Panthenol Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Panthenol Price Trend, Index and Forecast

Track the latest insights on panthenol price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Panthenol Prices Outlook Q3 2025

- Canada: USD 13.1/KG

- China: USD 18.8/KG

- France: USD 11.7/KG

- Thailand: USD 7.61/KG

- Brazil: USD 9.43/KG

Panthenol Price Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the third quarter of 2025, the panthenol prices in Canada reached 13.1 USD/KG in September. Prices moved upward as stronger demand from personal care and healthcare manufacturers encouraged more consistent procurement. Distributors adopted tighter inventory practices, and logistical costs shaped supply planning through the quarter, supporting firmer commercial activity.

During the third quarter of 2025, the panthenol prices in China reached 18.8 USD/KG in September. The slight decrease reflected comfortable stock levels across downstream users, who moderated their purchasing. Stable production ensured continued availability, while softer export momentum left more material for the domestic market and encouraged competitive supplier positioning.

During the third quarter of 2025, the panthenol prices in France reached 11.7 USD/KG in September. Prices trended lower as personal care manufacturers slowed intake and distributors managed healthy inventories. Steady import arrivals supported balanced supply, and procurement remained measured as market participants focused on optimizing stock rotation.

During the third quarter of 2025, the panthenol prices in Thailand reached 7.61 USD/KG in September. A mild easing occurred as end users maintained stable inventory positions and followed cautious buying cycles. Regional import flows were predictable, contributing to smooth availability and allowing downstream manufacturers to pace purchases steadily.

During the third quarter of 2025, the panthenol prices in Brazil reached 9.43 USD/KG in September. Prices moved upward due to intermittent import delays that tightened availability for formulators. Currency-driven cost adjustments affected landed expenses, and the personal care sector maintained firm consumption, supporting more active supply chain engagement.

Panthenol Prices Outlook Q2 2025

- Canada: USD 12.7/KG

- China: USD 19.1/KG

- France: USD 12.0/KG

- Thailand: USD 7.6/KG

- Brazil: USD 9.3/KG

During the second quarter of 2025, panthenol prices in Canada reached 12.7 USD/KG in June. Panthenol prices exhibited moderate stability, with minor fluctuations influenced by changes in raw material and energy costs. Upstream supply remained consistent, although global shipping delays and regional logistics adjustments led to slight pricing pressure. Demand from the cosmetics, personal care, and pharmaceutical sectors remained steady, supporting overall market balance. Regulatory conditions and formulation trends also contributed to stable procurement activity. While external factors introduced occasional volatility, the Canadian market maintained a cautiously firm pricing sentiment throughout the quarter.

During the second quarter of 2025, panthenol prices in China reached 19.1 USD/KG in June. Panthenol prices in China experienced a gradual downward trend, primarily driven by an oversupply in the domestic market and reduced export activity. Weaker demand from the personal care and pharmaceutical sectors contributed to easing procurement pressure across major production hubs. While upstream costs remained relatively stable, market participants observed increased inventory levels that weighed on pricing. Export uncertainties and cautious buying behavior further impacted overall sentiment. Despite stable raw material availability, the market maintained a moderately soft tone throughout the quarter, reflecting a supply-demand imbalance and restrained consumption trends.

During the second quarter of 2025, panthenol prices in France reached 12.0 USD/KG in June. Panthenol prices remained relatively steady, with mild softness due to effective logistics and consistent import channels from China. Demand from personal care and pharmaceutical manufacturers stayed stable, supporting balanced procurement. At the same time, freight charges and geopolitical uncertainty impacted broader European sourcing, French buyers adapted by optimizing their supply contracts. Overall market sentiment was cautiously positive, reflecting moderate supply-demand equilibrium and reliable production inputs.

During the second quarter of 2025, panthenol prices in Thailand reached 7.6 USD/KG in June. Panthenol prices displayed stable momentum, supported by regular domestic and regional sourcing. Local demand from the cosmetics, healthcare, and dietary supplement sectors remained strong. The market remained responsive to global feedstock dynamics and upstream cost trends, which introduced minor price variations. Overall, pricing conditions remained steady, underpinned by efficient supply chains and consistent downstream consumption.

During the second quarter of 2025, panthenol prices in Brazil reached 9.3 USD/KG in June. Panthenol prices in Brazil maintained a balanced trend, driven by steady demand across the cosmetics, pharmaceuticals, and food & beverage industries. Supply was reliably sustained through imports and domestic distribution networks. While changes influenced procurement costs in freight and regional trade flows, the overall market maintained equilibrium. Sentiment stayed stable, reflecting ongoing consumption trends and supportive supply infrastructure.

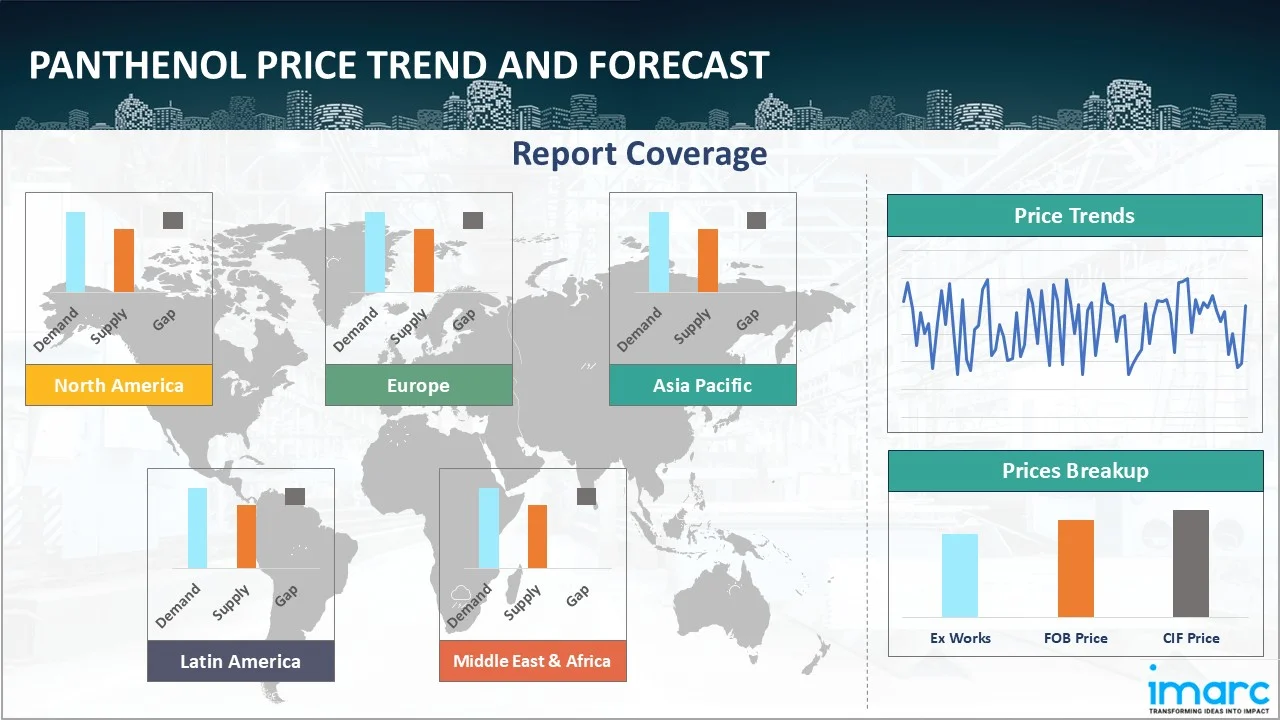

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing the panthenol prices.

Europe Panthenol Price Trend

Q3 2025:

As per the panthenol price index, Europe experienced softer conditions this quarter, consistent with the decline reported in France. Demand from cosmetic laboratories and contract manufacturers in Western Europe eased as brands focused on inventory rationalization following earlier production expansions. In Central Europe, importers faced stable but lengthier lead times due to congestion at major logistics hubs, although supply was not disrupted. Southern European formulators temporarily reduced call-offs as tourist-season–driven manufacturing cycles shifted toward finished goods rather than ingredient procurement. Eastern European buyers benefited from increased product availability through Baltic and Northern port routes. Overall, pricing reflected a calm environment shaped by moderated operating rates and well-supplied distribution networks.

Q2 2025:

In Europe, panthenol prices exhibited moderate fluctuations, driven by variable feedstock costs and regional energy price pressures. Markets such as Germany, France, and Italy experienced steady demand from cosmetic and dermatological product manufacturers, which helped stabilize prices. However, supply-side adjustments and regulatory compliance costs added mild volatility. Despite this, the overall pricing environment remained stable, supported by predictable consumption trends and efficient inventory management across the region’s key manufacturing hubs.

This analysis can be extended to include detailed panthenol price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Panthenol Price Trend

Q3 2025:

As per the panthenol price index, North America showed an upward trajectory this quarter, consistent with rising prices in Canada. Demand strengthened across the United States and Canada as contract manufacturers ramped up production for premium skincare and OTC formulations ahead of seasonal launches. Procurement cycles became more active, particularly among facilities along the U.S. East Coast where lead times tightened due to congested inbound container traffic. In the Midwest, several formulators raised ingredient intake to secure supply before scheduled maintenance at key blending plants. Rising trucking and regulatory compliance costs added pressure to distribution. Overall, upward pricing reflected firm demand and more complex logistics across the region.

Q2 2025:

In North America, panthenol prices remained relatively stable throughout, with mild upward adjustments due to increasing energy costs and fluctuations in raw material availability. Steady demand from personal care and pharmaceutical manufacturers supported pricing consistency, particularly in the U.S. and Canada. While logistical costs remained manageable, occasional delays had a slight impact on the short-term supply flow. Overall, the market maintained a balance between supply and demand, with prices largely tracking movements in input costs and consistent end-use consumption across the region.

Specific panthenol historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Panthenol Price Trend

Q3 2025:

As per panthenol price chart, the prices in the Middle East and Africa fluctuated due to a complex interplay of factors, primarily driven by supply chain disruptions, seasonal demand shifts, and geopolitical influences.

Q2 2025:

The report explores the panthenol pricing trends and panthenol price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

In addition to region-wise data, information on panthenol prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Panthenol Price Trend

Q3 2025:

Panthenol prices in Asia Pacific trended lower this quarter, reflecting declines in China and Thailand. In China, domestic producers operated with steady output while downstream cosmetic manufacturers lowered intake amid subdued retail momentum. South Korea and Japan balanced production with existing inventory, moderating ingredient procurement. Southeast Asian markets, including Vietnam and Malaysia, saw consistent import arrivals from China, which maintained ample regional availability. South Asian formulators continued to source through established distribution channels, benefiting from shorter lead times. Across the region, softened demand and reliable supply chains created a broadly easing price environment.

Q2 2025:

In the Asia Pacific region, panthenol prices exhibited a slight upward trend, driven by increasing costs of feedstock chemicals and energy inputs. Prices remained largely stable across major markets, including China, India, and South Korea, with only minor fluctuations resulting from regional adjustments to the supply chain. Consistent demand from the cosmetics and pharmaceutical sectors contributed to a steady pricing environment. Market dynamics reflected balanced supply and consumption trends, keeping panthenol pricing aligned with production costs and ongoing industrial activity in the region.

This panthenol price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Panthenol Price Trend

Q3 2025:

Panthenol prices in Latin America moved upward this quarter, driven primarily by firmer conditions in Brazil. Brazilian formulators experienced intermittent delays at major ports, tightening the flow of imported material. This prompted more assertive booking activity across local cosmetics and haircare producers. In the Andean region, distributors faced variable freight surcharges due to shifting container availability, while MERCOSUR economies experienced less stable supply owing to elongated transit times from Asia. Despite these dynamics, downstream demand for skincare and pharmaceutical preparations remained steady, supporting firmer pricing across multiple sub-regions.

Q2 2025:

In Latin America, panthenol prices remained relatively stable during the second quarter of 2025, supported by steady demand from the cosmetics, pharmaceutical, and personal care sectors. Key markets, such as Brazil, Mexico, and Argentina, observed minor price variations, primarily influenced by import dynamics and regional logistics costs. Supply chains functioned efficiently, ensuring consistent availability across distribution channels. Market sentiment stayed balanced, with pricing aligned to input cost trends and sustained downstream consumption. Overall, the region maintained a steady pricing environment with no major disruptions during the quarter.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Panthenol Pricing Report, Market Analysis, and News

IMARC's latest publication, “Panthenol Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the panthenol market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of panthenol at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed panthenol prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting panthenol pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Panthenol Industry Analysis

The global panthenol industry size reached USD 198.72 Million in 2025. By 2034, IMARC Group expects the market to reach USD 266.74 Million, at a projected CAGR of 3.33% during 2026-2034. The market benefits from rising consumption in personal care, haircare, and pharmaceutical formulations, driven by growing demand for moisturizing, barrier-enhancing, and soothing ingredients. Expanding applications in high-purity clinical products and broader adoption in dermatological lines also contribute to sustained global growth.

Latest News and Developments:

- April 2025: K-beauty brand Etude launched its ‘Soonjung Director’s Tone-up Sun Cream’ in the Indian market, marking an expansion of its skincare portfolio with a focus on sun protection. Formulated with panthenol and madecassoside, this sun cream aims to soothe irritated skin while delivering long-lasting hydration.

- October 2024: Korean beauty brand COSRX unveiled its latest skincare innovation, The Alpha-Arbutin 2 Skin Discoloration Serum, featuring a unique formulation that includes panthenol, among other powerful ingredients. The new serum targets skin discoloration, fading dark spots, and post-inflammatory hyperpigmentation while nurturing sensitive skin.

Product Description

Panthenol, also known as provitamin B5, is a derivative of pantothenic acid and is widely recognized for its hydrating, healing, and soothing properties. It is commonly used in skincare, haircare, and pharmaceutical formulations due to its ability to deeply penetrate the skin and hair, where it is converted into pantothenic acid.

Panthenol enhances moisture retention, promotes skin elasticity, and improves the texture and strength of hair. It helps relieve irritation, supports wound healing, and strengthens the skin barrier. Found in a wide range of products, including creams, lotions, shampoos, conditioners, and topical ointments, panthenol is valued for its non-irritating and gentle nature. Its ability to promote regeneration and improve softness makes it ideal for daily personal care.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Panthenol |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Panthenol Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of panthenol pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting panthenol price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The panthenol price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)