Pharmaceutical Labeling Market Report by Label Type (Pressure-Sensitive Label, Glue-Applied Label, Sleeve Label, In-Mold Label, and Others), Material (Paper, Polymer Film, and Others), Application (Instructional Label, Decorative Label, Functional Label, Promotional Label, and Others), End Use (Bottles, Blister Packs, Parenteral Containers, Pre-Fillable Syringes, Pre-Fillable Inhalers, Pouches, and Others), and Region 2026-2034

Market Overview:

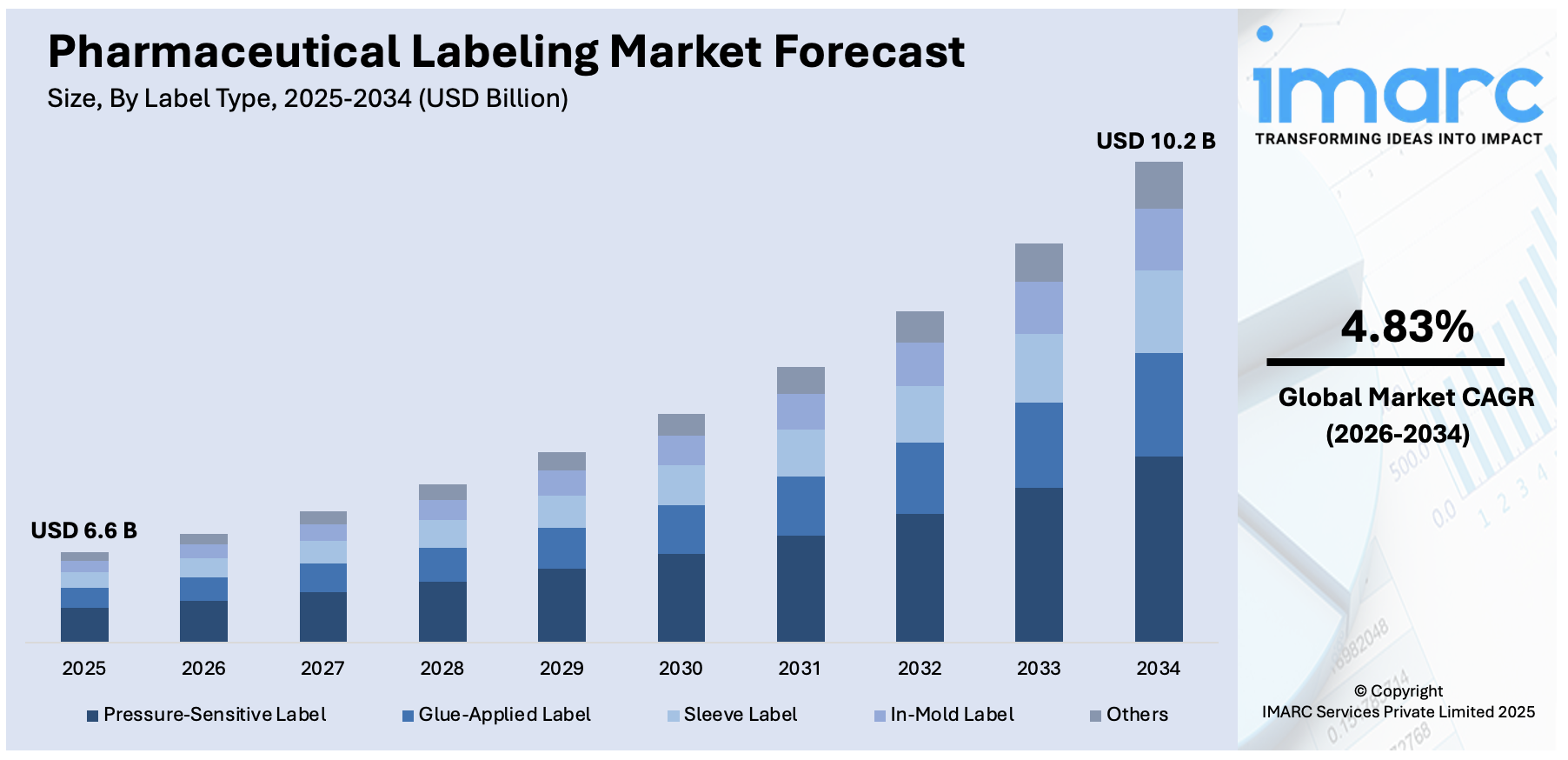

The global pharmaceutical labeling market size reached USD 6.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 10.2 Billion by 2034, exhibiting a growth rate (CAGR) of 4.83% during 2026-2034. The regulatory compliance and safety, rising drug approvals, globalization of pharmaceuticals, significant advances in packaging technology, and increasing focus on patient-centricity are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.6 Billion |

| Market Forecast in 2034 | USD 10.2 Billion |

| Market Growth Rate (2026-2034) |

4.83%

|

Pharmaceutical labeling is a critical aspect of the pharmaceutical industry that involves the creation and presentation of essential information on drug products. This information is typically conveyed through labels, packaging inserts, and accompanying documentation. The primary purpose of pharmaceutical labeling is to provide clear, accurate, and comprehensive details about a medication's uses, dosage instructions, potential side effects, contraindications, storage requirements, and other relevant safety information. Effective pharmaceutical labeling not only ensures the safe and appropriate use of medications by healthcare professionals and patients but also facilitates regulatory compliance and adherence to industry standards.

To get more information on this market Request Sample

The continuous influx of new drugs and therapies entering the market demands efficient and timely labeling processes. As pharmaceutical companies develop and gain approvals for new medications, the need for accurate and informative labels becomes paramount to facilitate proper usage and minimize risks. Additionally, with pharmaceutical products being distributed and marketed globally, the demand for standardized and multilingual labeling has surged. Labels need to be adapted to various languages and regulatory requirements to effectively cater to diverse markets. Other than this, the increasing emphasis of the pharmaceutical industry on patient-centric care and information sharing has led to the development of patient-friendly labeling. Clear, easy-to-understand labels empower patients to make informed decisions about their medications and treatment plans. Besides this, counterfeit drugs pose a significant threat to patient safety and industry credibility. Sophisticated labeling solutions, including holograms and tamper-evident features, help prevent counterfeit drugs from entering the supply chain. In line with this, automation and digitalization in labeling processes have streamlined operations, reduced errors, and accelerated time-to-market for pharmaceutical products. These technological advancements drive efficiency and cost-effectiveness within the labeling ecosystem.

Pharmaceutical Labeling Market Trends/Drivers:

Regulatory Compliance and Safety

The stringent regulations set forth by health authorities, such as the FDA and EMA, play a pivotal role in shaping the pharmaceutical labeling landscape. These regulations are designed to ensure patient safety, minimize risks, and enhance transparency in drug information. Pharmaceutical companies are required to provide accurate and up-to-date information on drug labels, including indications, contraindications, dosage instructions, and potential side effects. Non-compliance with these regulations can result in severe penalties, legal actions, and reputational damage for companies. As a result, pharmaceutical labeling processes must align with evolving regulatory guidelines to maintain compliance and uphold patient safety standards. This factor highlights the critical nature of accurate and comprehensive labeling in mitigating potential harm to patients and maintaining the integrity of the pharmaceutical industry.

Rise in Drug Approvals

The ever-expanding pipeline of new pharmaceutical products, including novel therapies and generics, is a driving force behind the growth of the pharmaceutical labeling market. As new drugs receive approvals from regulatory agencies, the need for effective labeling becomes paramount. Pharmaceutical labels are the primary means of conveying essential information to healthcare professionals and patients, facilitating safe and proper usage of medications. The rapid pace of drug approvals underscores the urgency for streamlined labeling processes to ensure that accurate and up-to-date information is available at the time of product launch. Furthermore, each drug's unique characteristics and intended use require tailored labeling approaches, making labeling an integral part of the drug development and commercialization lifecycle.

Rapid Globalization of Pharmaceuticals

As pharmaceutical companies expand their reach into various markets, they must navigate diverse regulatory requirements and language considerations. Labels need to accommodate different languages, cultural nuances, and local regulations while maintaining consistency and accuracy. Multinational pharmaceutical companies face the challenge of harmonizing labeling practices across regions while ensuring compliance with varying regulatory landscapes. The globalization of pharmaceuticals necessitates agile labeling strategies that can adapt to different markets without compromising patient safety or regulatory adherence. This factor underscores the importance of cross-functional collaboration and efficient labeling processes to cater to the diverse needs of a global audience.

Pharmaceutical Labeling Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pharmaceutical labeling market report, along with forecasts at the global and regional levels for 2026-2034. Our report has categorized the market based on label type, material, application, and end use.

Breakup by Label Type:

- Pressure-Sensitive Label

- Glue-Applied Label

- Sleeve Label

- In-Mold Label

- Others

Pressure-sensitive label dominates the market

The report has provided a detailed breakup and analysis of the market based on the label type. This includes pressure-sensitive label, glue-applied label, sleeve model, in-mold label, and others. According to the report, pressure-sensitive label represented the largest segment.

Pressure-sensitive labels offer a versatile and user-friendly labeling solution that is compatible with a wide range of packaging materials, including glass, plastic, and cardboard. This flexibility of application across various surfaces makes pressure-sensitive labels a preferred choice for pharmaceutical companies seeking consistency in labeling across their product portfolio. Moreover, pressure-sensitive labels eliminate the need for heat, solvents, or specialized equipment during application, streamlining the labeling process and reducing operational complexities. This factor contributes to enhanced efficiency and cost-effectiveness in pharmaceutical manufacturing and packaging workflows. Furthermore, pressure-sensitive labels accommodate the demand for customization and personalization in pharmaceutical packaging. They enable the incorporation of branding elements, regulatory information, barcodes, and even variable data, facilitating accurate tracking and traceability throughout the supply chain.

Breakup by Material:

- Paper

- Polymer Film

- Others

Polymer film hold the largest share in the market

A detailed breakup and analysis of the market based on the material has also been provided in the report. This includes paper, polymer film, and others. According to the report, polymer film accounted for the largest market share.

Polymer films provide excellent printability and clarity, allowing for precise reproduction of intricate designs, branding elements, and vital drug information on labels. This clarity is vital for conveying crucial details to healthcare professionals and patients, ensuring accurate medication usage. Additionally, polymer films exhibit remarkable durability and resistance to environmental factors such as moisture, light, and temperature fluctuations. This resilience safeguards the integrity of the label and the information it carries throughout the product's lifecycle, thereby maintaining regulatory compliance and patient safety. Furthermore, polymer films offer compatibility with various label printing technologies, including digital and flexographic methods. This adaptability facilitates streamlined manufacturing processes, quicker turnaround times, and cost-effective label production. Moreover, polymer films are available in different thicknesses, finishes, and textures, allowing for customization based on specific packaging requirements and design preferences. This versatility enables pharmaceutical companies to create labels that align with their branding strategy while adhering to regulatory guidelines.

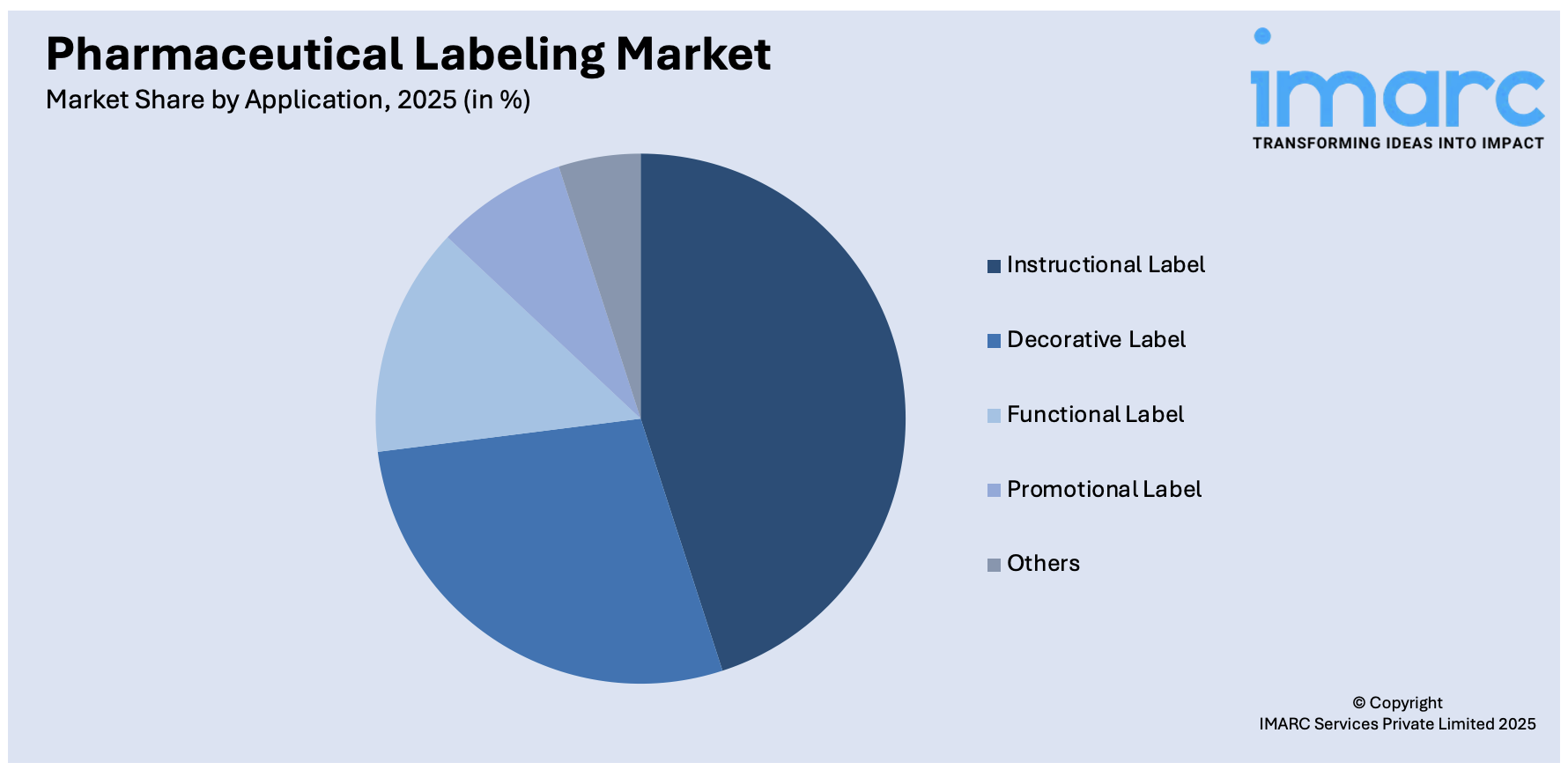

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Instructional Label

- Decorative Label

- Functional Label

- Promotional Label

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes instructional label, decorative label, functional label, promotional label, and others.

The instructional label segment serves as a critical component of pharmaceutical labeling, providing comprehensive and clear guidance on the appropriate use and administration of medications. These labels convey vital information such as dosage instructions, usage guidelines, potential side effects, contraindications, and storage recommendations. The primary goal of instructional labels is to ensure patient safety by empowering healthcare professionals and patients with accurate information to make informed decisions about medication usage. Regulatory compliance plays a significant role in shaping instructional labels, as adherence to guidelines set by health authorities is essential to prevent errors and promote effective treatment outcomes.

While functional and instructional aspects remain paramount, decorative labels contribute to brand identity, differentiation, and market positioning. These labels often incorporate company logos, color schemes, and design elements that resonate with the target audience. By combining aesthetic creativity with functional information, decorative labels facilitate recognition in a crowded market and create a memorable impression on consumers. However, it's essential to strike a balance between aesthetics and the clarity of information to ensure that regulatory compliance and patient safety are not compromised.

The functional label segment encompasses labels that provide specialized features beyond basic information dissemination. These labels may include features such as tamper-evident seals, authentication elements, QR codes, RFID technology, and serialization. Functional labels play a pivotal role in ensuring product integrity, supply chain security, and patient safety. Tamper-evident seals, for instance, prevent unauthorized access to medication packaging, reducing the risk of tampering or counterfeiting. QR codes and RFID technology enhance traceability and enable patients to access additional information online. The functional label segment caters to the evolving needs of the pharmaceutical industry, aligning with advancements in technology and the increasing focus on patient engagement and product authenticity.

Breakup by End Use:

- Bottles

- Blister Packs

- Parenteral Containers

- Pre-Fillable Syringes

- Pre-Fillable Inhalers

- Pouches

- Others

Bottles hold the largest share in the market

A detailed breakup and analysis of the market based on the end use has also been provided in the report. This includes bottles, blister packs, parenteral containers, pre-fillable syringes, pre-fillable inhalers, pouches, and others. According to the report, bottles accounted for the largest market share.

Bottles provide an effective barrier against external elements, such as moisture, light, and contaminants, preserving the potency and stability of pharmaceutical products. This protective feature ensures that medications remain safe and effective throughout their shelf life, a fundamental aspect of regulatory compliance and patient well-being. Furthermore, bottles are available in various sizes and materials, catering to the diverse needs of pharmaceutical companies. Their compatibility with different closure mechanisms, such as child-resistant caps, tamper-evident seals, and dispensing closures, enhances patient safety and regulatory adherence. Bottles also facilitate efficient labeling, allowing ample surface area for instructional, decorative, and functional labels. Their straightforward design supports clear communication of essential drug information to healthcare professionals and patients, aligning with the industry's focus on patient-centric care.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

North America exhibits a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. According to the report, North America accounted for the largest market share.

One of the primary drivers is the robust pharmaceutical sector across the region, characterized by a high volume of drug production, research and development activities, and a mature healthcare ecosystem. The stringent regulatory framework established by organizations like the FDA necessitates comprehensive and accurate labeling to ensure patient safety and regulatory compliance. This emphasis on regulatory adherence has propelled the demand for sophisticated labeling solutions that effectively convey vital drug information to healthcare professionals and patients. Moreover, the North American market has witnessed substantial advancements in labeling technology, including digital printing, serialization, and smart labeling solutions. These innovations enhance traceability, supply chain security, and patient engagement, further amplifying the demand for cutting-edge labeling products and services. Additionally, the region's emphasis on patient-centric care and the growing focus on personalized medicine have heightened the need for clear and informative labeling. The pharmaceutical industry's commitment to transparency and effective communication aligns with the role of labeling in delivering accurate information to end-users.

Competitive Landscape:

Leading companies have invested in research and development to introduce innovative labeling solutions that incorporate advanced technologies. This includes the integration of smart features like QR codes, RFID, and tamper-evident seals to enhance traceability, authentication, and patient engagement. Additionally, to cater to diverse pharmaceutical product portfolios, key players have focused on providing customizable and personalized labeling options. This allows pharmaceutical companies to align labels with their branding strategies while complying with regulatory guidelines. Other than this, given the importance of regulatory compliance, key players offer expertise in navigating complex regulatory landscapes. They work closely with pharmaceutical companies to ensure that labels meet the requirements set forth by health authorities, preventing non-compliance-related setbacks. Besides this, numerous prominent players have expanded their global presence, offering multilingual labeling solutions tailored to different markets. This expansion addresses the globalization of pharmaceutical distribution and packaging while ensuring accurate communication to diverse audiences.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- 3M

- Avery Dennison Corporation

- Bemis

- CCL Industries

- Essentra

- LINTEC

- SATO Holdings

- Advanced Labels

- Edwards Label

- Jet Label

- Consolidated Label

- Axon

- Clabro Label

- Classic Label

- Maverick Label

- Metro Label

- Progressive Label

- MCC Label

- Mercian Labels

- Taylor Label

Recent Developments:

- Jet Label has recently been acquired by ProMach, a prominent player in the industry. This strategic move by ProMach is aimed at bolstering its presence in the niche yet burgeoning field of label printing and converting. By incorporating Jet Label into its operations, ProMach has effectively integrated an additional dimension to its existing framework.

- Avery Dennison has developed a broad portfolio of tamper-evident and anti-counterfeiting label solutions, including destructible labels, box damage films and void labels, to help curb the drug counterfeiting trend.

Pharmaceutical Labeling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Label Types Covered | Pressure-Sensitive Label, Glue-Applied Label, Sleeve Label, In-Mold Label, Others |

| Materials Covered | Paper, Polymer Film, Others |

| Applications Covered | Instructional Label, Decorative Label, Functional Label, Promotional Label, Others |

| End Uses Covered | Bottles, Blister Packs, Parenteral Containers, Pre-Fillable Syringes, Pre-Fillable Inhalers, Pouches, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | 3M, Avery Dennison Corporation, Bemis, CCL Industries, Essentra, LINTEC, SATO Holdings, Advanced Labels, Edwards Label, Jet Label, Consolidated Label, Axon, Clabro Label, Classic Label, Maverick Label, Metro Label, Progressive Label, MCC Label, Mercian Labels, Taylor Label, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pharmaceutical labeling market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global pharmaceutical labeling market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pharmaceutical labeling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global pharmaceutical labeling market was valued at USD 6.6 Billion in 2025.

We expect the global pharmaceutical labeling market to exhibit a CAGR of 4.83% during 2026-2034.

The rising environmental concerns towards non-biodegradable plastic labels, along with the introduction of eco-friendly and sustainable alternatives, are primarily driving the global pharmaceutical labeling market.

The sudden outbreak of the COVID-19 pandemic has led to the growing demand for pharmaceutical labeling in the packaging of novel drugs and vaccines against the coronavirus infection.

Based on the label type, the global pharmaceutical labeling market can be segmented into pressure-sensitive label, glue-applied label, sleeve label, in-mold label, and others. Currently, pressure-sensitive label holds the majority of the total market share.

Based on the material, the global pharmaceutical labeling market has been divided into paper, polymer film, and others. Among these, polymer film currently exhibits a clear dominance in the market.

Based on the end use, the global pharmaceutical labeling market can be categorized into bottles, blister packs, parenteral containers, pre-fillable syringes, pre-fillable inhalers, pouches, and others. Currently, bottles account for the largest market share.

On a regional level, the market has been classified into Europe, North America, Asia Pacific, Middle East and Africa, and Latin America, where North America currently dominates the global market.

Some of the major players in the global pharmaceutical labeling market include 3M, Avery Dennison Corporation, Bemis, CCL Industries, Essentra, LINTEC, SATO Holdings, Advanced Labels, Edwards Label, Jet Label, Consolidated Label, Axon, Clabro Label, Classic Label, Maverick Label, Metro Label, Progressive Label, MCC Label, Mercian Labels, Taylor Label, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)