Pharmaceutical Robots Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Pharmaceutical Robots Market Size and Share:

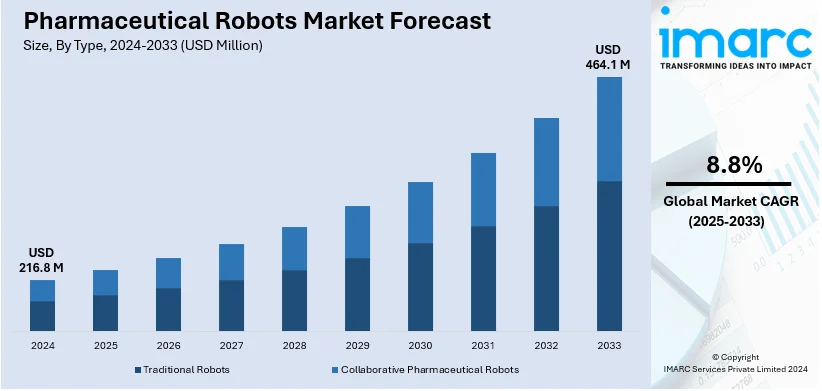

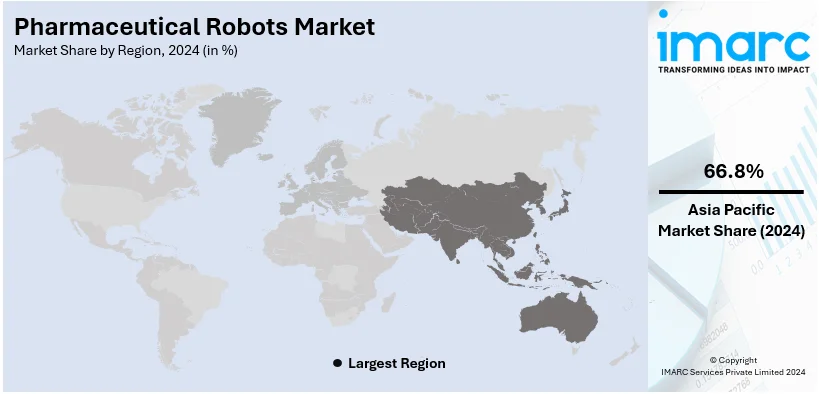

The global pharmaceutical robots market size was valued at USD 216.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 464.1 Million by 2033, exhibiting a CAGR of 8.8% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 66.8% in 2024. The rising demand for pharmaceutical products, the emerging advancement in robotics technology, and the implementation of stringent regulatory frameworks to ensure product safety and quality during production processes are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 216.8 Million |

| Market Forecast in 2033 | USD 464.1 Million |

| Market Growth Rate (2025-2033) | 8.8% |

The pharmaceutical industry faces mounting pressure to enhance production efficiency and meet stringent regulatory standards while minimizing costs. Automation has become an essential solution for addressing these challenges, and pharmaceutical robots play a pivotal role in this transformation. Robots help streamline manufacturing processes, reduce human intervention, and minimize the risk of contamination, ensuring compliance with Good Manufacturing Practices (GMP). With robots capable of executing repetitive and labor-intensive tasks such as material handling, dispensing, packaging, and inspection, the adoption of automation has become a key driver for market growth. Quality control is a critical aspect of pharmaceutical manufacturing, as even minor deviations can compromise the safety and efficacy of drugs. Pharmaceutical robots are engineered to deliver exceptional precision, repeatability, and reliability, making them ideal for tasks requiring high accuracy. Automated solutions also reduce the risk of human error, which can be a significant concern in manual manufacturing processes. This enhanced quality assurance is particularly important for the production of complex biologics, sterile pharmaceuticals, and personalized medicines, where precise handling is required.

The United States has emerged as a key region in the pharmaceutical robots market owing to the evolving advancements in robotic technology. The demand for advanced drugs like biologics, biosimilars, and personalized medicines is increasing in the country. The rising production demands, coupled with the need for faster time-to-market, are encouraging pharmaceutical manufacturers to invest in automation. Robotic systems enable manufacturers to streamline operations, reduce production cycle times, and scale up output to meet increasing market demands. Robots are becoming integral to processes such as drug dispensing, packaging, labeling, and quality inspection, allowing companies to achieve operational excellence and remain competitive. The concept of "smart factories" is gaining traction in the United States, with pharmaceutical companies adopting Industry 4.0 principles to create highly automated and interconnected manufacturing facilities. Robotic systems play a central role in these smart factories, enabling seamless integration with other advanced technologies, which include cloud computing, data analytics and the Internet of Things (IoT). The IMARC Group also predicts that the US smart factory market is expected to exhibit a growth rate (CAGR) of 12.10% during 2024-2032.

Pharmaceutical Robots Market Trends:

The rising demand for pharmaceutical products

The pharmaceutical industry witnesses a dramatic shift due to machinery integration driven by the use of robotics technology, directly leading to the market growth. With the aging global population and rising chronic diseases, the demand for pharmaceuticals is growing. This drives the market demand. This is further augmented by tremendous growth in medicine that has incorporated innovative pharmacotherapies into the list of diseases that they can combat, including personalized medicines and complex biopharmaceuticals. For instance, as reported by IMARC Group, global generic drugs market size reached USD 389.0 Billion in 2024. With the help of robotics technology, the pharmaceutical manufacturing processes achieve an increase in efficiency and accuracy, and consequently improve the market share. According to the International Federation of Robotics (IFR), the global market for professional service robots reached a turnover of USD 6.7 Billion U.S. dollars, marking a 12% increase in 2020.

The emerging technological advancement in robotics technology

Robots equipped with advanced technologies, including sensing and control capabilities, enhance precision and standardization in processes such as drug manufacturing and dispensing. For instance, in July 2021, a poll conducted by Verdict revealed that robotics in pharmaceutical manufacturing has yet to peak, with 50% of respondents predicting it will take over five years, and 13% estimating a three-to-five-year timeline. Such ability minimizes human error and considerably improve product quality and patient safety, which is one of the major market trends. The developments in robotics technology are essential as they contribute to the solutions of the challenges facing the pharmaceutical industry. The employment of robots as well ensures the substitution of labour-intensive and repetitive tasks with them, hence maximizing resource utilization which in turn speeds up production cycle. This transition of the key companies to enhance their efficiencies and their productivity helps them generate higher market revenue.

The implementation of stringent regulatory frameworks

Regulatory authorities constitute an important determinant for the market through the establishment of strict legal frameworks. These regulations stipulate the safety, efficacy, and quality of pharmaceutical products, forcing pharmaceutical manufacturers to adopt robotics technology to meet the set requirements. For instance, stringent regulatory frameworks are driving the adoption of pharmaceutical robots in India, with over 36% of inspected drug manufacturing units shut down since last year due to quality violations, reflecting increased scrutiny after global incidents linked to substandard drugs. Robotics in pharmaceutical industry consist of technologies with functions that are similar to what is found within the industrial automation sector, including real time monitoring and data logging which are very essential in ensuring the compliance and satisfying the reliability of the automated pharmaceutical manufacturing processes. The implementation of these technologies plays a crucial role in satisfying the strict requirements prescribed by the regulatory authorities, which highlights the pharmaceutical robots market analysis.

Pharmaceutical Robots Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pharmaceutical robots market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end user.

Analysis by Type:

- Traditional Robots

- Articulated Robots

- SCARA Robots

- Delta/Parallel Robots

- Cartesian Robots

- Dual-arm Robots

- Collaborative Pharmaceutical Robots

Traditional robots (articulated robots, SCARA robots, delta/parallel robots, cartesian robots, dual-arm robots) stand as the largest component in 2024, holding 63.1% of the market. Traditional robots are widely utilized in the pharmaceutical industry for their unmatched capacity due to their already proved reliability and efficiency in handling different types of automated tasks normally necessary in pharmaceutical manufacturing. The market report revealed that the multifaceted work of the robots which is consistent with accuracy has been the reason behind their prominence occupying a substantial portion of the market for themselves. The market forecast shows that it remains the traditional robots to be the most preferred type, which can be attributed to constant upgrade and increase efficiency by major brands trying to penetrate in more complicated processes in pharmaceuticals.

Analysis by Application:

- Picking and Packaging

- Inspection of Pharmaceutical Drugs

- Laboratory Applications

Picking and packaging lead the market with 54.6% of market share in 2024. The operations involved in picking and packaging are benefits greatly from implementing robotics, as these systems improves speed, accuracy, and consistency in the packaging of pharmaceutical products. In addition, future market opportunities may be signified by further designed innovations in robot to handle and reduce the downtime, which can be as this to improve the whole productivity of pharmaceutical manufacturing. The pharmaceutical industry market report underlines the advantage which this technique provides in this kind of manufacturing processes especially on increased production efficiency along with reduced cost of operation.

Analysis by End User:

- Pharmaceutical Companies

- Research Laboratories

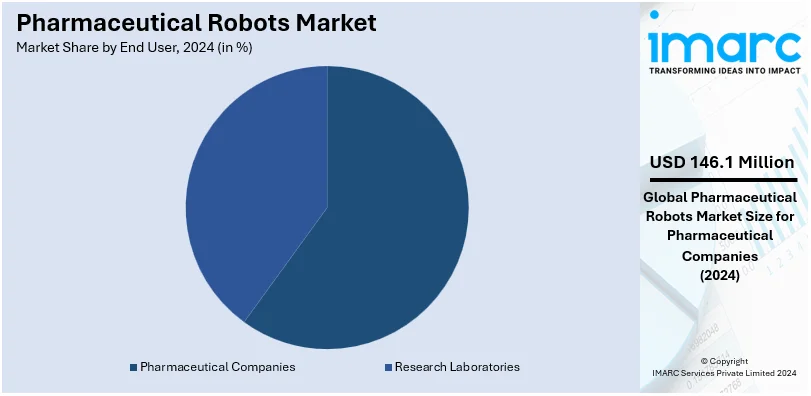

Pharmaceutical companies lead the market with 67.4% of market share in 2024. The pharmaceutical companies utilize robotic technology to come up with enhanced applications in the area of production, precision, and adherence of the safety and health standards and regulations. The market report indicates that as more pharmaceutical companies are motivated by innovation and cost-efficiency, robotic integration will become even more established. Market’s recent opportunities include the development of robotic uses that might give rise to more tailored and intricate solutions aimed to meet the particular needs of pharmaceutical producers. Robotic systems handle sample preparation, testing, and data analysis in labs, freeing researchers to focus on complex problem-solving.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 66.8%. Asia Pacific region market accounts the fast industrial growth and more intense push towards healthcare and pharmaceutical manufacturing. In line with the pharmaceutical robot market review, the three leading nations including China, Japan and South Korea are at the forefront in implementing robotics in pharmaceutical operations. The pharmaceutical robots report describes government actions and investments that greatly contribute to regional market expansion in this field. The market outlook for Asia Pacific remains positive due to an increasing demand for pharmaceuticals along with technological breakthroughs witnessed in the field of robotics. In 2024, Reliance-backed Addverb Robotics announced its plan to venture into robotics by launching India’s first AI-enabled humanoid robot in 2025. This robot is ideal for industries like healthcare, defense, and retail.

Key Regional Takeaways:

United States Pharmaceutical Robots Market Analysis

The United States hold 75.00% of the market share in the North American region. Pharmaceutical robots in the United States are revolutionizing drug manufacturing by guaranteeing improved accuracy and uniformity in production. These robots are proficient at reducing human error in delicate tasks such as drug formulation, compounding, and packaging, which directly enhances product quality. Their capability to perform repetitive and high-precision tasks speeds up production timelines, satisfying the increasing demand for medications spurred by an aging population and the rise of chronic diseases. Moreover, robots in pharmaceutical laboratories streamline repetitive testing and data collection procedures, facilitating quicker research results for new drugs. For example, in December 2020, the US pharmaceutical sector is swiftly embracing robotics to boost manufacturing efficiency, with automation applications like packaging and FDA-compliant traceability rising by 61% on production lines, motivated by reshoring practices and supply chain weaknesses caused by the pandemic. As advanced biologics and gene therapies expand, robotic systems guarantee adherence to strict regulations by ensuring constant performance in essential operations. Furthermore, their involvement in the creation and testing of new drugs hastens time-to-market, a crucial aspect for sustaining a competitive advantage in the highly innovative U. S. pharmaceutical industry. Their capacity to assist large-scale production without sacrificing precision renders them essential for achieving scalability and reliability.

Asia Pacific Pharmaceutical Robots Market Analysis

The adoption of pharmaceutical robots in the Asia-Pacific region is propelled by their capacity to efficiently satisfy the rising demand for medications. Robots allow pharmaceutical manufacturers to increase their production while adhering to strict quality standards, which is essential in economies that are developing their healthcare systems. Their capability to function continuously minimizes downtime, resulting in greater productivity. As per the Department of Pharmaceuticals, India, the swift expansion of the Indian pharmaceutical sector, from a turnover of USD 1 Billion in 1990 to USD 30 Billion by 2015, underscores its technological progress and manufacturing proficiency, where robotics now have a vital role in optimizing GMP-compliant drug production, improving efficiency, and ensuring quality in complex dosage forms and biologics. The use of robots aligns with the growing focus on precision medicine, allowing for the tailored manufacturing of drugs that correspond with emerging trends in healthcare. In nations with flourishing pharmaceutical research, robotic systems facilitate high-throughput screening and sophisticated drug discovery. By seamlessly integrating with pre-existing technologies, robots enhance productivity while preserving a high level of quality and innovation. For example, NVIDIA is contributing to Japan’s pharmaceutical market with NVIDIA BioNeMo, an end-to-end platform, which assists drug discovery researchers in creating and deploying AI models to generate biological intelligence from biomolecular data.

Europe Pharmaceutical Robots Market Analysis

Pharmaceutical robots in Europe play a crucial role in meeting the stringent quality standards set by the regulatory framework while also reducing costs in an area where labor costs are high. According to the EU, in 2023, average hourly labor expenses across the EU ranged from about USD 10. 05 in Bulgaria to USD 58. 80 in Luxembourg, with an EU average of around USD 34. 40, highlighting considerable wage differences that make pharmaceutical robots a budget-friendly option to lessen dependence on high-wage human labor in pricier regions. Robots improve aseptic manufacturing capabilities, guaranteeing adherence to rigorous guidelines, particularly for injectable medications and advanced therapies. Their accurate functioning bolsters advanced research and development initiatives in nanotechnology and gene therapies, fields where Europe excels. Robots are enhancing efficiency in pharmaceutical packaging, an essential aspect considering the continent's multilingual labeling requirements for drug safety and compliance. They also provide greater flexibility in production lines, permitting quick reconfiguration to create various drug formulations and satisfy different demands. Robots help reduce waste by accurately measuring raw materials and maximizing resource utilization, making processes more sustainable and aligning with Europe’s dedication to environmentally friendly practices.

Latin America Pharmaceutical Robots Market Analysis

Pharmaceutical robots in Latin America bolster the industry’s ability to meet rising regional healthcare demands. These robots support the precise assembly of medical devices and the packaging of pharmaceuticals, ensuring compliance with export standards. They are particularly advantageous for tasks requiring micro-scale precision, such as the production of active pharmaceutical ingredients (APIs). According to National Library of Medicine, Brazil's domestic production of active pharmaceutical ingredients (APIs) accounts for 5% of local demand, highlighting a strategic opportunity for pharmaceutical robots to enhance efficiency, reduce reliance on imports, and strengthen national pharmaceutical resilience through automated manufacturing solutions. By reducing process variability, robots enhance the quality of both generic and specialized drugs. Furthermore, their use helps expand manufacturing capabilities in emerging economies, fostering competitiveness in the global market. This technology also supports robust quality control measures, building trust in pharmaceutical exports.

Middle East and Africa Pharmaceutical Robots Market Analysis

Highly advanced systems offer unparalleled precision in compounding and formulation, critical for delivering innovative treatments to a diverse patient population. These technologies enhance consistency in the production of specialty medications, ensuring access to high-quality healthcare solutions. Their role in streamlining operations helps regional manufacturers overcome resource constraints while maintaining international quality standards. According to reports published by Springer Nature on April 2019, pharmaceutical robots can enhance pharmacovigilance systems in Arab countries, where only 45% are WHO members and disparities exist in system maturity, by automating data collection, increasing case reporting accuracy, and bridging gaps in underdeveloped regions like Somalia and Yemen, while leveraging advancements in Morocco's WHO collaboration and the Gulf Cooperation Council's unified approaches. By incorporating advanced analytics and monitoring tools, these systems improve the predictability of outcomes, reducing overall production risks. The adaptability of these solutions supports manufacturers in addressing a range of therapeutic needs, fostering regional healthcare growth and enabling participation in global pharmaceutical markets.

Competitive Landscape:

Key market players are heavily investing in advanced robotics and automation technologies to streamline production processes. Pharmaceutical robots are being equipped with cutting-edge features such as artificial intelligence (AI), machine learning (ML), and vision systems to improve their precision and adaptability in complex manufacturing environments. Insilico Medicine, In December 2023, launched Life Star, which is a sixth generation intelligent robotics drug delivery laboratory in Suzhou BioBAY Industrial Park. This lab enabled the company to accelerate its end to end drug discovery process and optimize the success rate of its medical medicine development system. Collaborations with technology providers, research institutions, and pharmaceutical manufacturers are a key strategy employed by market leaders to enhance their product offerings and market presence. These partnerships enable companies to leverage complementary expertise and resources to develop innovative robotic solutions tailored for pharmaceutical applications. Ensuring compliance with stringent regulatory standards is a critical factor for success in the pharmaceutical robots market. Leading companies are prioritizing the development of robots that meet Good Manufacturing Practice (GMP) standards and stick to guidelines that are framed by regulatory authorities.

The report provides a comprehensive analysis of the competitive landscape in the pharmaceutical robots market with detailed profiles of all major companies, including:

- ABB Ltd.

- DENSO Corporation

- FANUC Corporation

- Kawasaki Heavy Industries Ltd.

- Kuka AG

- Marchesini Group S.p.A

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Seiko Epson Corporation

- Shibuya Corporation

- Universal Robots A/S (Teradyne Inc.)

- Yaskawa Electric Corporation

Latest News and Developments:

- June 2024: ChargePoint Technology launched a robotic material handling solution that is primarily made for enhancing safety and efficiency in solid dosage drug manufacturing. By integrating PuroGrip, PuroVaso containers, and the automated Split Butterfly Valve, the system reduces manual handling risks and cross-contamination while enabling faster deployment of semi-continuous or autonomous manufacturing setups. The solution reflects the growing adoption of pharmaceutical robotics, with a focus on improving speed, quality, and safety in production processes.

- March 2024: Olis Robotics announced a strategic partnership with Kawasaki Robotics, Inc., aiming to enhance efficiency in robotic operations. This collaboration equips users with tools to resume production swiftly, cutting troubleshooting and downtime costs by up to 90%. The partnership integrates a secure, on-premise connection, allowing seamless access to Olis Robotics’ expert support. This development underscores both companies' commitment to advancing industrial automation through innovative and reliable solutions.

Pharmaceutical Robots Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Applications Covered | Picking and Packaging, Inspection of Pharmaceutical Drugs, Laboratory Applications |

| End Users Covered | Pharmaceutical Companies, Research Laboratories |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., DENSO Corporation, FANUC Corporation, Kawasaki Heavy Industries Ltd., Kuka AG, Marchesini Group S.p.A, Mitsubishi Electric Corporation, Robert Bosch GmbH, Seiko Epson Corporation, Shibuya Corporation, Universal Robots A/S (Teradyne Inc.), Yaskawa Electric Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pharmaceutical robots market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global pharmaceutical robots market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pharmaceutical robots industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Pharmaceutical robots are automated systems designed to perform precise, repetitive, and labor-intensive tasks in the pharmaceutical industry. These robots are used in various applications such as drug manufacturing, packaging, labeling, and quality inspection, ensuring accuracy, efficiency, and compliance with regulatory standards.

The pharmaceutical robots market was valued at USD 216.8 Million in 2024.

IMARC estimates the global pharmaceutical robots market to exhibit a CAGR of 8.8% during 2025-2033.

The global pharmaceutical robots market is driven by the rising demand for pharmaceutical products, advancements in robotics technology, the need for enhanced production efficiency, and the implementation of stringent regulatory frameworks to ensure quality and safety during drug manufacturing.

In 2024, traditional robots represented the largest segment by type, driven by their proven reliability and efficiency in handling diverse automated manufacturing tasks in the pharmaceutical industry.

Picking and packaging lead the market by application, owing to their ability to improve speed, accuracy, and consistency in pharmaceutical product packaging operations.

The pharmaceutical companies segment is the leading segment by end user, driven by their focus on cost-efficiency, innovation, and compliance with safety and health regulations in manufacturing processes.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market with a share of over 66.8% in 2024.

Some of the major players in the global pharmaceutical robots market include ABB Ltd., DENSO Corporation, FANUC Corporation, Kawasaki Heavy Industries Ltd., Kuka AG, Marchesini Group S.p.A, Mitsubishi Electric Corporation, Robert Bosch GmbH, Seiko Epson Corporation, Shibuya Corporation, Universal Robots A/S (Teradyne Inc.), Yaskawa Electric Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)