Paneer Market in India Size, Share, Trends and Forecast by Sector and Region, 2025-2033

Paneer Market in India Size and Share:

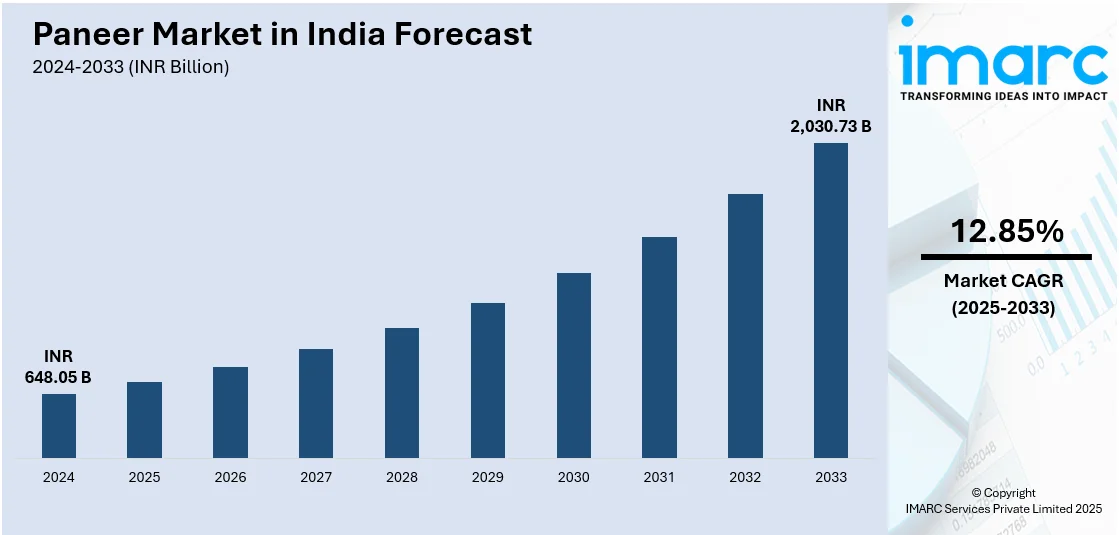

The paneer market in India size was valued at INR 648.05 Billion in 2024. Looking forward, IMARC Group estimates the market to reach INR 2,030.73 Billion by 2033, exhibiting a CAGR of 12.85% from 2025-2033. The market is growing due to rising vegetarian population, expanding retail sectors, and product innovations. Besides this, the market share in India is driven by increasing demand for organic, low-fat, and fortified paneer. Quick service restaurants (QSRs) and e-commerce platforms enhance accessibility, while improved packaging technologies ensure freshness, extending shelf life and reducing wastage in distribution channels.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 648.05 Billion |

|

Market Forecast in 2033

|

INR 2,030.73 Billion |

| Market Growth Rate 2025-2033 | 12.85% |

India’s rising vegetarian population is significantly catalyzing the demand for paneer as a primary protein source. Many Indian households prefer vegetarian diets, making paneer a staple in daily meals. Traditional Indian cuisine heavily incorporates paneer in curries, snacks, and festive dishes, driving consistent demand. Religious and cultural practices among Hindus, Jains, and certain Sikh communities encourage vegetarian food consumption. The increasing awareness about plant-based nutrition is encouraging consumers to adopt protein-rich vegetarian options like paneer. Growing health consciousness is leading to a preference for high-protein, low-carbohydrate foods, strengthening paneer’s market position. Urbanization and busy lifestyles are increasing reliance on packaged paneer for convenient home-cooked meals. Food delivery apps are driving home consumption of paneer through easy accessibility and fast service options. Hotels and catering services are incorporating more paneer dishes to cater to vegetarian guests.

To get more information on this market, Request Sample

Product innovations are significantly expanding paneer market share in India by offering diverse and value-added varieties. Dairy companies are introducing organic paneer to cater to health-conscious and premium segment consumers. Low-fat and high-protein paneer variants are gaining popularity among fitness enthusiasts and weight-conscious individuals. Flavored paneer options like spicy, herbed, and smoked varieties are attracting younger and experimental consumers. Ready-to-cook (RTC) marinated paneer is simplifying meal preparation, driving demand among urban working professionals. Fortified paneer with added vitamins and minerals is addressing nutritional deficiencies in different consumer groups. Advanced packaging technologies are improving paneer’s shelf life, reducing spoilage, and ensuring better freshness. Vacuum-sealed and nitrogen-flushed packaging is maintaining texture, taste, and hygiene standards for extended storage. Lactose-free paneer options are enabling dairy-sensitive consumers to enjoy protein-rich paneer-based meals, which represents a key factor propelling the market growth.

Paneer Market in India Trends:

Expanding dairy industry

India’s growing dairy sector is notably driving the paneer market by guaranteeing a consistent milk supply. According to BAHS 2024, the country's overall milk production reached 239.30 million tons in 2023-24, indicating a 5.62% increase over the last ten years from 146.3 million tons in 2014-15. Furthermore, production rose by 3.78% in 2023-24 in relation to 2022-23. Large dairy farms and cooperatives are increasing milk output through improved breeding and feeding methods. Enhanced cold chain infrastructure is minimizing waste and guaranteeing high-quality milk for paneer manufacturing. Government measures, such as subsidies and incentives are enhancing the dairy industry and aiding paneer producers. Structured dairy companies are increasing their production capabilities to satisfy the rising demand for paneer. Contemporary processing technologies are improving yield, texture, and shelf life, thereby enhancing product quality and uniformity. Heightened investment in dairy farming is aiding small and medium businesses in paneer production. Increasing use of automated processing units is facilitating efficient large-scale manufacturing with reduced human involvement. Enhanced distribution networks are guaranteeing accessibility in supermarkets, hypermarkets, and online grocery services throughout India.

Growth of quick service restaurants (QSRs)

The rapid expansion of quick service restaurants (QSRs) in India is increasing demand for milk-based dishes like paneer. Popular QSR chains are incorporating milk products in burgers, wraps, pizzas, sandwiches, ice-creams and coffee to attract vegetarian customers. To cater this demand, in January 2025, Third Wave Coffee, a coffee-focused QSR brand, is strengthening its retail presence in India by launching its 125th café, making its debut in Chennai. This expansion aligns with its strategy to grow in India's retail market. Additionally, rising disposable incomes and urbanization are driving consumer preference for convenient, restaurant-style paneer meals. Global fast-food brands are localizing menus with paneer options to cater to Indian taste preferences. Cloud kitchens and food delivery platforms are accelerating paneer consumption through quick and affordable meal options. Growth of franchise-based QSR models is expanding paneer’s reach in tier-2 and tier-3 cities. Increasing mall culture and multiplexes are driving footfall in QSRs, influencing sales of paneer-based snacks. Street food-inspired QSR chains are using paneer in fusion dishes, enhancing its popularity among younger consumers. Food aggregators are supporting QSRs in delivering paneer meals quickly to customers.

Rising number of e-commerce and retail platforms

The rising number of e-commerce and retail platforms in India is expanding consumer access to packaged paneer. Online grocery platforms are ensuring doorstep delivery of fresh paneer. According to IBEF, India's e-commerce industry is expected to reach US$ 325 billion by 2030, demonstrating substantial growth. Digital payments and easy checkout processes are simplifying paneer purchases through e-commerce channels. Increasing smartphone penetration and internet usage are encouraging consumers to buy paneer online conveniently. Discount offers, cashback deals, and subscription models are making online paneer shopping more attractive. Cold chain logistics and improved packaging technologies are ensuring the freshness and shelf life of paneer. Retail chains are expanding their dairy sections to include premium paneer varieties. Growth of modern trade stores is increasing shelf space for branded and value-added paneer products. Organized retail formats are allowing dairy brands to showcase multiple paneer variants including organic and flavored options. Private-label paneer brands by major retailers are offering competitive pricing, which further influences consumer adoption.

Paneer Market in India Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the paneer market in India market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on sector.

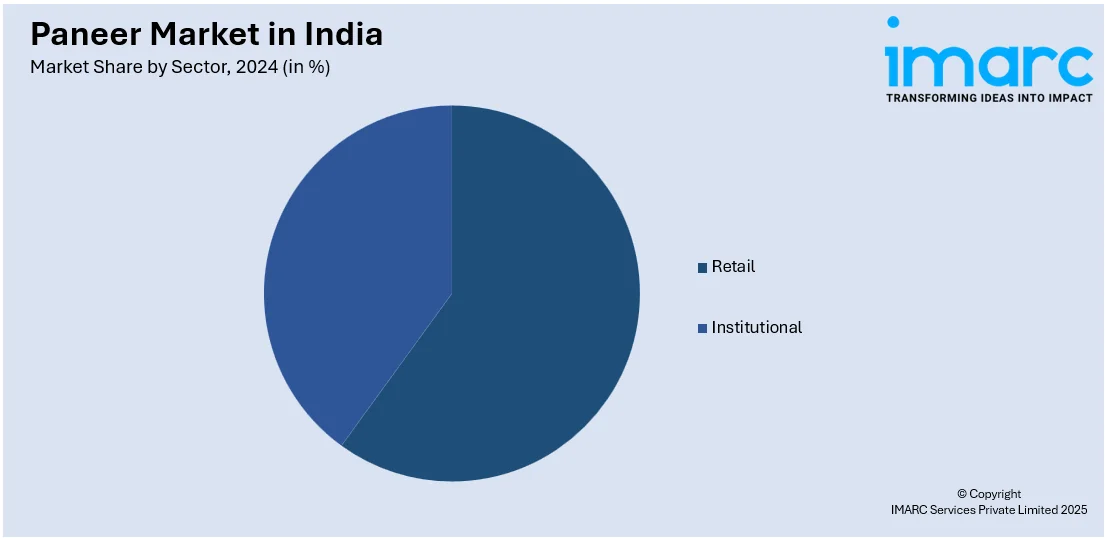

Analysis by Sector:

- Retail

- Institutional

The retail sector dominates India's paneer market due to strong consumer preference for packaged and branded paneer. Growing urbanization and rising disposable incomes are increasing demand for convenient, hygienically processed paneer. Supermarkets, hypermarkets, and local grocery stores are expanding their dairy sections, ensuring easy availability of fresh paneer. The emergence of organized retail chains is improving product visibility and accessibility. E-commerce platforms are driving online paneer sales through doorstep delivery and discount offers. Modern cold chain logistics and advanced packaging technologies are extending the shelf life of paneer, making retail distribution more efficient. Consumers are shifting from unbranded to branded paneer due to concerns over food safety and adulteration. Private-label brands launched by retail chains are offering competitive pricing, increasing consumer adoption of packaged paneer. Promotions, loyalty programs, and bundling strategies are further influencing retail paneer sales. Rural penetration of organized retail stores is increasing access to branded paneer in smaller towns.

Regional Analysis:

- Karnataka

- Maharashtra

- Tamil Nadu

- Delhi

- Gujarat

- Andhra Pradesh and Telangana

- Uttar Pradesh

- West Bengal

- Kerala

- Haryana

- Punjab

- Rajasthan

- Madhya Pradesh

- Bihar

- Orissa

Uttar Pradesh leads India’s paneer market due to high milk production and strong dairy industry presence. The state has a well-developed network of dairy cooperatives, ensuring a consistent supply of fresh milk for paneer production. Major dairy players like strong distribution channels across Uttar Pradesh. A large vegetarian population and cultural preference for dairy-based diets drive significant paneer consumption in the region. Traditional cuisine in Uttar Pradesh heavily incorporates paneer in daily meals, increasing household demand. Growing urbanization and rising disposable incomes are further catalyzing the demand for packaged paneer. Expanding modern retail infrastructure including supermarkets and hypermarkets, is making branded paneer more accessible. Government initiatives supporting dairy farming, such as subsidies and improved milk procurement systems, are strengthening the supply chain. Presence of large wholesale markets enables efficient distribution of paneer to the neighboring states. Increasing penetration of quick service restaurants (QSRs) and food delivery platforms is further influencing demand. The rise of organized dairy farms and cold storage facilities is improving paneer production and quality standards, consequently strengthening the market growth across the region.

Competitive Landscape:

Leading dairy brands are ensuring consistent supply of high-quality paneer. Organized dairy companies are implementing advanced processing technologies to enhance texture, shelf life, and nutritional value. Strategic pricing and promotional campaigns are making branded paneer more appealing to urban and rural consumers. Investments in cold chain infrastructure are maintaining paneer’s freshness during storage, transportation, and retail distribution. Expansion of production facilities is increasing supply to meet the growing demand across multiple regions. Private-label brands through their retail chains are offering affordable alternatives, expanding consumer choices in the market. Collaborations with e-commerce platforms are ensuring easy accessibility and convenient delivery of fresh paneer. In May 2024, Creamline Dairy Products, a subsidiary of Godrej Agrovet, launched 'Godrej Jersey My Farm,' a premium milk brand for Hyderabad consumers. Priced at ₹100 per liter, it is produced using a fully automated, zero human-touch process to ensure hygiene and freshness. Currently available in 70 stores and via quick-commerce platforms, the company plans to expand to 500 modern trade stores by year-end and introduce an ordering app. Moreover, key players are launching organic, low-fat, and flavored paneer variants to cater to health-conscious consumers.

The report provides a comprehensive analysis of the competitive landscape in the paneer market in India with detailed profiles of all major companies.

Latest News and Developments:

- November 2024: Ananda Dairy introduced India’s first paneer spread, offering a new way to enjoy the creamy texture of paneer. This patented product reflects the company’s commitment to innovation, health, and taste.

- August 2024: Amul launched a high-protein product range to address India's protein gap. Offerings include buttermilk and lassi, a blueberry shake, high protein dahi, and paneer. It also introduced the world’s highest protein milk.

Paneer Market in India Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion INR, Million Kg |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Retail Sector, Institutional Sector |

| Regions Covered | Karnataka, Maharashtra, Tamil Nadu, Delhi, Gujarat, Andhra Pradesh and Telangana, Uttar Pradesh, West Bengal, Kerala, Haryana, Punjab, Rajasthan, Madhya Pradesh, Bihar, Orissa |

| Companies Covered | GCMMF, Parag Milk Foods, Mother Dairy, Rajasthan Cooperative Dairy Federation Limited, VRS Foods Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the paneer market in India from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the paneer market in India market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the paneer market in India industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The paneer market in India was valued at INR 648.05 Billion in 2024.

The paneer industry in India is growing due to rising vegetarian populations, increasing health consciousness, and expanding dairy industries. Organized retail and e-commerce platforms enhance accessibility, driving branded paneer consumption. Quick service restaurants (QSRs) and food delivery services drive demand for ready-to-cook and innovative paneer products. Advancements in packaging technology improve shelf life, ensures better distribution. Government support for dairy farming strengthens milk supply for large-scale paneer production.

The paneer market in India is projected to exhibit a CAGR of 12.85% during 2025-2033, reaching a value of INR 2,030.73 Billion by 2033.

The retail sector accounted for the largest share in India’s paneer market due to strong consumer demand for packaged products. Rapid urbanization, higher disposable incomes, and evolving dietary preferences are boosting retail sales. Supermarkets, hypermarkets, and e-commerce platforms ensure easy availability, influencing branded paneer consumption. Growing health consciousness encourages consumers to choose hygienically processed, organic, and low-fat variants.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)