Packaging Adhesives Market Report by Type, Substrate Material Type, Packaging Type, End-Use Industry, and Region, 2025-2033

Packaging Adhesives Market Size and Share:

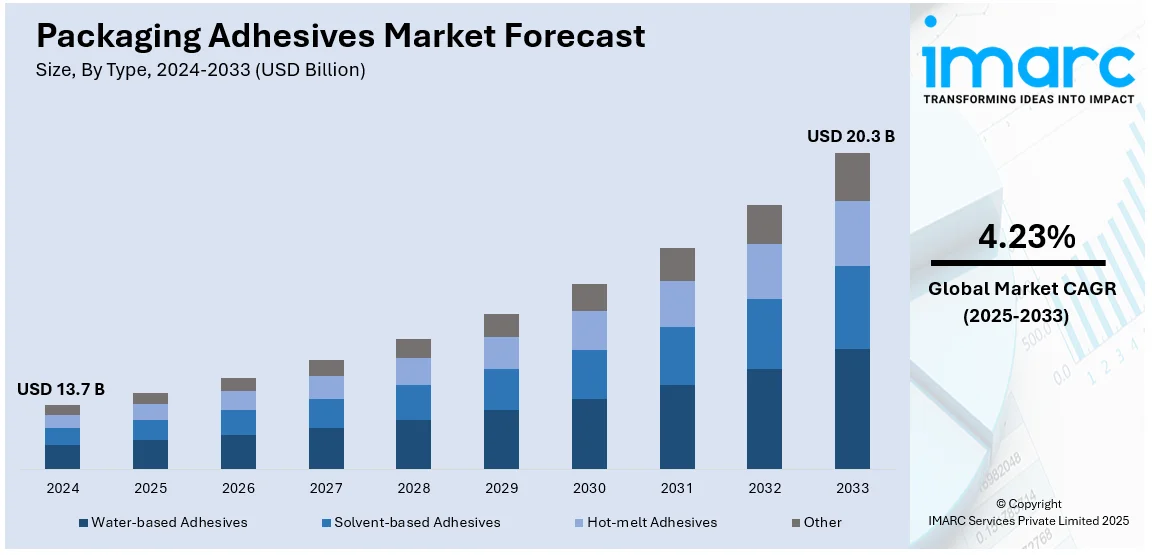

The global packaging adhesives market size was valued at USD 13.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 20.3 Billion by 2033, exhibiting a CAGR of 4.23% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 36.3% in 2024. The packaging adhesives market share is expanding rapidly in this region due to the increasing demand from consumer goods, food and beverage, and e-commerce sectors. Moreover, innovations in eco-friendly and sustainable adhesives are further boosting growth, with manufacturers increasingly emphasizing on improving safety, regulatory adherence, and performance in packaging applications worldwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 13.7 Billion |

|

Market Forecast in 2033

|

USD 20.3 Billion |

| Market Growth Rate (2025-2033) | 4.23% |

With emerging demand for weight-light, lightweight, flexible sustainable pack, and flexible sustainability across various fields such as health products, e-com, food drinks, among many others, the packaging adhesive market demand is significantly growing. An increase in online shopping along with the required, long-lasting and tamper-resistant packaging has also acted as a significant growth driver. Technological innovation in adhesive formulation, such as eco-friendly water-based and hot melt adhesives, aligns with the thrust for sustainability and regulatory compliance. Growth of emerging economies, coupled with growing disposable incomes and urbanization, is creating a positive packaging adhesives market outlook.

The United States stands out as a key market disruptor, driven by the growing demand for innovative packaging solutions across pharmaceuticals, food and beverages, , and e-commerce industries. As the online retail industry continues to grow, demand for secure, durable, and eco-friendly packaging also increases, boosting the adoption of advanced adhesives. The growing demand for prepared, ready-to-eat meals and packaged goods continues to support the growth of this market, as the preservation of package integrity and ensuring product safety greatly depend on adhesives. Current trends toward sustainability continue to have an increasing impact on innovations in formulations - especially water-based and bio-based adhesives that are used to meet new norms in environmental legislation.

Packaging Adhesives Market Trends:

Increasing shift toward sustainability

According to the packaging adhesives market report, the escalating demand for eco-friendly packaging is significantly driving the growth. Companies are currently emphasizing on producing adhesives that are water-based, biodegradable, or recyclable to lower environmental impact and landfill pollution, and align with sustainability trend soaring within packaging industry. According to a research article published in the journal Polymers in March 2023, a bio-based adhesive was developed using a blend of shellac, tannic acid, and chitosan. The combination of chitosan and tannic acid in this bio-adhesive showed 30% better tensile strength in comparison to other commercial adhesives, while the blend of chitosan and shellac exhibited a 23% improvement. Moreover, this trend is especially robust in regions where stringent regulations regarding sustainability are implemented, compelling manufacturers to provide greener alternatives. In addition, this intense inclination toward sustainable packaging is offering substantial growth prospects for adhesive producers as they are focusing on innovations to address the regulatory policies.

Rapid growth in retail and e-commerce sector

The accelerating expansion of the retail and e-commerce sector is spurring the demand for packaging adhesives. With a magnifying rise in online shopping, the demand for lightweight, secure, and durable packaging has heightened, significantly boosting innovations in adhesives that provide better efficiency and robust bonding. As per industry reports, by 2024, an estimated 2.71 Billion consumers are expected to shop online. Additionally, the global e-commerce market is projected to reach a value of USD 4.8 Trillion by 2024. Moreover, packaging adhesives play a crucial role in ensuring the tamper resistance as well as safety of the product, further supporting their amplified utilization in the shipping and logistics sector. In addition, this rising trend is especially prominent in developing economies with proliferating online retail sector.

Technological advancements in smart packaging

Smart packaging, incorporated with digital technologies such as sensors and QR codes, is rapidly gaining momentum across numerous sectors. Adhesives leveraged in these upgraded packaging must offer advanced performance, including resistance to moisture and temperature changes. Moreover, such innovations in packaging technology are compelling adhesive producers to manufacture specialized solutions that can efficiently address the evolving needs of smart packaging. In addition, this trend is anticipated to further drive the packaging adhesives growth as numerous businesses are currently seeking innovative strategies to enhance transparency in supply chain and improve consumer engagement through unique packaging solutions. For instance, in April 2024, DS Smith, a multinational packaging business, announced a strategic partnership with Bioenyzmatic Fuel Cells to upgrade its smart packaging solutions by leveraging recyclable paper.

Packaging Adhesives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global packaging adhesives market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, substrate material type, packaging type, and end-use industry.

Analysis by Type:

- Water-based Adhesives

- Solvent-based Adhesives

- Hot-melt Adhesives

- Other

Water-based adhesives stand as the largest component in 2024, holding around 49.8% of the market. Water-based adhesives are the most leveraged adhesives primarily due to their versatile and eco-friendly profile. Such adhesives, generally utilized in application such as paper packaging, provide resilient bonding while reducing harmful emissions. Moreover, with the increasing focus on sustainability across numerous sectors, water-based solutions are rapidly being preferred over solvent-based adhesives. In addition, they are especially effective in food packaging, where environmental adherence and safety are crucial objectives. Furthermore, the demand for such adhesives is constantly elevating as industries are currently prioritizing low-volatile organic compound (VOC), greener solutions. For instance, in November 2023, researchers of Newcastle University, UK, developed a water-based adhesive that exhibits exceptional adhesion in neutral pH and can be detached by altering the pH level. This innovative adhesive can effectively serve as a recyclable, novel adhesive.

Analysis by Substrate Material Type:

- Acrylics

- Polyurethane

- Polyvinyl Chloride

- Polypropylene

- Others

Polyvinyl chloride leads the market in 2024. Polyvinyl chloride (PVC) is an extensively leveraged substrate material in the packaging adhesive industry, chiefly prominent for its cost-efficiency, durability, and flexibility. PVC is generally deployed in numerous packaging applications, including shrink wraps, bottles, and blister packaging, where robust adhesive bonding is requisite. Moreover, its exceptional compatibility with various adhesive types improves its demand across key sectors. In addition, despite environmental issues, the constant advancements in PVC manufacturing and innovations in adhesive formulations maintains its relevance in the packaging industry.

Analysis by Packaging Type:

- Flexible Packaging

- Folding Cartons

- Boxes & Cases

- Labeling

- Others

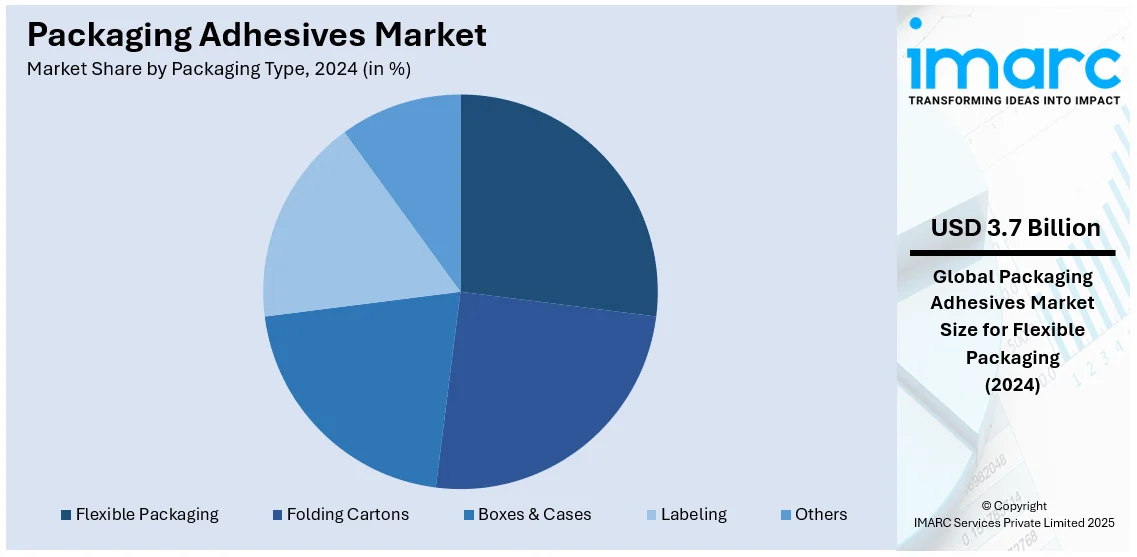

Flexible packaging leads the market with around 27% of market share in 2024. Flexible packaging accounts for the leading market segment in the global packaging adhesives market, mainly because of its high durability and lightweight nature. This packaging format has the capability to preserve the freshness of the product, especially in the food and beverage sector. Moreover, adhesives used in this packaging type must provide resilient bonding while offering flexibility requisite in storage, handling, and transportation processes. In addition, as the demand for sustainable and convenient packaging types heightens, flexible packaging continues to strengthen its domination, reinforced by innovations in adhesive technology for heterogenous materials. For instance, in January 2024, Sappi, a sustainable material provider, unveiled its two new flexible packaging papers that are produced from renewable raw material. These papers can be used in food sector for both edible and non-edible products.

Analysis by End-Use Industry:

- Food & Beverages

- Cosmetics

- Healthcare

- Others

The food and beverages holds a significant market share, primarily driven by the demand for sustainable, secure, and tamper-resistant packaging. Adhesives leveraged in this industry must adhere with strict safety policies while guaranteeing that the packaging can effectively preserve product quality as well as aid in shelf-life extension. Moreover, such adhesives are generally utilized in sealing applications, flexible packaging, and labels. In addition, as consumer demand for environmentally friendly and convenient packaging heightens, the food and beverages industry continue to boost innovations in adhesive formulation.

In the cosmetics sector, packaging adhesives are critical for producing both functional and visually appealing packaging that safeguards sensitive cosmetic products. Moreover, adhesives are leveraged in numerous packaging types, such as cartons, tubes, and bottles to promote product safety, brand aesthetics, and durability. In addition, this segment demands adhesives that can provide robust bonding while addressing the sector's customized demands for premium packaging finishes. Furthermore, the increasing emphasis on sustainability as well as luxury packaging in cosmetics packaging is bolstering the demand for upgraded adhesive solutions in this industry.

The healthcare industry is a crucial end-use sector for packaging adhesives, with major applications in personal care products, pharmaceutical products packaging, and medical devices. Adhesives utilized in healthcare packaging must comply with stringent hygiene and safety regulations, ensuring secure seals as well as product safety from contamination. Moreover, this segment requires specialized adhesives for medical labeling, blister packs, and sterilization pouches. Additionally, as safety concerns and healthcare regulatory policies increase rapidly, adhesive technologies are upgrading to cater to the elevated standards of compliance and performance requisite in this sector.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 36.3%. Asia Pacific has emerged as the leading regional market principally due to its proliferating e-commerce sector and magnifying industrialization. The increased adhesive demand in consumer goods and food sector is also aiding in market growth. Moreover, the region’s inclination toward eco-friendly packaging and sustainable packaging solutions, combined with fueling urbanization and elevated disposable incomes, further bolster adhesive demand. According to industry reports, 90% of the consumers in the Asia Pacific region are willing to spend significantly on sustainable products, with sustainable packaging being one of the major purchasing criteria. In addition, robust economic growth and the increasing development of industrial infrastructure strengthen the region’s leadership in the global packaging adhesive market.

Key Regional Takeaways:

United States Packaging Adhesives Market Analysis

In 2024, the United States accounts for over 88.70% of the packaging adhesives market in North America. The United States packaging adhesives market is mainly driven by advances in e-commerce, which has significantly increased demand for durable, reliable, and lightweight packaging solutions. With the proliferation of online retail, there is a growing demand for adhesives that can ensure the structural integrity of packages during transit. According to reports, the online consumers in the United States are likely to increase by 5.6% in 2024 to 273.49 Million. Additionally, an increasing preference for convenience food products is also boosting demand for flexible packaging, wherein adhesives play a critical role in lamination and sealing. Sustainability initiatives are also one of the key drivers in the U.S. market. Many companies in the country are also switching to eco-friendly adhesives that are passing on to stringent environmental laws and increasing consumer demands for green products. A growth trend in biodegradable, water-based adhesives is showing a trend for carbon footprint reduction. Formulation innovation is also in the forms of low VOC products, which both regulation standards and industry sustainability goals push for. Besides, the rising interest in cost-effectiveness stimulates innovative developments in high-performance adhesives capable of reducing waste and energy consumption during application. For instance, high-performance packaging adhesives are increasingly being used in food and beverages, healthcare, and personal care industries in order to improve product safety and extend shelf life at reduced costs.

Asia Pacific Packaging Adhesives Market Analysis

The packaging adhesives market in the Asia Pacific is driven by swift industrialization and urban growth in nations such as China, India, and those in Southeast Asia. The CIA indicates that in 2023, urban inhabitants in China comprised 64.6% of the overall population. This expansion is causing a rapid increase in the demand for consumer products, fueling the necessity for efficient and affordable packaging options. Correspondingly, the growth of the middle-class demographic and rising income levels is leading to increased demand for packaged foods, drinks, and personal care items, enhancing adhesive use. Furthermore, e-commerce serves as a key growth catalyst in the area, with multiple platforms transforming retail logistics. The demand for durable and tamper-evident packaging to facilitate rapid delivery services is prompting advancements in pressure-sensitive and hot-melt adhesive technologies. Moreover, the increasing need for lightweight and flexible packaging, which enhances product longevity and transport efficiency, is presenting a positive market perspective. Sustainability trends are gaining more influence in the area, as nations implement tougher environmental laws and buyers favor eco-conscious products. This change is promoting the creation of water-based and solvent-free adhesives to adhere to environmental regulations. Moreover, the emergence of smart packaging solutions, incorporating QR codes and RFID tags, demands specific adhesives that meet high-performance requirements.

Europe Packaging Adhesives Market Analysis

Strict environmental laws and the area's leadership in sustainability efforts are driving market expansion. The European Union's focus on reducing plastic waste and moving toward circular economy initiatives is compelling producers to develop biodegradable and recyclable adhesives that align with these goals. Water-based and bio-based adhesives are increasingly popular as industries look to minimize their environmental footprint. Correspondingly, the growth of the food and beverage industry, particularly in ready-to-eat dishes and processed foods, is another major driver. In this industry, flexible and multi-layer packaging is used extensively, requiring adhesives that have superior bonding strength and compatibility with various materials. Similarly, the European pharmaceutical industry is growing strongly, and this will require innovative adhesive solutions for tamper-evident and sterile packaging. According to reports, pharmaceutical industry sales in Germany saw a rise of 5.7% in 2023. Moreover, e-commerce is an expanding sector in Europe, increasing the demand for durable packaging solutions capable of enduring long-distance shipping. The need for adhesives that provide durability and weather resistance is increasing. Furthermore, innovations in adhesive formulations, including UV-curable and hot-melt adhesives, are addressing the market's requirements for superior performance and energy efficiency.

Latin America Packaging Adhesives Market Analysis

Market demand is fueled in Latin America mainly by the development of the food and beverage industries-the biggest sector of the region's economies. Consumers increase the demand for higher-quality packing materials and adhesives while increasing their processed and packaged foods intake, assisted by urbanization and the developing middle class. The other aspect contributing to this growth is through exports: agricultural exports are becoming significantly prominent, whereas the manufacturing-based ones are as well. As reported, the exports of Brazilian agribusiness recorded an all-time high of USD 166.55 Billion in 2023. In the case of fertilizers, pesticides, and bulk chemicals, adhesives are applied for packaging purposes. Chemical resistance, moisture, and varying temperature requirements for adhesives characterize agricultural products. In this context, the region is slowly changing to the eco-friendly category due to growing sustainability awareness among consumers and businesses.

Middle East and Africa Packaging Adhesives Market Analysis

The growing demand for packaged food and beverages items, fueled by urbanization and changing consumer lifestyles is influencing the market positively. According to the CIA, the urban population in the Saudi Arabia was 85% of total population in 2023. The urban population is increasingly preferring RTE meals which requires reliable packaging solutions. Besides this, the rapid growth of the pharmaceutical and personal care sectors also plays a significant role in boosting adhesive demand. Furthermore, the region’s growing focus on sustainability is encouraging the adoption of water-based and biodegradable adhesives. In the Gulf countries, where e-commerce is rapidly growing, the need for strong and lightweight packaging adhesives that cater to logistics demands is a notable driver of market growth.

Competitive Landscape:

Packaging adhesives key players are fostering growth by executing strategic initiatives aligned with innovation, sustainability, and market expansion. Most of these companies are spending extensively on research and development in advanced adhesive formulations such as bio-based, water-based, and solvent-free to comply with the fast-emerging need for green packaging. Collaborative partnerships with manufacturers of packaging materials and end-users allow for development of customized adhesives tailored for specific applications. This will lead to enhanced product performance. Key players are now adopting sustainable practices, such as using renewable raw materials and carbon footprint reduction to meet regulatory requirements and consumer demands for environmentally friendly solutions.

The report provides a comprehensive analysis of the competitive landscape in the packaging adhesives market with detailed profiles of all major companies, including:

- 3M, Arkema Group

- Ashland Inc.

- Avery Dennison Corporation

- Dymax Corporation

- H.B. Fuller Company

- Henkel AG & Co.

- KGaA

- Jowat SE

- Paramelt RMC B.V.

- Sika AG

- The DOW Chemical Company

- Wacker Chemie AG.

Latest News and Developments:

- December 2024: In another major development, Arkema announced the closing of its acquisition of Dow's flexible packaging laminating adhesives business, a top global adhesives supplier in the flexible packaging market. With this operation, the Group will strengthen its portfolio of solutions for flexible packaging and emerge as one of the players of choice for the attractive flexible packaging market.

- November 2024: Packsize®, the frontrunner in sustainable, size-optimized, on-demand packaging, revealed a new collaboration with Henkel Adhesive Technologies to improve the Company's eco-friendly product range, delivering creative solutions that assist companies in minimizing their ecological footprint. This alliance illustrates Packsize's emphasis on strategic collaborations within its market entry strategy.

- September 2024: Bostik, a part of the Arkema Group, today unveiled an important milestone on the trajectory toward Net Zero by its adhesive solutions segment - a new Kizen LIME packaging adhesives range. It marks a further important step by Bostik toward carbon footprint reduction and more sustainable packaging solutions.

- April 2024: Flow Materials (Flow) has launched a new range of adhesives for the current flexible packaging sector. Located in Zug, Switzerland, and serving the UK and the EU, MEA Flow was established in 2022 by a group of former Dow Chemical professionals, including UK resident Mike Holmes, who aimed to transform the adhesive supply landscape for flexible packaging converters.

Packaging Adhesives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Water-based Adhesives, Solvent-based Adhesives, Hot-melt Adhesives, Others |

| Substrate Material Types Covered | Acrylics, Polyurethane, Polyvinyl Chloride, Polypropylene, Others |

| Packaging Types Covered | Flexible Packaging, Folding Cartons, Boxes & Cases, Labeling, Others |

| End-Use Industries Covered | Food and Beverages, Cosmetics, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M, Arkema Group, Ashland Inc., Avery Dennison Corporation, Dymax Corporation, H.B. Fuller Company, Henkel AG & Co. KGaA, Jowat SE, Paramelt RMC B.V., Sika AG, The DOW Chemical Company, Wacker Chemie AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the packaging adhesives market from 2019-2033.

- The packaging adhesives market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the packaging adhesives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The packaging adhesives market was valued at USD 13.7 Billion in 2024.

IMARC estimates the packaging adhesives market to exhibit a CAGR of 4.23% 2025-2033.

The market for packaging adhesives is propelled by the rising need for sustainable, lightweight, and long-lasting packaging options, progress in adhesive technologies, and the rising consumption of packaged products stimulated by e-commerce and urban development.

Asia Pacific dominates the market, on account of swift urban development, rising consumer demand for packaged products, the rise of e-commerce, and the growth of sectors like food and beverages, healthcare, and electronics in developing economies.

Some of the major players in the packaging adhesives market include 3M, Arkema Group, Ashland Inc., Avery Dennison Corporation, Dymax Corporation, H.B. Fuller Company, Henkel AG & Co. KGaA, Jowat SE, Paramelt RMC B.V., Sika AG, The DOW Chemical Company, and Wacker Chemie AG. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)