Pentaerythritol Market Size, Share, Trends and Forecast by Product Type, Application, End-Use Industry, and Region, 2025-2033

Pentaerythritol Market Size and Share:

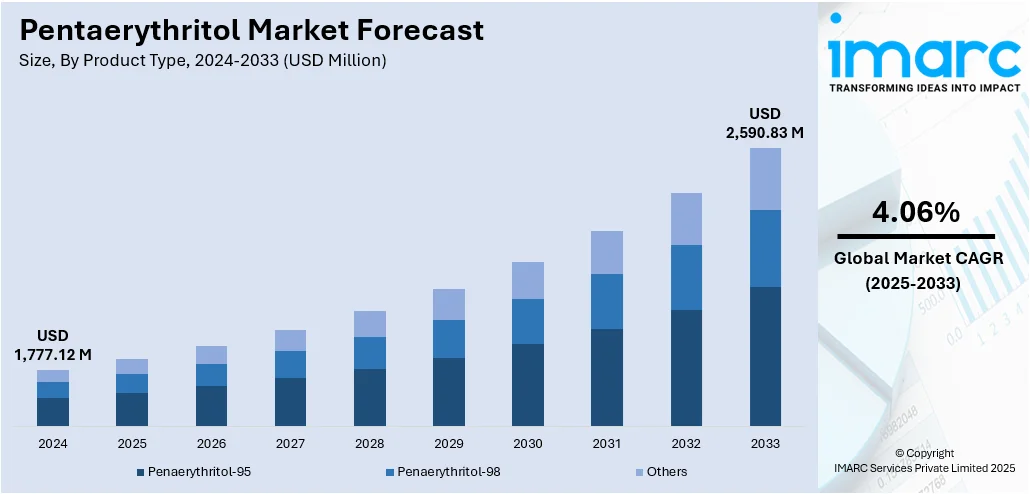

The global pentaerythritol market size was valued at USD 1,777.12 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,590.83 Million by 2033, exhibiting a CAGR of 4.06% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 40% in 2024. The market is expanding due to increasing use of pentaerythritol in eco-friendly coatings, high-performance lubricants, and bio-based polyols. Moreover, advancements in automotive and packaging applications continue to strengthen pentaerythritol market share across industrial, construction, and healthcare product segments worldwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,777.12 Million |

|

Market Forecast in 2033

|

USD 2,590.83 Million |

| Market Growth Rate 2025-2033 | 4.06% |

The global market is seeing steady demand growth from the coatings sector as manufacturers move toward eco-friendly and high-performance solutions. Pentaerythritol’s role in producing low-VOC alkyd resins supports sustainability goals while meeting durability requirements for industrial and decorative coatings. Its ability to enhance gloss retention, weather resistance, and adhesion performance is attracting widespread adoption across construction and manufacturing industries. With increasing environmental regulations worldwide, producers are focusing on bio-based raw materials to cater to evolving market preferences. This shift is strengthening pentaerythritol’s position as a preferred component in sustainable coatings, driving consistent market expansion across multiple regions and applications.

To get more information on this market, Request Sample

In the United States, demand for pentaerythritol is rising in advanced lubricant manufacturing, supported by growing requirements for high thermal stability and oxidation resistance. Its derivatives, such as pentaerythritol esters, are being incorporated into synthetic lubricants for automotive, aerospace, and heavy machinery applications. The U.S. market is benefiting from strong industrial activity and an expanding automotive sector, where energy-efficient lubricants are in high demand. As manufacturers prioritise performance and compliance with stringent environmental standards, pentaerythritol-based formulations are gaining greater acceptance. This trend is set to boost domestic production and innovation in specialty lubricants, reinforcing the material’s long-term role in high-performance industrial solutions.

Pentaerythritol Market Trends:

Advancements in High-Value End-Use Applications

Growing interest in specialised, high-performance applications is contributing to global pentaerythritol market growth. Manufacturers are increasingly investing in innovations that enhance usability, meet stricter compliance standards, and widen market reach across industrial and medical sectors. The focus is shifting toward solutions that combine material efficiency with ease of use, allowing for faster adoption in critical operations. Demand for medical-grade products that deliver both reliability and operational convenience is becoming a major driver. In April 2025, Baxter introduced a room-temperature Hemopatch Sealing Hemostat in Europe, incorporating NHS-PEG derived from pentaerythritol. The innovation improved surgical accessibility, eliminated refrigeration requirements, and ensured product readiness in urgent procedures. By addressing long-standing storage and handling challenges, it strengthened the appeal of pentaerythritol-based materials in healthcare. Hospitals and surgical facilities are prioritising products that can be deployed instantly without additional preparation, which positions pentaerythritol derivatives as valuable components in advanced surgical solutions. This trend is set to increase demand from specialised medical applications, thereby encouraging producers to explore similar innovations in other high-performance areas, such as precision coatings and functional polymers. As a result, the sector is likely to see stable expansion driven by innovation-led adoption and an emphasis on premium-grade applications worldwide.

Regulatory Support for Expanded Industrial Uses

Supportive regulations and updated usage guidelines are shaping pentaerythritol market trends, particularly in packaging, food-contact materials, and other regulated industries. With safety requirements becoming clearer, businesses have more confidence in integrating pentaerythritol-based compounds into products that face strict compliance checks. This regulatory clarity creates an environment where manufacturers can pursue new markets without uncertainty over legal standards, reducing barriers to entry. In May 2025, China’s CFSA invited public comments on using pentaerythritol tetrakis(3-(3,5-di-tert-butyl-4 hydroxyphenyl)propionate) in PVDF plastics for food contact. The update expanded the allowable application scope, driving greater demand for these additives in compliant packaging. This shift demonstrates increasing recognition of pentaerythritol’s suitability for high-regulation markets and its ability to meet stringent migration and safety requirements. For producers, this development presents an opportunity to serve a broader customer base, particularly in markets with large-scale food packaging needs. It also signals the potential for similar regulatory movements in other regions, accelerating global acceptance. By aligning with these evolving standards, companies can position themselves as trusted suppliers of safe, compliant materials, paving the way for stronger integration into international packaging supply chains and enhancing the commercial reach of pentaerythritol-based solutions in both domestic and export-driven markets.

Rising Industrial and Automotive Usage Demand

Extensive utilization of pentaerythritol in the automotive industry is one of the key factors driving the growth of the market. In this industry, pentaerythritol is used in the manufacturing of automotive lubricants and polyurethane foams that are integrated into vehicle interiors and door handles, bumper systems, gear knobs, dashboards and seat cushions. According to a report published by the IMARC Group, the global automotive lubricants market reached USD 81.06 Billion in 2024 and is forecasted to grow at a CAGR of 3.30% from 2025-2033. Furthermore, the increasing demand for formaldehyde and acetaldehyde substitutes in the production of paints, coatings, alkyd adhesives, plasticizers, radiation-cured coatings and industrial inks and synthetic rubber is also providing a boost to the market growth. Apart from this, various industries are using pentaerythritol as a stable alternative for electrical transformer liquids. Additionally, growing environmental consciousness among the masses that has led to an increasing preference for bio-based polyols, including pentaerythritol, is creating a positive outlook for the market. Other factors, including rapid industrialization, along with extensive research and development (R&D) activities, are projected to drive the market further. According to the United Nations Industrial Development Organization (UNIDO), a 2.3% growth was recorded in industrial sectors globally in 2023, highlighting robust industrialization across the world.

Pentaerythritol Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pentaerythritol market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, application, and end-use industry.

Analysis by Product Type:

- Penaerythritol-95

- Penaerythritol-98

- Others

As per the pentaerythritol market outlook, in 2024, pentaerythritol-95 segment led the market, driven by its high purity and consistent performance in industrial applications. Its superior chemical stability and reactivity made it a preferred choice for producing alkyd resins, synthetic lubricants, and explosives. Manufacturers favored this grade for its reliability in meeting strict quality requirements across coatings, automotive, and construction sectors. Growing demand for high-performance materials in fast-growing economies boosted its adoption. The segment further benefited from expanding export opportunities, as regulatory shifts in several regions encouraged the use of higher-purity inputs in chemical manufacturing. This alignment with both performance needs and compliance standards positioned Pentaerythritol-95 as the dominant product type in the global market during the year.

Analysis by Application:

- Alkyd Paints

- Alkyd Inks

- Alkyd Adhesives

- Plasticizers

- Alkyd Varnishes

- Radiation Cure Coatings

- Lubricants

- Others

In 2024, the alkyd paints led the pentaerythritol market, driven by their durability, gloss retention, and cost-effectiveness compared to alternatives. Pentaerythritol serves as a critical raw material in alkyd resin production, which forms the backbone of these paints. Growing construction activity, coupled with demand for long-lasting protective and decorative coatings, sustained high consumption levels. Industrial maintenance projects and infrastructure upgrades, particularly in emerging economies, reinforced this trend. Additionally, alkyd paints’ compatibility with varied surfaces and weather resistance made them a staple in both architectural and industrial uses. As stricter performance and environmental standards emerged, formulations increasingly incorporated higher-quality resins, boosting pentaerythritol demand within this segment.

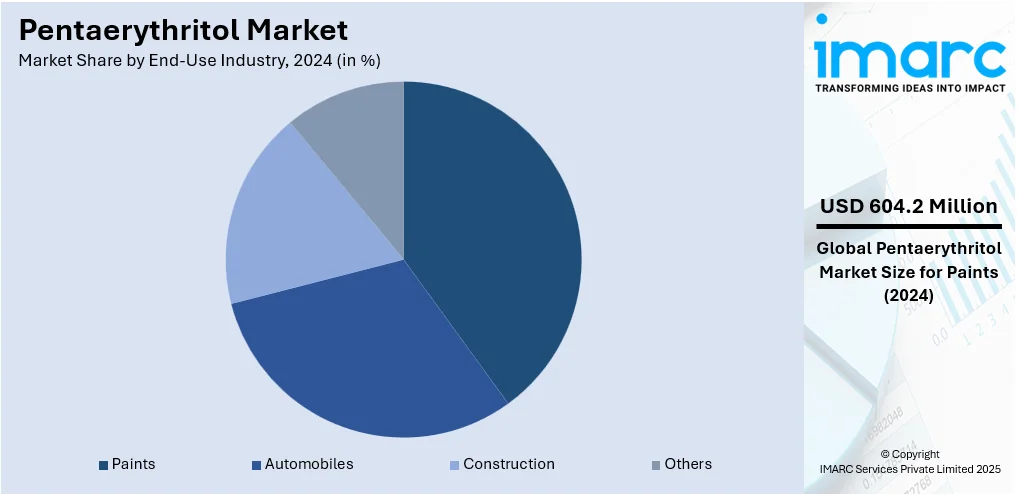

Analysis by End-Use Industry:

- Paints

- Automobiles

- Construction

- Others

As per the pentaerythritol market forecast, in 2024, paints segment led the market, accounting for the market share of 34%, driven by robust demand from both decorative and industrial applications. Pentaerythritol-based resins offer improved hardness, chemical resistance, and finish quality, making them essential in premium coating formulations. Global urbanization trends, especially in Asia and the Middle East, fueled the need for residential and commercial construction, directly lifting paint consumption. Repainting cycles in mature markets also contributed, as property owners invested in performance coatings to extend maintenance intervals. The versatility of pentaerythritol in enabling both solvent-based and waterborne systems provided flexibility for manufacturers responding to evolving regulatory and performance demands, keeping paints at the forefront of market share.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the Asia Pacific led the pentaerythritol market, accounting for the market share of 40% supported by strong industrial growth, expanding construction activity, and a thriving automotive sector. Key economies like China, India, and Japan acted as production hubs for coatings, adhesives, lubricants, and other downstream products utilizing pentaerythritol. Competitive manufacturing costs and large-scale resin production capacity attracted investments and boosted local consumption. Rapid infrastructure development projects, coupled with rising disposable incomes, spurred demand for decorative and protective coatings across urban and rural markets. Additionally, favorable trade policies and export-oriented manufacturing strengthened the region’s position as both a major producer and consumer. This combination of domestic growth and global supply capabilities secured Asia-Pacific’s leading market share.

Key Regional Takeaways:

United States Pentaerythritol Market Analysis

In 2024, the United States accounted for 86.70% of the pentaerythritol market in North America, driven by multiple factors. The United States pentaerythritol market is primarily driven by the rising demand for alkyd resins, where pentaerythritol serves as a crucial raw material, particularly in the production of paints, coatings, and varnishes. The construction and automotive industries rely heavily on these coatings for surface protection and aesthetic finishes, thereby increasing the consumption of pentaerythritol as automotive production and construction activities increase across the country. For instance, from January to May 2025, total construction expenditure in the United States reached USD 841.5 Billion, according to the Census Bureau. In May 2025, public construction expenditure reached an approximate seasonally adjusted annual rate of USD 511.6 Billion. Additionally, the growing focus on energy efficiency and environmental sustainability has boosted the usage of pentaerythritol-based lubricants and polyols in the manufacturing of eco-friendly products. Its application in the synthesis of explosives, such as pentaerythritol tetranitrate (PETN), is also contributing substantially to market demand, particularly in the defense and mining sectors. Furthermore, the chemical’s role in flame retardant manufacturing and plasticizers aligns with regulatory shifts toward safer, less toxic industrial chemicals, enhancing its market appeal. Other than this, increased investment in infrastructure and industrial activities is further propelling demand for pentaerythritol-based materials across multiple sectors in the United States.

Asia Pacific Pentaerythritol Market Analysis

The Asia‑Pacific pentaerythritol market is expanding due to rapid industrialization across emerging economies such as China, India, South Korea, and Southeast Asian nations, where soaring demand for automotive coatings, durable plastics, and high-performance composites is propelling raw material consumption. For instance, the Index of Industrial Production (IIP) in India recorded a growth of 2.9% in February 2025, underscoring the robust industrialization across the country, as per the Press Information Bureau (PIB). Booming consumer electronics and appliance manufacturing in the region is also driving the uptake of UV‑curable and powder coatings, where pentaerythritol functions as a key cross‑linking agent for abrasion‑resistant and fast‑curing finishes. Additionally, supply chain dynamics, including indigenous petrochemical capacities in key countries and expanding R&D capabilities in polymer chemistry and catalytic processing, are driving down production costs and enhancing local availability. Growing foreign direct investment in advanced materials manufacturing and construction, supported by regional trade agreements, is also strengthening the downstream market and supporting overall expansion.

Europe Pentaerythritol Market Analysis

The growth of the Europe pentaerythritol market is largely propelled by the thriving coatings and decorative paints industry, which utilizes pentaerythritol‐derived alkyd resins for high‐performance finishes in automotive, architectural, and industrial applications. Rapid urbanization and investments in infrastructure across key European economies continue to stimulate construction activity, further boosting resin consumption. For instance, in July 2025, the European Commission approved 94 transportation infrastructure projects to receive approximately €2.8 Billion in EU grants under the Connecting Europe Facility (CEF) in order to promote sustainable and connected mobility throughout Europe. Additionally, Europe’s increasing emphasis on sustainability and lower volatile organic compound (VOC) emissions has heightened the demand for bio‐based and low‐toxicity polyols. Pentaerythritol aligns well with these regulatory and environmental trends, particularly within the EU framework. The region's strong emphasis on renewable energy is also encouraging the use of eco-friendly chemicals in various industrial processes. For instance, in 2023, installations of wind power capacity in Europe reached 18.3 GW, as per industry reports. From 2024 to 2030, the installation of new wind power capacity is expected to reach 260 GW in Europe. Other than this, pentaerythritol is also being increasingly adopted in the production of biodegradable lubricants and environmentally safe stabilizers, particularly in countries with strict environmental compliance policies.

Latin America Pentaerythritol Market Analysis

The Latin America pentaerythritol market is significantly influenced by expanding infrastructure and construction activity in countries such as Brazil, Mexico, and Argentina, which fuels demand for high‑performance coatings and alkyd resins for architectural and industrial applications. For instance, the construction market in Brazil reached USD 150.0 Billion in 2024 and is projected to reach USD 211.4 Billion by 2033, growing at a CAGR of 4% during 2025-2033, as per the IMARC Group. Growth in automotive manufacturing and aftermarket refinishing is further propelling the demand for specialty paint and powder coatings that incorporate pentaerythritol as a cross‑linking agent. Besides this, improvements in domestic chemical production capacity and logistical enhancements in major ports and trade corridors are helping reduce costs and ensure supply reliability, thereby supporting overall market growth.

Middle East and Africa Pentaerythritol Market Analysis

The Middle East and Africa pentaerythritol market is experiencing robust growth due to the rapid expansion of petrochemical and downstream chemical industries, which is generating increased local supply and demand for specialty polyols used in coatings, resins, and plastic additives. For instance, the petrochemicals market in Saudi Arabia reached USD 6.0 Billion in 2024 and is forecasted to reach USD 9.0 Billion by 2033, growing at a CAGR of 4.60% during 2025-2033, according to a report by the IMARC Group. Moreover, the increasing focus on smart and sustainable infrastructure projects, including solar energy installations and eco‑friendly buildings, is boosting uptake of high‑performance, low‑VOC alkyd and polyurethane coatings that rely on pentaerythritol as a cross-linker. Investment in agrochemical formulation plants and improved regulatory frameworks for chemical safety are also encouraging regional producers to adopt pentaerythritol-based intermediates.

Competitive Landscape:

Companies in the pentaerythritol market are adopting targeted strategies to meet shifting industrial requirements and comply with tightening environmental and safety regulations. Many are using advanced process monitoring, data analytics, and simulation tools to optimize resin formulations, enhance product consistency, and shorten development cycles. Automation and precision control systems are being integrated into manufacturing lines to boost efficiency, reduce waste, and maintain high purity levels required for applications in coatings, lubricants, and adhesives. Firms are also focusing on sustainable production methods, including energy-efficient operations and renewable raw material sourcing, to meet green certification standards. By combining innovation with compliance-focused operations, market players are positioning themselves to respond quickly to customer demands and maintain competitiveness in a cost-sensitive global environment.

The report provides a comprehensive analysis of the competitive landscape in the pentaerythritol market with detailed profiles of all major companies, including:

- Celanese Corporation

- Copenor Companhia Petroquímica do Nordeste

- Ercros S.A.

- Hubei Yihua Group Co. Ltd.

- Merck KGaA

- Mitsui Chemicals Inc.

Latest News and Developments:

- March 2025: Mitsui Chemicals Inc. launched a new Coating Technical Center (CTC) in Gurugram, India. The launch of this advanced coatings center intends to strengthen the company's technical assistance capacities in the engineering materials and coatings division.

- February 2024: Perstorp officially inaugurated its brand-new, cutting-edge technology facility in Bharuch, India. The novel facility will produce pentaerythritol and its ancillary ISCC Plus certified grade products to cater to market demand across Asia. The facility is expected to manufacture 40,000 Metric Tons of pentaerythritol.

- February 2024: JAT Holdings PLC officially commenced operations at its new Alkyd Resin facility in Bangladesh. The new facility will produce the main raw materials for paint, enamel wood coatings, nitrocellulose, and solvent-based polyurethane.

- March 2019: Perstrop announced that it will increase the effective yearly production capacity of pentaerythritol by 12.5%. at its facilities in Bruchhausen/Arnsberg, Germany. The enhanced capacity and ISCC accreditation of the Bruchhausen site, along with the introduction of Voxtar production there, will greatly increase the supply security of Voxtar, which is a type of pentaerythritol.

Pentaerythritol Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Penaerythritol-95, Penaerythritol-98, Others |

| Applications Covered | Alkyd Paints, Alkyd Inks, Alkyd Adhesives, Plasticizers, Alkyd Varnishes, Radiation Cure Coatings, Lubricants, Others |

| End-Use Industries Covered | Paints, Automobiles, Construction, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Celanese Corporation, Copenor Companhia Petroquímica do Nordeste, Ercros S.A., Hubei Yihua Group Co. Ltd., Merck KGaA and Mitsui Chemicals Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pentaerythritol market from 2019-2033.

- The pentaerythritol market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pentaerythritol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pentaerythritol market was valued at USD 1,777.12 Million in 2024.

The pentaerythritol market is projected to exhibit a CAGR of 4.06% during 2025-2033, reaching a value of USD 2,590.83 Million by 2033.

Rising demand for high-performance coatings, lubricants, and adhesives, growth in construction and automotive sectors, increasing use in environmentally friendly paints, and technological advancements in resin production are propelling the pentaerythritol market, supported by expanding industrial activity in emerging economies.

In 2024, Asia Pacific dominated the pentaerythritol market, accounted for the market share of 40%, driven by rapid industrialization, large-scale infrastructure projects, and strong automotive manufacturing. Competitive production costs, abundant raw materials, and rising domestic consumption in China, India, and Japan strengthened the region’s leadership in global market share.

Some of the major players in the global pentaerythritol market include Celanese Corporation, Copenor Companhia Petroquímica do Nordeste, Ercros S.A., Hubei Yihua Group Co. Ltd., Merck KGaA, Mitsui Chemicals Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)