Personal Finance Software Market Report by Product Type (Web-based Software, Mobile-based Software), End User (Small Business, Individual Consumers), and Region 2026-2034

Market Overview:

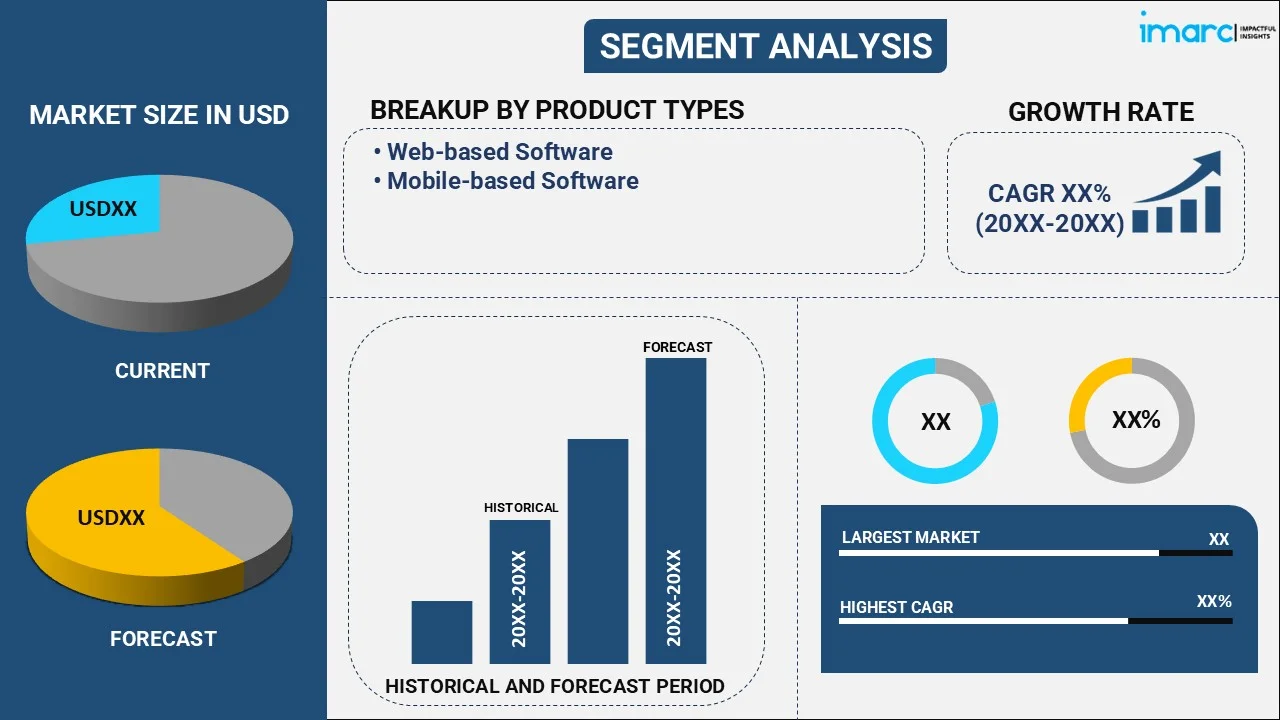

The global personal finance software market size reached USD 1.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.1 Billion by 2034, exhibiting a growth rate (CAGR) of 4.51% during 2026-2034. The growing need to track and manage income, integration of the internet of things (IoT), and wide availability of digital services and mobile apps represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1.4 Billion |

|

Market Forecast in 2034

|

USD 2.1 Billion |

| Market Growth Rate 2026-2034 | 4.51% |

Rising Demand for Safe, Secure, and Efficient Finance Tracking Solutions Impelling Market Growth

The increasing demand for safe, secure, and efficient finance tracking solutions among individuals and small businesses represents one of the major factors propelling the market growth around the world. Both individuals and small businesses face similar financial challenges as larger enterprises but with fewer resources. They are focusing on handling their finances effectively to ensure profitability, compliance with regulations, and personal financial well-being. As a result, they are utilizing various finance tracking solutions that provide a secure environment for managing their financial transactions, expenses, and budgets. Nowadays, they often deal with multiple accounts, transactions, and payment methods, making manual tracking and reconciliation processes cumbersome and error-prone. By adopting finance tracking solutions, they can streamline these tasks, accurately track their finances, and gain better control over their financial activities. In addition, rising number of digital payments and online banking platforms is increasing the complexity and volume of financial data, which is contributing to the personal finance software market growth.

To get more information on this market Request Sample

What is Personal Finance Software?

Personal finance software is a specialized computer program or application designed to help individuals manage their personal finances effectively. It provides a comprehensive set of tools and features that enable users to track income, expenses, investments, budgets, and financial goals in a structured and organized manner. It allows users to link their bank accounts, credit cards, and other financial accounts to import and categorize transactions automatically and eliminate the need for manual data entry. It also enables users to analyze their spending patterns, identify areas of saving, and make informed financial decisions by providing an overview of income and expenditures. It helps track progress toward personal financial goals, alerts users about impending bill payments, and provides timely reminders to avoid late fees or penalties. It aids in financial planning and decision-making by delivering insights into net worth, investment performance, and cash flow. It also assists in monitoring investment portfolios, tracking stock prices, analyzing investment performances, and setting up alerts for market movements or target prices.

Personal Finance Software Market Trends:

At present, there is a rise in the demand for personal finance software to track and manage the income of consumers around the world. This, along with the increasing awareness about the benefits of personal finance software among individuals, represents one of the key factors supporting the growth of the market. In addition, the increasing focus of organizations on digitalizing their financial services, coupled with the growing number of internet users, is offering a favorable market outlook. Besides this, the escalating demand for personal finance software due to the rising inclination towards a budget-oriented lifestyle is propelling the growth of the market. Moreover, the integration of the internet of things (IoT) in personal finance software to collect and analyze data of clients for gaining valuable insights into their needs and ensuring faster decision-making is strengthening the growth of the market. In line with this, IoT payment platforms allow people to pay their invoices through a variety of devices not limited to contactless cards, smartphones, and smartwatches. They also help elevate customer experiences and make the payment process smoother, which is impelling the growth of the market. Apart from this, the growing number of tax payable citizens, as collecting taxes and fees is a fundamental way to generate public revenues for making investments in human capital, infrastructure, and the provision of services for citizens and businesses, is positively influencing the market. Additionally, the wide availability of digital services and mobile apps that manage the personal finance of individuals, along with the rapid development of telecommunication infrastructures, is offering lucrative growth opportunities to industry investors. Furthermore, the rising employment of mobile banking on account of real-time customer assistance, user-friendly interfaces, and immediate transactions is bolstering the growth of the market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global personal finance software market report, along with forecasts at the global, regional and country level from 2026-2034. Our report has categorized the market based on product type and end user.

Product Type Insights:

To get detailed segment analysis of this market Request Sample

- Web-based Software

- Mobile-based Software

The report has provided a detailed breakup and analysis of the personal finance software market based on the product type. This includes web-based software and mobile-based software. According to the report, web-based software represented the largest segment due to the high security provided by web-based personal finance software, as it is integrated with anti-virus and anti-malware solutions. In addition, web-based programs enable users to input their financial information, such as bank account and credit card information, loans, and debts, and track real-time transactions.

Mobile-based software offers mobile applications with built-in personal financial software that guarantee effective operations. It helps save money and cut back on wasteful spending. It offers various advantages over web-based software, such as instant online and offline access, pushes notifications and instant updates, productivity enhancement, cost savings, and others, which, in turn, is strengthening the market growth in this segment.

End User Insights:

- Small Business

- Individual Consumers

A detailed breakup and analysis of the personal finance software market based on the end-user has also been provided in the report. This includes small businesses and individual consumers. According to the report, small businesses accounted for the largest market share as various small and home businesses use personal finance software to combine and separate financial data from companies to produce the needed analytical output for better financial planning. It assists in identifying spending patterns, assisting with debt repayment, and keeping track of financial objectives to enable business users to make wiser financial decisions. It provides efficient planning and control of the influx and outflow of money and aids users of small-size businesses in effortlessly managing their business operations and funding. Additionally, it produces reports and bills depending on data.

The individual consumers market uses personal finance software to keep track of the income, expenses, credit cards, investments, and bank accounts of a person on a smartphone or computer. It can effectively handle financial transactions by assisting a person in tracking their monthly expenses. According to the personal finance software market analysis, there has been a rise in internet penetration and daily internet usage, which is catalyzing the demand for personal finance software to track and manage financial activities. Additionally, this program manages all financial facts simply, as it can keep track of investments and small transactions. Further, it can be connected to internet banking for providing real-time transaction updates, assisting the individual customer in managing their finances and boosting its uptake within this market.

Regional Insights:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (the United Kingdom, Germany, France, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America (the United States and Canada) was the largest market for personal finance software. The growing number of key market players in the region are offering a favorable market outlook. In line with this, they are focusing on increasing the range of products. Key players are also creating cutting-edge personal finance software solutions to meet the different operating and development needs of end-user sectors. As a result, the market is anticipated to benefit from these lucrative opportunities. The rapid digitalization is helping in creating a uniquely tailored and user-friendly banking experience in the region. Numerous individuals are reaping significant financial gains from technological improvements and innovations in the financial services sector, including digital banking, digital lending, and other areas. Various information technology improvements and the growing creation of dynamic and user-friendly interfaces for websites and applications are catalyzing the demand for personal finance software in the region.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global personal finance software market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include:

- Alzex Software

- BankTree Software Limited

- Buxfer Inc.

- CountAbout

- Microsoft Corporation

- Money Dashboard Ltd.

- Moneyspire Inc.

- Personal Capital Corporation (Empower Retirement)

- PocketSmith Ltd.

- Quicken Inc.

- The Infinite Kind

- You Need a Budget

(Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.)

Latest Industry Updates:

- March 2025: NPCI introduced BHIM 3.0, an enhanced version of their personal finance application, with sophisticated features such as expense management, bill splitting, and money management. This release placed NPCI in an enhanced position in the pan-Indian digital finance market, thus enabling more user interaction and growing market share through highly efficient solutions and ease of interaction.

- February 2025: Moneyspire released its newest software update, including an enhanced user interface, sophisticated budgeting features, and increased security. The release enhanced the personal finance software industry by providing customers with customizable options and effortless integration, further establishing Moneyspire as a top finance management tool.

- October 2024: Jio Financial Services rolled out an enhanced version of the JioFinance app, which bolstered its services with digital insurance packages and 24/7 services. This release expanded the app's reach, further solidifying its position in the market for personal finance software by securing a broader user base and enhancing financial access.

- September 2024: Axway finalized the acquisition of Sopra Banking Software, establishing itself as a top enterprise software player in banking and financial services. The strategic acquisition bolstered Axway's portfolio, broadening its horizons in personal finance software and solidifying its position in the international arena.

- July 2024: CRED introduced CRED Money, an individual finance management solution providing integrated financial monitoring, on-time payment management, and expenditure analysis. This technology has enriched the individual finance software industry by streamlining financial decision-making, enhancing user interaction, and promoting more informed financial behavior among consumers.

- July 2024: Bain Capital acquired Envestnet, Inc. for USD 4.5 Billion to enhance its presence in personal finance software. The deal strengthened digital wealth management tools, signaling increased investment in fintech innovation and intensifying competition in the personal finance market.

Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Segment Coverage | Product Type, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alzex Software, BankTree Software Limited, Buxfer Inc., CountAbout, Microsoft Corporation, Money Dashboard Ltd., Moneyspire Inc., Personal Capital Corporation (Empower Retirement), PocketSmith Ltd., Quicken Inc., The Infinite Kind and You Need a Budget |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the personal finance software market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global personal finance software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the personal finance software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The personal finance software market was valued at USD 1.4 Billion in 2025.

The personal finance software market is estimated to exhibit a CAGR of 4.51% during 2026-2034.

The growing need to track and manage income, integration of the internet of things (IoT), and wide availability of digital services and mobile apps represent some of the key factors driving the market.

North America currently dominates the market due to the growing number of key market players in the region.

Some of the major players in the personal finance software market include Alzex Software, BankTree Software Limited, Buxfer Inc., CountAbout, Microsoft Corporation, Money Dashboard Ltd., Moneyspire Inc., Personal Capital Corporation (Empower Retirement), PocketSmith Ltd., Quicken Inc., The Infinite Kind and You Need a Budget, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)