Palmitic Acid Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Palmitic Acid Market Size and Share:

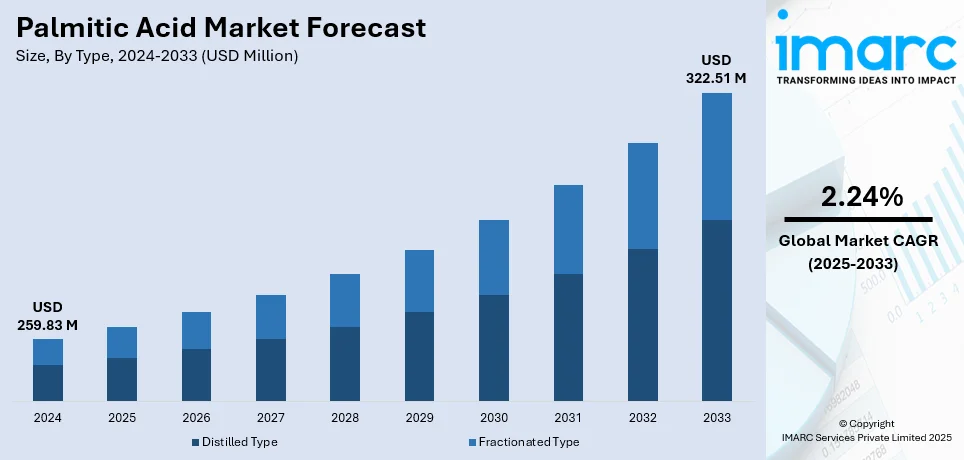

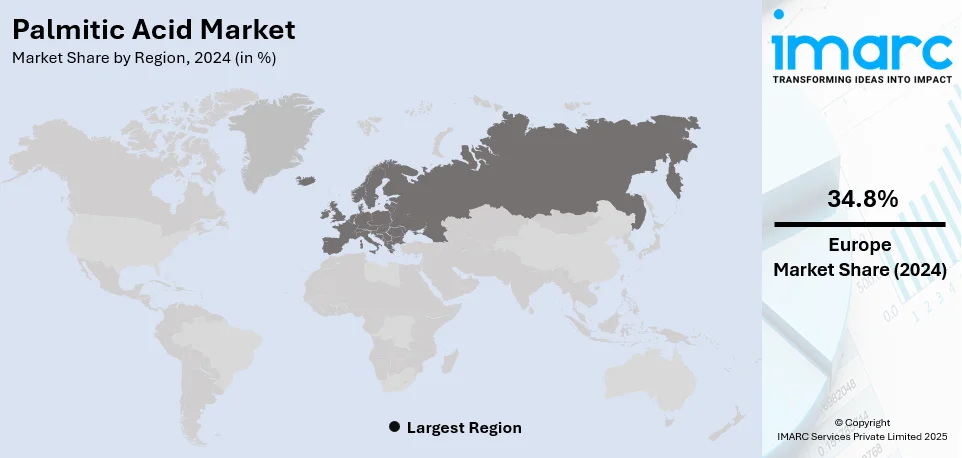

The global palmitic acid market size was valued at USD 259.83 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 322.51 Million by 2033, exhibiting a CAGR of 2.24% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 34.8% in 2024. Growing product usage in food products as a food additive and flavor enhancer, the rising number of research and development (R&D) activities, and increasing industrial applications are some of the factors propelling the palmitic acid market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 259.83 Million |

| Market Forecast in 2033 | USD 322.51 Million |

| Market Growth Rate (2025-2033) |

2.24%

|

The market is primarily driven by the increasing adoption of palmitic acid in bio-based lubricants and industrial surfactants, as industries seek sustainable alternatives to petroleum-based chemicals. Additionally, continual technological advancements in oleochemical processing that enhance production efficiency, reduce costs, and expand accessibility, is providing an impetus to the market. Also, government incentives and research investments in renewable chemicals are promoting domestic production. For example, on 14 March 2024, UK Research and Innovation (UKRI) announced a £13.5 Million investment in 48 engineering biology research and development projects. Funded through the UKRI Technology Missions Fund and delivered by Innovate UK, these initiatives aim to address challenges in health, environmental sustainability, and food production. Notable projects include engineering red blood cells for novel therapies, developing bio-based materials for eco-friendly paints, and creating sustainable alternatives to palm oil. Furthermore, expanding applications in personal care, particularly in anti-aging and skin-conditioning formulations, are also contributing to the palmitic market growth.

The United States is a key regional market that is experiencing significant growth due to the rising demand for specialized pharmaceutical formulations, as palmitic acid is widely used in drug delivery systems and excipients. According to an industry report, in 2023, the United States spent $722.5 Billion on pharmaceuticals, a 13.6% increase from 2022. Besides this, the increasing emphasis on sustainable and bio-based personal care products, coupled with growing consumer preference for natural ingredients, is further increasing the overall product adoption. Moreover, stringent environmental regulations encouraging the shift toward biodegradable and renewable raw materials, are further stimulating palmitic acid market growth. Furthermore, rapid expansion of the industrial sector, including metalworking and polymer manufacturing, is augmenting the product application in processing aids and stabilizers, creating a favorable market outlook.

Palmitic Acid Market Trends:

Rapid Advancements in Biotechnology

Rapid developments in biotechnology is one of the prominent palmitic acid market trends as these developments enable the increased production of the product. According to the Ministry of Commerce and Industry, India has 94 investment projects in the Pharma, Biotech & Lifesciences sector worth USD 88.83 Million. Biotechnological innovations transform the production of acid, making it more economical and efficient. By using metabolic and gene engineering approaches, microbes can be modified to generate huge amounts of acid without relying on conventional palm oil sources. Since using algae and other microorganisms to produce acid is a more environmentally friendly option than using conventional sources, scientists are working to develop this technology. Also, advances in biotechnology enable the identification of new uses in other sectors, such as pharmaceuticals, biofuels, and specialty chemicals. These new uses expand the market potential, further driving industry growth. With the continued advancements in biotechnology, its contribution to palmitic acid production, sustainability, and versatility in a positive manner is set to propel the market forward.

Shift Towards Sustainable and Natural Ingredients

The global shift towards sustainable and natural ingredients in cosmetics, food, and pharmaceuticals is transforming the palmitic acid market outlook. For instance, the research and development (R&D) expenditures for biopharmaceuticals are anticipated to have totaled USD 198 Billion worldwide in 2020. Consumers are increasingly conscious of the environmental and health impacts of their choices, which results in a growing preference for products derived from sustainable and renewable sources. In response to this demand, manufacturers seek eco-friendly alternatives, including palmitic acid derived from plant-based sources like palm oil, coconut oil, or other vegetable oils. Sustainable sourcing practices and certifications have become essential considerations for companies looking to meet consumer expectations and regulatory requirements. Further, increasing awareness about the potential harmful effects of synthetic and chemically derived products creates a shift towards natural alternatives. Palmitic acid, a naturally occurring fatty acid, fits well into this trend. As a result, it has found applications in natural and organic cosmetics, personal care products, and even clean-label food formulations.

Rising Favorable Regulations Promoting the Product Usage

The rise in positive regulations that promote the use of the product in various applications is fueling palmitic acid market demand. Governments and regulatory bodies around the world have realized the importance of green and sustainable products. Hence, governments are implementing policies and standards that promote the use of natural and renewable products. In the food industry, regulatory clearances and safety tests lead to the use of palmitic acid as a food additive and preservative. Moreover, regulatory clearances promote the use of palmitic acid in pharmaceuticals to ensure safe pharmaceuticals. According to the Washington State Department of Corrections, women spend USD 3,756 a year on beauty products and services. Compliance with these regulations has encouraged manufacturers to use palmitic acid in various formulations. Positive regulations not only ensure the efficacy and safety of palmitic acid but also a sound business proposition, where investment and research are channeled towards the manufacturing of innovative applications. Such regulatory support is likely to fuel the growth of the market in various industries.

Palmitic Acid Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global palmitic acid market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Distilled Type

- Fractionated Type

Fractionated type leads the market in 2024. It offers higher purity and functionality in a broad scope of industrial uses. It is manufactured by the process of fractionation, the separation of fatty acids based on melting points, to yield a purified and concentrated product. Fractionated palmitic acid is a highly demanded ingredient in food applications due to its fat-structuring functionality in processed foods, confectioneries, and baked goods. It is a leading contender in cosmetics and personal care applications in the form of creams, lotions, and emulsifiers owing to its stability and moisturizing properties. Due to its oxidative stability, it is also suitable for pharmaceutical and industrial applications such as lubricants and surfactants. The growing demand for high-performance, eco-friendly, and specialty products, contributes to the market growth, particularly in sectors that prefer purity, consistency, and functional benefits over traditional alternatives.

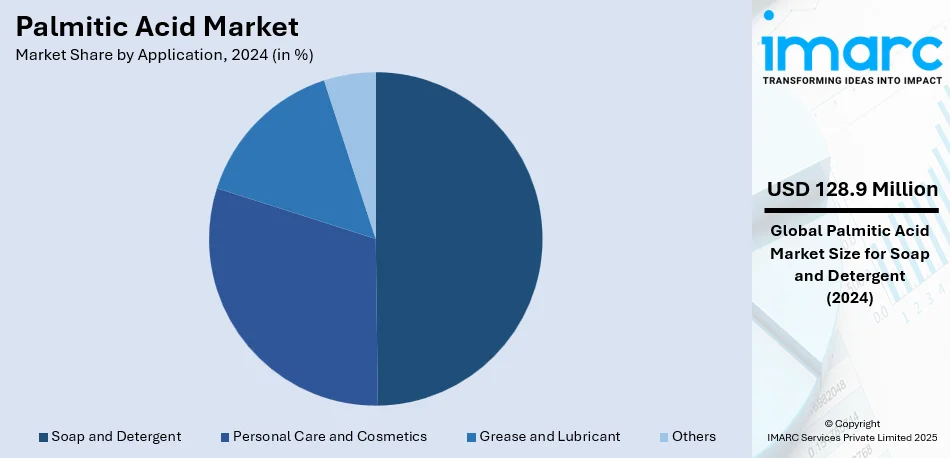

Analysis by Application:

- Soap and Detergent

- Personal Care and Cosmetics

- Grease and Lubricant

- Others

Soaps and detergents leads the market with around 49.6% of market share in 2024, due to the compound's essential role as an emulsifier and surfactant. Palmitic acid adds cleansing strength, foaming, and texture to soaps and detergents and is therefore employed as a common ingredient in household and industrial cleansers. The ability of palmitic acid to impart hardness and stability to soap preparations is a promise for enhanced and durable cleaning action. With consumers seeking natural and biodegradable ingredients, the application of palmitic acid from environmentally friendly sources, e.g., vegetable oils, has gained popularity among producers. Greater demand for environmentally friendly and skin-friendly personal care products further spurred its use in mild soap and specialty detergent applications. Growth in the world's hygiene and sanitation industry, particularly in the developing world, continues to drive the demand for quality surfactants, supporting palmitic acid's position in this application segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 34.8%, driven by robust demand in industries like food, cosmetics, pharma, and personal care. The region's emphasis on green and high-quality ingredients encourages the use of palmitic acid in various formulations, particularly in skin care and pharmaceutical applications. Stringent environmental regulations and consumers' inclination towards bio-based products also drive the market dynamics, forcing manufacturers to adopt green manufacturing and sustainable sourcing practices. Europe's industrialized infrastructure and research-based innovations also encourage the production of high-purity palmitic acid for specialty applications. The region's highly developed supply chains and trade networks also ensure market stability and growth. With increasing investment in green chemistry and sustainable procurement of raw materials, Europe is a major market, leading global trends and setting high quality and environmental compliance standards for palmitic acid production.

Key Regional Takeaways:

United States Palmitic Acid Market Analysis

The increasing demand for palmitic acid in the United States is mainly fueled by the huge investment in the chemical sector. As per the International Trade Administration, the total foreign direct investment (FDI) in US chemical production was USD 766.7 Billion in 2023. Palmitic acid is a raw material that is highly preferred for the production of an enormous range of products and thus generates demand in the market. Continued industry expansion and growth lead to increasing demand for palmitic acid, which is utilized on a large scale for the production of a range of chemicals, lubricants, surfactants, and detergents. With the expansion of the chemical industry in the region, the use of palmitic acid as a raw material is on the rise. Moreover, continued technological advancements, research and development (R&D) efforts, and developments in manufacturing capacity are driving regional market growth. Besides this, overall economic growth in the manufacturing and industrial sectors is a major market growth driver. In addition to this, investment in industry continues to drive capacity and infrastructure growth, allowing its palmitic acid use in an enormous range of industries.

Asia Pacific Palmitic Acid Market Analysis

In the Asia-Pacific region, the use of palmitic acid is growing at an exponential rate due to the growth of the pharma industry. According to reports, the foreign direct investment movement in the drugs and pharmaceuticals sector in terms of equity was USD 22.52 Billion between April 2000 and March 2024, which is approximately 3.4% of the total movement received from all the various industries. With further growth in the healthcare industry, palmitic acid is utilized in drug formulation, as a stabilizer in pharmaceuticals, and as an emulsifier in tablet coating. Therefore, growth in the healthcare industry provides an impetus for the palmitic acid market in the region. The increasing demand for effective, high-quality excipients in this health care further provides an impetus to the use of palmitic acid in the pharma industry. Apart from this, growth in health and wellness in the region also leads to research and development (R&D) activities for the use of palmitic acid in the pharma industry.

Europe Palmitic Acid Market Analysis

In Europe, the increasing demand for palmitic acid is directly proportionate to the growth of the food and beverage industry. Palmitic acid is a food additive and flavor enhancer. As per reports, in 2020, there were 291,000 food and beverage processing industries in the European Union. Palmitic acid is a major component in the flavor, texture, and shelf life of an incredibly large number of foods. As consumers prefer more variety and tasty food, the demand for palmitic acid is increasing. The growth of the food processing industry in the region generates a high demand for palmitic acid because it is a contributory factor in emulsifiers, stabilizers, and an important ingredient in processed food. As a result of the upcoming regulation of food safety and the increasing demand for clean-label foods, the multifunctionality of palmitic acid makes it an important ingredient in the preparation of an incredibly large number of foods, from baked food to dairy alternatives.

Latin America Palmitic Acid Market Analysis

The growing personal care and cosmetic market is fueling the demand for palmitic acid in Latin America. Growing market expansion in the region is driven by rising levels of consumers' disposable incomes. The growth rate of consumer disposable income in Latin America is likely to grow at a rate of almost 60% over the period from 2021 to 2040. Palmitic acid is used in personal care and skin and hair care product formulation. The increased spending on haircare, skincare, and beauty care products further fuels the high requirement for palmitic acid. Palmitic acid is also used in lotions, creams, shampoos, and other personal care product formulations because of its thickening and stabilizing characteristics, thereby enhancing the functionality and texture of personal care products. The growth in the regional economy, especially in emerging markets, is accelerating the spending by consumers on personal care products, which is propelling the demand for palmitic acid in the region.

Middle East and Africa Palmitic Acid Market Analysis

In the Middle East and Africa, the growing demand for biofuels is fueling the use of palmitic acid, which is one of the key growth drivers for the industry. According to industry reports, the United Arab Emirates plans to invest USD 13.5 Billion in Brazilian biofuels. Palmitic acid is widely used in the production of biodiesel as a key feedstock. Therefore, with the growing popularity of biofuels due to the sustainability factor and the greener alternative, demand for palmitic acid rises. In addition to this, growing energy requirements in the region, coupled with the focus on sustainable energy solutions, lead to a greater focus on renewable biofuels and, hence, on palmitic acid. With more biofuels being generated in the region, the use of palmitic acid is also on the upswing.

Competitive Landscape:

The competition in the palmitic acid market is led by the presence of various global and regional players competing on product development, capacity expansion, and strategic alliances. Companies are compelled towards sustainable production methods, such as palm oil-free, to meet growing environmental and regulatory pressures. The industry is reasonably fragmented, and leading players use advanced manufacturing technology to improve product quality and serve different end-user industries, such as the food, cosmetics, pharmaceuticals, and industrial segments. Volatility in raw material prices and stringent environmental regulations compel companies towards effective supply chain management and green sourcing practices. Increased research and development (R&D) investment in bio-based alternatives and specialty applications is also a competitive driver. Growing consumer interest in natural ingredients is a key driver of competitive pressure, and manufacturers are compelled to invest in green and high-purity products to remain market-relevant.

The report provides a comprehensive analysis of the competitive landscape in the palmitic market with detailed profiles of all major companies, including:

- Acme Synthetic Chemicals

- BASF SE

- Caila & Pares S.A.

- Godrej Industries Limited (Godrej Group)

- IOI Oleochemical (IOI Corporation Berhad)

- Kao Corporation

- KLK Oleo (Kuala Lumpur Kepong Berhad)

- Musim Mas Group

- Pacific Oleochemicals Sdn Bhd

- PMC Group, Inc.

- P.T. Cisadane Raya Chemicals

- P.T. Sumi Asih

- VVF Limited

- Wilmar International Ltd

Latest News and Developments:

- September 2024: Volac Wilmar Feed Ingredients has launched Mega-Fat 70, a new rumen-protected fat formulation featuring 70% palmitic acid and 20% oleic acid. The product provides key benefits for dairy diets, with palmitic acid boosting milk fat and oleic acid enhancing body condition, fertility, and digestibility. Mega-Fat 70 is positioned as a versatile option within the Megalac range.

- July 2024: Godrej Industries' Chemicals Business signed a transfer agreement to purchase the Ethoxylation Unit II in Kheda from Shree Vallabh Chemicals. This acquisition will enhance their product range, particularly in oleochemicals, by incorporating Ethoxylation technology. The move supports its growth and innovation strategy, with a focus on expanding applications for products like palmitic acid. The deal is expected to drive cost synergies and accelerate investment timelines.

- January 2024: Checkerspot, a biotech firm and Certified B Corporation™, announced a breakthrough in creating a human milk fat copy OPO (Oleic-Palmitic-Oleic) using microalgae fermentation. This new method allows precise placement of fatty acids, including palmitic acid, at specific spots on the glycerol backbone. The new OPO source offers a more accurate match to human milk fats for baby nutrition. This advancement addresses the challenge of mimicking the fatty acid profile of human milk using conventional oils in infant formula.

- February 2022: Fairchem Organics is expanding its production capacity to 120,000 MTPA by the end of FY22, focusing on oleo chemicals like Palmitic Acid. This increase follows a prior expansion from 45,000 MTPA to 72,000 MTPA in FY21. Palmitic Acid is a key product in the company's portfolio, alongside Dimer and Linoleic Acids. Fairchem aims to integrate operations further, emphasizing value addition and bio-fuel manufacturing.

- September 2021: Bunge Loders Croklaan (BLC) launched Betapol Organic, an approved organic oleic-palmitic-oleic (OPO) component for baby milk formula in China and Europe. The product mimics the lipid structure of human breast milk, focusing on palmitic acid in the SN-2 position. Clinical studies show that this OPO structure improves energy intake, reduces constipation, and enhances bone density and gut health. BLC's portfolio includes various OPO products tailored to specific market needs.

Palmitic Acid Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Distilled Type, Fractionated type |

| Applications Covered | Soap and Detergent, Personal Care and Cosmetics, Grease and Lubricant, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acme Synthetic Chemicals, BASF SE, Caila & Pares S.A., Godrej Industries Limited (Godrej Group), IOI Oleochemical (IOI Corporation Berhad), Kao Corporation, KLK Oleo (Kuala Lumpur Kepong Berhad), Musim Mas Group, Pacific Oleochemicals Sdn Bhd, PMC Group, Inc., P.T. Cisadane Raya Chemicals, P.T. Sumi Asih, VVF Limited, Wilmar International Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the palmitic acid market from 2019-2033.

- The palmitic acid market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the palmitic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The palmitic acid market was valued at USD 259.83 Million in 2024.

The palmitic acid market is projected to exhibit a CAGR of 2.24% during 2025-2033, reaching a value of USD 322.51 Million by 2033.

The market is driven by increasing demand in the food, cosmetics, and pharmaceutical industries due to its emulsifying and surfactant properties. Additionally, the growing use in biodiesel production and the expanding personal care sector further fuel market growth. Rising industrial applications and expanding research on sustainable sources also contribute to demand.

Europe currently dominates the palmitic acid market, accounting for a share of 34.8% in 2024. The dominance is fueled by stringent regulations promoting sustainable ingredients, and the region’s advanced industrial base supporting high consumption in food processing and manufacturing.

Some of the major players in the palmitic acid market include Acme Synthetic Chemicals, BASF SE, Caila & Pares S.A., Godrej Industries Limited (Godrej Group), IOI Oleochemical (IOI Corporation Berhad), Kao Corporation, KLK Oleo (Kuala Lumpur Kepong Berhad), Musim Mas Group, Pacific Oleochemicals Sdn Bhd, PMC Group, Inc., P.T. Cisadane Raya Chemicals, P.T. Sumi Asih, VVF Limited, and Wilmar International Ltd, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)