Pakistan Tyre Market Size, Share, Trends and Forecast by Vehicle Type, OEM and Replacement Segment, Domestic Production and Imports, Legitimate and Grey Market, Radial and Bias Tyres, Tube and Tubeless Tyres, and Region, 2025-2033

Pakistan Tyre Market Size and Share:

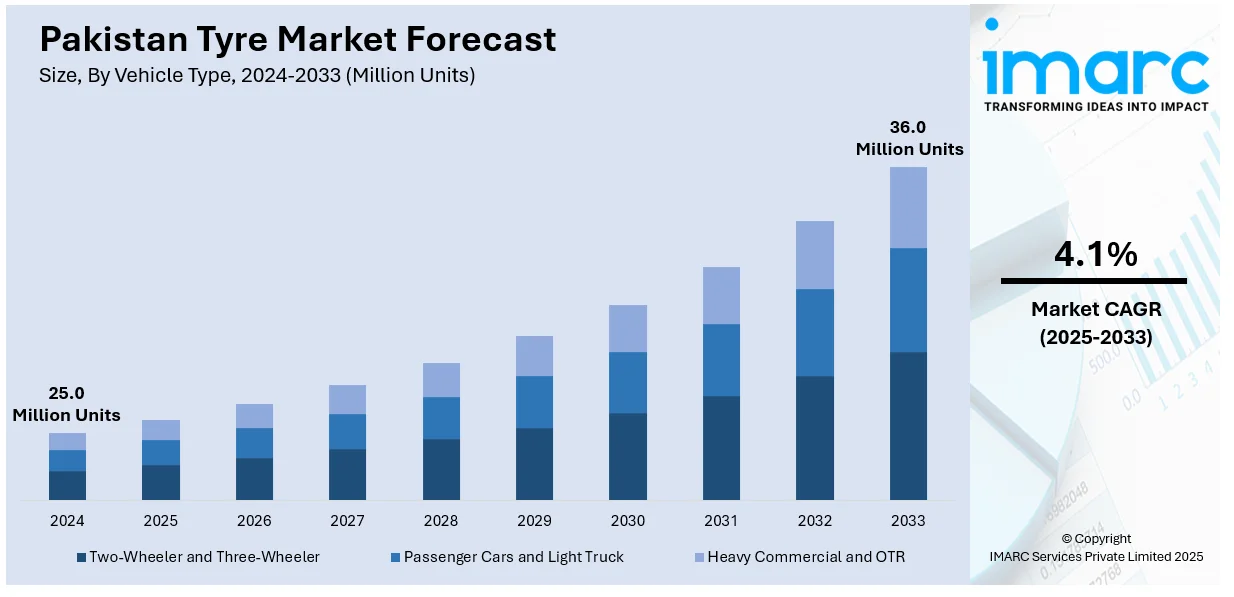

The Pakistan tyre market size was valued at 25 Million Units in 2024. Looking forward, IMARC Group estimates the market to reach 36.0 Million Units by 2033, exhibiting a CAGR of 4.1% during 2025-2033. Punjab currently dominates the market, holding a significant market share of around 38.0% in 2024. The market is driven by growing vehicle ownership, rapid urbanization, and expanding logistics/e-commerce sectors. Rising disposable incomes and easier auto financing enhance demand, while poor road conditions increase replacement needs. Government policies promoting local manufacturing reduce import reliance, and seasonal factors. The dominance of two/three-wheelers and commercial vehicles is further expanding the Pakistan tyre market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

25 Million Units |

|

Market Forecast in 2033

|

36.0 Million Units |

| Market Growth Rate 2025-2033 | 4.1% |

The market is primarily driven by the growing automotive industry, fueled by increasing vehicle ownership and rapid urbanization. Rising disposable incomes and easier access to auto financing have increased demand for passenger cars and two-wheelers, directly increasing tyre consumption. Additionally, infrastructure development, including road expansion projects, has enhanced transportation networks, leading to higher commercial vehicle usage and tyre replacement needs. The government’s focus on industrialization and local manufacturing, supported by policies, such as the Auto Industry Development Program (AIDP), further stimulates the Pakistan tyre market growth. Seasonal demand variations, such as increased travel during festivals, also contribute to periodic spikes in tyre sales.

To get more information on this market, Request Sample

In addition, the expanding logistics and e-commerce sectors, which rely heavily on commercial vehicles, is creating sustained demand for truck and bus tyres. The online shopping industry in Pakistan is likely to grow to USD 14.1 Billion by 2024. This growth is driven by growing internet penetration, the adoption of digital banking, and the active participation of more than 87 million social media users. As internet sites become major retail outlets, especially during peak shopping season, the tire sector in Pakistan stands to gain from the rise in sales of digital car accessories and growing trade alliances with China. The rise in international trade and CPEC-related transportation activities has further accelerated this trend. Moreover, consumer awareness about tyre safety and performance has led to a shift toward premium and radial tyres, pushing manufacturers to innovate. Frequent tyre replacements due to poor road conditions and extreme weather also sustain aftermarket demand. Import restrictions and incentives for local tyre production have encouraged domestic manufacturing, reducing reliance on imports and fostering competitive pricing, which continues to propel market expansion.

Pakistan Tyre Market Trends:

Rising Vehicle Ownership Driving Tyre Demand

The tyre market in Pakistan is experiencing strong momentum due to the consistent rise in vehicle ownership across the country. A primary indicator of this trend is the projected addition of approximately 31 million two- and three-wheelers and 5 million light-duty vehicles on Pakistan's roads between 2020 and 2050, as reported by the Asian Transport Observatory. This rise reflects growing personal mobility and increased dependence on private transportation. Furthermore, the motorization rate of vehicles per 1,000 individuals is anticipated to rise to 270 by 2050, signaling an expanding base of consumers requiring tyres regularly. The growing population, coupled with urban expansion and lifestyle shifts, continues to propel vehicle sales, which in turn fuels consistent Pakistan tyre market demand. This trend creates a stable foundation for tyre manufacturers to expand operations and product portfolios to cater to diversified vehicle categories.

Infrastructure and Industrial Growth Supporting Tyre Consumption

The market is also benefitting from substantial infrastructural and industrial development. Significant governmental reforms aimed at improving economic growth have led to a steady expansion in industrial sectors such as construction, manufacturing, and agriculture each of which depends heavily on reliable vehicle fleets and, by extension, quality tyres. According to the World Bank Group, the industrial sector, including construction, contributed 20.7% to Pakistan’s GDP in 2023. This expansion reflects rising activity in key sectors that utilize heavy-duty and specialty vehicles, further strengthening tyre demand. In particular, construction equipment, agricultural machinery, and freight transportation vehicles are seeing increased deployment, leading to a parallel rise in the consumption of tyres tailored to these applications. As industrialization deepens, the market is poised to grow rapidly, with high-performance and durable tyres becoming a crucial focus for manufacturers.

Policy Support and Investment Fuelling Domestic Production

Government of Pakistan has adopted multiple policy measures aimed at strengthening domestic tyre manufacturing, which has emerged as a key growth catalyst for the market. Additionally, the imposition of higher import taxes (up to 30% in 2023) on tyre imports has been instrumental in protecting and promoting local production, with domestic output growing by 18% year-on-year. These fiscal measures are intended to reduce dependence on imports (which fell by 22% in 2022-23) and create a favorable environment for indigenous manufacturers. In parallel, increasing tyre demand has attracted greater investment from both local and foreign entities, thereby enhancing capacity expansion and technological advancement in tyre production. This influx of capital and strategic interest is expected to accelerate industry growth in the coming years. With such policy-driven momentum, the tyre market is transforming into a self-sustaining ecosystem capable of meeting domestic demand while potentially exploring export opportunities.

Pakistan Tyre Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Pakistan tyre market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on vehicle type, OEM and replacement segment, domestic production and imports, legitimate and grey market, radial and bias tyres, and tube and tubeless tyres.

Analysis by Vehicle Type:

- Two-Wheeler and Three-Wheeler

- Passenger Cars and Light Truck

- Heavy Commercial and OTR

Two-wheeler and three-wheeler vehicles stand as the largest component in 2024, due to their affordability, fuel efficiency, and suitability for urban mobility. Motorcycles and rickshaws are the primary modes of transportation for middle- and lower-income groups, especially in congested cities where traffic and narrow roads limit four-wheeler usage. Rising demand for budget-friendly personal transport, coupled with flexible financing options, has significantly enhanced sales of two- and three-wheelers, directly driving tyre demand. Additionally, the growth of ride-hailing and last-mile delivery services has further increased the need for durable tyres in this segment. Three-wheelers, widely used for public transport and goods movement, also contribute substantially to tyre replacement cycles due to their high daily usage. Local tyre manufacturers prioritize this segment, offering cost-effective products tailored to Pakistan’s road conditions. With urbanization and population growth sustaining demand, two- and three-wheelers will likely remain the largest tyre market segment in the future according to the Pakistan tyre market forecast.

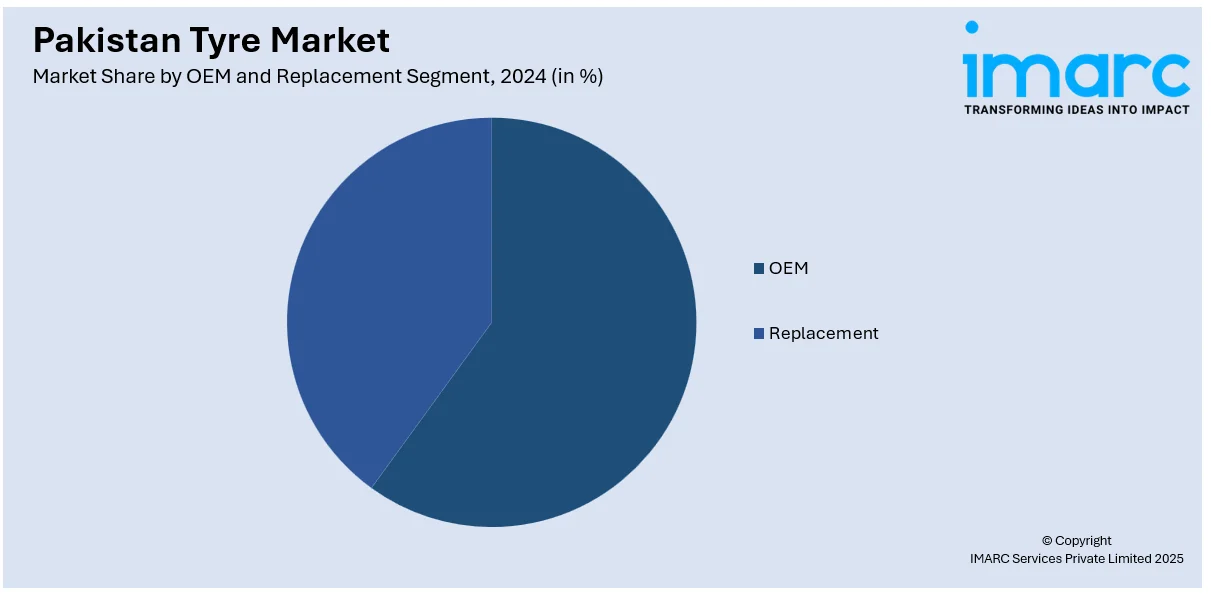

Analysis by OEM and Replacement Segment:

- OEM

- Replacement

Replacement leads the market with around 72.9% of market share in 2024, due to frequent wear and tear caused by poor road conditions, extreme weather, and high vehicle usage. Unlike OEM tyres, which are tied to new vehicle sales, replacement tyres benefit from the country’s vast existing vehicle fleet, including ageing cars, motorcycles, and commercial vehicles that require regular tyre changes. The growth of ride-hailing services, logistics, and public transport further accelerates replacement demand, as these vehicles log higher mileage and need more frequent replacements. Additionally, price-conscious consumers often opt for budget-friendly retreaded or locally manufactured tyres, improving aftermarket sales. Seasonal factors, such as increased travel during festivals and monsoon-related tyre damage, also contribute to cyclical spikes in replacement demand. With limited penetration of new vehicles compared to the expanding used-car market, the replacement segment is creating a positive Pakistan tyre market outlook, driven by affordability and necessity.

Analysis by Domestic Production and Imports:

- Domestic Production

- Imports

Domestic production leads the market with around 58.6% of market share in 2024, driven by government policies promoting local manufacturing and import substitution. Favorable initiatives such as tariff protections, tax incentives, and investment-friendly regulations have encouraged the establishment of domestic tyre plants, reducing reliance on foreign suppliers. Local manufacturers cater primarily to the replacement market, producing cost-effective tyres tailored to Pakistan’s road conditions and consumer preferences, particularly for two-wheelers and commercial vehicles. While imports still play a role in supplying premium and specialty tyres, their share has declined due to higher duties and foreign exchange constraints. The growth of domestic production has also improved price competitiveness and availability, making locally made tyres the preferred choice for budget-conscious buyers. With expanding production capacities and increasing demand from the automotive and logistics sectors, domestic tyre manufacturing is expected to further strengthen its market dominance, supported by ongoing industrial and policy developments.

Analysis by Legitimate and Grey Market:

- Legitimate

- Grey

Legitimate leads the market in 2024, due to growing consumer awareness and stricter regulatory measures. Genuine tyre manufacturers and authorized distributors dominate the sector by offering quality-certified products with warranties, safety assurances, and reliable after-sales services. Increased enforcement against counterfeit imports and smuggled tyres has further strengthened the legitimate market's position. Additionally, collaborations between industry stakeholders and government agencies have improved compliance with safety standards, making branded tyres the preferred choice for both individual and commercial buyers. While the grey market still exists, offering cheaper alternatives, its share is shrinking as consumers prioritize durability and performance over short-term cost savings. The expansion of organized retail channels and digital platforms has also made legitimate tyres more accessible nationwide. With rising vehicle ownership and stricter quality controls, the legitimate segment is poised to maintain its dominance, supported by consumer trust and regulatory reinforcement.

Analysis by Radial and Bias Tyres:

- Bias

- Radial

Bias leads the market in 2024, holding a larger share compared to radial tyres, particularly in the commercial and two-wheeler segments. Their widespread preference stems from lower costs, easier repairability, and better suitability for rough road conditions commonly found across the country. Commercial vehicle operators, in particular, favor bias tyres due to their robust construction and ability to withstand heavy loads on uneven terrain. While radial tyres are gaining traction in passenger vehicles for their fuel efficiency and longer lifespan, their higher upfront cost and limited availability in smaller cities restrict broader adoption. Additionally, the lack of advanced road infrastructure in many regions reduces the performance advantage of radial tyres, reinforcing the dominance of bias tyres. However, as awareness grows and road conditions improve, radial tyres are gradually gaining market share, though bias tyres remain the preferred choice for cost-conscious and off-road applications in Pakistan's tyre market.

Analysis by Tube and Tubeless Tyres:

- Tube Tyres

- Tubeless Tyres

Tube leads the market in 2024, particularly in the two-wheeler and commercial vehicle segments. This preference stems from their lower cost, easier repairability, and widespread compatibility with existing vehicle rims across the country's price-sensitive market. Tube tyres remain popular among motorcycle and rickshaw owners who prioritize affordability and accessibility of replacement parts, especially in rural areas where repair infrastructure for tubeless tyres is limited. While tubeless tyres are gaining acceptance in premium passenger vehicles due to their safety advantages and puncture resistance, their higher cost and requirement for specialized rims hinder mass adoption. The country's rough road conditions also make frequent tyre repairs inevitable, favoring tube-type designs that can be easily serviced by local mechanics. As vehicle manufacturers gradually introduce more models with tubeless-ready rims and urban consumers become more quality-conscious, the market may see a gradual shift, but tube tyres currently maintain their stronghold due to economic and practical considerations.

Regional Analysis:

- Punjab

- Sindh

- Khyber Pakhtunkhwa

- Balochistan

In 2024, Punjab accounted for the largest market share of over 38.0%, due to its dense population, extensive road networks, and higher vehicle ownership rates. As the country's most industrialized province, Punjab hosts major urban centers, including Lahore, Faisalabad, and Rawalpindi, where growing urbanization has increased demand for both personal and commercial vehicles. The province's well-developed agricultural sector also contributes to robust demand for tractor and off-road tyres. Additionally, Punjab's central location makes it a key logistics hub, driving continuous demand for commercial vehicle tyres to support intercity and regional transportation. The presence of numerous tyre dealerships, distributors, and manufacturing units further strengthens Punjab's position as the primary tyre market. With better road infrastructure compared to other provinces and higher disposable incomes among residents, Punjab is likely to maintain its leadership in tyre consumption, supported by ongoing economic activity and population growth.

Competitive Landscape:

The competitive landscape of the market is characterized by both local and international players striving to capture market share through innovation, affordability, and strategic expansions. Key competitors are investing in domestic manufacturing to reduce import dependency and leverage government incentives, while also enhancing production capacities to meet rising demand. Many are focusing on cost-effective solutions for the two- and three-wheeler segments, which dominate sales, by introducing durable tyres suited to rough road conditions. Brands are also expanding distribution networks and after-sales services to strengthen customer loyalty. Additionally, companies are adopting advanced technologies to improve tyre longevity and fuel efficiency, catering to price-sensitive consumers. Aggressive marketing campaigns, promotional discounts, and collaborations with automotive manufacturers further intensify competition, ensuring a dynamic and changing market.

The report provides a comprehensive analysis of the competitive landscape in the Pakistan tyre market with detailed profiles of all major companies, including:

- General Tyre and Rubber Co. Ltd.

- Panther Tyres Limited

- Diamond Tyres Limited

- Service Industries Limited

- Ghauri Tyre and Tube Pvt. Limited

Latest News and Developments:

- December 2024: Armstrong ZE Pvt. Ltd. secured USD 50.2 Million in funding from the International Finance Cooperation (IFC) and a group of regional banks, including Meezan Bank, HBL, Habib Metropolitan Bank, and Bank Alfalah, to help them build a greenfield tyre production plant in Gharo town, Sindh, which will significantly increase local tyre manufacturing. By bringing a locally produced international brand to Pakistan, the project would provide consumers access to reasonably priced, high-quality tyres while bolstering domestic supply chains, generating employment, and stimulating growth.

- August 2024: Ghandhara Tyre and Rubber Company Limited (GTR) signed a Memorandum of Understanding (MoU) with Shandong Huasheng Rubber Co., Ltd. (SHRC) for the establishment of a Joint Venture Company in Pakistan for the production and sales of Truck Bus Radial (TBR) and Passenger Car Radial (PCR) tyres. This collaboration seeks to improve the production methods of GTR through the use of SHRC's cutting-edge technical proficiency and proprietary knowledge and will contribute substantially to the economy of Pakistan.

- May 2024: Service Long March (SLM) Tyres, a joint venture between China and Pakistan, announced plans to invest over EURO 80 Million in its tyre manufacturing plant in Pakistan. With this additional investment, the company plans to double its manufacturing capacity and enhance exports to USD 100 Million annually by 2025.

Pakistan Tyre Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD, Million Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Two-Wheeler and Three-Wheeler, Passenger Cars and Light Truck, Heavy Commercial and OTR |

| OEM and Replacement Segments Covered | OEM, Replacement |

| Domestic Production and Imports Covered | Domestic Production, Imports |

| Legitimate and Grey Markets Covered | Legitimate, Grey |

| Radial and Bias Tyres Covered | Bias, Radial |

| Tube and Tubeless Tyres Covered | Tube Tyres, Tubeless Tyres |

| Regions Covered | Punjab, Sindh, Khyber Pakhtunkhwa, Balochistan |

| Companies Covered | General Tyre and Rubber Co. Ltd., Panther Tyres Limited, Diamond Tyres Limited, Service Industries Limited and Ghauri Tyre and Tube Pvt. Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Pakistan tyre market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Pakistan tyre market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Pakistan tyre industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tyre market was valued at 25 Million Units in 2024.

The Pakistan tyre market is driven by rising vehicle ownership, rapid urbanization, infrastructure development, and supportive government policies. Additionally, growth in logistics, e-commerce, and local manufacturing, alongside increased consumer awareness of tyre safety, is fueling steady demand across segments.

The tyre market is projected to exhibit a CAGR of 4.1% during 2025-2033, reaching a value of 36.0 Million Units by 2033.

The replacement segment accounted for the largest market share in 2024, holding approximately 72.9% of the market, driven by frequent wear from poor road conditions and high vehicle usage. The growth of ride-hailing and logistics further accelerates demand, as these vehicles require more frequent tyre changes.

Some of the major players in the Pakistan tyre market include General Tyre and Rubber Co. Ltd., Panther Tyres Limited, Diamond Tyres Limited, Service Industries Limited, and Ghauri Tyre and Tube Pvt. Limited, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)