Paper Board Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Paper Board Price Trend, Index and Forecast

Track real-time and historical paper board prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Paper Board Prices January 2026

| Region | Price (USD/Kg) | Latest Movement |

|---|---|---|

| Northeast Asia | 0.23 | Unchanged |

| Europe | 0.25 | Unchanged |

| India | 0.25 | -3.8% ↓ Down |

| Southeast Asia | 0.32 | Unchanged |

| North America | 0.15 | -6.3% ↓ Down |

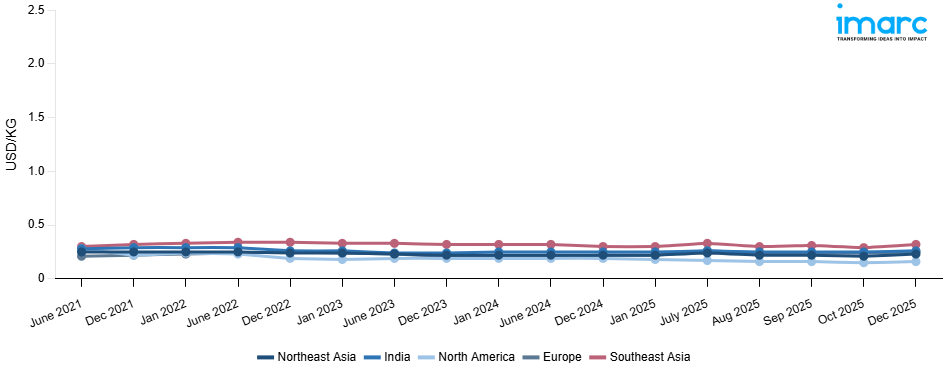

Paper Board Price Index (USD/KG):

The chart below highlights monthly paper board prices across different regions.

Get Access to Monthly/Quarterly/Yearly Prices, Request Sample

Market Overview Q3 Ending September 2025

Northeast Asia: A key factor was softer demand from downstream packaging sectors, especially in export‑oriented manufacturing hubs facing weak global orders. On the supply side, several mills in China and South Korea ran with stable or higher utilization to clear inventories, leading to increased throughput and some competitive pricing. Input costs, especially pulp and energy, remained relatively stable, which limited the upward cost push. However, logistics costs, port handling, and inland transport in regions like Japan and coastal China saw mild volatility due to congestion and shipping rate fluctuations, which created some localized cost burdens.

Europe: Europe’s paperboard pricing showed resilience, with an upward movement. Demand in key markets remained firm, sustained by stable consumption in the packaging, FMCG, and retail sectors. Many European brand owners continued to lean into higher‑quality folded cartonboard and coated grades, supporting premium pricing. On the supply side, pulp and recovered fiber costs increased somewhat due to tighter recycling availability and energy cost pressures, which fed into higher base costs. European mills also faced increases in electricity and gas costs, reflecting broader regional energy volatility, which constrained margin flexibility. Moreover, import competition from regions with lower cost structures was partly constrained by transportation costs and customs duties, giving local mills some pricing leverage.

India: India’s paperboard prices rose, reflecting robust domestic demand in e‑commerce packaging, FMCG secondary packaging, and pharmaceutical sectors. The demand side remained healthy as Indian consumers and retail expansion continued apace. On the supply side, some mills faced moderating raw material availability, pushing procurement costs upward. Energy and labor costs also rose during the quarter, compressing margins and pushing end prices. Domestically, logistics and inland freight costs (road, rail) also increased due to fuel inflation and constrained capacity, adding to cost pressure. Import duties and trade policy acted as partial price support for domestic producers. Currency depreciation pressures in some months added to import cost volatility for those mills reliant on imported pulp or chemicals.

Southeast Asia: Countries such as Thailand, Indonesia, Vietnam, and Malaysia saw renewed pickup in exports, food and beverage packaging demand, and e‑commerce logistics packaging. On the supply side, fiber and pulp imports faced shipping cost inflation, port handling surcharges, and occasional congestion delays, pushing input costs upward. Local mills often passed these increases downstream. Energy and chemical costs in Southeast Asia also trended upward, adding pressure. Moreover, some mills operated at constrained capacity due to scheduled maintenance or disruptions, limiting available supply. Several governments in the region also began encouraging local value addition of packaging, which reduced reliance on imports and supported stronger local pricing.

North America: North America experienced weakening paperboard prices, as reflected in the drop in September. Demand from e‑commerce and retail packaging softened compared to earlier quarters, partly due to high inflation and weaker consumer spending. Supply remained ample, with mills in the US and Canada operating at stable capacity and maintaining inventories. Recycled fiber costs declined in parts of 2025, relaxing cost pressures for paperboard producers, which gave a margin cushion. Some producers offered discounts or promotional pricing to maintain volumes in a sluggish demand environment. Transportation and logistics costs also eased slightly in some corridors, enabling cost pass‑throughs to soften price levels.

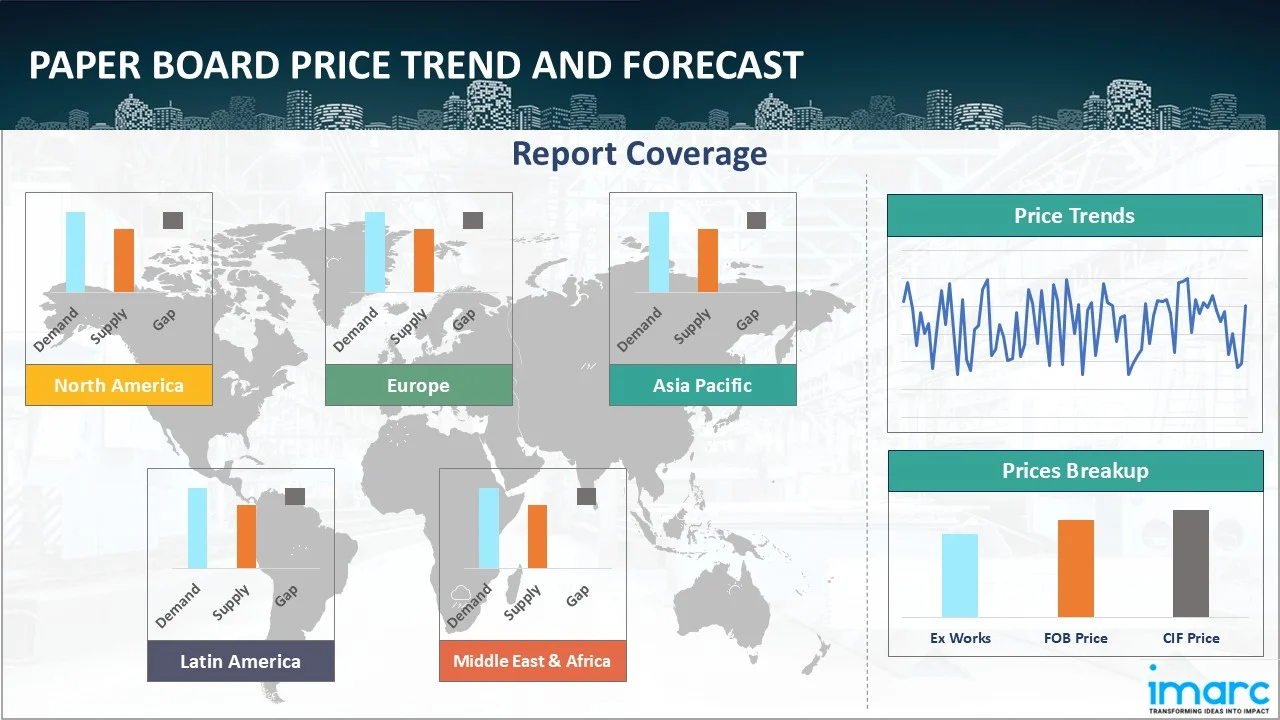

Paper Board Price Trend, Market Analysis, and News

IMARC's latest publication, “Paper Board Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the paperboard market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of paper board at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed paperboard prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting paperboard pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Paper Board Industry Analysis

The global paper board industry size reached USD 177.30 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 263.53 Billion, at a projected CAGR of 4.10% during 2026-2034. The market is driven by the rising e‑commerce and packaging demand, stricter regulatory push for sustainable and recyclable materials, growing demand from food, pharmaceutical and FMCG sectors, continuous innovation in specialty and barrier paperboard technologies, and increasing consumer preference for eco‑friendly packaging.

Latest developments in the Paper Board Industry:

- January 2025: International Paper received regulatory approval to acquire DS Smith in a landmark US–UK all-share transaction valued at approximately $7.2 billion. International Paper is seeking to boost its European presence in the paper and packaging sector.

- September 2024: Colpac launched its new Stagione Light product line, featuring lightweight, leak-resistant paperboard containers for food service applications. Made from FSC-certified, recyclable board, the single-piece packs include a grease-resistant barrier and are suitable for both hot and chilled foods. Designed to meet growing demand for sustainable, functional packaging in retail and takeaway sectors, the Stagione Light range offers enhanced shelf efficiency and end-user convenience.

Product Description

Paper Board is a thick, stiff paper-based substrate (typically 200–600 gsm) used as a structural board for cartons, packaging, displays, and rigid containers. It is positioned between paper and fiberboard in the global consumption hierarchy, valued for its balance of lightweight strength, printability, and recyclability. Paper Board finds widespread use in consumer packaging, point-of-sale displays, book covers, and rigid packaging. Its key defining attributes include stiffness, bending resistance, smooth printable surface, and dimensional stability. In usage, brands adopt paperboard to enhance consumer appeal through high-quality graphics while delivering structural integrity and environmentally friendly packaging performance, replacing plastics or heavier fiberboard solutions.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Paper Board |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Ammonium Perchlorate Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of paper board pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting paper board price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The paper board price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The paper board prices in January 2026 were 0.23 USD/Kg in Northeast Asia, 0.25 USD/Kg in Europe, 0.25 USD/Kg in India, 0.32 USD/Kg in Southeast Asia, and 0.15 USD/Kg in North America.

The paper board pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for paper board prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)