Philippines Activewear Market Size, Share, Trends and Forecast by Product Type, Material Type, Pricing, Age Group, Distribution Channel, End User, and Region, 2025-2033

Philippines Activewear Market Overview:

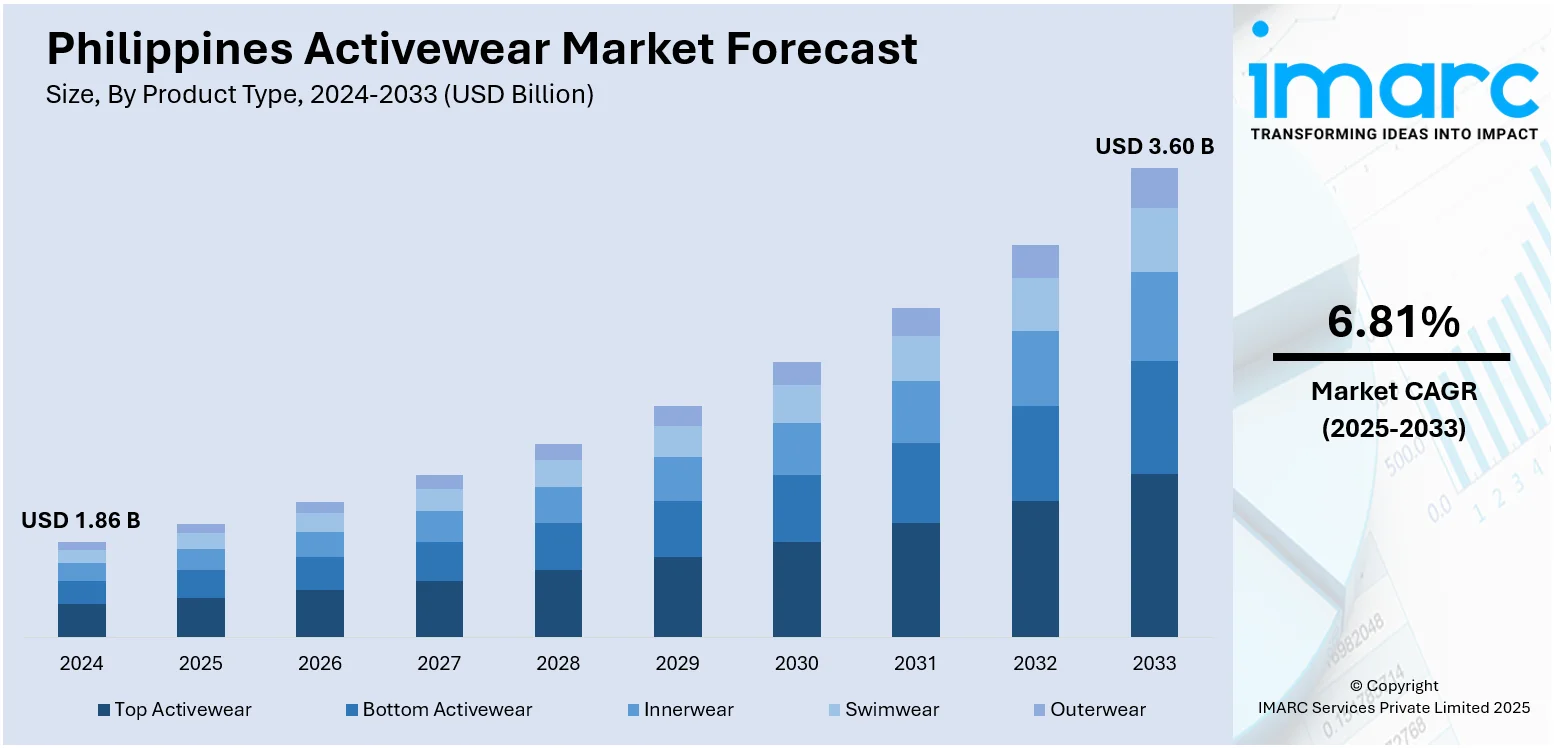

The Philippines activewear market size reached USD 1.86 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.60 Billion by 2033, exhibiting a growth rate (CAGR) of 6.81% during 2025-2033. Rising health awareness, growing disposable income, and urban lifestyle shifts are some of the factors contributing to the Philippines activewear market share. Social media influence, youth fashion trends, and celebrity endorsements boost adoption. Expanding gym memberships, fitness classes, and e-commerce accessibility further strengthen the market’s growth momentum.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.86 Billion |

| Market Forecast in 2033 | USD 3.60 Billion |

| Market Growth Rate 2025-2033 | 6.81% |

Philippines Activewear Market Trends:

Activewear as Everyday Wear

Activewear in the Philippines is no longer confined to gyms or sports fields. A strong cultural shift has pushed it into daily wardrobes, especially among younger consumers and working professionals in urban centers. Lightweight leggings, joggers, and performance t-shirts are styled casually with denim jackets, sneakers, or even office-appropriate layers. This change is tied to the rise of hybrid work models, where comfort at home merges with the need to look presentable during sudden video calls or quick office visits. Social media influencers have also played a role, showcasing “athleisure looks” that blur the line between fitness and fashion. The humid climate supports this preference, as moisture-wicking fabrics offer practical comfort during long commutes and erratic weather. Global brands such as Nike and Adidas highlight versatile pieces, while local players adapt designs to suit Filipino body types and budget ranges. The growth of this trend points toward an enduring cultural acceptance of activewear as not just functional apparel, but a lifestyle statement. These factors are intensifying the Philippines activewear market growth.

To get more information on this market, Request Sample

Sustainability-Driven Purchases

Another rising theme in the Philippines activewear market centers on sustainability. Shoppers, especially Gen Z and millennial buyers, are increasingly mindful of how their purchases affect the environment. This is pushing both global and local brands to explore recycled fabrics, plant-based dyes, and ethically sourced cotton in their product lines. For many Filipinos, climate issues feel immediate, given the country’s vulnerability to typhoons and rising sea levels, so eco-conscious shopping aligns with broader social concerns. Online platforms now highlight “green” or “eco-friendly” collections, making it easier for consumers to filter by values rather than just price or design. Startups are also experimenting with small-batch, locally made sportswear that minimizes waste and supports community artisans. Though premium price points remain a barrier for mass adoption, awareness campaigns and transparent labeling are helping build trust. Over time, sustainability is expected to move from a niche differentiator into a competitive necessity, reshaping how brands design, market, and price their activewear collections in the Philippines.

Philippines Activewear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, pricing, age group, distribution channel, and end user.

Product Type Insights:

- Top Activewear

- Bottom Activewear

- Innerwear

- Swimwear

- Outerwear

The report has provided a detailed breakup and analysis of the market based on the product type. This includes top activewear, bottom activewear, innerwear, swimwear, and outerwear.

Material Type Insights:

- Nylon

- Polyester

- Cotton

- Neoprene

- Polypropylene

- Spandex

The report has provided a detailed breakup and analysis of the market based on the material type. This includes nylon, polyester, cotton, neoprene, polypropylene, and spandex.

Pricing Insights:

- Economy

- Premium

The report has provided a detailed breakup and analysis of the market based on the pricing. This includes economy and premium.

Age Group Insights:

- 1–15 Years

- 16–30 Years

- 31–44 Years

- 45–64 Years

- More than 65 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 1–15 years, 16–30 years, 31–44 years, 45–64 years, and more than 65 years.

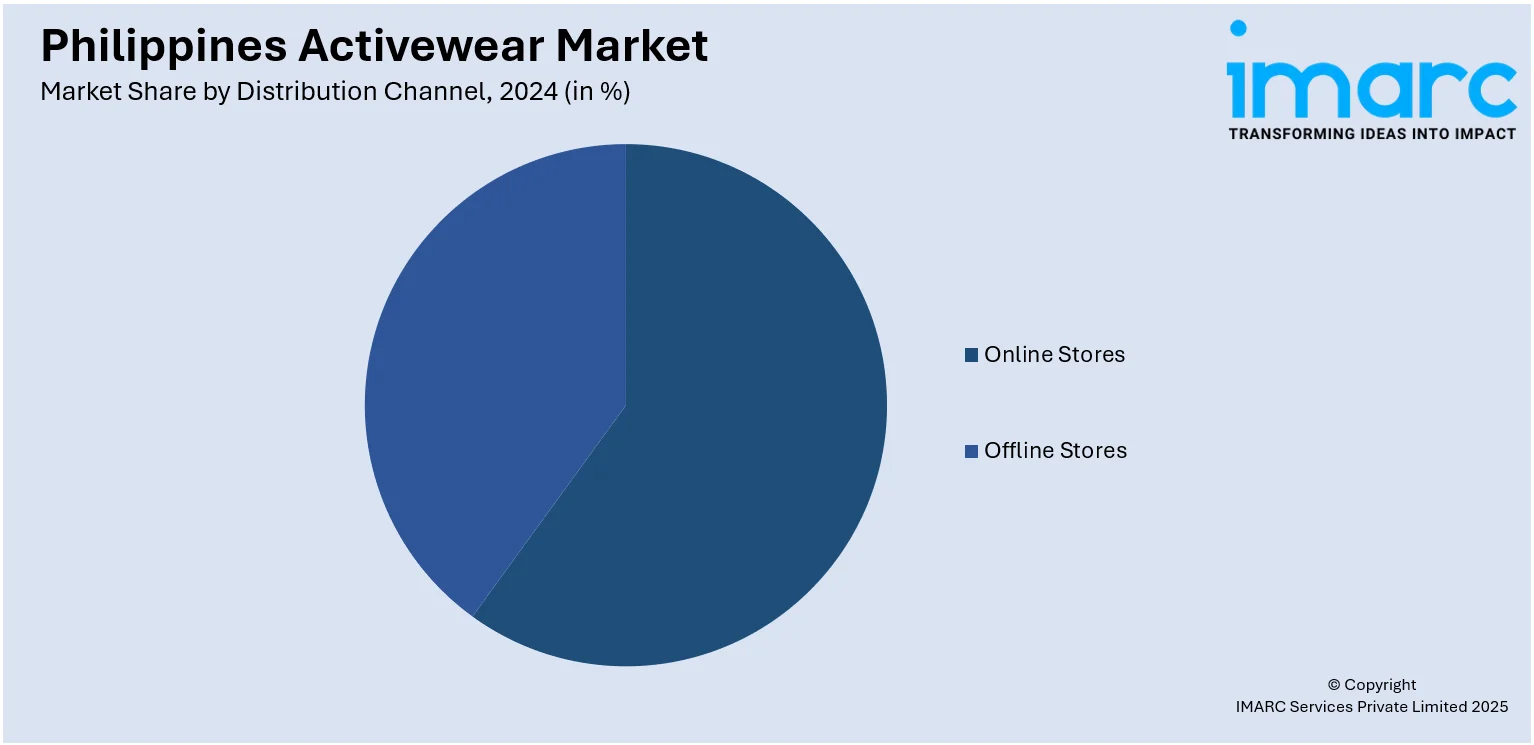

Distribution Channel Insights:

- Online Stores

- Offline Stores

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online stores and offline stores.

End User Insights:

- Men

- Women

- Kids

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and kids.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Activewear Market News:

- In July 2025, JD Sports expanded its footprint in the Philippines with the opening of its second store at Glorietta, following its debut at SM Mall of Asia on June 26. Operated by SSI Group, the UK-based sports fashion retailer enters a rapidly growing activewear market driven by health consciousness, youth fashion trends, and rising fitness culture, aiming to capture strong demand for premium sportswear in Metro Manila.

Philippines Activewear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Top Activewear, Bottom Activewear, Innerwear, Swimwear, Outerwear |

| Material Types Covered | Nylon, Polyester, Cotton, Neoprene, Polypropylene, Spandex |

| Pricings Covered | Economy, Premium |

| Age Groups Covered | 1-15 Years, 16-30 Years, 31-44 Years, 45-64 Years, More Than 65 Years |

| Distribution Channels Covered | Online Stores, Offline Stores |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines activewear market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines activewear market on the basis of product type?

- What is the breakup of the Philippines activewear market on the basis of material type?

- What is the breakup of the Philippines activewear market on the basis of pricing?

- What is the breakup of the Philippines activewear market on the basis of age group?

- What is the breakup of the Philippines activewear market on the basis of distribution channel?

- What is the breakup of the Philippines activewear market on the basis of end user?

- What is the breakup of the Philippines activewear market on the basis of region?

- What are the various stages in the value chain of the Philippines activewear market?

- What are the key driving factors and challenges in the Philippines activewear market?

- What is the structure of the Philippines activewear market and who are the key players?

- What is the degree of competition in the Philippines activewear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines activewear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines activewear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines activewear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)