering a favorable organic food and beverages market outlook.

Europe Organic Food and Beverages Market Analysis

The market in Europe is experiencing heightened demand as the adoption of organic products rises, driven by expanding organic farming practices that establish a reliable supply foundation to support market growth. Reports suggest that the EU aims to allocate a minimum of 25% of its agricultural land to organic farming by 2030. Increasing consumer interest in healthier and eco-friendly products coincides with agricultural policies that promote sustainable farming practices. Local farmers are progressively adopting organic practices, enhancing accessibility and decreasing reliance on traditional products. Organic farming methods provide increased traceability and clarity, appealing to consumers looking for natural and chemical-free alternatives. Increasing institutional backing and cooperative agricultural projects are enhancing the area's ability to satisfy demand, thus considerably boosting the consumption of organic food and beverages.

Asia Pacific Organic Food and Beverages Market Analysis

The market in the Asia-Pacific is witnessing growth due to increasing adoption of organic products, fueled by a rise in plant-based diets, influenced by changing consumer preferences for healthier and more sustainable options. For example, India has a vegetarian population of 20–39%, influenced by cultural and religious traditions. Increasing awareness about health advantages associated with organic foods is encouraging people to choose plant-based dietary options. Supermarkets and neighborhood stores are modifying stock levels to satisfy demand, while food service providers are adding plant-based dishes obtained from organic agriculture. Rising dietary issues, allergies, and lifestyle preferences are altering eating practices, fostering a cultural shift towards plant-centered diets. This trend is consistently contributing to the organic foods and beverages market growth.

Latin America Organic Food and Beverages Market Analysis

The market in Latin America is growing, with an increase in the adoption of organic products driven by rising urbanization and disposable income, encouraging consumers to invest in healthier eating habits. As of 2025, the typical yearly income in Brazil is about BRL 40,200, equating to roughly USD 7,025.63 annually. The rising demand in urban regions is associated with lifestyle changes, as people seek out organic and chemical-free options. Growth in supermarkets and local shops are increasing the visibility and accessibility of these products for middle-income individuals.

Middle East and Africa Organic Food and Beverages Market Analysis

The market in the Middle East and Africa is gaining momentum as more consumers embrace organic options, driven by increased agricultural investment that promotes long-term market viability. For example, Saudi Arabia’s Agricultural Development Fund (ADF) is projected to authorize SAR 7.4 billion (USD 2 billion) in loans in 2025, maintaining its growth from SAR 7.17 billion in 2024. Increased investment in organic agriculture initiatives is enhancing the supply of pesticide-free produce, facilitating consumer access. Agricultural stakeholders are progressively directing investments towards organic methods that correspond with evolving health-focused preferences.

Competitive Landscape:

Major participants in the market are concentrating on widening their product ranges to meet the increasing demand for healthier and more sustainable choices. They are investing resources in research activities to boost product innovation, advance organic farming methods, and guarantee superior quality standards. Numerous entities are establishing strategic alliances and collaborations with organic farms, suppliers, and distributors to enhance their supply chains. Moreover, businesses are utilizing digital platforms to enhance consumer interaction, providing e-commerce options, and executing marketing initiatives to promote the advantages of organic products. Sustainability practices and certifications are increasingly central for brands seeking to cultivate consumer trust and loyalty. In 2025, Organic India launched the "Sirf Naam Se Nahi, Kaam Se Organic" campaign emphasizing the importance of verifying organic claims on product labels, encouraging consumers to question authenticity. It highlights Organic India's commitment to transparency, backed by over 600 tests on herbs and sourcing from 2,000 farmers.

The report provides a comprehensive analysis of the competitive landscape in the organic food and beverages market with detailed profiles of all major companies, including:

- Amy's Kitchen Inc.

- Belvoir Fruit Farms Ltd.

- Danone S.A.

- Dole Food Company, Inc

- Eden Foods Inc.

- General Mills Inc.

- Organic Valley

- SunOpta Inc.

- The Hain Celestial Group Inc.

- The Kroger Company

- United Natural Foods Inc.

Latest News and Developments:

- May 2025: Tata Consumer revealed plans to enhance its Ching’s Secret range with a new series of Korean noodles and persist in expanding specialized teas and items within its Organic India portfolio. In drinks, the focus was on inexpensive functional beverages that could meet a particular demand and attract a broader range of customers.

- April 2025: Walmart introduced Glen Powell's line of organic food items. It offered a new range of organic condiments, which were devoid of high-fructose corn syrup, artificial colors, and other additives. The selection featured classic ketchup, mayonnaise, mustard, and barbecue sauce along with variations like Hot Honey Ketchup and Hot Honey BBQ Sauce.

- April 2025: Suja Organic, a brand of organic cold-pressed juices, unveiled Sunrise Greens, the latest organic juice in the functional beverage lineup that tasted unlike green juice. Packed with advantages, it blended a hint of sweetness and a generous amount of greens to begin the day on a healthy note.

- March 2025: Natural Products Expo West, the large assembly of the natural and organic CPG and retail sector, brought together over 60,000 industry experts in Anaheim, California. Just Ice Tea, the organic and Fair Trade certified tea brand, launched three new flavors that would enhance the development of its range of bottled and canned teas. One of the items was ‘Orange Mango Herbal Fusion’, which combined organic red and green rooibos tea with ashwagandha, orange peel, and organic mango concentrate for a refreshing, mildly sweetened, and caffeine-free drink.

- February 2025: Sharjah Agriculture and Livestock Production (Ektifa)’s dairy brand Meliha added a laban drink to its offerings, responding to the increasing demand for organic products in the UAE. The initiative illustrated an increasing dedication from the UAE to encourage nutritious living and the ethos of safe and healthy food.

Organic Food and Beverages Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amy's Kitchen Inc., Belvoir Fruit Farms Ltd., Danone S.A., Dole Food Company, Inc, Eden Foods Inc., General Mills Inc., Organic Valley, SunOpta Inc., The Hain Celestial Group Inc., The Kroger Company, United Natural Foods Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the organic food and beverages market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global organic food and beverages market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the organic food and beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The organic food and beverages market was valued at USD 331.37 Billion in 2024.

The organic food and beverages market is projected to exhibit a CAGR of 12.0% during 2025-2033, reaching a value of USD 917.8 Billion by 2033.

The market is driven by the growing health consciousness among consumers, increased demand for natural and sustainable products, and a rising awareness about the environmental impact of conventional farming. Additionally, advancements in organic farming practices, government support, and the expansion of organic product availability are bolstering the market growth and consumer adoption.

North America currently dominates the organic food and beverages market, accounting for a share of 45.8%. The dominance of the region is because of strong consumer demand for healthy and sustainable products, a well-established retail infrastructure, and increasing awareness about environmental and health concerns. Additionally, supportive government policies, a growing preference for organic lifestyles, and higher disposable incomes further contribute to its market leadership.

Some of the major players in the organic food and beverages market include Amy's Kitchen Inc., Belvoir Fruit Farms Ltd., Danone S.A., Dole Food Company, Inc, Eden Foods Inc., General Mills Inc., Organic Valley, SunOpta Inc., The Hain Celestial Group Inc., The Kroger Company, United Natural Foods Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)