Pet Toys Market Size, Share, Trends and Forecast by Type, Application, Distribution Channel, and Region, 2026-2034

Pet Toys Market Size and Share:

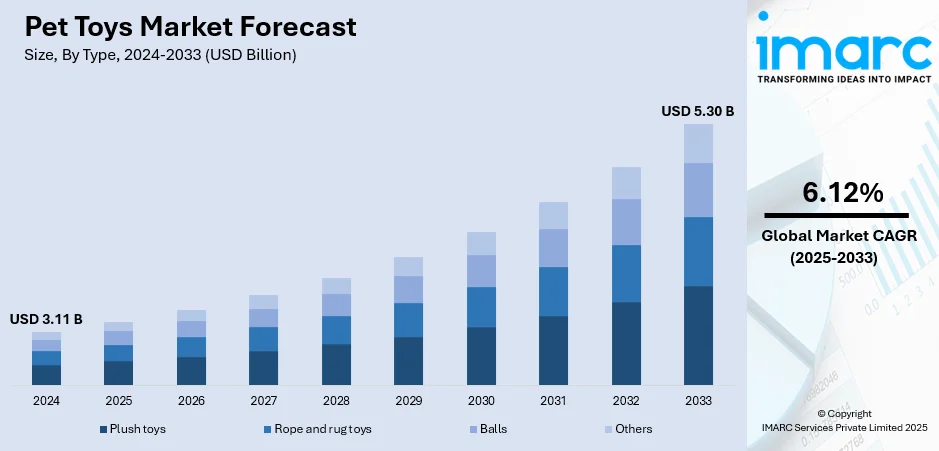

The global pet toys market size was valued at USD 3.11 Billion in 2025. The market is projected to reach USD 5.30 Billion by 2034, exhibiting a CAGR of 6.12% from 2026-2034. North America currently dominates the market, holding a market share of over 34.5% in 2024. The market is driven by increasing pet ownership, heightened awareness of pet health, and the growing inclusion of pets as part of the family. Toys are no longer considered discretionary but as required tools that enhance physical exercise, mental stimulation, and emotional health. Amplified demand among households globally emphasizes their role in promoting healthier lifestyles for pets. This cultural change, along with changing consumer patterns, continues to guide global forces, reinforcing the combined pet toys market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.11 Billion |

|

Market Forecast in 2034

|

USD 5.30 Billion |

| Market Growth Rate 2026-2034 | 6.12% |

The global pet toys market is being compelled by the consistent increase in pet adoption across the globe due to urbanization, nuclear families, and the emotional comfort pets bring to contemporary homes. Accelerating concern for animal welfare and greater acceptance of pets as friends in both established and emerging economies have strengthened the demand for products that enhance pets' lives. Consumers are looking for toys that are entertaining but also useful for behavior development, stress reduction, and general health. As per the sources, In February 2025, the Lamb Chop dog toy was officially launched in the United States, rapidly becoming a viral sensation and establishing itself as one of the most sought-after products in the pet toy market. Furthermore, the growth of e-commerce platforms has also made it easier, enabling more consumers to buy varied and innovative products. Global lifestyle trends, for example, eco-friendly behavior, have also shaped the demand for sustainable and non-toxic pet toys. These dynamics together propel steady market growth, innovation and consumer education driving buying decisions across markets.

To get more information on this market, Request Sample

The United States held an 87.80% market share in 2024, where the pet toys market growth is fueled by a strong pet companionship culture and the prevailing perception of animals as part of the family. American consumers exhibit high demand for pet care, driven by rising disposable incomes and the desire to deliver better comfort and enrichment to pets. The nation's highly evolved retail environment, including specialty outlets, supermarkets, and online sites, provides rich product options and fosters repeat sales. The increase in popularity of pet-oriented recreational activity, training regimes, and wellness regimens has raised toys' status to being necessary equipment, not amenities. Social media sites that feature playful behavior further drive consumer choice, amplifying demand for innovative and interactive products. According to the sources, in February 2025, Jazwares announced the launch of Chew Mees, a Squishmallows-inspired pet toy line featuring plush designs modeled after food, nature, and celebrity-inspired characters, including dog toys reflecting Taylor Swift and Travis Kelce. Moreover, demographic trends, such as younger generations getting pets earlier in life, continue to grow the consumer pool and drive long-term demand growth in pet toys.

Pet Toys Market Trends:

Growing Pet Adoption and Increased Interest in Pet Health

One of the largest drivers of pet toys market trends is the growing worldwide number of pet owners, which continues to fuel steady demand for products improving pet health and quality of life. For example, in 2022, China had almost 74 million pet dogs and 67 million pet cats, as estimated by the Global Animal Health Association. This sharp growth demonstrates a culture shift in which pets are accepted as full members of the family. Owners are simultaneously becoming more aware of their pets' physical and mental requirements, recognizing play as essential to avoid anxiety, behavioral problems, and lack of exercise. Pet toys serve as vital outlets by promoting exercise, enhancing agility, and driving mental growth. Their function now goes far beyond mere entertainment, placing them in the position of being vital tools in the pursuit of overall health. The shift in consumer attitude has solidified toys as household essentials, further justifying their global and long-term use.

Pet Humanization and Lifestyle-led Demand for Toys

The increased pet humanization trend has not only affected pet owners' behavior but also changed the way they live with their pets. Pets are now considered companions or family members, and their psychological and emotional needs are more emphasized. This has resulted in high demand for toys that simulate human interaction, offer comfort, and stimulate bonding experiences. Additionally, today's lifestyles involving long working hours and limited free time limit the level of active involvement owners may have with their pets. In such a situation, playthings have become essential companions, providing amusement and intellectual stimulation when owners are not present. Interactive toys, puzzle toys, and comfort objects assist in reducing separation anxiety and promoting independence in pets. As a result, the intersection of humanization and lifestyle changes has placed pet toys beyond mere accessories, making them purpose-driven options to satisfy owners' and pets' demands.

Social Media Influence, Growing Disposable Incomes, and Innovation

Pet toy popularity has also been supported by social media sites and the growth of pet influencers who present playful play with toys, creating aspirational tendencies in owners. A 2024 American survey emphasized that 70% of respondents utilized Facebook, 50% of respondents used Instagram, and 21% of respondents used X (previously Twitter), highlighting the influence of online platforms on consumer consciousness. Coupled with this is increasing disposable incomes, especially in emerging economies, enabling pet owners to allocate more money to top-of-the-line, long-lasting, and interactive products. The U.S. Energy Information Administration (EIA), worldwide disposable income was USD 10,136 in 2022 and is expected to reach USD 16,979 by 2050, driving demand for premium products. Manufacturers are capitalizing on this by coming out with creative toy designs with capabilities such as motion, sound, treat-dispensing, and puzzle-sololving mechanisms. These innovations not only improve play experiences of pets but also drive repeat buys, making the market competitive and dynamic.

Pet Toys Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pet toys market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, application, and distribution channel.

Analysis by Type:

- Plush toys

- Rope and rug toys

- Balls

- Others

With 38.7% market share in 2024, balls proved to be a ruling category in the market of pet toys, demonstrating their cross-cultural popularity as multi-purpose and stimulating play instruments. Their contribution to promotion of physical activity and intellectual engagement has turned them into indispensable items for enhancing the relationship between pets and owners. Balls come in various forms, ranging from rubber for tough chewers to squeaky and foam ones to play indoors. Their low cost and ubiquitous availability induce repeated purchase, while product innovations like glow-in-the-dark, texture, and treat-dispensing functionality increase their popularity. Veterinarian and trainer endorsements further cement their worth in helping keep pets fit and healthy, further bolstering demand. The synergy of accessibility, flexibility, and ongoing innovation ensures that balls remain a top category, which demonstrates consumer trust in their capacity to deliver consistent enrichment and entertainment for pets throughout homes globally.

Analysis by Application:

- Dog

- Cat

- Others

Accounting for 52.6% of the market in 2024, dog specific toys continued to dominate the most influential segment due to the high rate of dog ownership as family pets. The toys address various canine requirements ranging from chew and tug items to interactive gadgets aimed at stress relief and training stimulation. Increasing populations of dogs in urban regions with limited space further underscore the significance of stimulating play. Pet owners are highly buying toys to prevent destructive habits and mental stimulation, particularly as dogs become accustomed to living in apartments. Pet humanization also supports greater expenditure since owners voluntarily spend money on higher-quality and innovative toys that bring comfort and stimulating play. With social media grabbing attention with fun experiences and influencing tastes, buying demand keeps trending upward. This combination of need, emotional attachment, and lifestyle incorporation reinforces the dominant market power of dog toys, guaranteeing steady customer interest and category growth.

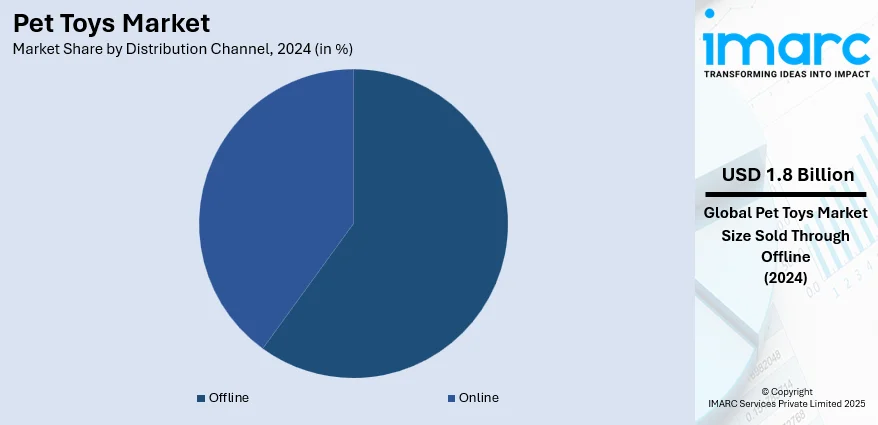

Analysis by Distribution Channel:

- Online

- Offline

Offering 57.9% market share in 2024, offline distribution channels were consumers' first preference for buying pet toys since they could examine the product physically before purchasing. In-store visits guarantee durability, safety, and appropriateness and provide interaction with experienced personnel for proper toy recommendations. Supermarkets, hypermarkets, and specialist stores also feature promotions, bundled value, and in-store demonstrations, generating exciting shopping experiences that reinforce customer loyalty. The availability of products immediately available in offline locations adds to their immediacy, particularly for emergency buys. Although digital uptake has intensified across the world, offline stores continue to control areas where human interaction and touch-and-feel assessment are sought. Seasonal promotions and local events by retailers contribute to traffic, thereby making physical spaces crucial in generating repeat purchases. The persistence of the value of physical shopping experiences makes offline channels the focal point in developing the pet toys market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Accounting for 34.5% of the global share in 2024, North America consolidated its dominance of the pet toys space based on a culture that assigns great emotional importance to pets as part of family. Significant household expenditure on enrichment items demonstrates the depth of commitment to pet health in the region. The region enjoys the presence of an evolved retail environment incorporating specialty stores, supermarkets, and well-established online channels, presenting shoppers with rich choice. Social media is a powerful trend influencer with pet influencers creating demand for engaging and innovative designs. Increasing disposable incomes further enable owners to spend on high-quality toys that guarantee longevity and higher stimulation. Veterinarians and trainers also emphasize the importance of exercise and wellness toys, solidifying their status as necessities rather than luxuries. Continued innovation and acceptance of premium products affirm North America as a leading force in the worldwide pet toys market.

Key Regional Takeaways:

United States Pet Toys Market Analysis

The United States pet toys market outlook is also largely driven by the humanization of pets, where pet owners treat their pets as family. The emotional bonding leads to the need for high-quality, interactive, and mentally stimulating pet toys to improve pet health. Consequently, spending on pets in the United States amounted to USD 152 Billion in 2024, as stated by the World Animal Foundation. Additionally, heightening awareness regarding pet health and physical and mental stimulation is prompting consumers to spend on a range of toys, such as chewable, puzzle, and electronic toys. Growing adoption of pets, especially dogs and cats, is also increasing the consumer base. Referring to a World Animal Foundation report in 2025, 71% of American households have a pet, which is equivalent to 94 Million households. Of these, 68 Million households owned a pet dog, and 49 Million households owned a cat. Busy lives and extended working hours are also pushing pet owners to look for toys that can engage their pets while they are away. In addition, material and design innovation with an emphasis on durability and greenness is increasingly appealing to environmentally aware consumers. Also driving the market through premiumization of pet goods.

Asia Pacific Pet Toys Market Analysis

Asia Pacific's pet toys market is growing as a result of growing pet care learning and the impact of veterinary specialists who stress the role of play in pet development. Pet owners are boosting knowledgeable about behavioral training, and therefore there is increased demand for toys promoting discipline, obedience, and socialization. The popularity of pet cafes, grooming parlors, and pet-friendly public places throughout the region is also precipitating a more active lifestyle for pets and, subsequently, a higher demand for portable and outdoor-friendly toys. Besides, higher disposable incomes and better living standards in the emerging economies are facilitating greater expenditure on pet care products. For example, India's per capita disposable income was USD 2.54 Thousand in 2023 and is anticipated to reach almost USD 4.34 Thousand by 2029, according to the India Brand Equity Foundation (IBEF). Apart from this, regional expansion in domestic pet product brands with competitive pricing and locally applicable designs is also picking up, driving market growth.

Europe Pet Toys Market Analysis

The Europe pet toys market growth is heavily driven by a growing trend towards pet ownership by the younger age group and urban residents in search of companionship and emotional support from pets. Based on the Global Animal Health Association, pet cats and dogs in the European Union numbered 113 Million and 92 Million respectively in 2022. Among them, Germany accounted for 15.7 Million pet cats and 10.7 Million pet dogs, and the UK had 13 Million pet dogs and 12 Million pet cats. This cultural transformation is driving the need for varied and entertaining toys that suit many pet species and breeds. Further, growing concerns regarding pet health and behavioral requirements are motivating owners to buy toys that encourage exercise, mental stimulation, and alleviate anxiety or destructive tendencies. Increasing demand for sustainable and green products also affects purchasing behavior, as buyers are opting for pet toys derived from natural, biodegradable, or recyclable materials. European consumers also prefer quality, long-lasting toys, an aspect that resonates with wider lifestyle values of, for instance, minimalism and ethical manufacture. Aside from this, pet fashion and personalization trends, boosted by innovative social media platforms, are leading to increasing purchases and toy-type experimentation, boding well for industry growth.

Latin America Pet Toys Market Analysis

Latin America's market for pet toys is growing strongly with an increasing interest in pet wellbeing, with the owners themselves becoming intensified focused on finding products that can help their animals' mental stimulation and emotional equilibrium. The global pet care trend is motivating consumers to try a broader variety of toys, such as interactive, sensory, and breed-specific toys. In addition, growing attendance at pet events, like fairs and training sessions, is also heightening awareness regarding the importance of toys in socialization and training. Also, retail and online growth is improving availability of products throughout the region. For example, Brazil's e-commerce business is likely to reach USD 200 Billion by 2026 and grow at a rate of 14.3%, according to the International Trade Administration (ITA).

Middle East and Africa Pet Toys Market Analysis

Middle East and Africa pet toys market is also highly impacted by the growing trend of pet ownership among urban dwellers, especially in big cities where lifestyles are increasingly becoming modernized and pet-oriented. For example, as per a survey carried out in Riyadh, Saudi Arabia, between September 2020 and February 2021, 77.4% of the participants indicated that they had pet cats, and 24.6% indicated that they had pet birds. With pets becoming companions and not just animals, owners are spending more on items that improve the quality of life of their pets, such as exercise, comfort, and mental stimulation toys. The expansion of pet services such as grooming parlors, vet clinics, and specialty pet stores is also driving higher awareness and availability of pet toys, further boosting market growth.

Competitive Landscape:

Pet toys industry competition is defined by continuous innovation, robust consumer involvement, and changing lifestyle trends among pet owners. Industry participants are increasingly concentrating on developing toys that integrate functionality with enrichment, highlighting durability, security, and interactive elements to satisfy boosting consumer expectations. The variety of products, from chew and fetch toys to puzzle and treat-dispensing ones, mirrors the flexibility of manufacturers to various pet need and desire. Offline stores remain a vital channel for brand exposure as bolstered by the increasing power of e-commerce websites that provide ease of convenience and greater accessibility. Social media, and more so pet-centric content, has emerged as a key driving force in influencing consumer behavior and driving demand for novel and personalized products. With more budgets from households being allocated to pets, differentiation and innovation are likely to drive competition, facilitating continued growth and enhancing the pet toys market forecast outlook.

The report provides a comprehensive analysis of the competitive landscape in the pet toys market with detailed profiles of all major companies, including:

- Allstar Innovations

- Central Garden & Pet Company

- Company of Animals

- Fluff & Tuff Inc.

- JOLLY PETS Ltd.

- Kong Company

- Mammoth Pet Products

- Multipet International Inc.

- Outward Hounds LLC

- Petmate

- Petsport Usa Inc.

- West Paw Inc.

- ZippyPaws

Latest News and Developments:

- April 2025: SANDDOG announced the launch of a new lineup of interactive toys for dogs developed to encourage play, interaction, and overall health in dogs of all breeds and sizes. Tested for durability and toughness, these novel toys seamlessly blend style with safety.

- March 2025: Benebone introduced the Benebone Bounce collection, a new range of interactive rubber dog toys. This is the company's first significant entry into the interactive pet toys sector.

- February 2025: Brightkins officially launched the Kanoodle Dog Edition, an innovative brainteasing puzzle pet toy. This novel puzzle toy turns snack time into an engaging, interactive experience for dogs of all types, sizes, and ages.

- February 2025: e.l.f. Cosmetics announced the launch of a limited-edition dog toy in collaboration with Best Friends Animal Society. The Power Grip Primer Small Dog Toy demonstrates the beauty brand’s dedication to animal welfare.

- January 2025: SportPet Designs successfully completed the acquisition of Mammoth Pet Products, a renowned manufacturer of innovative toys for dogs. This acquisition supports the company’s mission to offer premium, inventive toys that improve the lives of both pet owners and their pets.

Pet Toys Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Plush toys, Rope and rug toys, Balls, Others |

| Applications Covered | Dog, Cat, Others |

| Distribution channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allstar Innovations, Central Garden & Pet Company, Company of Animals, Fluff & Tuff Inc., JOLLY PETS Ltd., Kong Company, Mammoth Pet Products, Multipet International Inc., Outward Hounds LLC, Petmate, Petsport Usa Inc., West Paw Inc., ZippyPaws, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pet toys market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pet toys market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pet toys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pet toys market was valued at USD 3.11 Billion in 2024.

The pet toys market is projected to exhibit a CAGR of 6.12% during 2025-2033, reaching a value of USD 5.30 Billion by 2033.

The pet toys market is driven by rising global pet ownership, the pet humanization trend, and awareness of animal wellness. Growing disposable incomes support spending on durable, premium, and interactive toys. Social media consideration combined with design and functional innovations further builds demand, rendering pet toys key drivers for physical exercise and mental stimulation.

North America currently dominates the pet toys market, accounting for a share of 34.5%. The market is underpinned by extensive pet ownership and cultural focus on pets as part of the family. Deep consumer expenditure on high-end offerings, combined with established offline and online distribution channels, underpins demand. Also, design innovation and growing popularity of interactive and wellness-oriented toys continue to support the region's leadership in the world market.

Some of the major players in the pet toys market include Allstar Inovations, Central Garden & Pet Company, Company of Animals, Fluff & Tuff Inc., JOLLY PETS Ltd., Kong Company, Mammoth Pet Products, Multipet International Inc., Outward Hounds LLC, Petmate, Petsport Usa Inc., West Paw Inc., ZippyPaws, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)