Peptide Therapeutics Market Size, Share, Trends and Forecast by Type, Type of Manufacturer, Synthesis Technology, Routes of Administration, Application, and Region, 2025-2033

Peptide Therapeutics Market Size and Share:

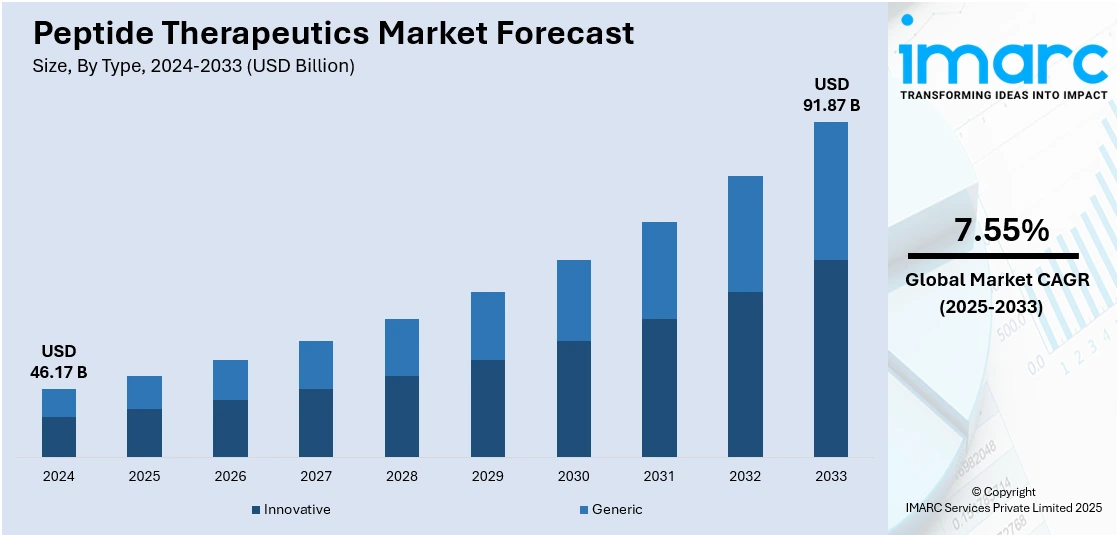

The global peptide therapeutics market size was valued at USD 46.17 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 91.87 Billion by 2033, exhibiting a CAGR of 7.55% during 2025-2033. North America currently dominates the market, holding a significant market share of around 40.9% in 2024. The market is driven by the growing prevalence of cancer, metabolic disorders, and infectious diseases, prompting increased demand for targeted and efficient treatments. Advancements in peptide synthesis technologies, drug delivery systems, and bioavailability enhancements are accelerating research and commercial adoption. Additionally, favorable regulatory approvals, rising investments in biopharmaceutical, and expanding applications in personalized medicine are key factors augmenting the peptide therapeutic market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 46.17 Billion |

|

Market Forecast in 2033

|

USD 91.87 Billion |

| Market Growth Rate 2025-2033 | 7.55% |

The market is driven by continual advancements, including the integration of artificial intelligence (AI) and computational modeling in peptide drug discovery, enabling faster identification of bioactive sequences with improved efficacy. Additionally, expanding clinical trial pipelines for metabolic and infectious diseases further reinforces demand. Besides this, growing investments in manufacturing capabilities, including solid-phase peptide synthesis (SPPS) and hybrid synthesis methods, are facilitating cost-effective scale-up and providing an impetus to the market. For instance, on April 3, 2025, CordenPharma announced a strategic investment of more than EUR 1 Billion (about USD 1.1 Billion) to expand its global peptide production capacity. The company's growth ambitions include adding 26,000 square meters of manufacturing space and 30,000 L of solid-phase peptide synthesis (SPPS) capability. Moreover, strategic partnerships between biotech startups and large pharmaceutical firms are supporting accelerated innovation and commercialization.

In the United States, the market is gaining momentum through targeted government initiatives aimed at rare disease treatment. According to industry reports, the U.S. FDA provides financial support for a select number of clinical trials to aid sponsors in developing medicinal products for rare conditions. In October 2024, the FDA announced funding for seven new clinical studies in fiscal year 2024, including one Phase 3 trial, with a total allocation of USD 17.2 Million over four years. This public sector investment enhances early-stage research and development activities, contributing to a more favorable environment for the advancement of peptide-based therapies addressing rare and complex diseases. Furthermore, the increasing prevalence of personalized medicine is also fueling the need for peptide-based precision therapies. In addition to this, the robust presence of CROs and CDMOs with specialized peptide capabilities allows companies to progress from preclinical to commercial stages efficiently. Also, rising interest in minimally invasive drug delivery has driven the development of injectable and transdermal peptide formulations. Apart from this, supportive FDA regulatory pathways, including fast-track and breakthrough therapy designations for peptide candidates, have further accelerated market entry.

Peptide Therapeutics Market Trends:

Increasing Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases, such as cancer, diabetes, and cardiovascular conditions, is a primary factor providing an impetus to the market. According to the NCBI, global cancer cases are projected to rise significantly, reaching 35.3 million by 2050, representing a 76.6% increase over the expected 20 million cases in 2022. Peptides, known for their high specificity and ability to target precise biological processes, offer promising treatment options for chronic diseases, which often require long-term and effective management solutions. In line with this, with a rise in lifestyle-related health conditions and an aging global population, the demand for innovative, targeted therapies is on the rise. Peptide therapeutics align well with this need due to their unique mechanisms of action, which minimize side effects as compared to traditional small-molecule drugs. Moreover, government and pharmaceutical sector investments in research and development (R&D) drive the creation of novel peptides, expanding treatment possibilities. In addition to this, advancements in peptide synthesis, formulation, and delivery have enhanced their bioavailability and stability, which is positively impacting the market, Consequently, there is a robust peptide therapeutics market growth, addressing critical unmet needs in chronic disease management.

Advancements in Peptide Synthesis and Delivery Technologies

Continual advancements in peptide synthesis and drug delivery technologies are significantly supporting the development and efficacy of peptide therapeutics. Innovative techniques, such as solid-phase peptide synthesis (SPPS) and automated synthesis platforms, have streamlined the production of high-quality peptides, making them more efficient and cost-effective. Moreover, improved delivery systems, such as nanoparticle formulations and transdermal patches, are addressing challenges related to peptide stability and bioavailability, which is expected to create a positive peptide therapeutics market outlook. In addition to this, these technological innovations not only enhance the therapeutic potential of peptides but also expand their applications across various medical fields, including oncology, endocrinology, and immunology. According to an industry report, nearly 200 clinical trials employing peptide vaccines for infectious diseases, cancer prevention, and therapy were documented on ClinicalTrials.gov between 2023 and 2024. As these advancements continue to evolve, they are expected to propel the market by supporting the development of novel and effective peptide-based therapies.

Growing Focus on Personalized Medicine

The increasing emphasis on personalized medicine is acting as another major growth-inducing factor in the market across the globe. According to the peptide therapeutics market analysis, the market for peptide therapies is growing due to personalized medicine, which customizes medicines to patients based on genetic, environmental, and lifestyle factors. Peptides are particularly well-suited for this approach, as they can be designed to target specific pathways and biological markers unique to individual patients. The rise of genomics and biomarker research is facilitating the identification of patient populations that may benefit from peptide-based therapies. As healthcare systems increasingly recognize the value of personalized treatments in improving patient outcomes and minimizing side effects, the need for peptide therapeutics is expected to rise. This shift toward personalized medicine is shaping the future landscape of the pharmaceutical industry. Over 25% of all new drug approvals since 2014 have been used for personalized treatments, according to the FDA. An industry report highlights that 85% of hypertension patients and 80% of type 2 diabetes patients reached target clinical outcomes with personalized approaches, compared to 65% under standard treatments.

Peptide Therapeutics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global peptide therapeutics market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, type of manufacturer, synthesis technology, routes of administration, and application.

Analysis by Type:

- Innovative

- Generic

Innovative leads the market with around 64.0% of market share in 2024. These therapeutics are typically first-in-class or best-in-class drugs, characterized by novel mechanisms of action, enhanced targeting abilities, and improved pharmacokinetic profiles. Unlike generic or biosimilar peptides, innovative peptides are developed through advanced technologies such as solid-phase peptide synthesis, recombinant DNA methods, and peptide conjugation platforms. Their importance is underscored by their high therapeutic value across complex diseases, including cancer, metabolic disorders, and rare genetic conditions. Apart from this, pharmaceutical companies are extensively investing in research and development (R&D) for innovative peptides due to their potential for exclusivity and premium pricing. Furthermore, regulatory incentives like orphan drug designations and fast-track approvals have boosted their commercial viability. As the demand for precision medicine and biologically targeted therapies grows, the innovative segment remains a cornerstone for shaping the future trajectory of peptide drug development and commercialization.

Analysis by Type of Manufacturer:

- Outsourced

- In-house

In-house leads the market with around 64.4% of market share in 2024. In-house manufacturing offers pharmaceutical companies’ greater control over production quality, timelines, and intellectual property. By maintaining internal capabilities, companies can ensure consistency in complex synthesis processes, particularly crucial for high-purity peptide drugs that require stringent quality standards. In-house facilities allow for tighter integration between research and development (R&D) and manufacturing, enabling faster transitions from clinical development to commercial production. This also enhances flexibility in scaling production based on demand and allows quicker implementation of process improvements or modifications. For companies developing innovative or proprietary peptides, in-house manufacturing safeguards sensitive formulations and reduces reliance on external partners. It also helps in managing regulatory compliance more effectively, especially for therapies targeting rare diseases or requiring specialized delivery methods. As peptide drugs become more complex and personalized, the role of in-house manufacturing is expected to expand in the market.

Analysis by Synthesis Technology:

- Solid Phase Peptide Synthesis

- Liquid Phase Peptide Synthesis

- Hybrid Technology

Liquid phase peptide synthesis leads the market with around 44.3% of market share in 2024. It is an important technology to produce simple peptides at a large scale. This method, which involves synthesizing peptides in solution using soluble reactants, offers advantages such as better reaction monitoring, easier purification of intermediates, and cost-effectiveness for high-volume manufacturing. LPPS is especially useful when producing peptides that do not require complex modifications or sequences, making it a practical choice for established, off-patent therapeutic peptides or early-stage development. Despite the broader industry shift toward solid phase peptide synthesis (SPPS) for complex molecules, LPPS continues to be relevant due to its scalability, efficiency in batch processing, and lower reagent cost. Manufacturers with expertise in LPPS achieve high yields with consistent purity, which is critical for meeting regulatory standards. Its continued application reinforces its role as a foundational technology in the peptide production landscape.

Analysis by Routes of Administration:

- Parenteral

- Oral

- Others

Parental leads the market with around 88.7% of market share in 2024. Administering peptides via injection, typically intravenous, subcutaneous, or intramuscular, ensures rapid absorption, controlled dosing, and optimal therapeutic concentration in the bloodstream. This route bypasses enzymatic degradation and first-pass metabolism, which are major limitations for oral formulations. In the market, parenteral delivery supports a wide range of treatments, including hormone regulation, cancer therapy, metabolic disorders, and rare disease management. Many blockbuster peptide drugs, such as insulin analogs and GLP-1 receptor agonists, rely on subcutaneous administration for long-term disease control. Advances in delivery devices, including auto-injectors and pre-filled syringes, have also improved patient compliance and convenience. As research continues into alternative delivery methods, parenteral administration remains the standard for ensuring therapeutic efficacy and safety of peptide-based treatments.

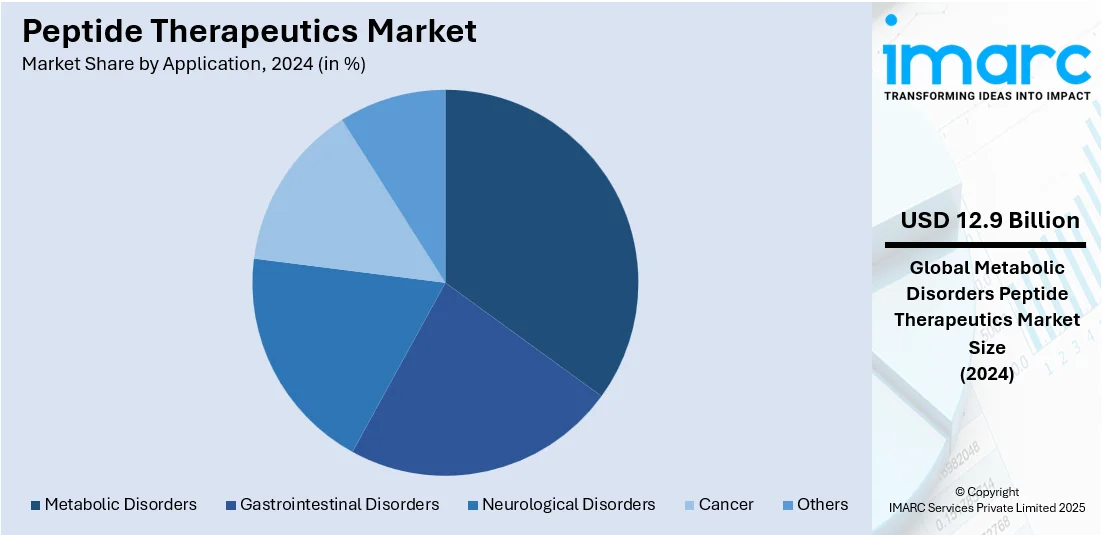

Analysis by Application:

- Gastrointestinal Disorders

- Neurological Disorders

- Metabolic Disorders

- Cancer

- Others

Metabolic disorders lead the market with around 27.9% of market share in 2024 due to the rising global incidence of conditions like diabetes, obesity, and metabolic syndrome. Peptide-based drugs offer distinct advantages, such as high specificity, low toxicity, and the ability to modulate complex biological pathways, making them ideal for treating these disorders. One of the most notable examples is the widespread use of GLP-1 receptor agonists like semaglutide and liraglutide in managing type 2 diabetes and obesity. The demand for such treatments is accelerating as lifestyle-related metabolic diseases become more prevalent across both developed and emerging economies. Additionally, advancements in peptide synthesis and drug delivery systems are expanding the therapeutic potential of peptides, enhancing their stability and bioavailability. This has encouraged pharmaceutical companies to invest heavily in research and development (R&D) for peptide drugs targeting metabolic pathways, driving innovation and growth in this segment of market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.9% driven by a strong pharmaceutical industry, advanced healthcare infrastructure, and high research and development (R&D) investment. The region, particularly the United States, hosts a concentration of major biotech firms and research institutions actively developing peptide-based drugs for cancer, metabolic disorders, and rare diseases. Regulatory support from agencies like the FDA, along with streamlined approval pathways for orphan drugs and breakthrough therapies, has accelerated market entry for innovative peptides. Additionally, the region benefits from a high prevalence of chronic diseases, growing demand for personalized medicine, and favorable reimbursement structures that support the adoption of advanced therapies. The region also sees active collaborations between academic centers and pharmaceutical companies, encouraging continuous innovation in peptide drug development. With a strong clinical trial ecosystem and rising patient awareness, North America remains a key contributor to both the revenue and innovation pipeline of the global market.

Key Regional Takeaways:

United States Peptide Therapeutics Market Analysis

In 2024, the United States holds a substantial share of around 86.50% of the market share in North America. The market in the United States is primarily driven by increased research and development (R&D) investments by pharmaceutical and biotechnology companies. In line with this, the heightened presence of advanced healthcare infrastructure and supportive reimbursement frameworks is accelerating the clinical adoption of peptide-based therapies. The rising incidence of chronic illnesses, including metabolic and cardiovascular disorders, requiring precise and targeted treatment solutions, is supporting market demand. According to the American Heart Association's 2025 statistical report, the United States recorded 941,652 cardiovascular disease (CVD)-related deaths in 2022, marking an increase of over 10,000 deaths from the 931,578 reported in 2021. Furthermore, growing public and private funding for rare disease therapeutics, encouraging peptide-centric pipelines, is propelling growth in the market. The rapid integration of artificial intelligence and machine learning into drug discovery processes, enabling rapid identification of therapeutic peptide candidates, is contributing to industry innovation and market appeal. Similarly, numerous collaborations between academic institutions and industry players that augment translational research and commercialization prospects are strengthening market presence. Additionally, increased reliance on contract manufacturing organizations for scalable peptide production is optimizing supply chains and bolstering product sales.

Europe Peptide Therapeutics Market Analysis

The European market is experiencing growth due to strong regulatory incentives for orphan and specialty drugs, which are promoting innovation in peptide-based treatments. In accordance with this, increased funding through Horizon Europe and national research initiatives is accelerating the clinical development of peptide formulations. Similarly, the rising burden of age-related conditions, including osteoporosis and neurodegenerative diseases, is increasing the peptide therapeutics market demand. According to NCBI, the annual number of osteoporotic fractures in the European Union was estimated at 4.28 million in 2019 and is projected to rise to 5.34 million by 2034, indicating a significant increase in fracture-related healthcare needs across the region. The growing manufacturing footprint in countries such as Germany and Switzerland, enhancing production efficiency, is supporting market scalability. Furthermore, the rising number of EMA approvals for novel peptide drugs, improving accessibility and clinical adoption, is bolstering market reach. The rapid integration of peptide-based solutions into antimicrobial resistance (AMR) strategies aligned with EU health goals is further strengthening market demand. Besides this, robust academic research in peptide chemistry and translational science, fostering innovation pipelines, is expanding therapeutic potential in the market.

Asia Pacific Peptide Therapeutics Market Analysis

The market in the Asia Pacific is gaining momentum due to rising healthcare expenditure across emerging economies, improving access to specialized treatments. In addition to this, the increasing prevalence of lifestyle-related disorders, such as diabetes and obesity, requires targeted therapeutic approaches, which are also driving product demand. As per an industry report, India leads globally with 212 million people living with diabetes, surpassing China's 148 million. Also, India has the highest number of individuals over the age of 30 with untreated diabetes, estimated at 133 million, compared to 78 million in China. Similarly, the rapid scale-up of domestic pharmaceutical manufacturing in countries like India, China, and South Korea, enabling cost-efficient peptide production, is enhancing market competitiveness. Moreover, the ongoing establishment of regional research and development (R&D) centers by global pharmaceutical firms supporting innovation and technology exchange is strengthening the market landscape. Apart from this, growing public awareness of personalized medicine and preventive care, particularly in the urban population, is accelerating the product uptake across a range of treatment areas.

Latin America Peptide Therapeutics Market Analysis

In Latin America, the market is progressing, attributed to the increasing burden of chronic diseases such as diabetes and cardiovascular disorders. Similarly, significant improvements in regional healthcare systems, enhancing access to specialty therapies, are supporting the broader adoption of peptide-based drugs. The Federal Government of Brazil increased the Ministry of Health's budget for specialized treatments by 34% between 2022 and 2024, raising the allocation from BRL 54.9 Billion in 2022 (about USD 10.98 Billion) to BRL 74.7 Billion (about USD 14.94 Billion) in 2024. Furthermore, various collaborations between domestic pharmaceutical firms and global players, facilitating technology transfer and localized production, are strengthening market infrastructure. Moreover, active participation in international regulatory alignment efforts, reducing barriers to entry for innovative therapies, is streamlining approval processes and accelerating market expansion across the region.

Middle East and Africa Peptide Therapeutics Market Analysis

In the Middle East and Africa, the market is advancing, supported by the growing incidences of lifestyle-related diseases such as obesity and type 2 diabetes, particularly in urban centers. According to the World Obesity Federation, the number of obese adults in the Middle East and Africa is projected to increase by over 200%, rising from 11.8 million to 37.2 million by 2030. Additionally, a rise in government-led healthcare reforms and increased public investment in specialty medical services are improving access to advanced treatments in the market. The strategic expansion of pharmaceutical distribution networks across the Gulf and Sub-Saharan regions is enhancing product availability. Moreover, growing participation in international clinical research collaborations is fostering innovation and promoting the integration of peptide-based therapies into national treatment protocols.

Competitive Landscape:

The market is characterized by intense competition driven by technological advancements, growing demand for targeted treatments, and expanding therapeutic applications. Several players are focusing on innovative drug delivery methods, including oral, transdermal, and nanoparticle-based systems, to overcome challenges such as enzymatic degradation and short half-life. Biosynthetic techniques and solid-phase peptide synthesis are refined for scalability and cost efficiency. According to the peptide therapeutics market forecast, the sector is expected to grow steadily in the future years, driven by increased research and development (R&D) spending and favorable regulatory environments for biologics. Peptides have promising clinical applications in oncology, endocrinology, and infectious disorders. Market participants are also engaging in strategic collaborations, licensing deals, and contract manufacturing partnerships to strengthen their portfolios. The market landscape is further shaped by patent expiries, prompting an influx of generics and biosimilars. The emphasis is shifting toward long-acting and multifunctional peptides, reflecting the push for improved patient outcomes and competitive differentiation.

The report provides a comprehensive analysis of the competitive landscape in the peptide therapeutics market with detailed profiles of all major companies, including:

- Amgen Inc.

- Apitope International NV

- Arch Biopartners Inc.

- AstraZeneca plc

- Circle Pharma Inc.

- Corden Pharma GmbH

- F. Hoffmann-La Roche AG

- Ipsen Group

- Lonza Group AG

- Novo Nordisk A/S

- Pfizer Inc.

- Teva Pharmaceuticals Industries Ltd.

- Zealand Pharma A/S

Latest News and Developments:

- April 2025: Cyprumed and MSD partnered to develop oral peptide therapeutics using Cyprumed’s delivery technology, with potential payments up to USD 493 Million. MSD gains global rights, supporting advancements in macrocyclic peptides.

- April 2025: Sai Life Sciences launched a peptide research center in Hyderabad, India, to meet the rising demand for peptide therapeutics. Equipped with automation and high-throughput systems, it supports advanced synthesis and discovery.

- March 2025: Arecor Therapeutics partnered with a clinical-stage biopharma firm to develop a novel peptide therapy formulation using its Arestat platform. The agreement supports innovation in chronic disease treatment.

- March 2025: Shilpa Medicare launched a hybrid CDMO, offering services for small molecules, biologics, and peptides, with a focus on oncology. The model combines traditional CDMO functions with off-the-shelf formulations for B2B licensing, featuring advanced peptide synthesis and fill/finish capabilities, supporting rapid market entry and innovation.

- February 2025: Biocon Limited introduced its generic GLP-1 peptide, Liraglutide, in the UK for treating diabetes and obesity. This launch strengthens Biocon’s position in peptide therapeutics and reportedly marks the first MHRA-approved generic Liraglutide in a regulated market, enhancing global access to cost-effective metabolic disease treatments.

- February 2025: Granules India acquired Swiss CDMO Senn Chemicals AG for INR 192 Crore (about USD 22.99 Million). This acquisition strengthens Granules’ peptide therapeutics capabilities, enhancing its peptide synthesis and CDMO services.

Peptide Therapeutics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Innovative, Generic |

| Type of Manufacturers Covered | Outsourced, In-house |

| Synthesis Technologies Covered | Solid Phase Peptide Synthesis, Liquid Phase Peptide Synthesis, Hybrid Technology |

| Routes of Administrations Covered | Parenteral, Oral, Others |

| Applications Covered | Gastrointestinal Disorders, Neurological Disorders, Metabolic Disorders, Cancer, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amgen Inc., Apitope International NV, Arch Biopartners Inc., AstraZeneca plc, Circle Pharma Inc., Corden Pharma GmbH, F. Hoffmann-La Roche AG, Ipsen Group, Lonza Group AG, Novo Nordisk A/S, Pfizer Inc., Teva Pharmaceuticals Industries Ltd. and Zealand Pharma A/S |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the peptide therapeutics market from 2019-2033.

- The peptide therapeutics market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the peptide therapeutics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The peptide therapeutics market was valued at USD 46.17 Billion in 2024.

The peptide therapeutics market is projected to exhibit a CAGR of 7.55% during 2025-2033, reaching a value of USD 91.87 Billion by 2033.

The market is driven by the growing prevalence of chronic diseases, advancements in peptide drug design and delivery technologies, rising investments in pharmaceutical R&D, increasing approvals of peptide-based drugs, and the expanding use of peptides in oncology, metabolic disorders, and infectious diseases.

North America currently dominates the peptide therapeutics market with a market share of 40.9%. The dominance is fueled by the presence of established pharmaceutical companies, strong healthcare infrastructure, favorable regulatory frameworks, high research and development (R&D) expenditure, and a large patient population with cancer, diabetes, and cardiovascular conditions.

Some of the major players in the peptide therapeutics market include Amgen Inc., Apitope International NV, Arch Biopartners Inc., AstraZeneca plc, Circle Pharma Inc., Corden Pharma GmbH, F. Hoffmann-La Roche AG, Ipsen Group, Lonza Group AG, Novo Nordisk A/S, Pfizer Inc., Teva Pharmaceuticals Industries Ltd. and Zealand Pharma A/S, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)