PET Packaging Market Size, Share, Trends and Forecast by Packaging Type, Form, Pack Type, Filling Technology, End-User, and Region, 2025-2033

PET Packaging Market 2024, Size and Trends:

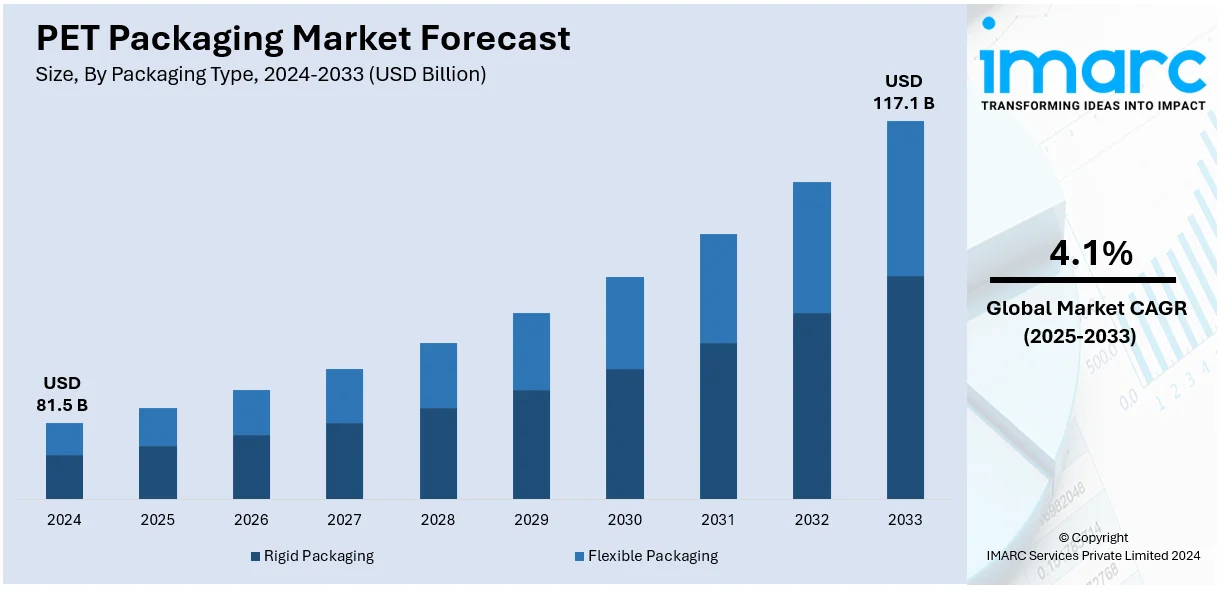

The global PET packaging market size reached USD 81.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 117.1 Billion by 2033, exhibiting a growth rate CAGR of 4.1% during 2025-2033. North America dominates the market in 2024 with a significant share of over 38.7% in 2024. The increasing popularity of different-sized and customized packs for brand differentiation, coupled with the escalating usage of eco-friendly products, is primarily driving the PET Packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 81.5 Billion |

|

Market Forecast in 2033

|

USD 117.1 Billion |

| Market Growth Rate (2025-2033) | 4.1% |

The global PET packaging market growth is majorly driven by the growing demand for lightweight and durable packaging solutions in the beverage and food industries. In line with this, the increasing environmental awareness among consumers is encouraging the adoption of recyclable PET materials, thereby promoting market growth. Furthermore, the increasing applications of PET in pharmaceutical and personal care products, due to its hygienic and safe nature, are acting as major growth-inducing factors. Furthermore, the penetration of e-commerce platforms requiring robust and versatile packaging solutions is further expanding the scope of the market. Moreover, the increase in the adoption of sustainable and cost-effective alternatives by manufacturers is impelling the market growth. Besides, the growing demand for eco-friendly packaging is encouraging the manufacturers to develop bio-based PET products.

The United States stands out as a key regional market, driven by advancements in material innovations, enhancing packaging durability and efficiency. The rising trend of customization in packaging designs to cater to diverse consumer preferences is bolstering the PET packaging market demand. Increasing investments in research and development for biodegradable and compostable PET options align with sustainability goals, further fueling the market growth. Expanding applications in sectors such as cosmetics, healthcare, and industrial goods are also contributing to the market growth. Moreover, significant rise in single-use medical and pharmaceutical packaging usage post-pandemic underscores the demand for PET solutions, emphasizing their importance in ensuring product safety and compliance with industry standards. Additionally, the region is witnessing increased advancements in PET production technologies, including lightweight packaging and heat-resistant solutions, which is creating a positive outlook for the market. Furthermore, the increasing focus on meeting regulatory requirements for sustainable and recyclable packaging is boosting product demand across industries. Additionally, the rising collaboration between packaging companies and retail brands is optimizing supply chains, further boosting the PET packaging market share.

PET Packaging Market Trends:

Rising Focus on Sustainability

According to the latest PET packaging market trends, increasing consumer environmental awareness is encouraging the adoption of PET packaging as an eco-friendly solution. Additionally, it has minimal storage and solid waste requirements, thereby acting as another significant growth-inducing factor. For instance, a new life cycle assessment (LCA) report by the National Association for PET Container Resources (NAPCOR) states that PET plastic bottles deliver significant environmental savings as compared to glass and aluminum bottles. Furthermore, NAPCOR partnered with one of the solid waste management and life cycle assessment consulting firms, Franklin Associates, for its recent study and concluded that PET plastic is a novel packaging solution for minimizing increasing global warming levels across the U.S. Besides this, the National Association for PET Container Resources also suggested the adoption of PET beverage packaging. For instance, in August 2023, one of the waste management companies in Scotland, Biffa, invested more than GBP80 Million to develop the infrastructures required to deliver a Deposit Return Scheme for cans and bottles. Additionally, companies are introducing innovative recycling technologies to improve the sustainability of PET materials, thereby driving the PET packaging market demand. As such, according to a survey conducted, 72% of individuals in Spain are prepared to pay better for products with sustainable packaging. Besides this, organizations, such as the PET Packaging Association for Clean Environment, act as catalysts in developing and disseminating best practices related to PET applications and recycling. It engages proactively with stakeholders to assist in policy framing.

Increasing Design Innovations

As per the latest PET packaging market outlook, several key players are extensively focusing on improving the functional and aesthetic aspects of PET packaging. In line with this, some of the innovations include enhanced barrier properties to extend the shelf life of products, especially in the food and beverage (F&B) sector, and designs that improve user experience, such as the introduction of easy-to-open caps and ergonomic shapes. Manufacturers are further using specific colors and shapes, thereby elevating the PET packaging market revenue. For instance, Sidel introduced StarLITE-R for carbonated soft drinks (CSD). It is a bottle made of 100% recycled PET that increases bottle base performance and secures ultimate packaging quality. In addition to this, PressureSAFE provides personal and home care brands with a safe container compared to traditional metal aerosols. It offers brand-specific packaging that is distinctive, safe, robust, and environmentally friendly. Moreover, in March 2020, ALPLA developed a 1-litre reusable PET bottle together with KHS, one of the specialists for packaging and bottling systems. Besides this, Berry Global Group's tethered closure design received an award from the Association for Packaging and Processing Technologies.

Strategic Collaborations

Based on the recent PET packaging market forecast, various companies across the supply chain, such as manufacturers, material suppliers, end-users, etc., are extensively partnering to introduce advanced and eco-friendly PET solutions. These collaborations generally focus on enhancing recycling processes and incorporating recycled PET (rPET) content into new items to minimize environmental impact. Besides this, partnerships between recycling companies and PET manufacturers can streamline the integration of rPET in packaging, thereby ensuring a more sustainable lifecycle for the products. Moreover, collaborations with technology firms are important for integrating smart packaging solutions that enhance supply chain transparency and consumer engagement. By working together, companies can leverage each other's strengths to adapt to changing market demands, innovate faster, comply with stringent environmental regulations, etc., ultimately leading to a more efficient and sustainable PET packaging industry. For instance, in January 2023, Carbios and Novozymes collaborated with a long-term exclusive strategic partnership to secure worldwide leadership in the bio recycling of PET, which is increasing the PET packaging market's recent price. Similarly, in June 2022, BOBST, along with one of the industrial adhesive specialists, BASF, and barrier film expert Evertis, supported one of the recycling companies in Europe, Sulayr, by forming a partnership that combined their expertise from across the packaging value chain.

PET Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on the packaging type, form, pack type, filling technology, and end user.

Analysis by Packaging Type:

- Rigid Packaging

- Flexible Packaging

Rigid packaging leads the market with a share of 76.5% in 2024. The rigid packaging type is extensively utilized in consumer-packaged goods (CPG), as it offers support and structure for products and is known for its strength. Some of the common examples of rigid materials include plastic bottles and boxes, aluminum cans, corrugated and paperboard boxes, glass jars, etc. Wide-ranging applications are glass bottles of spirits, cans of soup, cereal boxes, laundry detergent bottles, etc. For instance, DuFor Resins offers a wide range of sustainable, customized, and recycled polyesters for rigid packaging. Similarly, Chemco provides innovative packaging solutions, including PET containers, bottles, and jars, that enhance shelf-life and enhance brand presentation and also prioritize sustainability. This, in turn, validates the PET packaging market forecast.

Analysis by Form:

- Amorphous PET

- Crystalline PET

Amorphous PET leads the market in 2024. Amorphous PET refers to thermal and rigid plastics. It is known to be a clear and glossy material, and that can come with an anti-fog finish. Amorphous PET offers excellent chemical resistance and exhibits deep foaming capabilities, superior impact strength, and gas and water barrier properties. Furthermore, amorphous polyethylene terephthalate (APET) films are non-toxic and recyclable, which is fueling the market growth in this segmentation. For instance, PolymerFilms offers a full line of APET film products from world-leading producers such as Primex Plastics Corporation and Nan Ya Plastics. In line with this, INCOM RESOURCES develops APET Pellets that have passed several tests and ISO14000, FDA, ISO9000, GRS, and other certifications.

Analysis by Pack Type:

- Bottles and Jars

- Bags and Pouches

- Trays

- Lids/Caps and Closures

- Others

Bottles and jars lead the market in 2024 with a considerable share of 23.3%. Bottles and jars constitute a significant segment, as they are widely used in the packaging of pharmaceuticals, beverages, and personal care products, owing to their strength, clarity, and excellent barrier properties. According to the PET packaging market overview, they are gaining traction, as they offer flexibility, thereby making them ideal for confections, snacks, and other consumables. The augmenting consumer demand for more convenient packaging options and technological advancements is driving the growth of this segment. For instance, the Krones Group, headquartered in Neutraubling, Germany, develops, plans, and manufactures machines for the fields of filling and packaging technology.

Analysis by Filling Technology:

- Hot Fill

- Cold Fill

- Aseptic Fill

- Others

Cold fill leads the market share in 2024, due to its aptness for use with carbonated and non-carbonated beverages at low filling temperatures to avoid spoilage and carbonated loss. Its energy and lower cost for production make it particularly appealing for manufacturers. Apart from these, cold filling maintains better flavor properties and is also environmentally-friendly, thereby attracting eco-conscious brands along with customers. Additionally, its compatibility with a wide range of packaging materials further enhances its versatility and adoption across the beverage industry.

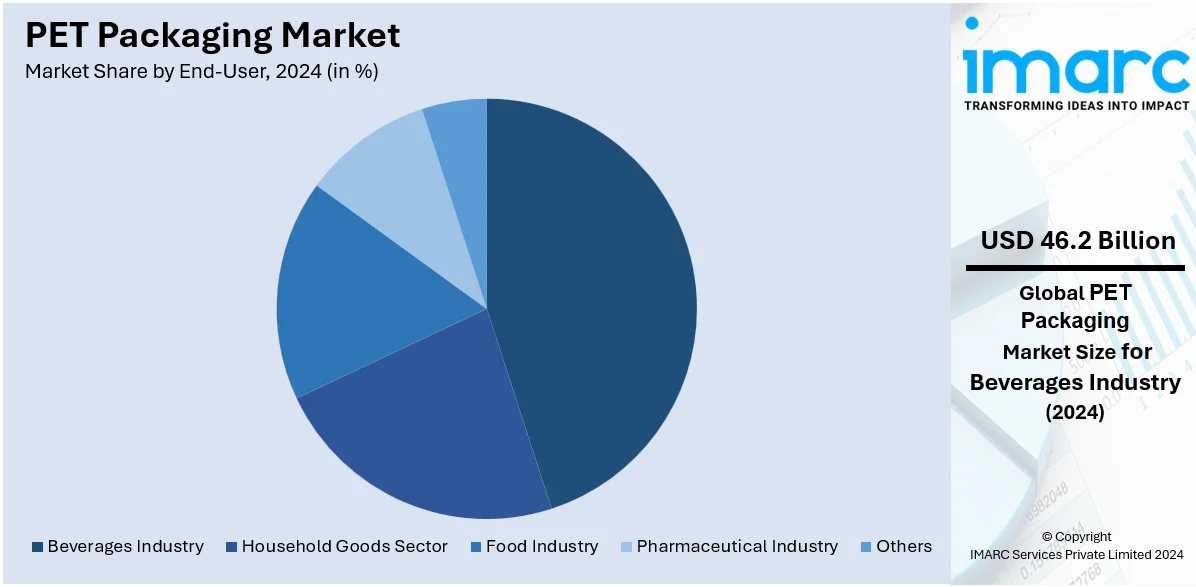

Analysis by End-User:

- Beverages Industry

- Bottled Water

- Carbonated Soft Drinks

- Milk and Dairy Products

- Juices

- Beer

- Others

- Household Goods Sector

- Food Industry

- Pharmaceutical Industry

- Others

Beverages industry leads the market in 2024 with a share of over 56.6%. PET packaging finds extensive applications in the beverages industry, on account of its versatility. It is lightweight and provides recyclability, thereby improving both shelf appeal and consumer convenience. Moreover, the household goods sector also usually relies on PET packaging for items like detergents and cleaners. Additionally, this type of packaging exhibits excellent barrier properties, which help to preserve freshness and extend the shelf life of baked goods, edible oils, ready-to-eat meals, etc. Apart from this, according to the PET packaging market statistics, it is gaining traction across the pharmaceutical sector, as it ensures that medications are securely packaged to protect them from contamination.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share with a significant share of around 38.7%. North America is a key significant market for PET packaging as it has more advanced capabilities of manufacturing, high beverage consumption, and increasing demand towards sustainable and recyclable products. The region's greater focus on innovation and adoption towards lightweight, eco-friendly packing solutions further improves its leadership in the market. Moreover, strong frameworks of regulations and growing awareness in the environment also support the usage of PET for different industries.

Key Regional Takeaways:

United States PET Packaging Market Analysis

The United States holds a crucial share in the North American market, with a share of around 83.30%. The food, beverage, and pharmaceutical sectors are highly contributing to expansion in the PET packaging industries in the US. Such adoption is spurred by the mounting demand for a packaging style that is rugged, lightweight, and recyclable packaging, particularly ready-to-eat meals, bottled water, and carbonated soft drinks or CSDs. PET has been widely applied in the American bottled water market in 2023 because it is affordable, recyclable. According to an industrial report, in 2023, Americans consumed 11.84 Billion gallons of carbonated soft drinks and only 15.94 Billion gallons of bottled water. Meanwhile, retail dollar sales of bottled water increased by 6.5% in 2023 to reach USD 48 Billion according to Beverage Marketing Corporation data. Innovations in recycled PET (rPET) are driven by strict environmental legislation and awareness among consumers. For instance, Coca-Cola declared by 2030, 50% of its PET bottles would be made from recycled materials. PET is lightweight and barriers, making it the go-to material for medicine bottles, and the pharmaceutical industry also contributes significantly. Moreover, the U.S. e-commerce market has expanded to more than USD 1.1 Trillion in 2023, according to a Digital Commerce 360 analysis of commerce department data., creating an increasing demand for PET solutions that are both light and robust.

Europe PET Packaging Market Analysis

Adoption of recyclable PET solutions is largely fueled by strict EU regulations, such as the Single-Use Plastics Directive. With countries such as Germany spearheading the recycling initiative at a PET bottle recovery rate of 98%, the region has accelerated the use of rPET with an emphasis on sustainability. Increasing demand for packaged foods and drinks also fuels the growth in markets such as France and the UK. PET packaging is key to the massive multibillion-dollar European bottled water industry in 2023. From the industry statistics, a paltry 29.2% of Italians tap water daily; over half, 43.3%, drink only bottled water making Italy the country that tops bottled water usage in Europe. Furthermore, new innovations in lightweighting technologies also lead to cost and environmental efficiencies due to the reduction of material usage. The personal care industry also significantly contributes since shampoos and liquid soaps are often packed in PET containers. The market is growing even faster with such collaborative efforts as Coca-Cola Europe's goal of 100% rPET by 2030.

Asia Pacific PET Packaging Market Analysis

The middle class in countries like China and India is on the rise, and urbanization is increasing, driving the demand for packaged products. According to an industry report, the country of China saw 13% less in bottle-grade PET export by Chinese Customs during the December 2022 time. Such exports were 15% less than what became the record shipments during that particular year. In a huge way, food and beverage dominates packaging demand within this particular region, and that sector really consumes PET extensively in terms of making water bottles. Moreover, the growing e-commerce market in India is set to reach over USD 100 Billion in 2023, according to the government's official data, which further drives the need for strong and lightweight PET packaging. About 12.2% of metropolitan families now get their drinking water from bottled sources, according to the report, and it is up from 2.7% a decade ago. As the Centre prepares to roll out the Jal Jeevan Mission, which aims to provide tap water to every rural household by 2024, the discovery is part of the latest report from the National Statistical Office. In addition, government initiatives that promote sustainability—such as India's 2022 ban on single-use plastics—boost demand for PET products that can be recycled. The pharmaceutical and personal care industries also significantly contribute to regional growth.

Latin America PET Packaging Market Analysis

Growing bottled beverage consumption is one of the key drivers of the market in Latin America. Brazil spent almost 4.80 billion gallons of bottled water every year, data from World Atlas indicated. Urbanization has driven demand for more packaged and processed meal supply by the food industry, which makes food also very important. Sustainable packaging is becoming increasingly popular; Coca-Cola has pledged to use 100% recycled PET by 2025 and is already bottling its beverages in recycled PET in 30 markets. PET is also a significant part of the cost-effective and long-lasting packaging of the Mexican pharmaceutical and cosmetics industries. According to a study, 63% of the 12 metric tons of post-consumer plastic packaging garbage produced in Brazil in 2017 was not managed. Therefore, this step by Coca-Cola is a step in the right direction.

Middle East and Africa PET Packaging Market Analysis

The Middle East's beverage market has grown steadily over the last ten years at a rate of about 5% per year, according to industry statistics, with total sales expected to reach USD 30 Billion in 2022. The high per capita consumption of bottled water is driving the GCC countries, led by Saudi Arabia and the UAE, to embrace PET more widely. Industry figures show that 76% of North Africa and the Middle East and 24% of sub-Saharan Africa use bottled water. Government programs, such as Saudi Vision 2030, are increasing demand for recyclable PET because people are becoming more aware of ecological issues. Consumption, urbanization and middle-class growth in Africa is driving demand for packaged foods and drinks, where South Africa and Nigeria lead the way. The lightness and tamper-proof characteristics of PET also increase its use in the pharmaceutical industry.

Competitive Landscape:

The competitive landscape of the global PET packaging market is characterized by the presence of numerous small-scale as well as large-scale manufacturers and suppliers investing in innovation to meet changing consumer demands. Companies are focusing on developing lightweight, recyclable, and sustainable packaging solutions to address environmental concerns. Additionally, advancements in production technologies, such as improved recycling processes and bio-based PET alternatives, are driving market differentiation. Strategic partnerships, mergers, and acquisitions are common as industry players aim to enhance their market presence and expand product portfolios.

The report provides a comprehensive analysis of the competitive landscape in the PET packaging market with detailed profiles of all major companies, including:

- Amcor plc

- Berry Global

- Graham Packaging Company

- Dunmore Corporation

- Huhtamäki Oyj

- Resilux NV

- E. I. du Pont de Nemours and Company

- Silgan Holdings Inc.

- GTX Hanex Plastic

- Comar LLC

- Sonoco Products Company

- Nampak Ltd.

- CCL Industries Inc.

- Smurfit Kappa Group

- Rexam PLC

Recent Developments:

- April 2024: PAAG, a member of Bell Holding, installed a Starlinger recoSTAR PET 165 HC iV+ PET bottle-to-bottle recycling line that has a production capacity of up to 1,800 kg/h in its Gebze facility near Istanbul.

- January 2024: Coca-Cola India has entered a strategic collaboration with one of the leading retail groups in India, Reliance Retail, on a PET recycling program that provides individuals incentives for returning empty PET bottles. This collaboration aims to collect five million PET bottles annually during the program’s pilot phase.

- January 2024: One of the research teams led by Dr. Beizhan Yan and Dr. Wei Min of Columbia University introduced an imaging technique called Stimulated Raman Scattering (SRS) microscopy that detected thousands of tiny bits of plastic in common single-use bottles of water.

PET Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Rigid Packaging, Flexible Packaging |

| Forms Covered | Amorphous PET, Crystalline PET |

| Pack Types Covered | Bottles and Jars, Bags and Pouches, Trays, Lids/Caps and Closures, Others |

| Filling Technologies Covered | Hot Fill, Cold Fill, Aseptic Fill, Others |

| End Users Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Amcor plc, Berry Global, Graham Packaging Company, Dunmore Corporation, Huhtamäki Oyj, Resilux NV, E. I. du Pont de Nemours and Company, Silgan Holdings Inc., GTX Hanex Plastic, Comar LLC, Sonoco Products Company, Nampak Ltd., CCL Industries Inc., Smurfit Kappa Group, Rexam PLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the PET packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global PET packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the PET packaging industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The PET packaging market was valued at USD 81.5 Billion in 2024.

IMARC estimates the PET packaging market to exhibit a CAGR of 4.1% during 2025-2033.

The market is driven by increasing demand for lightweight and durable packaging in food and beverage industries, the adoption of recyclable PET materials due to environmental awareness, and the growing application of PET in pharmaceuticals and personal care sectors. Additionally, the rise in e-commerce platforms requiring versatile packaging solutions is expanding market scope.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the PET packaging market include Amcor plc, Berry Global, Graham Packaging Company, Dunmore Corporation, Huhtamäki Oyj, Resilux NV, E. I. du Pont de Nemours and Company, Silgan Holdings Inc., GTX Hanex Plastic, Comar LLC, Sonoco Products Company, Nampak Ltd., CCL Industries Inc., Smurfit Kappa Group, and Rexam PLC, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)