Pet Food Packaging Market Size, Share, Trends and Forecast by Material, Food Type, Animal Type, Packaging Form, and Region, 2025-2033

Pet Food Packaging Market Size and Share:

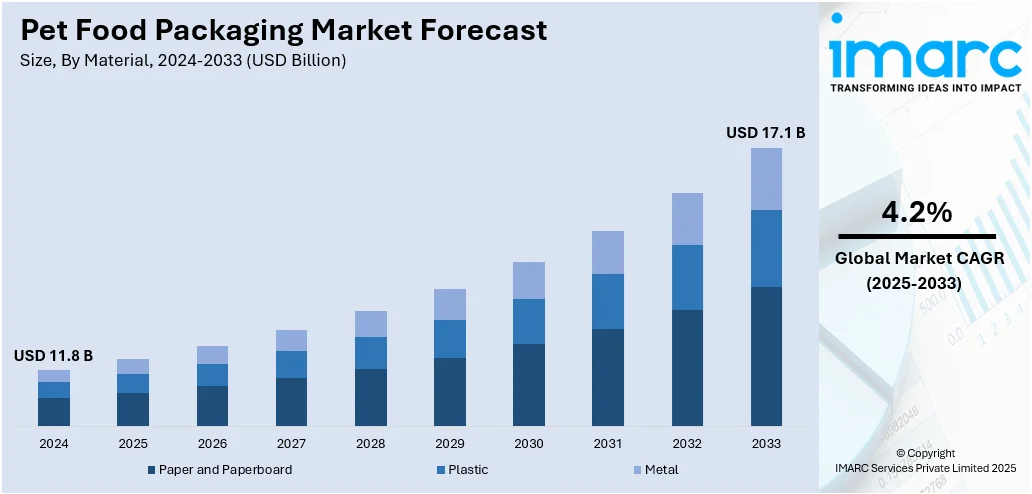

The global pet food packaging market size was valued at USD 11.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.1 Billion by 2033, exhibiting a CAGR of 4.2% during 2025-2033. North America currently dominates the market, holding a significant market share of over 36.0% in 2024. This leadership is attributed to strong consumer demand, premium product offerings, and advanced packaging technologies. As a result, the region continues to maintain the highest global pet food packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.8 Billion |

|

Market Forecast in 2033

|

USD 17.1 Billion |

| Market Growth Rate 2025-2033 | 4.2% |

The global pet food packaging market is primarily driven by evolving consumer expectations for transparency, sustainability, and traceability in product labeling. The increasing integration of smart packaging technologies, such as QR codes and RFID tags, enables real-time access to product origin and nutritional information, thereby enhancing consumer trust. Regulatory pressures on plastic waste reduction have also catalyzed the adoption of recyclable and biodegradable packaging materials. For instance, in June 2025, French pet food company Saga Nutrition partnered with Mondi to launch recyclable mono-material bags for its dry pet food, replacing traditional multi-material plastic. The packaging, part of Mondi’s re/cycle portfolio, aligns with CEFLEX guidelines and circular economy goals. It offers high-barrier protection and durability, enhancing sustainability and convenience. Moreover, the growing trend of e-commerce has heightened the need for packaging formats that ensure durability, tamper-evidence, and extended shelf stability during transit. Urbanization and shifting lifestyles are additionally driving demand for compact, single-serve packaging solutions that align with convenience-focused consumer behavior.

To get more information on this market, Request Sample

In the United States, the pet food packaging market growth is being propelled by rising demand for personalized and functional pet food solutions that require tailored packaging designs. The premiumization of pet food, particularly organic, grain-free, and veterinarian-formulated diets, necessitates advanced packaging that maintains product integrity and enhances visual appeal. Additionally, increasing investments in automated packaging machinery are enabling high-speed production with reduced waste, which appeals to environmentally conscious manufacturers. Retail innovation, including private-label branding and subscription-based pet food delivery services, is further influencing packaging strategies. Furthermore, the U.S. market benefits from strong infrastructure for packaging innovation and a robust regulatory framework that promotes packaging safety and material compliance.

Pet Food Packaging Market Trends:

Increasing Ownership Rates of Pets

The rise in pet ownership is a primary driver of the pet food packaging market. The APPA reports that U.S. pet ownership is projected to rise to 94 Million households in 2025, with Gen Z playing a pivotal role in increasing multi-pet households. More people are adopting pets, which increases the demand for pet food, subsequently boosting the need for effective packaging solutions. As per the American Pet Products Association (APPA), in 2024, a total of $150.6 billion in sales is expected in the U.S. on pets, as compared to USD 147 billion in 2023. Packaging companies are responding to this data by creating innovative packaging that serves the needs of many pet food products, such as dry kibble, wet food, and treats.

Rising Concerns of Sustainability

Consumers are becoming more environmentally conscious, which is being reflected in their purchasing preferences. In a recent Nielsen global survey, a whopping 81% of respondents said that it is extremely or very important that companies implement programs to improve the environment. About 73% said they would either definitely or probably change their consumption habits to reduce their impact on the environment. In response, packaging manufacturers are innovating with recyclable materials, biodegradable options, and designs that minimize the use of plastics. In response, companies are embracing sustainable packaging strategies, with a report stating that by 2025, over 40% of companies will adopt innovative and sustainable packaging techniques as they transition toward a circular economy. Companies like Mondi offer food packaging solutions for pets, such as BarrierPack Recyclable. These premade pouches and FFS roll-stock contain plastic laminates that are recyclable in areas where flexible packaging is accepted and through store drop-off.

Changes in Consumer Lifestyle and Preferences

People are leading busier lives which increases the demand for convenience in pet food products. Increased urbanization has resulted in longer commutes for many individuals, which consume large amounts of their day and contribute to a hurried lifestyle. As such, the World Bank projects that by 2050, the global urban population will more than double, with nearly 70% of the world living in cities. This has prompted many pet owners to opt for convenient food packaging solutions that are easy to carry and store. According to Our World in Data, Tokyo in Japan had the world's highest capital city population in 2018, with over 37 million inhabitants. This was followed by Delhi, India at over 28 million, Mexico City, Mexico at 21 million, and Cairo, Egypt at 20 million. Pet owners in these regions prefer easy-to-open and resealable packaging, single-serving containers, and lightweight packaging to support their love for pets and contribute to convenience in daily life.

Pet Food Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pet food packaging market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on material, food type, animal type, and packaging form.

Analysis by Material:

- Paper and Paperboard

- Plastic

- Metal

Plastic stand as the largest component in 2024, holding around 67.8% of the market. As per the pet food packaging market trends and forecast, plastic remains the largest segment due to its versatility, durability, and cost-effectiveness. Plastic packaging offers exceptional barrier properties that protect pet food from moisture, oxygen, and contaminants, thus extending shelf life and preserving freshness. It also allows for a wide range of design options, including various shapes, sizes, and colors, enhancing shelf appeal. Furthermore, rapid innovations in recyclable and biodegradable plastics that align with increasing consumer demand for sustainability are promoting the pet food packaging market share.

Analysis by Food Type:

- Dry Food

- Wet Food

- Others

Dry food leads the market with around 56.2% of market share in 2024. Based on the pet food packaging market analysis and overview, dry food represents the largest segment due to its widespread popularity and convenience. Dry pet food requires specific packaging solutions that provide excellent barrier properties to prevent exposure to humidity and contaminants, which can degrade the food's quality and shelf life. Packaging for dry pet food features multi-layered materials that ensure durability and maintain the product's freshness over extended periods. Additionally, rapid innovations such as resealable zippers and robust structural designs to enhance consumer convenience by making the packaging easier to store and use are fostering the pet food packaging industry growth.

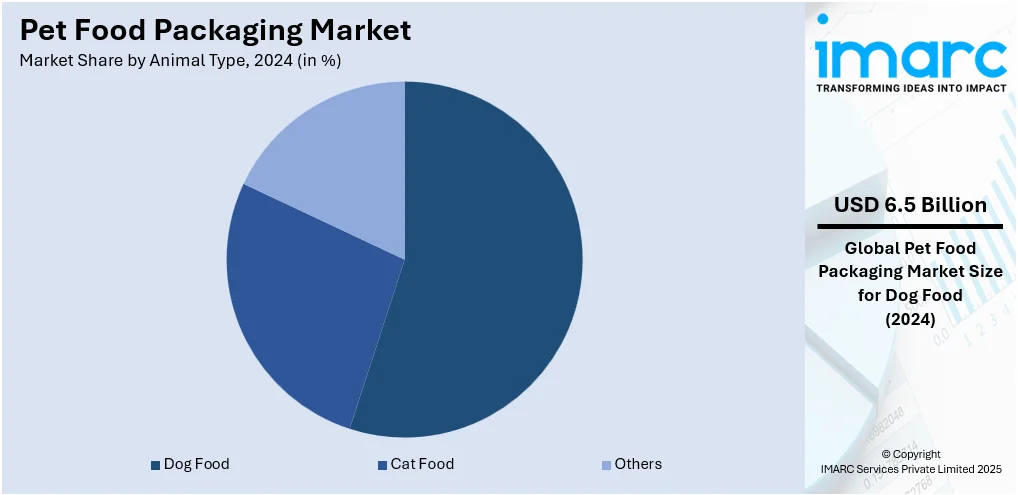

Analysis by Animal Type:

- Dog Food

- Cat Food

- Others

Dog food leads the market with around 55.0% of market share in 2024. According to the pet food packaging market outlook and segmentation, the dog food segment holds the largest share, reflecting the high population of dogs and their status as a primary pet in numerous households. Packaging for dog food caters to a variety of products, including dry kibble, wet food, and treats, each requiring different packaging characteristics to maintain freshness, nutritional value, and ease of use. Moreover, rapid innovations in packaging, such as robust materials that protect against spoilage and convenient features like easy-open tabs and resealable closures, are contributing to the pet food packaging demand.

Analysis by Packaging Form:

- Pouches

- Metal Cans

- Folding Cartons

- Bags

- Others

Bags lead the market with around 48.6% of market share in 2024. Based on the pet food packaging market research report, bags are the largest segment due to their practicality and efficiency in packaging a wide range of pet food types. They are favored for their lightweight properties, reducing shipping costs and making them easy for consumers to handle and store. Bags offer excellent barrier protection against moisture, air, and contaminants, which is crucial for maintaining the freshness and nutritional integrity of pet food. Additionally, they are highly customizable, supporting various printing technologies that allow for vibrant and attractive designs.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.0%. Based on the pet food packaging industry trends, North America holds the largest segment, driven by high pet ownership rates, a robust pet care industry, and strong consumer spending on pet products. The significant number of households that own pets and show a willingness to invest in premium pet care products, including specialized and health-oriented pet foods, is creating a positive outlook for the market growth. Furthermore, the ongoing shift towards more innovative, sustainable, and convenient packaging solutions, such as recyclable materials and smart packaging technologies that enhance user experience and product safety, is fostering the market growth. For instance, in February 2025, Nestlé Purina launched Gourmet Revelations Fine Cuts in Gelée cat food in a patented pyramid packaging design. Developed with behavioral insights, the jelly shape encourages natural feline eating patterns. The easy-release, spill-free pots offer convenience and premium presentation.

Key Regional Takeaways:

United States Pet Food Packaging Market Analysis

In 2024, the United States held a market share of around 87.90% in North America. The United States pet food packaging market is witnessing steady expansion due to the rising trend of premiumization in pet care products. Pet owners are increasingly seeking specialized packaging that reflects the high quality of ingredients used in pet food. According to the American Pet Products Association (APPA), the U.S. pet industry demonstrated continued growth and resiliency, with total expenditures reaching USD 152 Billion in 2024 and projected to climb to USD 157 Billion in 2025. This market momentum is fueling demand for visually appealing, resealable, and portion-controlled packaging formats. The rise in e-commerce has further driven innovation in secondary packaging, with lightweight and durable designs gaining prominence to reduce shipping costs and improve convenience. Increasing awareness of product traceability is also encouraging the use of smart packaging technologies, such as QR codes and NFC tags. These solutions enable consumers to verify the authenticity and nutritional value of pet food. Additionally, the aging pet population is influencing the development of packaging that supports easy dispensing for elderly pet owners. The United States market is also benefitting from increased R&D investments in biodegradable materials that align with evolving consumer expectations for sustainability without compromising on performance.

Europe Pet Food Packaging Market Analysis

The pet food packaging market in Europe is progressing rapidly, driven by the continent's strong regulatory emphasis on food safety and eco-conscious consumption. The European Commission reports that 40% of plastics used in the EU are allocated to packaging, prompting a robust shift toward recyclable or compostable formats like mono-material films and fiber-based alternatives. The popularity of gourmet-style pet food has increased the need for packaging that ensures flavor retention and extended freshness, such as metallized films and airtight pouches. Busy lifestyles are also contributing to the uptake of single-serve and ready-to-use packaging solutions, offering both convenience and portion control. The expansion of private-label offerings in retail chains has further influenced the need for differentiated and cost-effective packaging formats. Furthermore, there is a rising preference for clear labeling, which supports informed decision-making and encourages brands to invest in high-clarity packaging substrates. Enhanced visual branding, supported by digital printing technologies, is becoming a key marketing tool, helping brands build emotional connections with pet owners.

Asia Pacific Pet Food Packaging Market Analysis

The Asia Pacific pet food packaging market is expanding due to growing pet humanization and the surge in first-time pet ownership, especially in urban centers. The World Animal Foundation notes that in APAC, 32% of households own a dog, compared to 26% that own a cat, indicating a robust base of consumers seeking diverse packaging for different pet food needs. These shifts have increased the demand for compact, easy-to-store packaging options that cater to smaller living spaces. As on-the-go lifestyles gain traction, flexible pouches and stand-up bags are being increasingly adopted for their portability and resealing capabilities. Additionally, rising disposable incomes and heightened concern for hygiene are fostering the uptake of tamper-evident and contamination-resistant packaging. Local brands are also introducing innovative formats that integrate convenience features such as tear notches and ergonomic handles. Enhanced printing techniques are gaining popularity for enabling vibrant designs and ingredient transparency, appealing to young, tech-savvy pet owners.

Latin America Pet Food Packaging Market Analysis

Latin America’s pet food packaging market is experiencing growth fueled by a rise in dual-income households and increasing pet spending. According to reports, Brazil’s pet sector is projected to reach revenues of USD 14.44 Billion in 2025, marking a 3.5% increase from USD 13.96 billion in 2024. These socioeconomic shifts are encouraging the demand for packaging that simplifies storage and feeding routines, such as resealable pouches and portioned containers. There is also a growing interest in packaging that supports longer product shelf life, addressing challenges related to warmer climates in some areas. Local manufacturers are adopting modern packaging formats that combine functionality with shelf appeal, including windowed packs and vibrant digital prints. Innovations in lightweight materials are gaining ground, particularly for cost-sensitive segments, allowing brands to maintain affordability while improving user experience.

Middle East and Africa Pet Food Packaging Market Analysis

The pet food packaging market in the Middle East and Africa is gaining momentum, supported by growing urbanization and an expanding middle class. It has been estimated that urbanization will increase by 600 million people by 2030 in the GCC countries. Packaging that extends product freshness is particularly valued, given the region’s climate conditions. In addition, the growing trend of gifting pet-related products has led to rising demand for attractive, shelf-ready packaging formats. As awareness around pet nutrition rises, packaging formats that emphasize clarity and detailed product information are gaining favor.

Competitive Landscape:

The competitive landscape of the pet food packaging market is characterized by the presence of both global and regional players offering a wide range of flexible, rigid, and sustainable packaging solutions. Companies are increasingly focusing on innovation, customization, and environmentally friendly materials to meet evolving consumer preferences. Strategic initiatives such as mergers, acquisitions, capacity expansions, and collaborations are commonly adopted to strengthen market presence and expand geographical reach. For instance, in May 2025, Supreme Petfoods doubled its production capacity by installing two new lines with GIC’s support. The equipment includes conveyors, hoppers, weighers, and VFFS machines, enabling output of over 100 packs per minute. The installation was completed without interrupting existing operations, with one line achieving one million packs in six weeks. Technological advancements in packaging machinery and smart packaging solutions are also enhancing competitiveness. As demand for premium and specialized pet food rises, companies are investing in high-barrier and resealable packaging formats. The pet food packaging market forecast projects sustained competition, with a strong emphasis on product differentiation and sustainable practices over the coming years.

The report provides a comprehensive analysis of the competitive landscape in the pet food packaging market with detailed profiles of all major companies, including:

- Amcor plc

- American Packaging Corporation

- Berry Global Inc.

- Blue Buffalo Co. Ltd. (General Mills Inc.)

- Coveris

- Huhtamäki Oyj

- Mondi plc

- ProAmpac

- Silgan Holdings Inc.

- Smurfit Kappa Group plc

- Sonoco Products Company

- Transcontinental Inc.

- Winpak Ltd

Latest News and Developments:

- July 2025: Mars, Incorporated, a global leader in pet care products, made significant strides in sustainable packaging with the launch of a new recyclable mono-material pouch for its WHISKAS® brand in the UK and Germany. The new WHISKAS® pouches were designed for recyclability and were compatible with current or emerging recycling systems. This shift to recyclable packaging resulted in a 46% reduction in the carbon footprint compared to previous materials.

- May 2025: Nutrish rolled out a refreshed brand identity and redesigned packaging in the spring and summer of 2025 to enhance transparency and ease of choice. Emphasising real ingredients, health benefits, and simplified product names, the update aligned with pet owners’ evolving preferences. New packaging also reinforced support for shelter pets through charitable partnerships.

- February 2025: UFlex announced over USD 585 million in investments for sustainable packaging by 2025–26, including a WPP bags plant in Mexico and a recycling facility in India. The Mexican plant targeted the pet food sector with an 80 million bags/year capacity, while the Indian site aligned with EPR legislation and recycling goals.

Pet Food Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Paper and Paperboard, Plastic, Metal |

| Food Types Covered | Dry Food, Wet Food, Others |

| Animal Types Covered | Dog Food, Cat Food, Others |

| Packaging Forms Covered | Pouches, Metal Cans, Folding Cartons, Bags, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amcor plc, American Packaging Corporation, Berry Global Inc., Blue Buffalo Co. Ltd. (General Mills Inc.), Coveris, Huhtamäki Oyj, Mondi plc, ProAmpac, Silgan Holdings Inc., Smurfit Kappa Group plc, Sonoco Products Company, Transcontinental Inc., Winpak Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pet food packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global pet food packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pet food packaging industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pet food packaging market was valued at USD 11.8 Billion in 2024.

The pet food packaging market is projected to exhibit a CAGR of 4.2% during 2025-2033, reaching a value of USD 17.1 Billion by 2033.

The market is driven by rising pet ownership, increasing demand for convenient, safe, and sustainable packaging solutions, and growing consumer preference for premium and specialty pet food products. Advancements in packaging materials, focus on extending product shelf life, and innovations in design and branding also contribute to market growth. Additionally, heightened awareness of pet health and hygiene has increased the demand for high-quality, informative, and resealable packaging formats.

North America currently dominates the pet food packaging market, holding a significant share of over 36.0% in 2024, supported by high pet adoption rates, growing premium pet food segment, and strong presence of key market players.

Some of the major players in the pet food packaging market include Amcor plc, American Packaging Corporation, Berry Global Inc., Blue Buffalo Co. Ltd. (General Mills Inc.), Coveris, Huhtamäki Oyj, Mondi plc, ProAmpac, Silgan Holdings Inc., Smurfit Kappa Group plc, Sonoco Products Company, Transcontinental Inc., Winpak Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)