Petroleum Resins Market Size, Share, Trends and Forecast by Product, Application, End Use, and Region, 2025-2033

Petroleum Resins Market Size and Share:

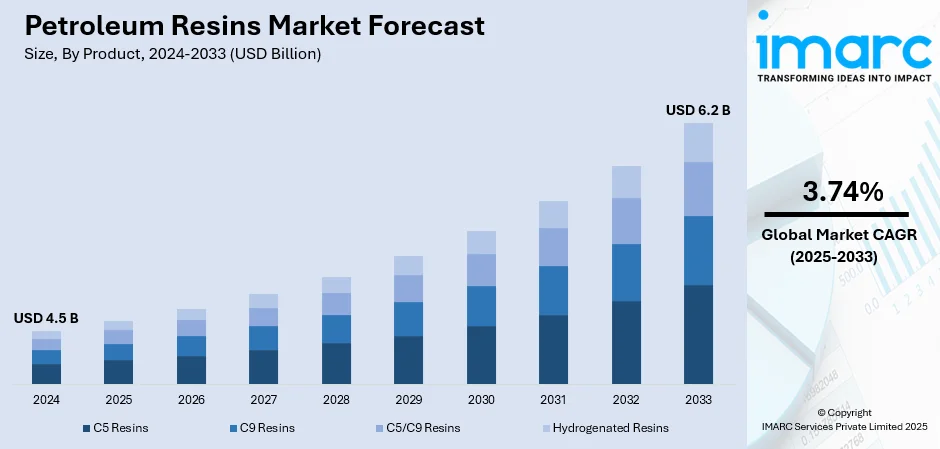

The global petroleum resins market size was valued at USD 4.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.2 Billion by 2033, exhibiting a CAGR of 3.74% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 46.8% in 2024. The market is expanding due to increasing demand for high-performance adhesives and sealants across automotive and packaging industries. In addition, growing investments in lightweight, moisture-resistant materials and strict environmental regulations are driving petroleum resins market share in various industrial and consumer applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.5 Billion |

|

Market Forecast in 2033

|

USD 6.2 Billion |

| Market Growth Rate (2025-2033) | 3.74% |

The expansion of the automotive and transportation industries is also a major driver for the market of petroleum resins. New-age cars need material that possesses high bonding strength, endurance, and cold and heat resistance, all of which are provided by petroleum resins with great efficiency. From tires to coatings and adhesives, these resins are applied widely in manufacturing light components that enhance fuel economy and minimize emissions. With governments and producers allocating funds towards electric vehicles (EVs) and sophisticated mobility solutions, the need for high-performance products such as petroleum resins keeps growing. The automotive industry is also focusing on designs that comply with both safety and environmental legislations, necessitating high-level materials to improve product dependability. In addition, growing vehicle manufacturing in countries like North America, Europe, and Asia Pacific is fueling demand for adhesives and coatings where petroleum resins are the core. With growing disposable income and increasing consumer demands for comfort and durability of vehicles, petroleum resins are increasingly becoming a sought-after option in production.

To get more information on this market, Request Sample

The United States petroleum resins industry is significantly fueled by the increasing need for adhesives and sealants within major industries like construction, automotive, and packaging. In the United States, where advanced manufacturing and infrastructure development are key to economic growth, adhesives and sealants are necessary to provide reliable bonding and sealing performance. Petroleum resins are becoming more commonly used in adhesive recipes to provide tackiness, peel strength, heat resistance, moisture resistance, and chemical resistance and are ideal for high-performance applications that demand long service life. The increasing popularity of lighter-weight materials in the automotive and aerospace sectors, as well as the increased requirement for prefabricated and modular building solutions, is boosting greater resin use. In the packaging industry, the surging demand for higher performing and eco-friendly packaging materials is leading to the use of petroleum resin-based adhesives by manufacturers to enhance tape strength and closure integrity.

Petroleum Resins Market Trends:

Rising Industrial Applications and Regulatory Support

The global petroleum resins market growth is primarily driven by their growing demand for manufacturing paints, sealants, personal hygiene products, tire, automotive, packaging tapes, and building and construction materials. Petroleum resins offer improved adhesive bond strength and resistance to acids, alkalis and water. In addition to this, they are also employed due to their exceptional thermal stability, peeling strength, tack ability, and high softening point. Governments worldwide are adopting stringent regulations regarding volatile organic compound (VOCs) emissions from vehicle coatings, which, in turn, is facilitating the demand for petroleum resins with low VOCs. An industry report estimated total VOC emissions at 1,132.1 Tons annually, with storage tanks contributing approximately 88.2% of that amount. In countries such as the United States, India, Germany, and China, governments are increasing their spending in the packaging sector, which is also propelling the market growth. IBEF noted that the government's progressive policies, including allowing 100% FDI through the automatic route, have augmented foreign investment in India’s packaging sector, attracting Rs. 10,127 crore (USD 1.74 Billion) in paper and pulp from April 2000 to December 2024. They are also imposing policies and measures to augment the production of vehicles, which is increasing the demand for petroleum resins. As such, in June 2025, GM announced a USD 4 Billion US manufacturing investment to expand gas and EV production, aiming for over two million vehicles annually and supporting job growth across key states. Furthermore, the development of advanced process technologies to increase the output of resins is positively impacting the growth of the market.

Technological Advancements Enhancing Resin Production

Technological innovations in the petroleum resin market trends manufacturing process are playing a crucial role in expanding the market. Advanced process technologies, such as catalytic reforming and hydro processing, have improved the efficiency and yield of petroleum resin production. These innovations reduce manufacturing costs while ensuring higher purity, better thermal stability, and improved bonding properties. Enhanced formulations are helping producers tailor resins for specific applications such as coatings, rubber compounding, and adhesives, where performance demands are continuously evolving. Moreover, technological advancements have enabled the production of low-emission resins, aligning with global sustainability and environmental goals. These developments are helping manufacturers meet stringent industry standards without compromising on product effectiveness. Additionally, the use of digital monitoring and automation in resin production has optimized energy usage and minimized waste, contributing to cost-effective and environmentally friendly processes. As the demand for high-quality resins grows across end-use industries, ongoing research and development efforts in refining process technologies are expected to create new market opportunities. The continuous improvement in production methods is not only increasing the capacity but also allowing customization, thereby supporting long-term expansion in the petroleum resins sector.

Rising Packaging Industry Demand Worldwide

The global packaging industry’s expansion is significantly contributing to the demand for petroleum resins. Packaging materials need to offer durability, flexibility, and resistance to moisture, heat, and chemical exposure, which petroleum resins effectively provide. These resins are widely used in tapes, adhesives, labels, and flexible films to enhance sealing strength and ensure product protection throughout transportation and storage. The rise of e-commerce and online retail has further accelerated packaging requirements, prompting manufacturers to seek advanced materials that are lightweight yet highly protective. Additionally, consumer demand for sustainable and recyclable packaging solutions is prompting the development of eco-friendly formulations that incorporate petroleum resins while reducing environmental impact. According to the petroleum resins market forecast, growing investments in the packaging sectors of developing regions, particularly in Asia and Latin America, are expected to drive significant market expansion. With the food and beverage, pharmaceuticals, and personal care industries requiring reliable packaging solutions, petroleum resins continue to find application in various packaging forms. The shift toward automation and smart packaging is also expected to further increase resin usage, making it a critical component in modern packaging solutions.

Petroleum Resins Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global petroleum resins market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and end use.

Analysis by Product:

- C5 Resins

- C9 Resins

- C5/C9 Resins

- Hydrogenated Resins

As per the petroleum resins market outlook, in 2024, C5 resins segment led the market accounted for the market share of 33.2%, driven by the increasing demand from various end-use industries such as adhesives, coatings, and rubber. C5 resins are widely appreciated for their compatibility, excellent heat resistance, and adhesive properties, which enhance product performance. Additionally, their cost-effectiveness compared to other resins has contributed to their rising adoption across industrial applications. The growing automotive and construction sectors, along with the rising requirement for lightweight materials with superior bonding capabilities, have further supported the demand for C5 resins. Moreover, environmental regulations encouraging low-emission products have propelled the use of petroleum-derived solutions like C5 resins, reinforcing their position in the market. The segment’s ability to meet high-performance standards while offering versatile solutions has cemented its leadership in the petroleum resins market.

Analysis by Application:

- Paints

- Adhesives

- Printing Inks

- Rubber and Tires

- Tapes and Labels

- Others

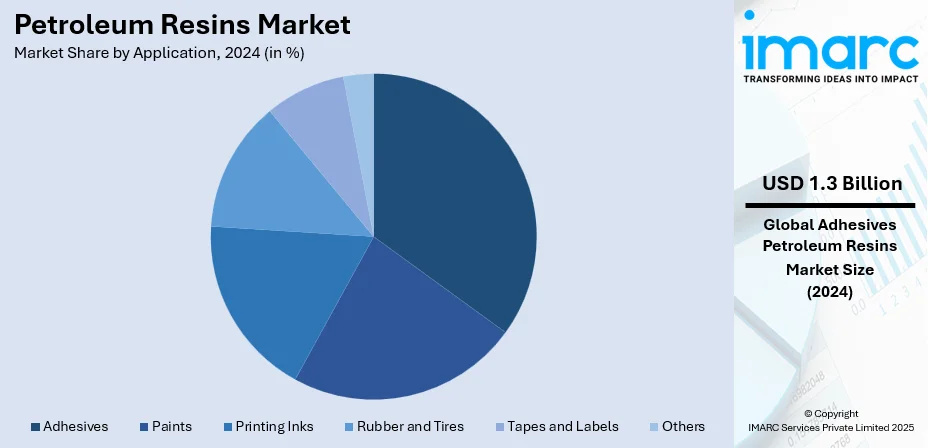

In 2024, adhesives segment led the petroleum resins market accounting for the market share of 28.9%. The surge in demand from construction, automotive, and packaging industries significantly contributed to the growth of this segment. Adhesives are essential in providing strong bonding, structural integrity, and flexibility, which are critical for manufacturing processes. The increasing focus on lightweight, durable, and efficient products has led to a greater reliance on petroleum-based resins in adhesive formulations. Furthermore, advancements in technology that improve the performance and ease of application of adhesives have further accelerated their adoption. Rising urbanization and infrastructure development globally have also created substantial demand for adhesives used in construction projects and consumer goods. Additionally, the demand for adhesives that withstand extreme temperatures, humidity, and mechanical stress has driven the preference for petroleum resins, thus positioning the adhesives segment at the forefront of the petroleum resins market.

Analysis by End Use:

- Automotive

- Construction

- Packaging

- Consumer Goods

- Personal Hygiene

- Others

In 2024, the construction led the petroleum resins market driven by driven by rapid urban development and rising infrastructure investments across emerging economies. Petroleum resins are widely used in construction materials such as coatings, sealants, flooring, and insulation products due to their superior binding properties, durability, and resistance to environmental stress. The increasing demand for sustainable and cost-effective building materials has further propelled the use of petroleum-based resins in structural applications. Furthermore, growing investments in residential, commercial, and industrial construction, especially in regions recovering from economic downturns, have boosted the requirement for high-performance materials. The segment has also benefited from technological innovations that enhance resin formulations to meet industry-specific requirements such as fire resistance, waterproofing, and thermal insulation. These factors combined with supportive government initiatives to modernize infrastructure have positioned the construction segment as a key driver in the petroleum resins market’s growth trajectory.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the Asia Pacific led the petroleum resins market accounted for the market share of 46.8%, propelled by strong industrial growth, increasing urbanization, and expanding manufacturing sectors. Countries like China, India, and Japan have emerged as key players, with rising investments in infrastructure, automotive, packaging, and consumer goods industries fueling demand for petroleum resins. The region’s growing population and rising disposable income have driven the consumption of end-use products requiring high-performance adhesives, coatings, and sealants. Moreover, rapid technological advancements and the presence of well-established supply chains have supported the efficient production and distribution of petroleum-based resins. Government policies encouraging industrialization and export-oriented manufacturing have also strengthened market growth. The region’s focus on adopting advanced materials to enhance product functionality, energy efficiency, and sustainability has further contributed to the rising demand. These factors collectively position Asia Pacific as a dominant force shaping the petroleum resins market landscape in 2024.

Key Regional Takeaways:

United States Petroleum Resins Market Analysis

In 2024, the United States accounted for 84.30% of the petroleum resins market in North America, driven by multiple factors. The market is primarily driven by the rising demand for pressure-sensitive adhesives used in tapes, labels, and packaging solutions across multiple industries. In accordance with this, the expanding printing inks sector, attributed to growth in commercial printing and flexible packaging, is positively influencing market development. For instance, in May 2024, Arkema announced its agreement to acquire Dow’s flexible packaging laminating adhesives business, valued at approximately USD 250 Million in annual sales. The deal enhances Arkema’s presence in sustainable packaging with leading brands and five global production sites. Similarly, increasing use of high-performance road marking materials, which require durable and weather-resistant resins, is further contributing to market expansion. Additionally, the growing woodworking and furniture manufacturing industries are promoting the use of resin-based adhesives. The emergence of advanced resin formulations tailored for specialty applications is widening end-use adaptability. Furthermore, rising investments in domestic manufacturing are increasing the demand for locally sourced resin materials, which is impelling the market. Apart from this, ongoing improvements in logistics infrastructure and expanding use in industrial coatings are continuously reinforcing market growth.

Europe Petroleum Resins Market Analysis

The Europe petroleum resins market is experiencing growth due to the rise in e-commerce, which is increasing demand for advanced packaging adhesives and sealants. In line with this, ongoing infrastructure renovation projects across several EU nations are stimulating the use of resin-based road marking and construction materials. As such, in July 2025, the EU allocated EUR 2.8 Billion to 94 transport projects under the Connecting Europe Facility, focusing on rail upgrades, greener ports, safer roads, digital systems, and improved cross-border and urban mobility across Member States. Similarly, changing environmental regulations encouraging the development of low-emission, recyclable resin formulations for coatings and adhesives are strengthening the market demand. The ongoing push for vehicle lightweighting, particularly in Germany and France, is fostering the need for resins used in automotive interiors and bonding solutions. Additionally, continual innovation in hybrid resins for hygiene and medical applications is opening new revenue streams. The growth in the electrical grid modernization sector, which drives the use of insulation-grade resins, is stimulating market appeal. Moreover, rising adoption of specialty tapes in aerospace and wind energy is sustaining overall market momentum.

Asia Pacific Petroleum Resins Market Analysis

The Asia Pacific market is largely influenced by expanding automotive production, where resins play a vital role in tire manufacturing, sealants, and protective coatings. Furthermore, accelerating industrialization across developing economies, driving demand for adhesives and insulation materials in the electronics and electrical sectors, is fostering market growth. Similarly, rapid growth in urban infrastructure projects is increasing the use of resins in paints, coatings, and road-marking materials. The rise in organized retail and flexible packaging formats is augmenting demand for hot-melt adhesives and laminating resins. Likewise, strong policy frameworks like “Make in India” and China’s industrial modernization efforts, strengthening domestic manufacturing, are impelling the market. Moreover, rising investment in petrochemical feedstock production is ensuring supply stability, enhancing competitiveness for resin manufacturers across the Asia Pacific. As such, in April 2025, Indian Oil Corporation announced an INR 61,077 Crore investment to build a major petrochemical complex in Paradip, Odisha, aiming to enhance domestic production and reduce import dependency.

Latin America Petroleum Resins Market Analysis

The Latin America petroleum resins market is gaining momentum due to expanding construction activities across Brazil, Mexico, and Colombia. In addition to this, the growth of the regional packaging industry, particularly in food and beverage sectors, is increasing the use of hot-melt adhesives formulated with petroleum resins. The rising investments in road infrastructure, fueling demand for durable road-marking materials, are propelling the market expansion. Accordingly, in September 2024, the World Bank approved a USD 150 Million loan for Bahia, Brazil, as part of a USD 1.662 Billion national program to modernize road infrastructure. The project emphasizes climate resilience, safety, and efficiency, aiming to improve access, reduce emissions, and benefit 2.35 million people in Bahia alone. Moreover, the presence of abundant hydrocarbon reserves in countries like Venezuela and Argentina is supporting local resin production, reducing reliance on imported raw materials, and improving supply chain stability.

Middle East and Africa Petroleum Resins Market Analysis

In the Middle East and Africa, the market is expanding due to the rise in construction of industrial and commercial facilities, which is augmenting demand for protective coatings and resin-based sealants. Similarly, rising demand for resin-based adhesives and coatings in wood and furniture manufacturing is also contributing to regional consumption. The growing packaging sector, driven by population growth and rising food exports, is expanding the market scope through the use of hot-melt adhesives. Besides this, the ongoing development of new petrochemical complexes across Saudi Arabia and the UAE is enhancing local resin production capacity and export competitiveness. Accordingly, Amiral, a USD 11 Billion petrochemical complex by Saudi Aramco and TotalEnergies in Saudi Arabia, will start operations in 2027, producing 1.65 Mt/year of ethylene and creating 7,000 jobs.

Competitive Landscape:

Companies in the petroleum resins market are adopting strategic measures to meet rising industry demand while complying with evolving regulatory standards. Key actions include utilizing data analytics and digital tools to boost R&D efficiency, drive product innovation, and enhance resin performance. Manufacturers are integrating automation into production processes to ensure consistent resin quality across key applications such as adhesives, coatings, rubber compounding, and printing inks. Furthermore, investments in regulatory compliance systems and quality control frameworks are streamlining market access and certification efforts. These initiatives enable faster response to market needs, minimize inefficiencies, and support data-driven decision-making—positioning companies for success in a competitive, regulation-driven environment.

The report provides a comprehensive analysis of the competitive landscape in the petroleum resins market with detailed profiles of all major companies, including:

- Arakawa Chemical Industries Ltd.

- Eastman Chemical Company

- Exxon Mobil Corporation

- Henan Anglxxon Chemical Products Co., Ltd.

- Idemitsu Kosan

- KOLON Industries Inc.

- Lesco Chemical Limited

- Neville Chemical Company

- Puyang Changyu Petroleum Resins Co. Ltd.

- Seacon Corporation

- TotalEnergies Group

- Zeon Corporation.

Latest News and Developments:

- July 2025: ExxonMobil began production at its Singapore complex of the world’s largest hydrogenated hydrocarbon resin plant (90,000 t/y) and a new 140,000 t/y halobutyl rubber plant. These additions support adhesive and tire industries, add 140 jobs, and expand capacity to meet Asia Pacific demand.

- July 2025: Keyera Corp. announced a USD 5.15 Billion deal to acquire Plains’ Canadian NGL assets, forming a cross-country corridor from B.C. to Ontario. The deal boosts Canadian control of key infrastructure and supports sectors using NGLs to produce resins, plastics, and other materials at hubs like Sarnia.

- May 2025: Neville Chemical expanded its US partnership with IMCD to distribute its petroleum-derived NEVTAC tackifying resins. These thermoplastic, low-VOC resins enhance adhesive and coating performance, offering UV stability, low odor, and suitability for SBC-based systems and rubber applications, supporting diverse industrial formulations nationwide.

- November 2024: Chitose Group launched "PET-MATSURI," the world’s first project to produce 100% bio-PET resin from microalgae. As part of the broader MATSURI initiative, the project aims to develop bio-based aromatic hydrocarbons, reduce reliance on petroleum, and promote sustainable resin production without competing with food resources.

- September 2024: JEPLAN Group’s PET REFINE TECHNOLOGY launched the HELIX brand for its recycled PET resin, made using proprietary chemical recycling. HELIX offers petroleum-equivalent quality and is used by major Japanese beverage and cosmetics companies, supporting circular economy goals and reducing CO2 emissions through continuous material reuse.

Petroleum Resins Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | C5 Resins, C9 Resins, C5/C9 Resins, Hydrogenated Resins |

| Applications Covered | Paints, Adhesives, Printing Inks, Rubber and Tires, Tapes and Labels, Others |

| End Uses Covered | Automotive, Construction, Packaging, Consumer Goods, Personal Hygiene, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arakawa Chemical Industries Ltd., Eastman Chemical Company, Exxon Mobil Corporation, Henan Anglxxon Chemical Products Co., Ltd., Idemitsu Kosan, KOLON Industries Inc., Lesco Chemical Limited, Neville Chemical Company, Puyang Changyu Petroleum Resins Co. Ltd., Seacon Corporation, TotalEnergies Group and Zeon Corporation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the petroleum resins market from 2019-2033.

- The petroleum resins market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the petroleum resins industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The petroleum resins market was valued at USD 4.5 Billion in 2024.

The petroleum resins market is projected to exhibit a CAGR of 3.74% during 2025-2033, reaching a value of USD 6.2 Billion by 2033.

Key factors driving the petroleum resins market include increasing demand in electronics, automotive, and chemical processing industries, along with their superior properties such as chemical resistance, thermal stability, and non-stick characteristics. Growth in renewable energy and medical sectors also contributes to rising global demand.

In 2024, Asia Pacific dominated the petroleum resins market, accounted for the market share of 46.8%. This growth is driven by expanding manufacturing sectors, rising industrialization, and strong demand in electronics, automotive, and chemical industries. China and India remain major contributors, supported by favorable government policies and rising infrastructure investments.

Some of the major players in the global petroleum resins market include Arakawa Chemical Industries Ltd., Eastman Chemical Company, Exxon Mobil Corporation, Henan Anglxxon Chemical Products Co., Ltd., Idemitsu Kosan, KOLON Industries Inc., Lesco Chemical Limited, Neville Chemical Company, Puyang Changyu Petroleum Resins Co. Ltd., Seacon Corporation, TotalEnergies Group and Zeon Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)