Patch Management Market Report by Component (Software, Services), Deployment (Cloud-Based, On-Premises), Enterprise Size (Small and Medium-Sized Enterprises, Large Enterprises), Vertical (Banking, Financial Services, And Insurance (BFSI), Information Technology (IT) and Telecom, Healthcare, Government and Defense, Retail, Education, and Others), and Region 2025-2033

Market Overview:

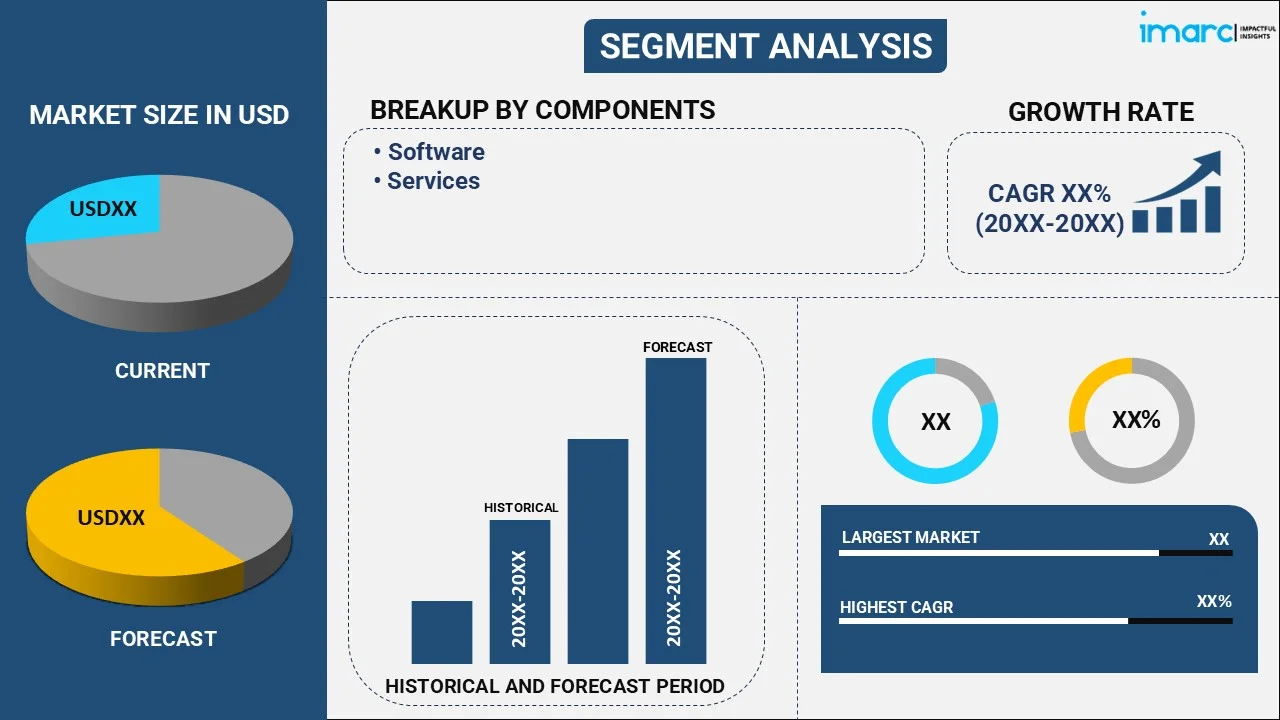

The global patch management market size reached USD 877.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,981.5 Million by 2033, exhibiting a growth rate (CAGR) of 9% during 2025-2033. The increasing concerns regarding cybersecurity threats among consumers, the growing complexity of information technology (IT) environments across the globe, and the presence of stringent regulatory compliance are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 877.2 Million |

| Market Forecast in 2033 | USD 1,981.5 Million |

| Market Growth Rate (2025-2033) |

9%

|

Patch management is a critical aspect of maintaining the security and functionality of computer systems, networks, and applications. It involves regularly monitoring for, testing, and applying available updates or patches to an organization's software, including operating systems and applications. These patches often fix security vulnerabilities, resolve software bugs, and provide enhancements to improve performance or add new features. Systems might be vulnerable to security risks including malware or hackers who take advantage of known flaws without proper patch management. Thus, numerous organizations use automated tools to streamline this process, ensuring timely and consistent application of updates, thereby improving system stability, reducing security risks, and maintaining compliance with relevant regulations.

The escalating importance and demand for patch management solutions majorly drives the global market. Since effective patch management is a fundamental component of a robust cybersecurity strategy, there has been a considerable rise in its adoption across the globe. Along with this, the rising complexity of IT environments, supported by the proliferation of diverse software applications and cloud-based services, makes manual patching time-consuming and prone to errors. Automated tools provide a solution, making the process more manageable and efficient, thereby contributing to the market. In addition, regulatory compliance is a crucial driver as various regulations and standards require organizations to demonstrate that they are maintaining the security of their IT systems, including keeping software up to date, further impacting the market favorably. Moreover, the shifting trend towards remote and flexible working, accelerated by the COVID-19 pandemic, has expanded the perimeter of IT networks, which is providing an impetus to the market.

Patch Management Market Trends/Drivers:

The Proliferation of Software Applications

The rapid expansion of software applications across various industries is one of the major drivers in the market. Organizations rely on a multitude of software products, including operating systems, business applications, and third-party software. Each of these applications requires regular updates and patches to address security vulnerabilities, bugs, and compatibility issues. The sector offers centralized updates that speed up software asset updates and guarantee complete software asset coverage. Additionally, governments and regulatory bodies across the globe are implementing stricter cybersecurity regulations and data protection laws that require organizations to impose proper security measures. The need for reliable systems is fueled by the possibility of harsh penalties and reputational harm for non-compliance, which is acting as a growth-inducing factor.

Increasing Consumer Awareness

With the rise in cybersecurity incidents and data breaches, there has been a significant increase in awareness regarding the importance of patch management. Businesses and individuals are more conscious of the risks associated with unpatched systems and the potential consequences of neglecting updates. This factor has led to a higher demand for these solutions as organizations prioritize proactive security measures. In addition, cybersecurity strategies have been reactive, focusing on incident response and mitigation after an attack occurs. Along with this, there is a growing shift towards proactive security measures to prevent attacks before they happen. It plays a vital role in this shift by enabling organizations to stay ahead of potential threats by identifying and remedying vulnerabilities before they are exploited.

Growing Integration with Vulnerability Management and Threat Intelligence

Cybercriminals often exploit known vulnerabilities in software systems to gain unauthorized access or launch attacks. Organizations that fail to patch their systems in a timely manner become prime targets for exploitation. High-profile security incidents have highlighted the importance of proactive patch management. The potential financial and reputational damage resulting from such exploits has significantly increased the demand for robust solutions. In confluence with this, patch management is closely linked to vulnerability management and threat intelligence practices. Vulnerability scanners and threat intelligence feeds identify and prioritize vulnerabilities and emerging threats, providing critical information for effective patch management. The integration of these three disciplines allows organizations to assess risks, prioritize patches, and respond to emerging threats in a timely and efficient manner.

Patch Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global patch management market report, along with forecasts at the global, regional, and country levels from 2025-2033 Our report has categorized the market based on component, deployment, enterprise size, and vertical.

Breakup by Component:

- Software

- Services

- Consulting

- Support and Integration

Software dominates the market

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services (consulting and support and integration). According to the report, software represented the largest segment.

The software segment is driven by the ever-increasing threats to cyber security and the need for vulnerability management. As organizations digitalize their operations, the need for robust security infrastructures, including regular software updates and patches, is escalating. Additionally, various industries are mandated by law to maintain certain levels of IT security, which includes up-to-date software patching. The high cost of neglecting patch management, both in terms of potential financial loss and reputational damage, further propels market growth.

Apart from this, the growing complexity of IT infrastructures due to the integration of new technologies, including AI and IoT, necessitates expert services to ensure effective patch management. In addition, organizations are outsourcing to focus more on their core competencies and alleviate the burden of in-house IT teams. The demand for managed services is particularly strong among small- and medium-sized enterprises (SMEs) that may lack the necessary in-house resources and expertise. Moreover, the rising trend of remote work models and bring your own device (BYOD) policies introduces new security vulnerabilities, further driving the need for professional services.

Breakup by Deployment:

- Cloud-based

- On-premises

Cloud-based hold the largest share in the market

A detailed breakup and analysis of the market based on the deployment has also been provided in the report. This includes cloud-based and on-premises. According to the report, cloud-based accounted for the largest market share.

The primary driver for cloud-based deployment in the industry is the cost-effectiveness of cloud solutions, which offer scalability and flexibility while eliminating the need for substantial capital expenditure on IT infrastructure. With cloud-based solutions, businesses can efficiently manage patches across various systems without the need for extensive hardware investments. Additionally, the increasing adoption of remote working and BYOD policies necessitates cloud-based solutions that allow patch management across geographically distributed and diverse device environments. Moreover, the growing acceptance and trust in cloud security, along with the rising need for real-time threat intelligence and faster response times, further influences the market for cloud-based solutions.

On the other hand, on-premises deployment in the industry is driven by the need for greater control over data and infrastructure. Organizations dealing with sensitive information, especially in sectors, including finance, healthcare, and government, often prefer on-premises solutions due to stringent regulatory requirements and concerns over data privacy in the cloud. In addition, the ability to customize and tailor on-premises solutions to fit specific organizational needs and infrastructures is another growth-inducing factor for choosing this deployment model in the industry.

Breakup by Enterprise Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises dominate the market

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium-sized enterprises and large enterprises. According to the report, large enterprises represented the largest segment.

The growing complexity of IT infrastructure in large organizations, which necessitates robust and efficient systems is significantly supporting the market. This complexity is increasing with the incorporation of new technologies, such as cloud services, AI, and IoT devices, which further expand the potential vulnerability landscape. Additionally, the high stakes of potential data breaches in large enterprises, both financially and reputationally, underscore the necessity for rigorous patch management. Moreover, large enterprises often have global operations, which implies compliance with different regional and country-specific data protection and privacy laws. In confluence with this, large enterprises are increasingly adopting digital transformation strategies, which involve updating legacy systems and implementing new digital tools, creating an ongoing need for effective patch management.

On the other hand, the market in small and medium-sized enterprises (SMEs) is driven by the growing threat landscape. Additionally, SMEs often lack the in-house resources and expertise to manage and deploy patches, driving the demand for easy-to-use and cost-effective solutions. The rise of cloud-based and as-a-service solutions has made patch management more accessible and affordable for SMEs. In addition, the increasing awareness of the financial and reputational risks associated with data breaches is prompting SMEs to invest more in their cyber security infrastructure.

Breakup by Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology (IT) and telecom

- Healthcare

- Government and Defense

- Retail

- Education

- Others

Banking, financial services, and insurance (BFSI) hold the largest share in the market

A detailed breakup and analysis of the market based on the vertical has also been provided in the report. This includes banking, financial services, and insurance (BFSI), information technology (IT) and telecom, healthcare, government and defense, retail, education, and others. According to the report, BFSI accounted for the largest market share.

The market in the BFSI vertical is driven by the highly sensitive nature of data handled by these industries necessitates robust cybersecurity measures. Regulatory compliance is another major driver, as these sectors are highly regulated with stringent data security and privacy requirements. Non-compliance can result in severe penalties and reputational damage. Furthermore, the trend of digital transformation in BFSI, including the adoption of digital banking, online insurance platforms, and fintech applications, increases the complexity of IT infrastructure, increasing the need for effective solutions.

On the other hand, the nature of IT and telecom industries involves the handling and storage of vast amounts of data, which makes them high-value targets for cyber-attacks. This necessitates robust security measures, including strong patch management. The continuous innovation in these sectors, which often leads to the integration of the latest technologies, increases the potential vulnerability landscape and necessitates a constant process of patching and updating systems. Moreover, regulatory compliance demands, particularly regarding data protection and privacy, drive these sectors to ensure their systems are updated and secure.

With the growing number of cyber-attacks targeting the healthcare industry, maintaining up-to-date systems is crucial to safeguard patient data. Additionally, the healthcare sector is subject to stringent regulatory requirements, which mandates rigorous data security standards, including effective solutions. The growing adoption of digital health technologies, including telehealth platforms, electronic health records (EHRs), and IoT medical devices, further increases the complexity of IT infrastructure in healthcare, thereby amplifying the need for efficient patch management.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest patch management market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

The industry in North America is driven by the growing threat of cyberattacks, coupled with the increasing digitization of businesses and services. The presence of numerous global corporations and tech companies, with complex IT infrastructures and substantial digital assets, further increases the product demand. North America also hosts several heavily regulated industries, such as healthcare, finance, and government, where regulatory compliance related to data security is a key driver. The region also witnesses high adoption rates of new technologies, including AI, IoT, and cloud computing, which increase the complexity of IT environments and potential vulnerabilities. Moreover, the heightened awareness about the cost and reputational implications of data breaches, spurred by high-profile cyber incidents, contributes to proactive investments in robust strategies in the region.

On the other hand, Europe is estimated to expand further in this domain during the forecast period due to the stringent data privacy and security regulations that necessitate robust patch management to ensure compliance and avoid hefty penalties. The rising cyber threat landscape, coupled with the increasing digital transformation initiatives by European businesses, further fuels the demand for efficient systems. Europe's strong financial, healthcare, and IT sectors, which are frequent targets for cyberattacks, are additional contributors to market growth. Furthermore, increased awareness of the reputational and financial risks associated with data breaches has made patch management a critical aspect of cybersecurity strategies across European enterprises.

Competitive Landscape:

The market is experiencing significant growth due to the digital landscape, where cyber threats are constantly evolving, organizations recognize the critical importance of maintaining a secure and up-to-date software environment. These solutions enable businesses to effectively manage and deploy software updates and patches, thereby mitigating vulnerabilities and reducing the risks of cyber-attacks. With the increasing frequency and complexity of security breaches, companies providing comprehensive solutions are capitalizing on the growing demand for robust cybersecurity measures. Moreover, as technology continues to advance, including the proliferation of Internet of Things (IoT) devices and cloud-based systems, the need for efficient and automated solutions increases.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Automox

- Avast Software s.r.o

- Broadcom Inc.

- ConnectWise LLC

- GFI Software

- Open Text Corporation

- Progress Software Corporation

- Qualys Inc.

- Secpod Technologies

- SolarWinds Corporation

- SysAid Technologies Private Limited

- Zoho Corporation Pvt. Ltd

Patch Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Deployments Covered | Cloud-Based, On-Premises |

| Enterprise Sizes Covered | Small And Medium-Sized Enterprises, Large Enterprises |

| Verticals Covered | Banking, Financial Services, And Insurance (BFSI), Information Technology (IT) and Telecom, Healthcare, Government and Defense, Retail, Education, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, and Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, and Mexico |

| Companies Covered | Automox, Avast Software s.r.o, Broadcom Inc., ConnectWise LLC, GFI Software, Open Text Corporation, Progress Software Corporation, Qualys Inc., Secpod Technologies, SolarWinds Corporation, SysAid Technologies Private Limited, Zoho Corporation Pvt. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global patch management market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global patch management market?

- What is the impact of each driver, restraint, and opportunity on the global patch management market?

- What are the key regional markets?

- Which countries represent the most attractive patch management market?

- What is the breakup of the market based on the component?

- Which is the most attractive component in the patch management market?

- What is the breakup of the market based on the deployment?

- Which is the most attractive deployment in the patch management market?

- What is the breakup of the market based on the enterprise size?

- Which is the most attractive enterprise size in the patch management market?

- What is the breakup of the market based on the vertical?

- Which is the most attractive vertical in the patch management market?

- What is the competitive structure of the global patch management market?

- Who are the key players/companies in the global patch management market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the patch management market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global patch management market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the patch management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)